Uttar Pradesh has been pushing hard toward e-Stamping, a secure digital way to pay stamp dutyand no “out of stock” vendor drama, and instant online verification.

Did you know that UP phased out physical stamp papers priced between ₹10,000 and ₹25,000 and moved to e-stamp alternatives? Previously purchased stock was usable/returnable until March 31, 2025.

In this guide, you’ll get: what e-Stamp is, why UP adopted it, benefits, a step-by-step buying flow, charges, required documents, validity, and how to verify a certificate.

What is e-Stamp in Uttar Pradesh?

E-Stamp is a secure, government-issued digital certificate for paying stamp duty in UP, replacing the physical stamp paper. Plus, it’s as straightforward as ordering groceries online. Here’s how it works:

Step 1: Head to a Government-Authorized Portal: Start by visiting an official, state-approved e-Stamping website (the kind banks and lawyers use).

Step 2: Prepare Your Document

- Option A: Upload your ready-to-sign agreement (like a rental contract).

- Option B: Use a free template to draft one right there.

Step 3: Fill in Key Details: The system will ask for:

- Names and addresses of both parties

- Purpose of the stamp (property sale, affidavit, etc.)

- Stamp duty amount (auto-calculated if you’re unsure)

Step 4: Review & Submit: Double-check all entries (especially spellings - these details become permanent). Submit to the nearest authorized collection center for processing.

Step 5: Pay Securely: Make electronic payments through your preferred online methods.

Step 6: Get Your e-Stamp Certificate: Within minutes, you’ll receive a digitally generated stamp certificate upon successful payment.

Now, what matters is that this isn't just another government tech experiment. UP's e-Stamp system carries full legal authority for all the documents you need in daily life - whether you're renting an apartment in Noida, finalizing a property deal in Lucknow, or submitting court affidavits. The best part? Every e-Stamped document holds the same weight as traditional stamp papers, minus all the negatives associated with traditional physical stamping.

Physical stamp papers come with several drawbacks that can create problems for users:

- Risk of Fraud: Counterfeit stamp papers remain an ongoing issue, potentially invalidating important documents even after agreements are signed.

- Limited Availability: Stamp vendors often don't carry all required denominations, forcing users to purchase higher-value stamps than needed.

- Verification Difficulties: Checking the authenticity of these physical stamps, rely on:

- Physical watermark inspection

- Manual verification processes

- Vendor records that may be incomplete

Given these persistent challenges with physical stamps, it becomes clear why Uttar Pradesh has moved towards e-Stamping. The digital solution directly addresses each of these limitations while bringing additional benefits to users across the state of UP.

What are the Key Benefits of Using e-Stamp Paper?

The key benefits of using eStamp paper are security you can verify, faster issuance, online checks, and durable validity.

- Unmatched Safety (Sovereign Guarantee): Every e-Stamp carries a UIN and a 2D/QR code for tamper-evident verification against SHCIL’s records - much harder to forge than paper stamps.

- High Convenience & Instant Issuance: Skip vendor queues and denomination juggling; data entry + payment = certificate generation. Registries can validate online.

- Lifetime Validity: Courts have repeatedly affirmed no expiry for stamp papers under the Stamp Act (refund time limits do not equal usage expiry). That logic applies to e-Stamps too - your paid-duty certificate remains valid as proof of payment whenever the document is executed.

- Easy Online Verification: Anyone can verify an e-Stamp by entering details (State, Certificate No., duty type, issue date) on SHCIL’s verification page - or by scanning the barcode.

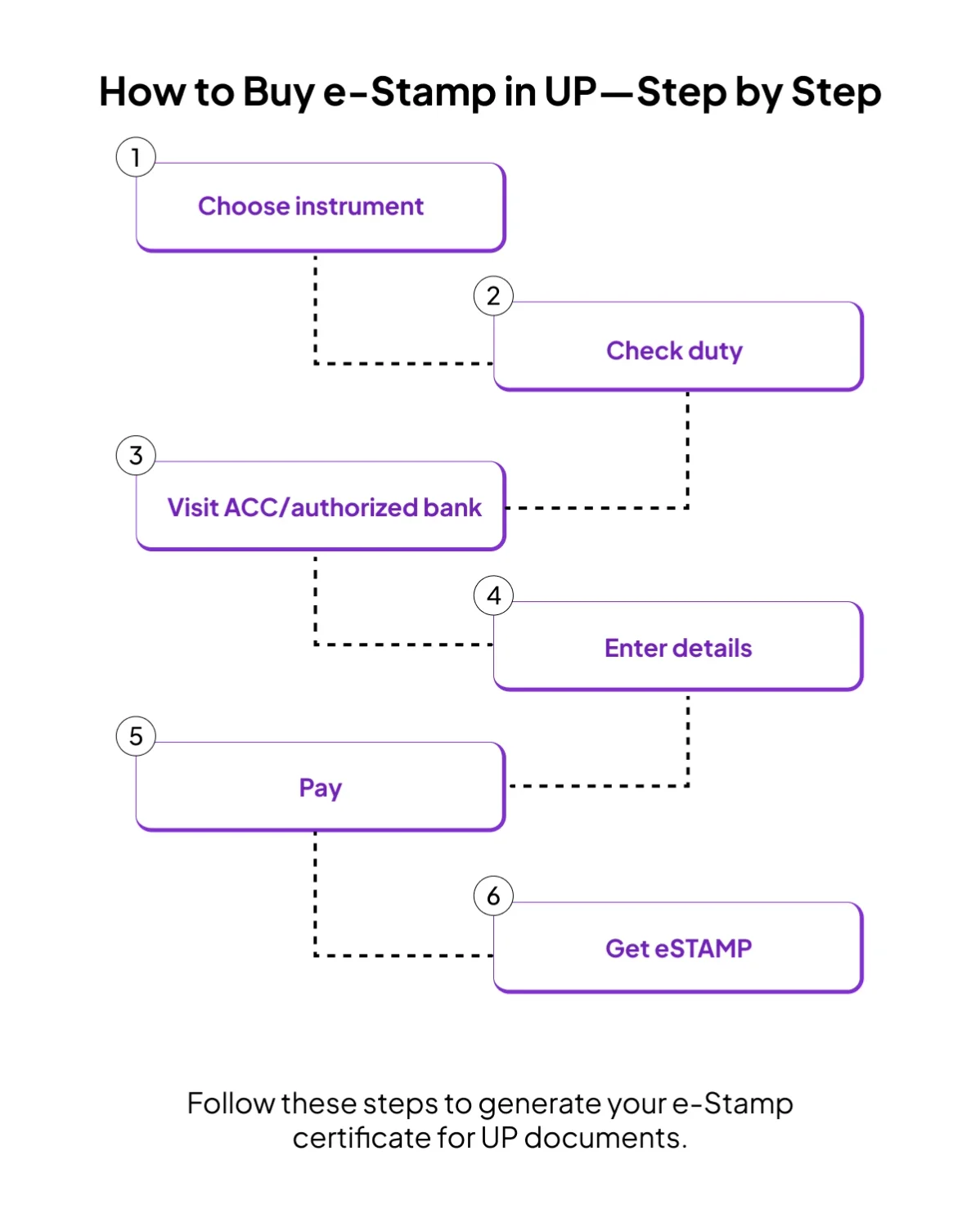

How to Buy e-Stamp in Uttar Pradesh: Stepwise Process

You can obtain e-Stamp through authorized centers (banks/ACCs) or limited online modes (see note below). Choose the stamp type/value, submit party details, pay, and get the digital certificate.

Step-by-Step Process to Purchase e-Stamp:

- Decide the instrument & location (sale deed, lease, affidavit, etc.).

- Check duty using the IGRS UP Stamp & Registration Fee Calculator (circle-rate/ASR or transaction value applies—whichever is higher).

- Visit an Authorized Collection Center (ACC) or bank authorized for e-Stamp in your district (UP publishes district-wise ACC lists)

- Provide details (parties, addresses, instrument type, consideration/property details). The standard e-Stamp form collects these

- Pay securely (as per center instructions).

- Receive the e-Stamp certificate (with UIN and barcode) and attach it to your document

Can You Buy e-Stamp Paper Online in Uttar Pradesh?

- Self-print at home: As of 2025, SHCIL enables citizen self-printing in select regions (e.g., Delhi, Himachal, J&K, Ladakh, Chandigarh, A&N, Karnataka)—UP is not on this list yet, so high-value UP transactions are typically issued via ACCs/banks.

- Low-value online e-Stamps: UP earlier allowed online issuance for small denominations (up to ₹500)—useful for affidavits etc. For higher values, plan to use ACCs. (Policy rollouts can change; check the SHCIL/IGRS UP site before you start.)

What Documents are Required for e-Stamping in Uttar Pradesh?

Keep identity proof plus transaction-specific papers handy.

- ID Proof (any one): Aadhaar, PAN, Passport. (Standard KYC at ACCs.)

- Property documents (for sale/transfer): Basic property particulars as per the registration application (the IGRS portal/PRERNA workflow captures these and calculates charges).

- Power of Attorney: Party IDs; for sale authority, POA duty aligns with conveyance if it authorizes sale.

- Affidavit/Notarial acts: Identity + the affidavit text; duty is nominal.

Why these matter: Accurate party/property data prevents mismatches and eases online verification/registration downstream.

What are the Current eStamp Charges and Duty in Uttar Pradesh?

Property sale/transfer in UP typically attracts 7% stamp duty, plus 1% registration fee on the higher of the transaction value or the circle rate (ASR). Women buyers currently get a 1% stamp-duty rebate up to ₹1 crore property value (max ₹1 lakh). Always confirm in the official calculator before paying.

What Are the Current e-Stamp Duty Rates in UP?

1. Property sale deeds: ~7% duty + 1% registration (calculator applies circle rate rules)

2. Women rebate (2025): 1% stamp-duty rebate on property values up to ₹1 crore (raised from the earlier ₹10 lakh cap).

3. Common non-property instruments (illustrative from UP’s Schedule I-B):

- Affidavit: ₹10

- Divorce deed: ₹50

- Adoption deed: ₹100

4. Power of Attorney: ranges by purpose - ₹10/₹20/₹50/₹100; if it authorizes the sale of immovable property, the duty is as per conveyance (ad valorem)

How to Calculate e-Stamp Charges?

- Find your valuation base: the higher of the agreement value and circle rate (ASR) for your area.

- Apply the rate: typically 7% for sale deeds (+ 1% registration). If the buyer is a woman and the property value is within ₹1 crore, apply 1% rebate to the stamp duty.

- Confirm via calculator or your sub-registrar/ACC before payment.

Validity & Legal Aspects of e-Stamp Paper

e-Stamp certificates do not expire; once duty is paid and linked to your document, the proof of payment stands.

- Validity Period of e-Stamp in Uttar Pradesh: There’s no time limit/expiry prescribed for using stamp paper under the Stamp Act (courts have clarified this). Refund windows (for unused stamps) don’t affect validity.

- Is e-Stamp Paper Accepted Everywhere in UP?: Yes - registrar offices and courts across UP accept e-Stamps; the state has been actively shifting away from high-denomination physical stamps toward e-Stamping.

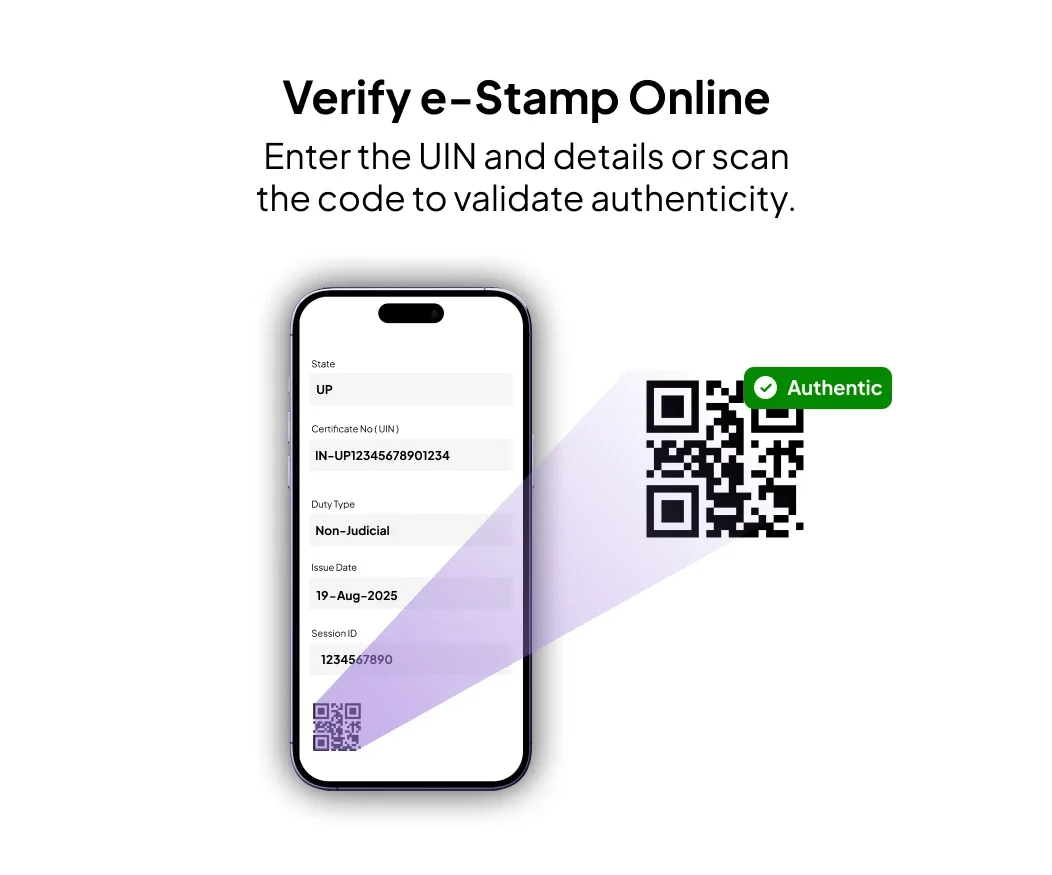

How to Verify e-Stamp Certificate in Uttar Pradesh

Use the SHCIL Verify Certificate page, enter the e-Stamp details, or scan the barcode—verification is instant.

Online e-Stamp Verification Process

- Open the SHCIL “Verify Certificate” page.

- Enter State (Uttar Pradesh), Certificate No. (UIN), Stamp Duty Type, Certificate Issue Date, and the session ID, then submit.

- Or select the barcode scanner option to scan the code on the certificate.

What Details Are Needed for Verification?

- State: Uttar Pradesh

- Certificate Number (UIN)

- Stamp Duty Type and Issue Date

- Session ID (displayed on the verify page) or simply scan the barcode.

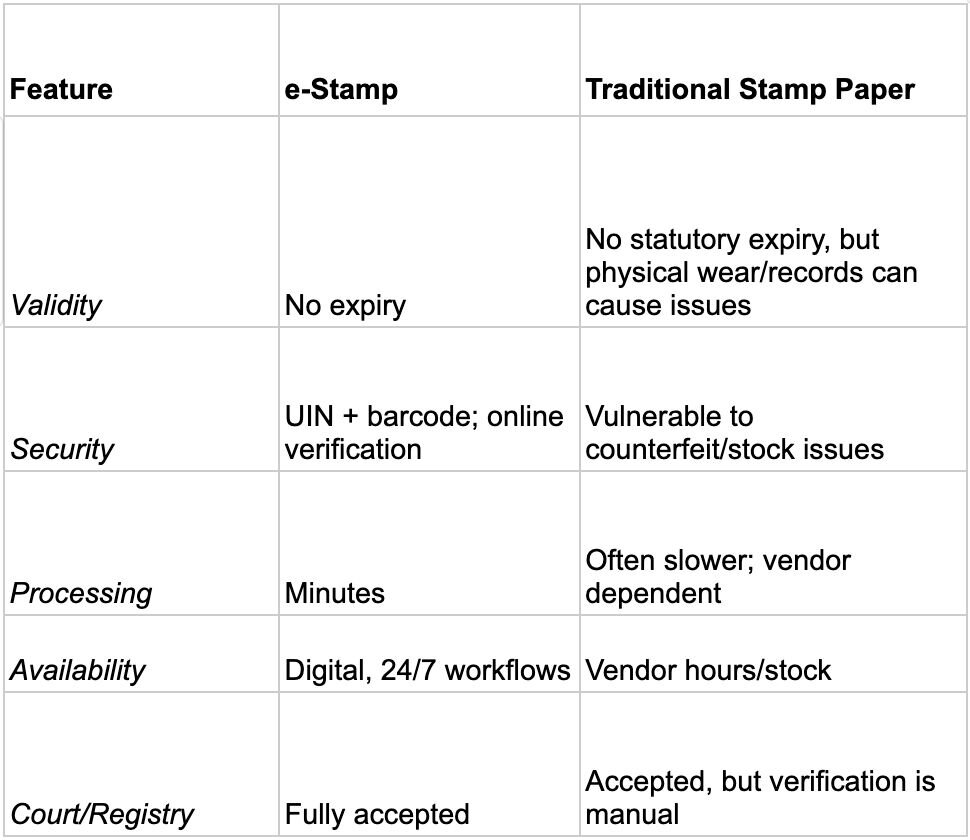

Explain the Difference between e-Stamp vs. Traditional Stamp Paper?

e-Stamp wins on security, speed, and verifiability - without sacrificing legal validity.

Security and Legal Differences

- e-Stamp: UIN + barcode, online verification, digital audit trail.

- Traditional: Susceptible to counterfeit/shortages; manual checks. UP is phasing out high-value physical denominations.

Which Is Better for Property Transactions?

e-Stamp is faster to issue and easier to verify at registration time; no counting denominations, no authenticity doubts.

Quick comparison:

Sources: SHCIL e-Stamp overview & verification; UP’s move away from high-denomination physical stamps. shcilestamp.com+1The Times of India

FREQUENTLY ASKED QUESTIONS:

Q: What is e-Stamp and How Does It Work in UP?

A: A digital proof of stamp duty. You/ACC submit document details, pay, and get a UIN-based certificate; registries verify it online.

Q: Where Can You Buy e-Stamp Paper in Uttar Pradesh?

A: From Authorized Collection Centers (ACCs)/banks listed by IGRS UP, limited online options exist for small denominations.

Q: What Are the Most Common Uses for e-Stamp Paper in UP?

A: Property sale/transfer, leases, affidavits, powers of attorney, etc.—the IGRS calculator covers the full list.

Q: How to Check the Authenticity of an e-Stamp?

A: Use the SHCIL Verify Certificate tool (UIN, state, duty type, date) or scan the barcode.

Q: Is e-Stamp Valid for a Lifetime?

A: Yes - the courts have held there’s no usage expiry for stamp papers; refund rules don’t equal expiry.