“A share certificate without proper stamping is like a contract without a seal; legally weak and prone to challenge.”

When companies issue shares, the paperwork and regulatory compliance around it is often overlooked in favor of valuations, investor relations, or structuring. Yet, one vital compliance aspect is stamp duty; especially on issuance of share certificates. Missteps here can lead to penalties, legal invalidity, or hassles down the road.

Keep reading to know more about:

- What is stamp duty and its legal basis

- How stamp duty works for share issuance (physical & demat) in India

- State vs central interplay

- How to compute, pay, certify and document stamp duty

- Risks, penalties, and good practices

Whether you're a startup founder, a legal/corporate professional, or a platform facilitating share issuance, understanding this is essential.

What Is Stamp Duty and Why It Matters?

Basic Concept of Stamp Duty

Stamp duty is a tax or duty levied by government on legal instruments (documents) to make them admissible in evidence. In India, many per-state and central laws govern this. The Indian Stamp Act, 1899 is the central statute; states and union territories have their own stamp acts, schedules, and rules under it.

A share certificate (or instrument of allotment) is considered such a document issuing it triggers a stamp duty obligation.

Why it matters:

- Without proper stamping (or within timeline), the share certificate may not be accepted as valid/document in a court of law.

- Delay or nonpayment can attract penalties, interest, and litigation risk.

- Regulatory compliance - filings, audits, and due diligence often check stamp compliance.

What Are the Key Legal and Regulatory Frameworks Governing Stamp Duty on Shares?

To understand obligations, we must go through the key statutes, amendments, and rules.

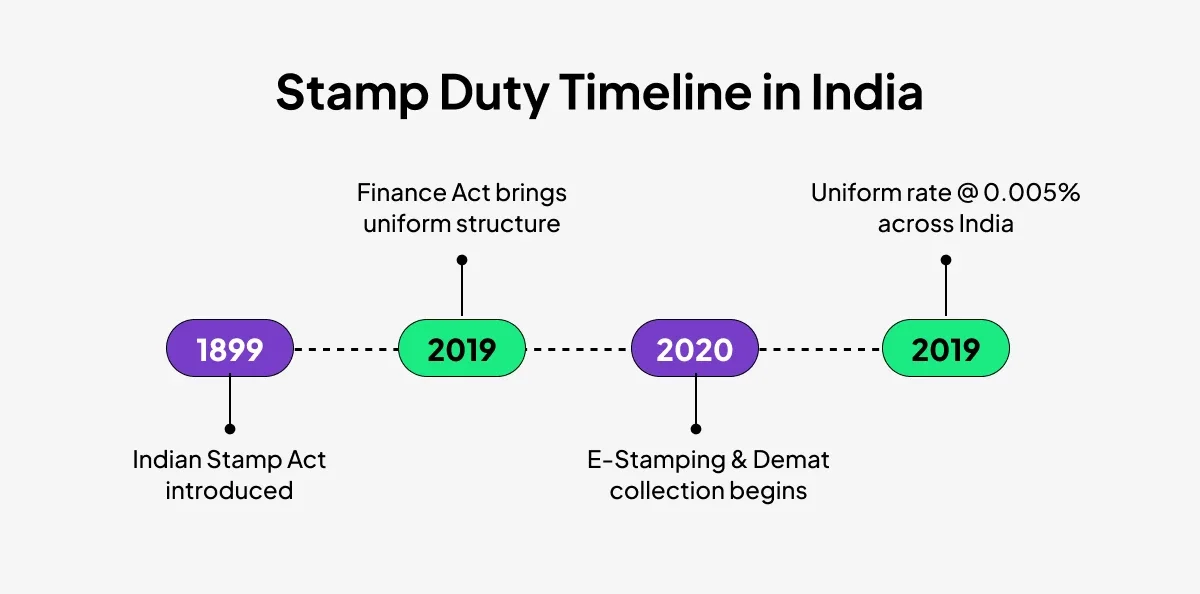

1. Indian Stamp Act, 1899 (Central Act)

This is the foundational law on stamp duty. It authorizes charging of stamp duty on instruments (Section 3, etc.), provides rules around penalty, stamp deficiency, etc.

