Buying a property is one of the biggest milestones in life. In Karnataka, an essential part of this journey is paying stamp duty and registration charges.

These charges aren’t just government fees, they give your ownership legal recognition. Without proper stamping, your property documents may not hold up in court.

In this guide, we’ll break down everything you need to know about stamp duty in Karnataka (2025), including:

- Latest stamp duty rates & registration charges

- Online e-Stamping process via Kaveri portal

- Karnataka’s new Digital e-Stamp Rules 2025

- Refunds, penalties, exemptions, and practical tips

- How ZoopSign makes e-Stamping seamless

What is Stamp Duty in Karnataka?

Stamp duty is a state-level tax charged on specific legal documents to give them official recognition under law. You can think of it as the government’s seal of approval, without it, even the most carefully drafted agreement may not be legally enforceable.

Why Does Stamp Duty Exists Exist?

Stamp duty is one of the major revenue sources for state governments in India, including Karnataka. Beyond revenue, it plays a crucial legal role:

- It prevents fraudulent or backdated agreements, since every document is time-stamped.

- It ensures that property or contractual rights are properly recorded.

- It acts as conclusive proof of the transaction in court, giving your document legal sanctity.

When Do You Pay Stamp Duty?

The most common scenario is property transactions such as buying a flat, plot, or house. But it goes far beyond real estate. In Karnataka, stamp duty is also levied on:

- Sale or transfer of property (flats, plots, houses, land)

- Affidavits (self-declarations submitted for official purposes)

- Power of Attorney (authorizing another person to act on your behalf)

- Adoption deeds (legalizing adoption under law)

- Partnership agreements (when forming a firm or business partnership)

- Loan agreements and mortgages (to validate financial contracts with banks or lenders)

Each of these instruments has its own prescribed rate of duty, notified by the Karnataka government.

Why is Stamp Duty Important in Karnataka?

Paying stamp duty ensures your document is:

- Legally valid in court - admissible as evidence if disputes arise

- Recognized by the government - for official registration and records

- Proof of rightful ownership - whether for property, contracts, or authority granted through agreements

Without stamp duty, your document may be considered invalid, attract penalties, or even be dismissed in legal proceedings.

Stamp Duty Rates in Karnataka (2025)

Property Stamp Duty & Registration Charges

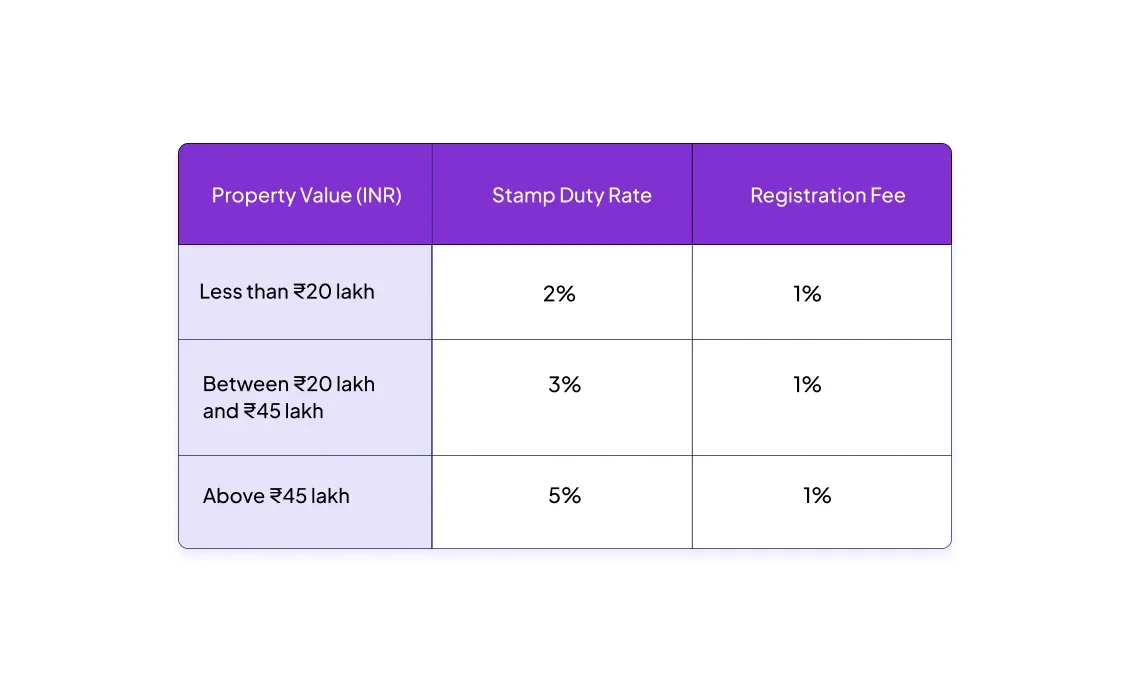

Based on the latest data from ClearTax, here’s how stamp duty and registration charges are structured in Karnataka for 2025:

These rates apply uniformly across all cities and regions in Karnataka - urban and rural distinctions affect only additional charges like cess and surcharge.

