Imagine rushing between stamp vendors in Coimbatore before your property registration deadline, only to find they're out of the denomination you need, or worse, you're unsure if the stamp paper is authentic. If you've ever struggled with scenarios like this, you know how inconvenient the old system was.

Long waits, limited options, and worrying about fake papers.

E-stamp is the digital fix that India’s stamp duty system has always needed, letting you pay stamp duty online and get an instant certificate.

No more hassles or headaches.

What is e-Stamp Duty in Tamil Nadu?

E-stamp duty in Tamil Nadu is the digital way to pay stamp duty for property deals, lease agreements, and other legal documents. Instead of physical stamp papers, you get a secure, electronic proof of payment that meets legal requirements under Indian and Tamil Nadu stamp laws.

This is just the start. Next, we’ll break down how e-stamp duty actually works in Tamil Nadu and what you need to know to navigate it smoothly.

Importance of e-Stamp in Tamil Nadu

e-Stamp in Tamil Nadu makes property transactions safer, prevents fraud, and ensures every document is legally valid through secure electronic stamping.

Let us tell you why e-stamp is such a big deal in Tamil Nadu. For starters, missing or incorrect stamping can cause serious legal headaches and even invalidate your contracts. Across India, over ₹200 crore is lost every year because of fraudulent or wrong stamping.

Tamil Nadu businesses process thousands of stamp duty documents every month, and handling this volume manually just piles on delays, errors, and compliance risks. Paper-based physical stamping slows things down, creates opportunity for fraud, and leaves room for costly mistakes. Section 35 of the Indian Stamp Act says that unstamped documents can be thrown out in court (not literally, of course)

So, making sure every document is properly stamped, traceable, and on time isn’t just good practice. It's the law.

Knowing the importance of e-stamp in Tamil Nadu is one part of the story. The other is knowing the available options. Not all e-stamp papers serve the same purpose. Different transactions call for different types.

Let’s break down the kinds of e-stamp papers you can get in Tamil Nadu.

Types of e-Stamp Papers in Tamil Nadu

E-stamp papers in Tamil Nadu are mainly of two types - judicial and non-judicial. Judicial papers are used for court matters, while non-judicial papers cover agreements, property transactions, and other legal documents.

Again, these are only two of all the different types of e-stamp paper used across different states.

1. Judicial E-Stamp Paper: These are used specifically for court-related processes, such as proceedings, orders, and judgments. If the matter is legal and related to the court somehow, this is the type required.

2. Non-Judicial E-Stamp Paper: The more commonly used category.

Non-judicial papers are needed for documents like property agreements, rental contracts, affidavits, and other official transactions. They ensure legal validity, compliance, and smooth stamp duty payment for day-to-day dealings.

So whether it’s for a courtroom procedure or something as common as a rental agreement in Chennai, e-stamp papers Tamil Nadu ensure your documents have full legal protection.

For a more detailed breakdown of their uses, differences, and legal implications, you can refer to our complete guide on judicial vs. non-judicial stamp papers.

What are the Benefits of Using e-Stamp Paper in Tamil Nadu?

Using e-stamp Tamil Nadu speeds up transactions, increases security, and cuts costs by replacing physical stamps with digital, tamper-proof certificates.

Switching to e-stamp paper in Tamil Nadu has made legal and property transactions smoother and more reliable.

By moving stamping online, the state has tackled many problems faced with traditional paper stamps.

- Faster Processing: No more waiting in lines or chasing vendors. You can get your e-stamp paper almost instantly, speeding up your agreements.

- Secure and Tamper-Proof: Each e-stamp comes with a unique ID, so it’s nearly impossible to forge or duplicate, giving you peace of mind.

- Easy Verification: Anyone can quickly verify an e-stamp online, making the whole process more transparent.

- Cost Savings: No more costs related to physical stamps, logistics, or manual errors. With e-stamps the process is all digital, saving you time and money.

- Environmentally Friendly: Less paper use means Tamil Nadu is also doing its part for the environment with electronic stamping in Tamil Nadu.