But crucially, it allows states to adopt schedules or enact their own stamp acts within their domain (subject to central modifications) for physical documents in their jurisdiction.

2. Finance Act, 2019 & Rules (Collection through Depositories) - Effective Jul 1, 2020

A major shift came with the Finance Act, 2019, which amended some aspects of how stamp duty is levied on securities (including shares). From 1st July 2020, a uniform regime was introduced, especially for dematerialized (electronic) securities, with collection via depositories and exchanges.

Key changes:

- The duties on issuance of share certificates (for both physical and electronic modes) have been standardized to 0.005% across all states.

- Transfers of shares (in both physical and demat) are subject to 0.015% stamp duty on the consideration value or market value (whichever is higher) for all modes.

- Collection and remittance of stamp duty on demat shares is done centrally via depositories (NSDL, CDSL) or exchange/clearing corporations.

- Earlier, dematerialized shares were often exempt from stamp duty or subject to differing rates; now the uniform regime eliminates that inconsistency.

Thus, the regime now aims for uniformity across states and between physical/demat modes.

3. Companies Act, 2013 & Share Allotment Rules

From the corporate law side:

- Under Section 56 of the Companies Act, 2013, and associated share capital rules, companies are obligated to issue share certificates to investors within a certain time (e.g., 60 days) of allotment.

- The stamping of share certificates, however, is a separate duty under Stamp Law and must be complied with within a given timeline (often 30 days).

Which Transactions or Events Trigger Stamp Duty on Share Certificates?

Issuance, allotment, rights/bonus issues, ESOPs, and reissued certificates can all trigger stamp duty on shares; state rules govern physical form nuances and demat regulations.

- Issuance / Allotment of Shares: When a company issues new shares to a subscriber/investor, the share certificate (or allotment instrument) must be stamped.

- Bonus / Rights / Preferential Allotments: If shares are allotted via bonus or rights, they too trigger stamp duty based on value.

- ESOPs / Employee Stock Schemes: When shares are issued under ESOPs, stamp duty is calculated on the exercise price/allotment value.

- Duplicate / Reissued Certificates: Typically, if the original was duly stamped, duplicates are not considered fresh issues and may not attract fresh stamp duty (but need careful state rule check).

What Is the Stamp Duty Rate and How Is It Calculated for Share Issuance?

The typical rate is 0.005% across India for demat shares, and up to 0.1% in states like Delhi for physical share certificates; always calculate on the total consideration, not just face value.

- The present rate for stamp duty on issuance of share certificates is 0.005% (i.e., 0.005 percent) of the value of shares issued, across all states, for both physical and demat share certificates.

- That means ₹5 per ₹1,00,000, or expressed differently: for ₹1,00,000 issuance, stamp duty = (₹1,00,000 × 0.005%) = ₹5.

Important nuance: Some state laws or legacy practices may persist in charging older state-based rates for physical certificates, so always check the specific state stamp act.

For example:

- In Delhi, historically, stamp duty was 0.1% on physical certificates (₹1 per ₹1,000), though under the new regime for demat, it adopts a uniform rate.

- In many states, older schedules still list ₹1 per ₹1,000 or part thereof (i.e, 0.1%) as the amount for stamping share certificates.

Thus, in practice, you should confirm whether the local state stamp act has overridden or adopted the new regime.

What Is the Process for Paying and Certifying Stamp Duty for Share Certificates?

Payment is done via e-stamping portals for demat and select states, or physical stamps/franking for physical certificates. Payment must occur within 30 days, followed by endorsement and record keeping for compliance

1. Who Pays the Stamp Duty?

- In the case of issuance, the company issuing the shares is responsible for paying the stamp duty on the certificate (or through a depository for demat shares).

- For transfers, the transferee (the buyer) typically pays the stamp duty.

2. Timeline for Payment

- The law generally requires stamp duty to be paid within 30 days from the date of issue of the share certificate.

- If delayed, the company needs to pay the duty as if it were a fresh application, plus penalty/interest/fines as applicable.