Example Calculation

Suppose you’re buying a property valued at ₹60 lakh in Karnataka:

- Stamp Duty (5%) = ₹3,00,000

- Registration Fee (1%) = ₹60,000

Total amount payable = ₹3,60,000

Important Update: 2025 Revisions (Late-August)

However, starting August 31, 2025, Karnataka introduced significant changes to these rates:

- Registration fee doubled from 1% to 2%

- Stamp duty remains at 5% on properties above ₹45 lakh

- Other charges, including cess and surcharge, continue to apply

- Overall transaction-related charges now total approximately 7.6% of property value (6.6% earlier)

This hike has sparked public debate due to the increased financial burden on homebuyers.

How to Pay Stamp Duty in Karnataka

Karnataka allows buyers to pay stamp duty through both online and offline channels. However, with the state’s shift toward digital governance, online payment via the Kaveri Online Services portal is now the most widely used method.

Online Payment (Kaveri Online Services)

The Kaveri Online Services portal is the official government platform for property registration, stamp duty, and related services. It offers a paperless, transparent way to pay stamp duty without visiting a sub-registrar’s office.

Step-by-step process:

- Visit the portal: Go to Kaveri Online Services.

- Login or register: Create an account with your details (name, mobile, email, Aadhaar, etc.).

- Enter transaction details: Fill in property specifics such as location, market value, buyer/seller details, and type of deed (sale, gift, lease, etc.).

- Calculate duty: The system automatically calculates the applicable stamp duty + registration fee + cess/surcharge based on your inputs.

- Generate challan: Once confirmed, generate an online challan for the payment.

- Make payment: Pay through secure methods like net banking, UPI, debit/credit cards.

- Download receipt: After payment, download and save the e-receipt. The challan/receipt is valid for 90 days, so ensure you complete registration within this window.

Pro Tip: Always verify the payment details and keep multiple copies of the receipt for future reference.

Offline Payment (Gradually Phasing Out)

Although Karnataka is moving to 100% digital stamping, offline options are still available in certain cases, especially in rural or semi-urban areas.

Traditional methods include:

- Sub-Registrar’s Office (SRO): Buyers can pay stamp duty directly at the SRO where the property is being registered.

- Impressed stamp papers: These are pre-printed papers with the duty value embossed. They can be purchased from licensed vendors or treasury offices.

- Bank drafts / challans: Payment can also be made via physical challans at designated banks, after which the receipt is attached to the property documents.

However, these offline modes are slow, prone to fraud risks, and less transparent compared to digital payments. Karnataka’s 2025 reforms are expected to fully phase out physical stamp paper procurement in favor of digital e-Stamping.

Refunds on Stamp Duty in Karnataka

In Karnataka, if a registered property transaction does not go through or is later cancelled, the government allows buyers to claim a refund of up to 98% of the stamp duty paid. This is a major relief for homebuyers who otherwise risk losing a large amount of money.

When Can You Claim a Refund?

- If the sale deed is cancelled by mutual consent of both buyer and seller.

- If the transaction is found to be legally invalid due to incorrect execution.

- If the buyer decides not to proceed with the property purchase after paying stamp duty, provided the deed is officially cancelled.

Process to Apply for Refund

1. Draft a cancellation deed - executed and signed by both parties.

2. Submit refund application to the jurisdictional Sub-Registrar’s Office.

3. Attach supporting documents:

- Original sale deed

- Proof of stamp duty payment (challan/receipt)

- Identity proofs of both parties

- Court order (if applicable)

4. The Sub-Registrar will verify and forward the request to the District Registrar for approval.

5. Once approved, the refund is credited to the applicant’s bank account.

Note: A small administrative fee (~2% of the duty paid) is deducted. That’s why refunds are capped at 98%.

Penalties for Non-Payment of Stamp Duty in Karnataka

Skipping or underpaying stamp duty is not just an oversight - it is a legal offence under the Indian Stamp Act, 1899 and Karnataka’s local stamp laws.

Consequences Include:

- Heavy Fines: Up to 10 times the original duty amount can be levied as a penalty.

- Fixed Penalties: Additional fines (commonly around ₹500 or more) may also apply.

- Legal Risk: An unstamped or insufficiently stamped document is inadmissible in court, meaning it cannot be used as evidence in property disputes.

- Criminal Liability: In extreme cases, intentional evasion can lead to imprisonment or forfeiture of rights to the property.

Example: If a buyer pays only 3% duty instead of 5% on a ₹50 lakh property, the missing duty is ₹1 lakh. The penalty could go up to ₹10 lakh in addition to the unpaid duty.