These advantages highlight why more individuals and businesses in Tamil Nadu are adopting e-stamp paper as their trusted choice for smooth, secure, and efficient stamping.

Up next, we’ll walk through the simple steps you need to take to obtain e-stamp paper in Tamil Nadu without any fuss.

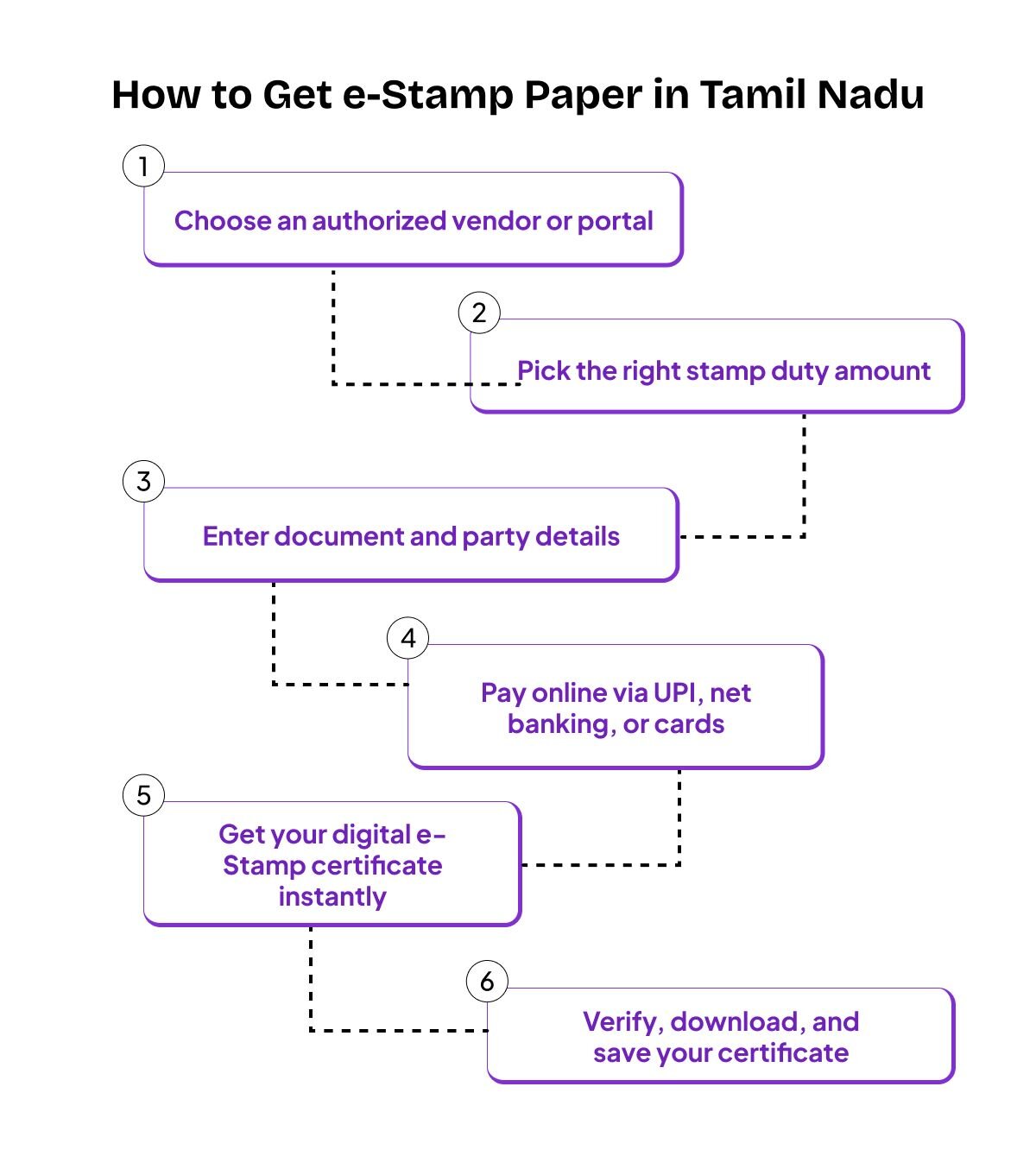

How Do You Obtain an e-Stamp Paper in Tamil Nadu

The Tamil Nadu e-Stamping process is simple: choose a vendor, select duty value, enter details, pay online, and instantly get a digital e-stamp certificate.