3. Mode / Method of Payment & Stamping

- E-Stamping / E-Stamp certificate: In several states and for demat shares, the duty is paid online through e-stamp portals (e.g., SHCIL e-stamp, NSDL depository mechanism).

- Physical stamps / adhesive stamps / franking machines: For physically issued share certificates, some states still allow or require affixing physical stamps, adhesive stamps, or using franking machines via stamp authorities.

- Affixing / Cancelling / Certification: Once stamps/franking is applied, the document (share certificate) must carry that and relevant cancellations/endorsements. The stamping authority must typically cancel or mark the stamp so that it can’t be reused.

- Submission / Recordkeeping: The stamped certificate, along with proof of duty payment (challan, receipt) must be recorded in company books and kept for audit or legal scrutiny.

Read Blog: Franking vs Stamping: Guide

How Do State-Specific Stamp Duty Rules Create Variation Across India?

Even though the amendments pushed a uniform rate, legacy state stamp acts or older schedules are still in force for physical share certificates in certain states or under state notifications.

Caveats:

- These rates may be outdated or superseded by newer state government notifications adopting uniform rate.

- In many states, for dematerialized shares, the uniform rate (0.005%) is already applied and state legacy rates do not govern.

- If certificate is issued physically but company is registered in a state with a live legacy schedule, the state rate may apply unless changed.

Best practice: Always check the relevant State Stamp Act / Department of Stamps & Registration website for up-to-date rates and notification amendments before finalizing stamping.

What Are the Risks and Penalties for Non-Compliance with Stamp Duty on Share Certificates?

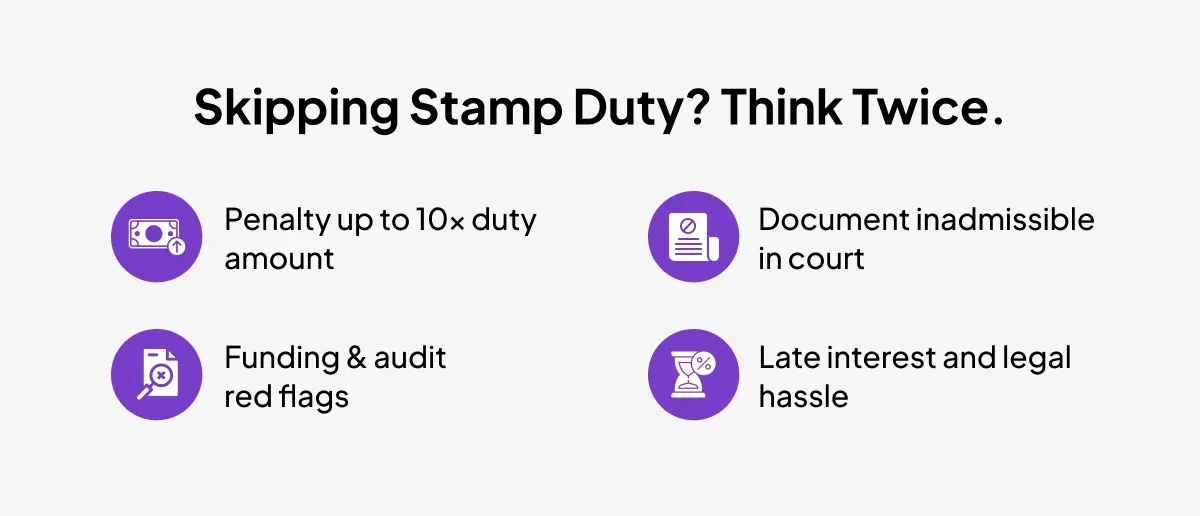

Risks include penalties, legal invalidity of unstamped certificates, audit flags during due diligence, and possible prosecution - making compliance essential. Skipping or delaying stamp duty can carry serious risks.

Here’s a breakdown:

1. Penalties & Interest

- Under the Stamp Act, deficiency or nonpayment can attract penalty up to 10 times the amount of the duty.

- Interest may also be levied for delay.

- Fine or prosecution in extreme cases for executing or signing documents without proper stamping.

2. Invalidity of Document for Legal Purposes

- The share certificate may not be admissible in court as evidence if unstamped or under-stamped.

