When it comes to making documents legally valid, two terms that often create confusion are franking and stamping.

If you’re a business owner, a legal professional, or someone handling important paperwork, understanding the difference between franking and stamping is crucial for ensuring your documents meet all legal requirements.

Before we get into the key differences, let’s understand these 2 individual keywords.

What Is Document Authentication and Why Is It Important?

Let’s talk about the core term first. Document authentication is the process of verifying that a document is genuine, legally valid, and has been properly executed according to applicable laws and regulations.

Now, both franking and stamping serve as methods of document authentication, but they work in different ways and are used in different contexts.

Understanding these differences is essential for anyone dealing with legal documents, contracts, or official paperwork.

What is Stamping?

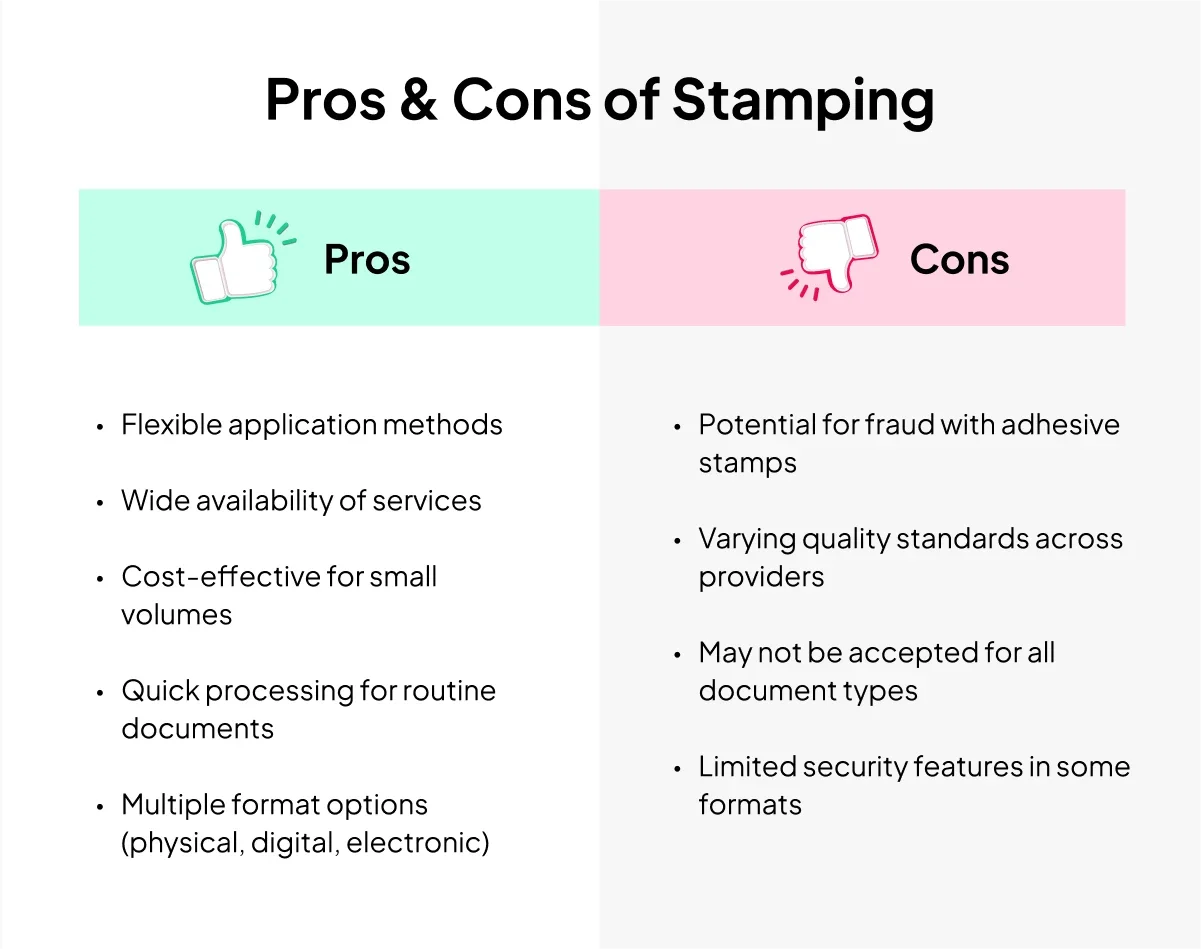

Stamping is a traditional method of document authentication that involves affixing a physical stamp or seal to a document. This process validates the document's authenticity and ensures it meets legal requirements. Stamp duty, which is a tax levied on certain legal documents, is often collected through the stamping process.

What Are the Different Types of Stamping Methods?

- Physical stamps: Traditional adhesive stamps affixed to documents

- Impressed stamps: Embossed or impressed markings made directly on the document

- Franking: A specific type of stamping (which we'll discuss in detail)

For a comprehensive understanding of stamping, including its various types, legal requirements, and step-by-step processes, you can explore our detailed guides on Types of Stamps and Judicial vs Non-Judicial Stamping. These resources provide in-depth coverage of stamping requirements across different jurisdictions and document types.

The stamping process ensures that documents comply with stamp duty regulations and provides legal validity to agreements, contracts, and other important paperwork. However, traditional stamping methods can be time-consuming and may require physical presence at designated offices.

What is Franking?

Let’s talk about franking in detail. Franking is a specific method of stamping that involves marking documents with an official stamp or impression, typically done by authorized government offices or designated agencies. The term "franking" comes from the concept of providing free passage or exemption from charges, though in a document context, it refers to the official validation process.

Franking is essentially a form of impressed stamping where documents are validated through an official mechanical process. Instead of using adhesive stamps, franking involves using a franking machine or official stamp that creates an impression directly on the document.

This impression serves as proof that the required stamp duty has been paid and that the document has been officially processed.

What Are the Types of Franking (Manual, Machine, Digital)?

1. Manual Franking

Manual franking is performed by hand using official stamps or seals. This traditional method requires physical handling of documents and is often used for smaller volumes of paperwork.

2. Machine Franking

Machine franking uses specialized equipment to create uniform impressions on documents. This method is more efficient for processing large volumes of documents and ensures consistency in the franking process.

3. Digital Franking

With technological advancement, digital franking has emerged as a modern solution. This method uses digital signatures and electronic validation to achieve the same legal effect as traditional franking.

What Are the Steps Involved in the Franking Process?

The franking process typically involves several steps:

Step 1: Document Preparation

Before franking, documents must be properly prepared and reviewed to ensure they meet all legal requirements. This includes verifying that all necessary information is included and that the document format complies with regulations.

Step 2: Duty Calculation

The appropriate stamp duty must be calculated based on the document type, value, and applicable rates. This calculation determines the franking fee that must be paid.

Step 3: Payment Processing

Stamp duty payment is processed through authorized channels. This may involve online payment systems, bank transfers, or direct payment at government offices.

Step 4: Franking Execution

Once payment is confirmed, the actual franking process takes place. The document receives an official impression that validates its authenticity and confirms duty payment.

Step 5: Verification

The franked document is verified to ensure the impression is clear, accurate, and properly positioned. This step confirms that the franking process has been completed successfully.

Franking Regulations and Requirements

Franking is governed by specific regulations that vary by jurisdiction. These regulations typically cover:

- Authorized franking agencies: Only designated offices or agencies can perform official franking

- Franking fees: Specific rates apply based on document type and value

- Time limits: Documents must be franked within the prescribed timeframes

- Documentation requirements: Specific information must be included in franked documents