Getting an e-stamp paper in Tamil Nadu is a pretty straightforward process, and you can do most of it online without any hassle. Here’s a quick rundown of the steps:

- Find an Authorized Vendor or Portal: The first step is to go to a government-approved e-stamp vendor such as the Stock Holding Corporation of India Limited (SHCIL) portal, or certain trusted platforms like ZoopSign which offer seamless e-stamping solutions for Tamil Nadu users.

- Select the Correct Stamp Duty Value: Choose the stamp duty amount that fits your type of transaction.

- Provide Your Details: Fill in essential details like the type of document, property information, and the parties involved.

- Make the Payment: Pay the stamp duty digitally using secure online payment methods like UPI, net banking, or cards.

- Get Your e-Stamp Certificate: Once payment is complete, you’ll immediately receive a digitally signed e-stamp certificate with a unique identification number (UIN) that proves your document is legally stamped.

- Verify and Save: Make sure all details are correct, download your certificate, and keep a copy.

Overall, the process to get an e-stamp paper in Tamil Nadu is straightforward, with clear steps to guide you.

Just make sure to provide accurate details and complete your payment securely, and you’ll have your digital stamp certificate in no time.

What Documents are Required for e-Stamping in Tamil Nadu?

To complete e-stamp Tamil Nadu transactions smoothly, you need valid ID, transaction-specific documents, and property proof ready.

To ensure a smooth e-stamping process, having the right documents ready is essential. These documents help verify the transaction and secure your stamp duty payment. Here are the main categories of documents you will typically need:

- Identification Proof: Valid government-issued IDs such as Aadhaar card, PAN card, or passport.

- Transaction-Specific Documents: Depending on the type of transaction, this could include sale agreements, lease agreements, power of attorney documents, etc.

- Property Details: Title deeds, property registration documents, land records, and other relevant proofs related to the property involved.

Make sure all your documents are accurate and up to date, to avoid any delays or complications during the e-stamping process. Keeping these ready will help you complete your stamp duty payment efficiently and get your e-stamp certificate without any issues.

Why documents are necessary for fraud control and verification

Documents are essential in the e-stamping process because they help verify the identities of the parties involved and confirm the legitimacy of the transaction. Having valid documents prevents fake or forged agreements, ensuring that every stamped document is trustworthy and legally valid.

This verification step is crucial to protect everyone from fraud and maintain the integrity of property and legal transactions in Tamil Nadu.

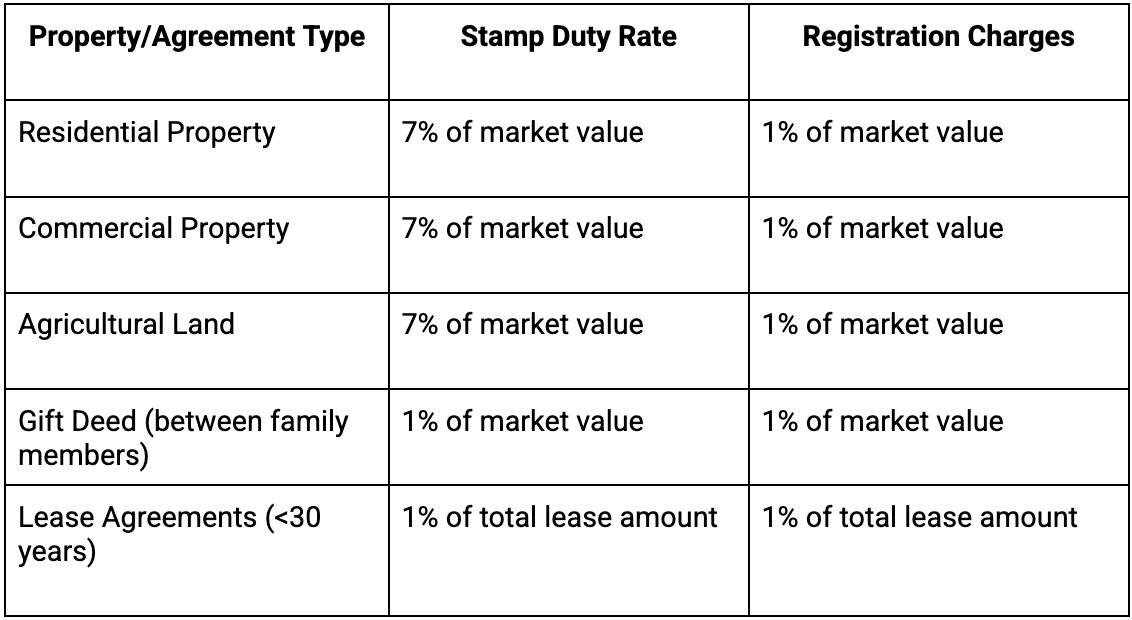

What are the Stamp Duty and Registration Charges in Tamil Nadu (2025)

When purchasing property in Tamil Nadu, understanding the applicable stamp duty and registration charges is essential for accurate budgeting. These charges vary depending on the type of property and transaction. Below is a clear summary of the 2025 rates for different property types and transaction categories.

Understanding stamp duty and registration charges is crucial for anyone involved in legal transactions like property deals, gift deeds, or lease agreements.

Being aware of these charges helps you plan your finances better and ensures smooth, hassle-free transactions.

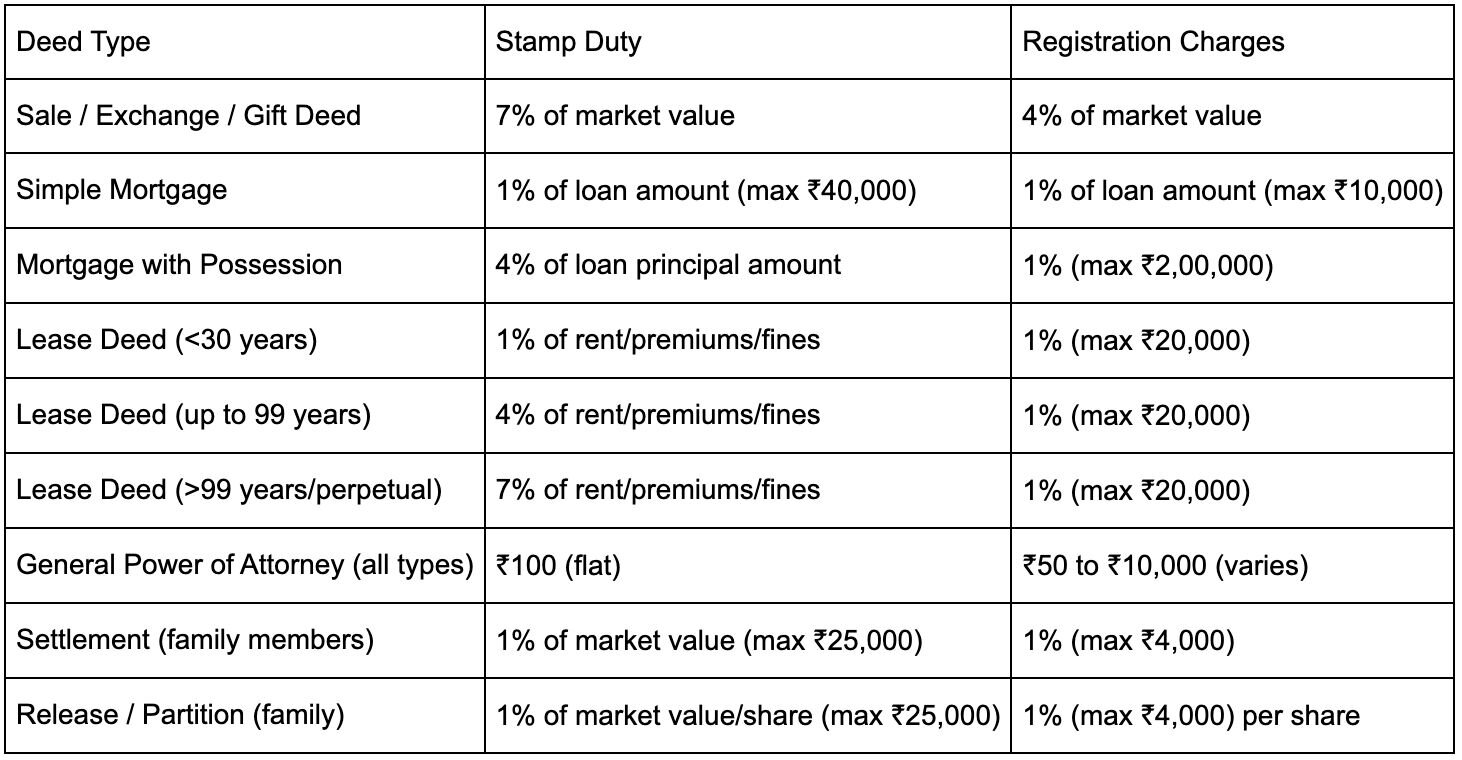

Stamp Duty and Registration Charges for Different Deeds in Tamil Nadu

Stamp duty and registration charges are mandatory government fees applied to various types of legal transactions, not just property purchases. These charges are essential for legally validating documents and recording ownership or transaction details officially.

The rates vary depending on the specific deed type and transaction nature.

Below is a summary of the 2025 stamp duty and registration charges applicable to different deeds in Tamil Nadu.

With a clear understanding of the stamp duty and registration charges applicable to different types of deeds in Tamil Nadu, you are better equipped to navigate the legal and financial aspects of your transactions.

Knowing these details helps avoid surprises and ensures you comply with all necessary formalities.

Factors Affecting Stamp Duty in Tamil Nadu

Stamp duty in Tamil Nadu varies by property type, location, transaction nature, market value, amenities, and buyer’s gender with some rebates available.

Several key factors influence the stamp duty charged on property transactions in Tamil Nadu:

- Property Location: Properties located within city municipal limits usually attract higher stamp duty rates compared to those in suburban or rural areas.

- Type of Property: Stamp duty varies based on whether the property is residential, commercial, agricultural, or industrial. Commercial properties generally have higher rates.

- Nature of the Transaction: Different types of deeds and transactions, such as sales, gifts, leases, or mortgages, attract different stamp duty rates.

- Market or Guideline Value: Stamp duty is calculated on the higher of the transaction price or the government-set guideline value.

- Age and Amenities: Newer properties or those with added amenities like clubhouses or pools may have higher assessed values, affecting stamp duty.

- Buyer’s Gender: Tamil Nadu provides a rebate on stamp duty rates for women buyers, reducing their overall cost.

By the way it’s also important to know that there are certain exemptions and concessions to stamp duty that can significantly reduce these charges.

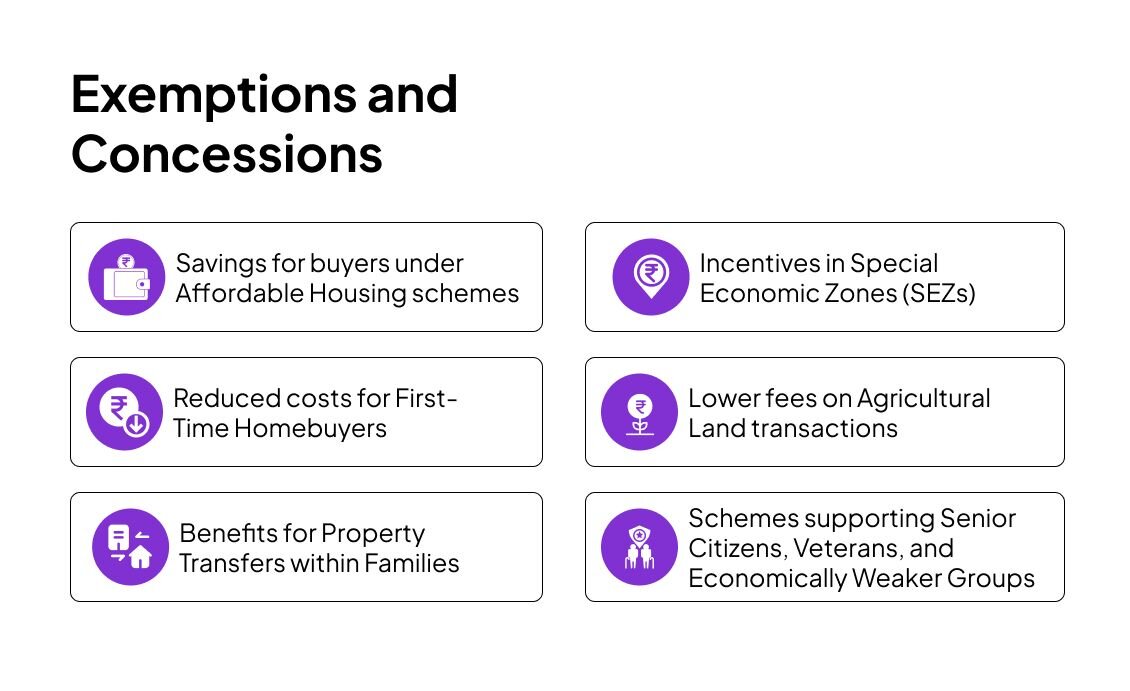

Stamp Duty and Registration Charges in Tamil Nadu: Exemptions and Concessions

Tamil Nadu property registration charges may be reduced or exempted for affordable housing, first-time buyers, family transfers, and special government schemes.

From what we have already covered stamp duty and registration charges form an essential part of property transactions in Tamil Nadu.

While these fees can add to the overall cost, the state government provides several exemptions and concessions to ease the burden for certain buyers and specific property types.

These measures aim to promote social and economic objectives.

Key exemptions and concessions include:

- Affordable Housing: Specified concessions apply to properties categorized under affordable housing schemes, designed to assist low-income groups.

- First-Time Homebuyers: Certain areas provide reduced or waived stamp duty rates for first-time buyers, subject to eligibility criteria such as maximum property value and residency requirements.

- Family Transfers: Transfers of property between family members may qualify for exemptions or reduced stamp duty charges.

- Special Economic Zones (SEZs): Properties within SEZs may benefit from concessions to encourage investments in these designated zones.

- Agricultural Land: Transfers of agricultural land often receive lower stamp duty and registration fees to promote farming and rural development.

- Government Schemes: The government runs schemes offering reduced stamp duty rates or exemptions for specific groups, including senior citizens, veterans, and economically disadvantaged categories.

Buyers can verify their eligibility for these concessions through the Sub-registrar Office or via the TNREGINET online portal. Being aware of these benefits can help in better financial planning and making informed property decisions.

How to Calculate Stamp Duty and Registration Fees in Tamil Nadu

When buying property in Tamil Nadu, stamp duty and registration fees are calculated based on the property's value, as defined by the state government. The chargeable amount is determined by comparing the transaction’s agreed price (consideration value) and the government’s ready reckoner or guideline value - whichever is higher.

For example, if a property is agreed to be sold at Rs. 50 lakh but the guideline value is Rs. 40 lakh, the calculations will be based on Rs. 50 lakh. Conversely, if the agreed price is lower than the guideline value, the government will take the higher guideline value as the basis for duty and fee assessment.

The current stamp duty rate in Tamil Nadu is 7% of this determined value, while the registration fee stands at 4%. So, if a property’s guideline value is Rs. 40 lakh, the stamp duty would amount to Rs. 2.8 lakh, and the registration charge would be Rs. 1.6 lakh, bringing the total additional cost to Rs. 4.4 lakh.

How to Verify e-Stamp Certificate in Tamil Nadu

You can easily verify your e-Stamp in Tamil Nadu online by entering the unique certificate number and other details on the official government portal.

Verifying your e-Stamp certificate in Tamil Nadu is a straightforward yet essential step to confirm the authenticity of your stamped document.

The process is conducted online through the official SHCIL portal, ensuring your property transaction or legal document is genuine and legally valid.

Simply enter the unique certificate number (UIN) along with other required details on the government-authorized SHCIL website. This cross-verification helps protect against fraud and provides confidence that your documentation complies with legal standards.

The entire verification typically takes just a few minutes and can be completed from the comfort of your home.

Online e-Stamp Verification Process and The Details Required

Verifying your e-Stamp certificate in Tamil Nadu is a straightforward process that can be completed online via the official SHCIL website. This portal enables you to confirm the authenticity of your e-Stamp in just a few simple steps:

- Visit the SHCIL e-Stamp portal.

- Select Tamil Nadu as the state of issuance.

- Enter the unique Certificate Number or Unique Identification Number (UIN) found on your e-Stamp certificate.

- Fill in the captcha or other verification details displayed on the screen.

- Click on the "Verify" button to view the authentication result.

This simple step eliminates risks of forgery or disputes later on, making the process more transparent and reliable. With the government’s digital systems in place, e-Stamping in Tamil Nadu is quickly becoming the standard for safer documentation.

Once verified, you can securely share and manage access to your e-stamp documents using ZoopSign’s Doc Track feature, ensuring full control and a tamper-proof audit trail.

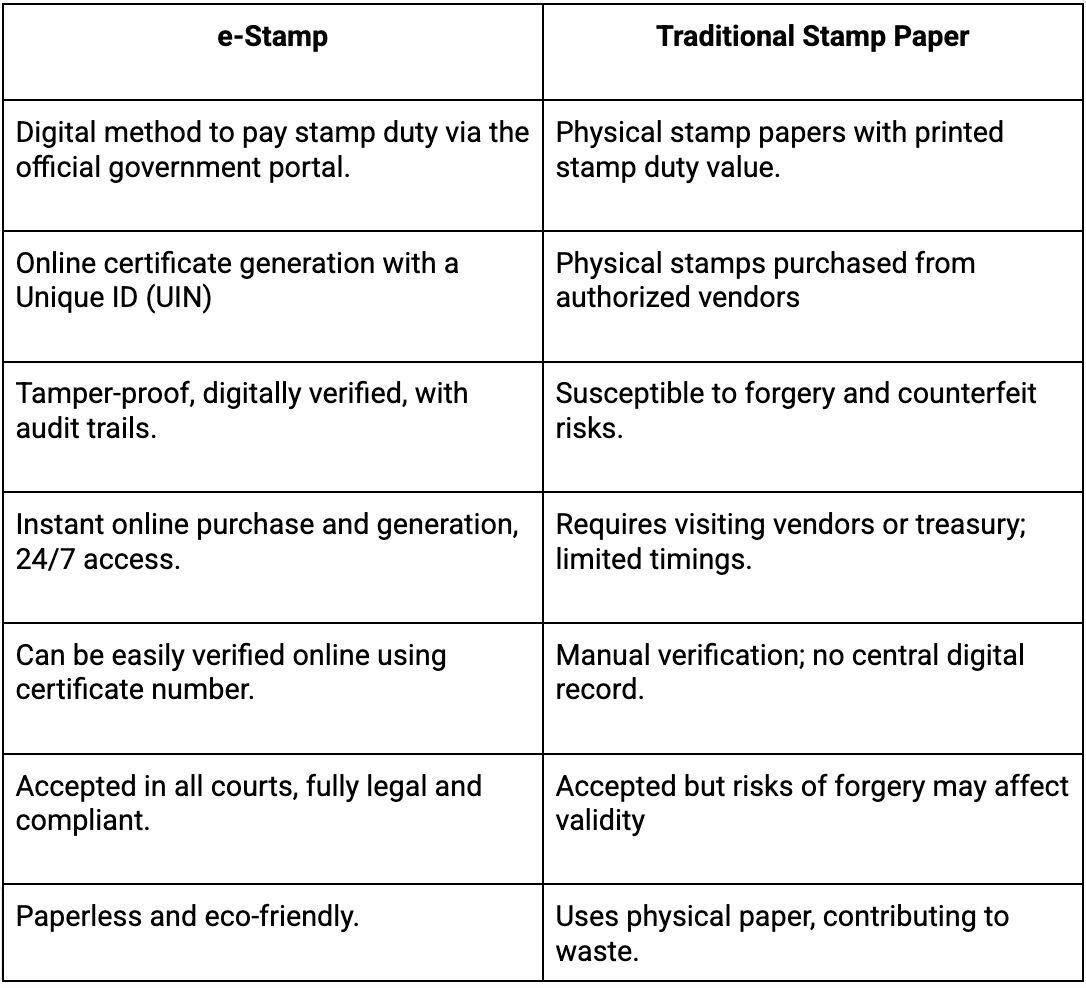

e-Stamp vs. Traditional Stamp Paper in Tamil Nadu

E-Stamp Tamil Nadu offers a faster, secure, and paperless method of paying stamp duty compared to traditional physical stamp papers prone to forgery.

In Tamil Nadu, both traditional stamp paper and e-Stamping are used for paying stamp duty on legal documents, each with its own features and processes.

The following table highlights the key differences between these two methods to help you understand their respective benefits and limitations.

This comparison highlights how e-Stamping in Tamil Nadu modernizes and streamlines the stamping process while addressing many of the limitations traditional stamp paper entails.

Why choose ZoopSign for e-Stamping in Tamil Nadu

No need to juggle multiple government portals like SHCIL or TNREGINET.

With ZoopSign, you get instant e-Stamps, a simple interface, secure transactions, and dedicated support, making your entire stamping process quicker, safer, and hassle-free.

Which is Better for Property Transactions in Tamil Nadu?

For property transactions in Tamil Nadu, e-Stamping is generally the better option compared to traditional stamp paper. It offers improved security against fraud, speeds up processing through digital workflows, and provides instant verification of payment. The online system also enhances transparency and reduces paperwork, making it a more convenient and trustworthy choice for property dealings.

Although there may be minor drawbacks, overall, e-Stamping provides greater advantages over physical stamp papers in Tamil Nadu.

Related Blogs:

Frequently Asked Questions (FAQs)

Q: What is an e-Stamp and how does it work in Tamil Nadu?

A: An e-Stamp or an electronic stamp in Tamil Nadu is a digital version of stamp paper used to pay stamp duty for legal documents like property deals and agreements. Instead of physical papers, you receive an electronic certificate with a unique ID that proves your payment, ensuring your documents are legally valid and easy to verify online.

Q: Can I pay the stamp duty and registration charges online in Tamil Nadu?

A: Yes, you can pay the stamp duty and registration charges online in Tamil Nadu. The state’s official portal TNREGINET allows you to calculate the applicable charges, make secure digital payments using net banking, credit/debit cards, or UPI, and download your payment receipt - all from the comfort of your home. This streamlined online process makes property transactions much easier and more transparent.

Q: How to verify the authenticity of an e-stamp certificate?

A: You can verify an e-stamp in Tamil Nadu online through an official government portal like SHCIL by entering its unique certificate number (UIN) along with other required details such as the issue date and stamp duty type. This quick online check confirms whether the e-stamp is genuine and valid, helping you avoid fraud and ensuring your document is legally recognized.

Q: How do you calculate stamp duty in Tamil Nadu?

A: Stamp duty in Tamil Nadu is calculated based on the higher value between the property's transaction price (consideration value) and the government’s guideline (ready reckoner) value. The current rate is generally 7% of this higher value for most property types, while registration charges are around 4%.

Q: What is the validity period of an e-Stamp paper in Tamil Nadu?

A: Yes, once purchased, e-Stamp papers in Tamil Nadu remain valid indefinitely. Unlike physical stamp papers that may degrade over time, e-Stamp certificates are digitally secured and legally recognized for a lifetime.