- Shareholder’s rights may be challenged or the certificate may be considered defective.

3. Audit / Due Diligence / Funding Risks

- During audits, financial due diligence (e.g. for funding, acquisitions), lack of stamping is a red flag.

- Investors or regulators may question compliance, delaying investment or triggering restatements or liabilities.

4. Reputational and Operational Risks

- Administrative burden of rectification, litigation, dealing with revenue department notices.

- Possible orders of back payment of duty, penalty, hearings with Stamp authorities, etc.

Bottom line: Treat stamping as a compliance step, not a variable cost to skip.

How Can Companies Ensure Proper Stamping and Compliance for Share Certificates?

Follow a step-by-step workflow - plan issuance, check applicable rates and mode, pay timely, affix/cancel stamps, update records, seek late adjudication if required, and automate with contract platforms where possible.

Below is a workflow you can embed (or integrate into platforms like ZoopSign) to ensure safe compliance.

Before Issuance: Planning Stage

1. Determine share price / consideration: Always stamp based on actual allotment price (face value + premium), not merely face value.

2. Determine mode: physical vs demat

- If issuing in dematerialized mode, stamping will happen via depositories automatically under the uniform regime.

- If issuing physical certificates, ascertain whether the state allows e-stamping or requires physical stamps/franking.

3. Check State Stamp Act / Notifications

- Confirm whether the state has adopted uniform 0.005% or still uses older schedules.

- Confirm whether e-stamp is allowed, franking permitted, etc.

4. Get internal board resolution / corporate authorization: Document decision to issue shares and incur stamp duty.

At the Time of Issuance / Certification

- Issue certificate / allotment instrument within the time prescribed under Companies Act (generally 60 days).

- Calculate stamp duty: value × 0.005%.

- Pay stamp duty / procure stamp or e-stamp certificate via relevant portal / office.

- Affix or affix e-stamp / cancel the stamp properly on the share certificate.

- Sign certificate (two directors, or one director + company secretary) as required under corporate rules.

- Attach proof of stamp duty payment / certificate to the original share certificate.

- Record in company books (stamp duty register, certificate ledger, duty payment record).

After the Fact / Delayed Stamping

- If stamping was delayed, apply for late stamping / adjudication process with the relevant stamp authority.

- Pay the required duty plus penalty/interest.

- Attach a certificate or receipt of late stamping to the share certificate.

- Document the process internally and maintain correspondence with stamp authority.

Integration with Platforms / Automation

For platforms such as ZoopSign that facilitate share issuance:

- Embed a stamp duty calculator (0.005% × value) to automatically compute duty.

- Pre-validate whether the company's state requires physical stamping or can accept e-stamp.

- Provide automated e-stamp / franking links or integration APIs (if possible) for users to pay duty and fetch certificate.

- Generate PDF templates for share certificates with a placeholder for stamp / e-stamp that can be auto-populated.

- Maintain logs and audit trails: who paid, when, which certificate, proof of duty, etc.

Read Blog: Understanding DSC- Digital Signature Certificate

FREQUENTLY ASKED QUESTIONS

Q: Are dematerialized (demat) shares exempt from stamp duty?

A: No. After the amendments effective July 1, 2020, demat shares are also subject to stamp duty (0.005% for issuance, 0.015% for transfer), collected via depositories.

Q: Does the stamp duty apply on face value or premium?

A: Stamp duty applies on the actual consideration value (face + premium), i.e. the issuance price agreed.

Q: If a company is in State A but issues a physical certificate in State B, which state’s stamp law applies?

A: Stamp duty is typically applicable where the company is registered / the instrument is executed (i.e. location of company / registered office). The act and schedule of that state are relevant. The stamping must comply with that state's stamp act.

Q: Are bonus shares, rights shares, ESOP shares stampable?

A: Yes. Allotments via bonus, rights, and ESOPs are subject to stamp duty based on issuance value.

Q: What about duplicate certificates?

A: If the original was duly stamped, duplicates typically do not attract fresh stamp duty. But again, state rules should be checked.

Different e-Stamping States/Cities: