Paying stamp duty has always been a crucial step in property transactions, agreements, and affidavits. Until recently, this meant relying on physical stamp papers, which are often hard to find in the right denomination and vulnerable to counterfeiting. To address these issues, the state introduced e-stamp paper Maharashtra, a digital alternative that facilitates quicker, safer, and easier stamp duty payment verification.

In this guide, we’ll cover everything you need to know about e-Stamp in Maharashtra - what it is, how it works, the stamp duty charges involved, the documents you’ll need, and why it’s now the preferred option over traditional stamp papers.

What is e-Stamp in Maharashtra India?

e-Stamp in Maharashtra is a government-authorized digital certificate that replaces physical stamp papers for paying stamp duty.

It is issued through authorized vendors like SHCIL (Stock Holding Corporation of India Limited) and ensures tamper-proof, real-time validation of transactions.

You can use e-Stamps to pay stamp duty on property deals, rental agreements, affidavits, and other legal documents in Maharashtra. By moving online, the process becomes quicker, more transparent, and eliminates the risk of counterfeit papers.

The process is designed to make stamp duty payment seamless and secure. Once generated, an e-Stamp certificate is tamper-proof and validated in real time, reducing the risk of counterfeit papers that were common in the old system.

With e-stamp now replacing traditional paper in Maharashtra, the obvious question is: why was this shift necessary in the first place?

Let’s look at the key reasons why Maharashtra chose to adopt e-stamping.

Key Reasons Why Maharashtra Adopted e-Stamping

Maharashtra moved to e-Stamping to make paying stamp duty in Maharashtra simpler, safer, and free from the usual hassles of physical stamp papers

Here’s what got the state to take the digital route:

- Removing vendor dependency: Earlier, people had to chase stamp vendors or franking centres for stamp papers, only to find “no stock” more often than not. e-Stamping removes that problem completely.

- No Middlemen: The new system removes the role of intermediaries, and now people can deal directly through authorized online platforms.

- Greater Transparency: Because of fixed fees and instant digital certificates, there’s no room for confusion or irregularities with e-Stamp papers.

- Fraud Prevention: Since e-Stamp certificates are tamper-proof, the chances of counterfeit papers are almost zero.

- Very Convenient: Stamp duty and registration charges can be paid online from anywhere, with certificates generated within minutes.

- Digital Push: The move also reflects Maharashtra’s larger push towards modern, tech-enabled public services.

Knowing why Maharashtra adopted e-Stamping is one part of the story. The other is knowing the available options. Not all e-stamp papers serve the same purpose - different transactions call for different types.

Let’s break down the kinds of e-stamp papers you can get in Maharashtra.

Types of E-Stamp Papers in Maharashtra

E-stamp papers in Maharashtra are mainly of two types - Judicial and Non-Judicial stamp paper. Judicial papers are used for court matters, while non-judicial papers cover agreements, property transactions, and other legal documents.

1. Judicial E-Stamp Paper

These are used specifically for court-related processes, such as proceedings, orders, and judgments. If the matter is legal and related to the court somehow, this is the type required.

2. Non-Judicial E-Stamp Paper

The more commonly used category. Non-judicial papers are needed for documents like property agreements, rental contracts, affidavits, and other official transactions. They ensure legal validity, compliance, and smooth stamp duty payment for day-to-day dealings.

So whether it’s for a courtroom procedure or something as common as a rental agreement in Mumbai, e-stamp papers Maharashtra ensure your documents have full legal protection.

Let’s now look at some benefits of using e-stamp paper in Maharashtra.

Read Blog: Types of Stamps: Your Guide to Digital and Physical Options

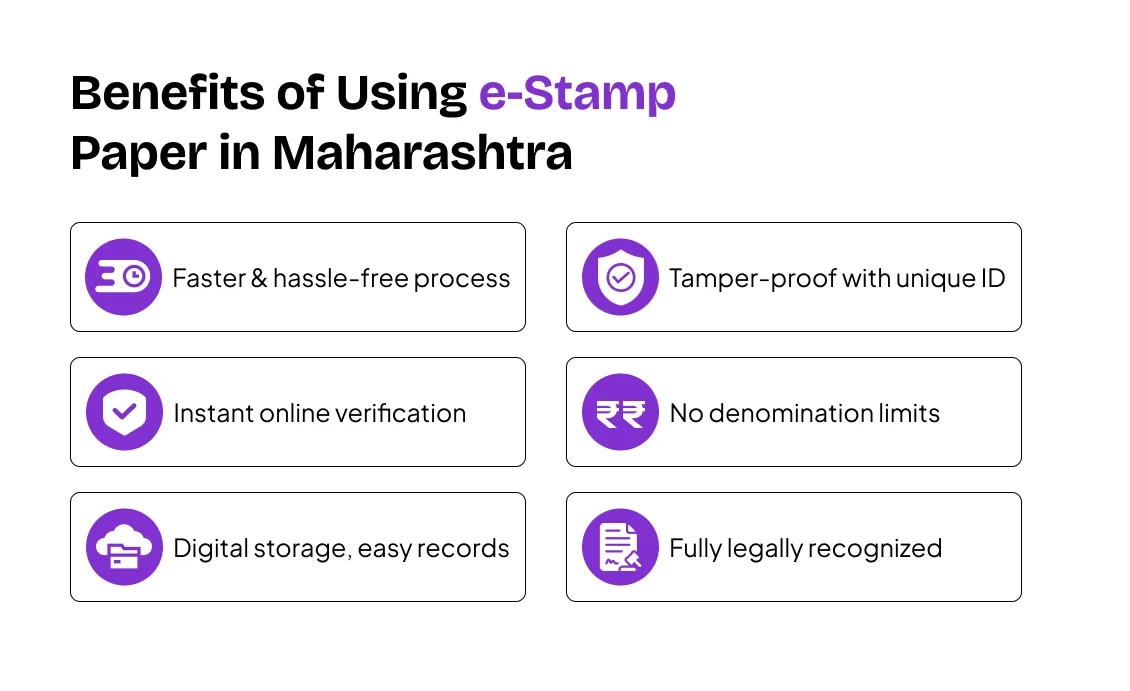

What are the Benefits of Using e-Stamp Paper in Maharashtra?

E-stamp paper in Maharashtra brings speed, security, and convenience to the stamping process. It helps reduce risks, simplifies stamp duty payment, and ensures long-term validity—all in a fully digital format.

- Saves Time: Getting an e-stamp certificate takes only a few minutes, unlike traditional stamp papers that often involve waiting in long queues. This efficiency helps both individuals and businesses complete formalities faster.

- Secure and Tamper-Proof: Every e-stamp carries a unique identification number (UIN), making it almost impossible to duplicate or forge. This greatly reduces risks of fraud in sensitive transactions such as stamp duty payment or property agreements.

- Easy to Verify: The authenticity of an e-stamp certificate can be instantly checked online using the verification option. This ensures peace of mind in legal and other related dealings, like those involving payment of stamp duty on property.

- Flexible Usage: Unlike traditional stamp papers with fixed denominations (say, a 100 rs stamp paper in Maharashtra), e-stamps don’t have denomination limits. This flexibility makes them more adaptable for different types of agreements and deeds.

- Digital Record-Keeping: Since e-stamp certificates can be downloaded and stored electronically, they make it easier to maintain safe records for future reference, especially in important matters like property registration charges or business contracts.

- Legally Recognized: E-stamps are fully valid under the Department of Registration and Stamps, Maharashtra, ensuring they have the same legal power as physical stamp papers.

With benefits like these, it’s clear why e-stamping has become the preferred option across Maharashtra.

But before you can generate an e-stamp certificate, you’ll need to keep certain documents handy.

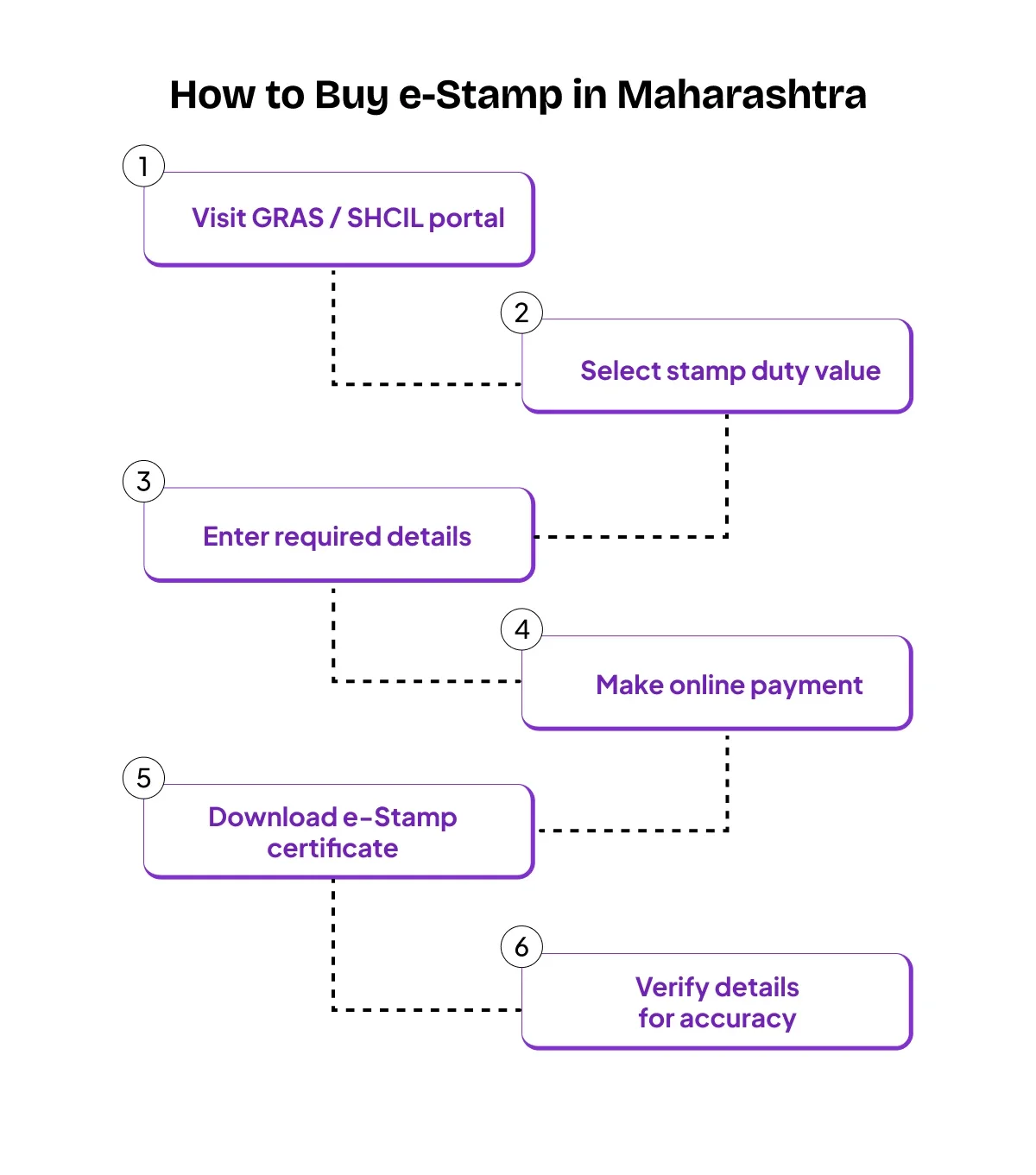

How to Buy an e-Stamp in Maharashtra

You can buy e-stamp paper in Maharashtra, online through the official portals like the GRAS portal or the SHCIL website. Simply choose the stamp duty value, enter the required details, make the stamp duty payment, and download your e-stamp certificate instantly.

- Visit the Official Portal: Go to the official GRAS Mahakosh portal or the SHCIL (Stock Holding Corporation of India Ltd.) website.

- Choose the Stamp Duty Value: Select the amount applicable for your transaction type, whether it’s for paying stamp duty on property or another legal document.

- Enter Details: Provide the necessary information such as document type, parties involved, and property details (if applicable).

- Make Payment: Pay the stamp duty using net banking, UPI, debit/credit cards, or other accepted methods.

- Get Your E-Stamp Certificate: Once payment is successful, the system instantly generates a digital certificate that you can download and keep for records.

- Verify the Information: Double-check that all details on the certificate are correct to avoid issues later on.

Getting an e-stamp is quick once you follow these steps correctly. But to make sure everything goes smoothly, you’ll need a few documents ready before you begin. Let’s look at what those documents are.

Documents Required for e-Stamping in Maharashtra India

To buy e-stamp in Maharashtra, you’ll need a valid identity proof along with transaction-related documents, depending on the type of agreement.

Here’s what you will commonly require:

- Identity Proof: Aadhaar Card, PAN Card, Passport, or Driving Licence.

- Address Proof: Utility bills or recent bank statements (issued within 90 days).

Transaction-Specific Documents:

- Property transactions - Sale agreement, lease agreement, title deed, or property registration documents.

- Power of Attorney (POA) - Duly drafted and signed POA document.

- Affidavits/Declarations - Sworn affidavit, notarized declaration, or related supporting papers.

Why are the Documents Necessary for Fraud control and Verification?

When you buy e-stamp paper in Maharashtra, the documents that are required act as a safety filter.

ID proofs, property papers, and affidavits confirm that the people involved are real and the transaction is genuine.

Without this layer of checking, fake details or misuse of stamp duty in Maharashtra would slip through. Having these documents upfront keeps the process simple, secure, and fraud-free.

What are the Stamp Duty and Charges in Maharashtra

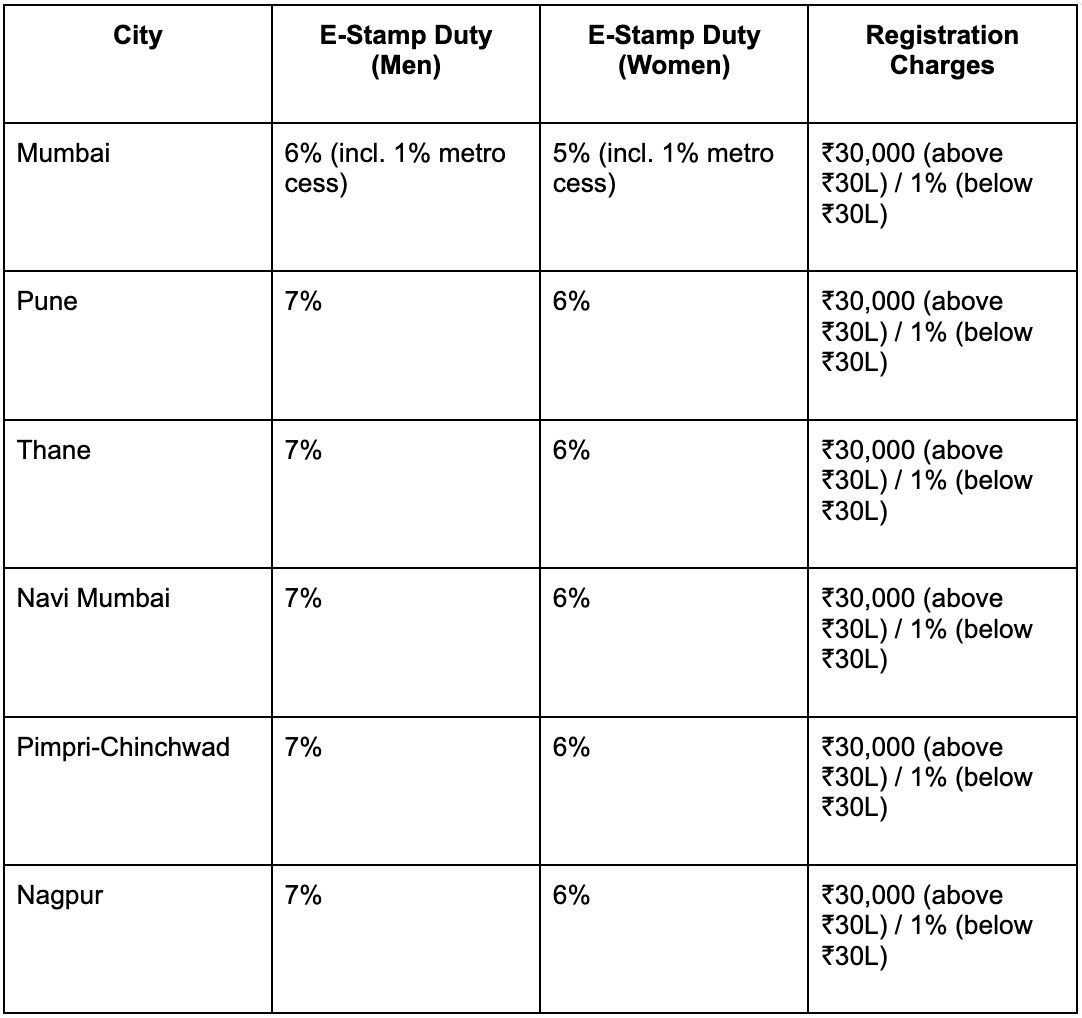

In Maharashtra, stamp duty isn’t the same everywhere. They vary based on location and property type. Whether you’re dealing with stamp duty in Mumbai, a gram panchayat area, or zones under the MMRDA, the percentage changes.

- For urban areas that fall within municipal limits, men pay 6% stamp duty while women pay a slightly lower rate of 5%, with registration fees fixed at 1% of the property value.

- In gram panchayat regions, the charges are lighter at 3% for men, 2% for women, plus 1% registration.

- And if the property is in a Panchayat, Municipal Council, or Cantonment zone that comes under the MMRDA, the duty works out to 4% for men, 3% for women, again with 1% registration.

By the way, the stamp duty you’ll actually pay depends on reckoner rates and the property’s market value, so the figure isn’t always straightforward. Instead of guessing, it’s smarter to use the government’s official calculator or confirm the numbers with a licensed vendor. Once the stamp duty payment is made your e-stamp certificate can be cross-checked on the SHCIL portal, so you know it’s valid and officially recorded.

What Are the Current e-Stamp Duty Rates in Maharashtra?

In 2025, e-stamp duty in Maharashtra ranges between 5%–7% depending on the city and whether the buyer is male or female. Registration charges are fixed at 1% of the property value (or ₹30,000 for properties above ₹30 lakh).

How to Calculate Stamp Duty and Registration Fees in Maharashtra

The amount you end up paying isn’t the same for every buyer. It shifts based on the property’s location, the buyer’s gender, and the rate the government sets as the minimum sale value.

If the property’s market price is higher than this reckoner rate, e-stamp duty is charged on that higher figure. Registration fees, on the other hand, stay fairly straightforward at 1% of the property’s value in most cases.

Example:

Say you’re buying a flat in Mumbai worth ₹50 lakhs.

- For a male buyer, stamp duty in Mumbai is 6%, which comes to ₹3 lakhs.

- Registration fees add another 1%, that is, ₹50,000.

That makes your total stamp duty and registration charges in Mumbai ₹3.5 lakhs.

To avoid guesswork, it’s always better to use the official stamp duty calculator or confirm with an authorized vendor before you proceed.

Use of Ready Recurring Rate for land valuation

The ready reckoner rate in Maharashtra is the government-notified minimum value of land and property, published through the sub-registrar’s office. It acts as the benchmark for calculating stamp duty and registration charges, ensuring no property is registered below a legally accepted price.

In simple terms, whether the market value of the property is higher or lower, the ready reckoner rate is the floor value used for taxation.

This system keeps property valuations transparent and prevents under-reporting of transactions. If the declared market value is less than the ready reckoner rate, buyers must still pay charges based on the higher reckoner rate. The rates are reviewed periodically to align with economic conditions.

For instance, in March 2022, ready reckoner rates rose by an average of 8.8% across cities like Thane, Navi Mumbai, Pune, and Panvel, while Mumbai’s rates remained unchanged.

Validity and Legal Recognition of e-Stamp Paper in Maharashtra

In Maharashtra e-Stamp certificates never expire. They are valid for a lifetime.

When you buy and use an e-Stamp certificate in Maharashtra, you don’t have to worry about it running out of time. Once the duty is paid and the document is executed as per the Maharashtra Stamp Act, the certificate holds lifelong validity.

The only technical rule to remember is that if you’re purchasing traditional physical stamp paper, it should be put to use within six months to avoid compliance issues. But with e-Stamping, that hurdle doesn’t exist—the certificate remains legally sound indefinitely.

The government has also made the system more transparent and convenient. With the 2025 amendment, Maharashtra introduced a facility to issue e-Stamp certificates online, accessible anytime and anywhere. A flat processing fee of ₹500 applies, and if you ever end up paying extra duty by mistake, the Inspector General of Registration (IGR) Maharashtra will refund it within 45 days.

This recognition not only streamlines how stamp duty is handled but also gives buyers and sellers confidence that their paperwork will hold up in any legal setting for as long as needed.

How to Verify e-Stamp Certificate in Maharashtra India

You can verify any e-Stamp online using its unique certificate number on the official SHCIL portal.

Verifying an e-Stamp certificate in Maharashtra is a simple yet important step to ensure your document is authentic and legally recognized. The process can be done entirely online in just a few minutes, with only a handful of details required. By cross-checking your certificate through the government-approved portal, you protect yourself from fraud and gain peace of mind knowing your property transaction is fully compliant

Online e-Stamp Verification Process and The Details Needed.

Verifying your e-Stamp certificate in Maharashtra is quick and can be done directly on the SHCIL website. The portal allows you to confirm the authenticity of your document in just a few simple steps

- Go to shcilestamp.com.

- Select the state (choose Maharashtra).

- Enter the Certificate Number or the UIN

- Fill in the Article Number / captcha and any other details shown.

- Click Verify to see the result.

This simple step eliminates risks of forgery or disputes later on, making the process more transparent and reliable. With the government’s digital systems in place, e-Stamping in Maharashtra is quickly becoming the standard for safer documentation.

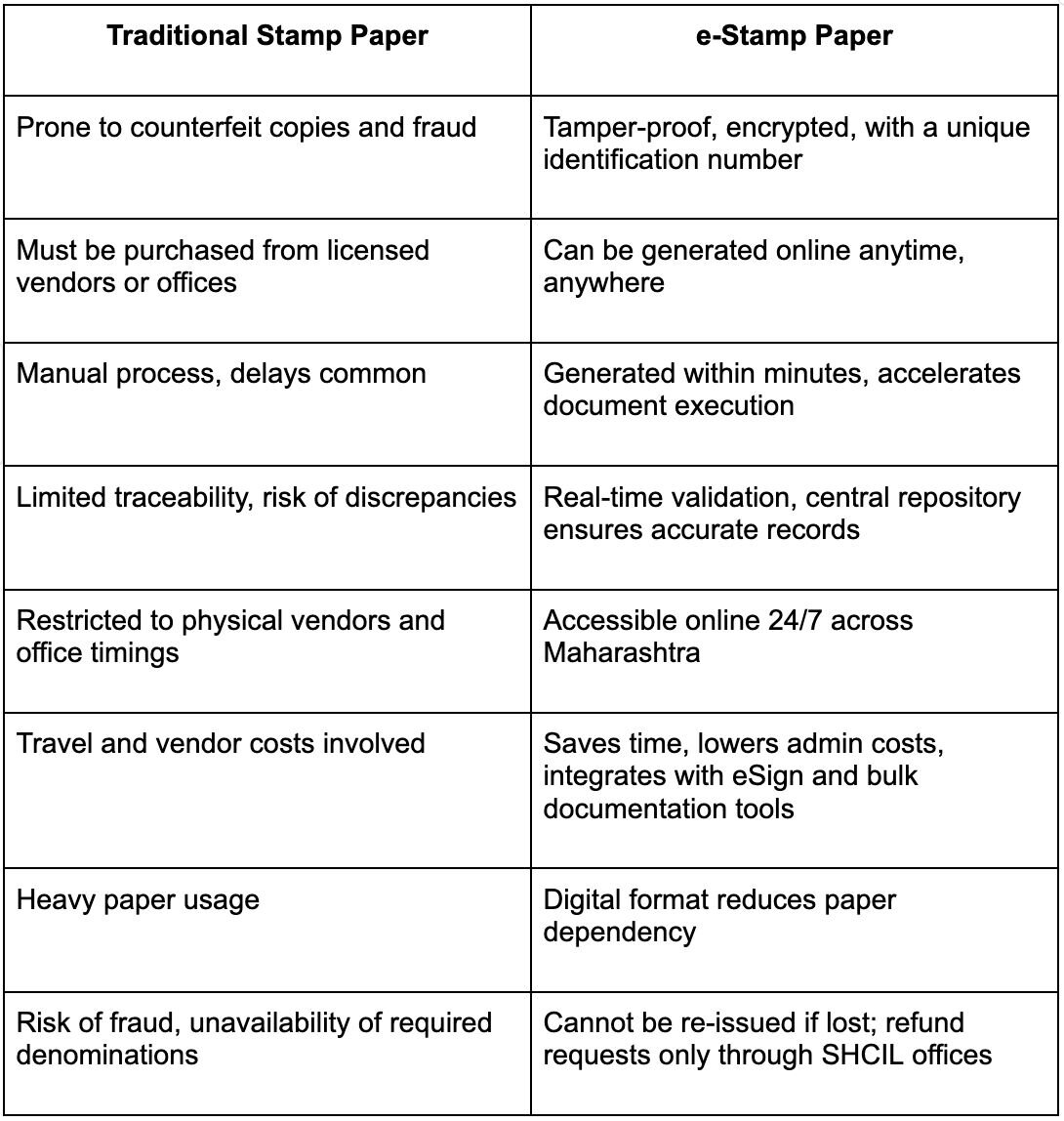

e-Stamp vs. Traditional Stamp Paper: Maharashtra

When it comes to paying stamp duty in Maharashtra, the shift from traditional stamp paper to e-Stamping has made the process faster, safer, and more transparent. Unlike physical papers that can be counterfeited or run out of stock with vendors, e-stamps are generated digitally with a unique identification number, making them tamper-proof and easily verifiable online.

Which one is Better for Property Transactions in Maharashtra?

When it comes to property transactions in Maharashtra, clearly e-Stamping is the preferred option over traditional stamp paper. It offers higher security against fraud, ensures quicker processing through digital workflows, and provides real-time validation of payments. The online system also improves transparency and reduces administrative burden, making it a more reliable choice for high-value property dealings.

While minor limitations exist, the benefits of e-Stamping simply outweigh those of physical stamp paper.

Read Blog:

- E-Stamping: What It Is, How It Works & Benefits (2025 Guide)

- How to Procure Assam eStamp Paper Online Instantly

- Franking vs Stamping: Key Differences in Document Authentication

- eStamp in Uttar Pradesh

- eStamp in Tamil Nadu

- eStamp in Karnataka

Frequently Asked Questions (FAQs)

Q: What is e-Stamp and how does it work in Maharashtra?

e-Stamp in Maharashtra is a digital alternative to physical stamp papers used for paying stamp duty in Maharashtra on property and other legal documents. Instead of buying paper from vendors, you can complete the entire stamp duty payment online, generate a tamper-proof certificate, and verify it instantly on the SHCIL portal. This makes the process of stamp duty in Maharashtra quicker, safer, and more transparent.

Q: Where can I buy e-stamp paper online in Maharashtra?

You can purchase e stamp paper in Maharashtra through official platforms like the SHCIL portal or the GRAS portal, all approved by the state government. This online service makes it easy to pay stamp duty charges securely without visiting a physical vendor. The system ensures authenticity, transparency, and convenience in every stamp duty payment.

Q: What are the key uses of e-stamp paper in Maharashtra?

In Maharashtra, e stamp paper is primarily used for transactions such as paying stamp duty on property, executing agreements, and handling land registration charges. It is also commonly required for affidavits, contracts, and various legal documents, making it a secure and transparent alternative to traditional stamp duty charges.

Q: How to verify the authenticity of an e-stamp certificate?

You can verify an e stamp paper entering its unique certificate number on the official SHCIL portal or the IGR Maharashtra website. The system instantly confirms whether the stamp duty payment is genuine, ensuring transparency and preventing fraud.

Q: Is e-stamp paper valid for a lifetime in Maharashtra?

Yes, once purchased, e stamp papers in Maharashtra remain valid indefinitely. Unlike physical stamp papers that may degrade with time, e-stamp certificates are digitally secured and legally recognized for a lifetime.