Karnataka’s Big Shift: Digital e-Stamping (2025)

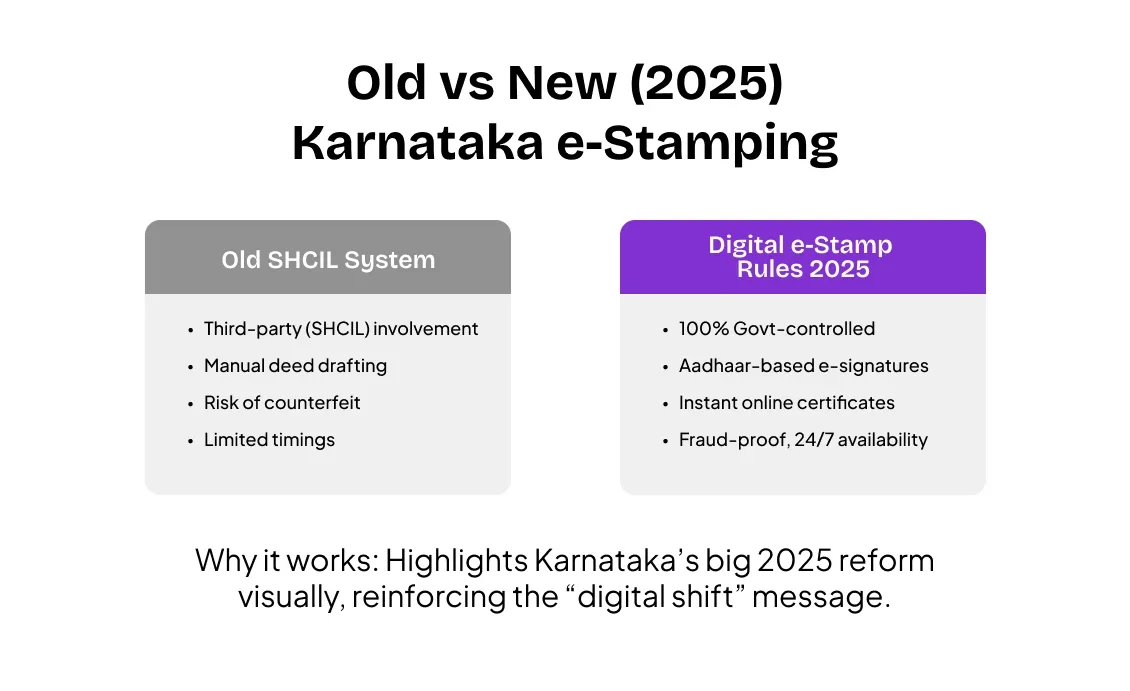

Karnataka became one of the first Indian states to fully digitize stamp duty collection with the introduction of the Digital e-Stamp Rules, 2025, effective from July 14, 2025. This reform replaced the older SHCIL (Stock Holding Corporation of India Ltd.) system with a government-controlled, 100% digital-first platform.

Key Features of Karnataka’s Digital e-Stamping

- Aadhaar-based e-signatures: Buyers and sellers can sign documents securely without physical presence.

- Template-driven deed drafting: Pre-approved digital templates reduce errors and standardize agreements.

- Direct treasury payments: No intermediaries; payments go directly to the state treasury, improving accountability.

- Instant e-Stamp certificate: A unique identification number (UIN) is generated immediately after payment.

- Fraud control: The system eliminates risks of counterfeit or duplicate stamp papers.

- Transparency & convenience: Entire process is online, accessible 24/7, with real-time verification.

Why This Matters for Buyers & Businesses

- Faster property registrations without dependence on vendors.

- Reduced fraud risks due to tamper-proof e-certificates.

- Improved compliance for businesses executing multiple contracts.

- Cost savings from avoiding delays, errors, and manual paperwork.

Read Blogs:

FAQs on Karnataka Stamp Duty

Q: What is the current stamp duty in Karnataka (2025)?

A: As of 2025, Karnataka levies 2% stamp duty on properties valued up to ₹20 lakh, 3% on properties between ₹21 lakh and ₹45 lakh, and 5% on properties above ₹45 lakh. In addition, buyers must pay a 10% cess on the duty amount and a surcharge of 2% in urban areas (3% in rural areas).

Q: Can I pay stamp duty fully online in Karnataka?

A: Yes. Karnataka has introduced a fully digital payment system through the Kaveri Online Services portal. Buyers can calculate the duty, generate challans, and make payments through net banking, UPI, or cards.

Q: Is stamp duty refundable?

A: Yes. If a property transaction is cancelled after registration, Karnataka offers a refund of up to 98% of the stamp duty paid. To claim, you need to submit a cancellation deed along with the original payment receipt and supporting documents at the Sub-Registrar’s office.

Q: What happens if I skip paying stamp duty?

A: Skipping or underpaying stamp duty can have serious legal and financial consequences. Documents without the proper duty are not valid in court, meaning they cannot be used as proof of ownership or agreement.

Q: Is ZoopSign legally recognized?

A: Yes. ZoopSign operates fully in line with Karnataka’s Digital e-Stamp Rules 2025. Every e-Stamp generated on ZoopSign carries a unique identification number (UIN), making it tamper-proof and legally valid across courts and government offices.