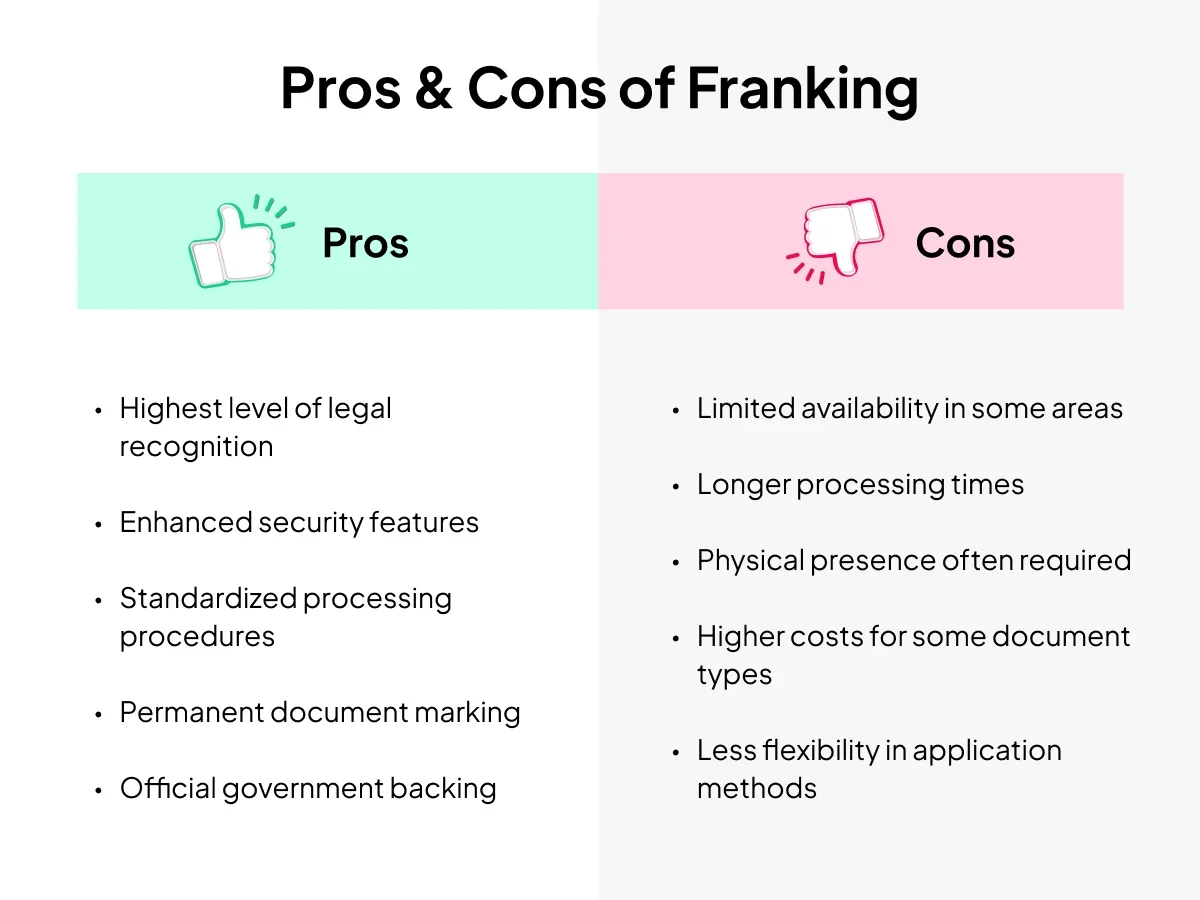

What Are the Benefits of Using Franking for Document Authentication?

- Legal Validity: Franked documents carry official legal recognition and are accepted by courts and government agencies without question.

- Fraud Prevention: The official franking process includes security features that help prevent document fraud and forgery.

- Standardization: Franking ensures uniformity in document processing and reduces ambiguity in legal proceedings.

- Efficient Processing: Modern franking systems can process large volumes of documents quickly and accurately.

What Are the Challenges Associated with Franking?

- Physical Presence Requirements: Traditional franking often requires physical presence at designated offices, which can be inconvenient.

- Processing Time: The franking process may involve waiting periods, especially during peak times.

- Geographic Limitations: Franking services may not be available in all locations, creating accessibility challenges.

- Cost Considerations: Franking fees can add to the overall cost of document processing, particularly for high-value transactions.

Key Differences Between Franking and Stamping

AspectStampingFranking Method of ApplicationCan involve adhesive stamps, impressed stamps, or electronic stamps applied in various waysSpecifically involves creating an official impression directly on the document using authorized equipmentAuthority & AuthorizationCan be performed by various authorized entities, including private agencies, banks, and government officesTypically performed only by specific government offices or their designated agenciesPhysical CharacteristicsMay involve physical stamps that can be removed or tampered with (adhesive stamps)Creates permanent impressions that cannot be easily removed or alteredCost StructureCosts vary based on stamp type and service providerUsually has standardized fees set by government regulationsProcessing TimeCan often be completed quickly, especially with electronic methodsMay require longer processing times due to official verification proceduresLegal RecognitionAccepted for most legal purposes, though some jurisdictions may have specific requirementsCarries the highest level of official recognition and is universally acceptedSecurity FeaturesVaries by type; adhesive stamps have lower security, and impressed stamps have higher securityHigh security with official impressions and government backingAvailabilityWidely available through multiple channels and service providersLimited to specific government offices and designated agenciesFlexibilityHigh flexibility in application methods and timingLower flexibility due to rigid official proceduresTechnology IntegrationHas evolved to include digital and electronic stamping solutionsTraditional but adapting to include digital franking methodsDocument TypesSuitable for various commercial and legal documentsPrimarily used for high-value transactions and official legal documentsFraud RiskHigher risk with adhesive stamps, lower with impressed stampsVery low risk due to official security measuresGeographic AccessibilityAvailable in most locations through various service providersMay not be available in all geographic locationsOperating HoursOften available during extended hours or 24/7 (digital methods)Limited to government office hoursVolume ProcessingEfficient for both small and large volumesMore suitable for smaller volumes due to manual processes

How Has Digitalization Changed Franking and Stamping in India?

Digitalization has significantly transformed the way stamp duty is paid in India, making the process faster, more secure, and widely accessible. Here's how the landscape has evolved:

1. Shift from Physical to Digital Methods

Traditionally, paying stamp duty involved physically purchasing stamp papers or visiting banks for franking. With digitalization, many states have adopted e-stamping, allowing users to complete the process online without visiting any office.

2. Introduction of E-Stamping

E-stamping is an online method facilitated by the Stock Holding Corporation of India Limited (SHCIL). Users can log in to the portal, enter document details, pay the duty online, and instantly download a legally valid e-stamp certificate. This method is now the preferred choice in many states.

3. Enhanced Security and Transparency

Unlike physical stamps that could be forged or duplicated, e-stamp papers come with a unique identification number (UIN) that can be verified online. This has significantly reduced fraud and increased trust in the system.

4. Reduced Dependency on Intermediaries

Earlier, stamp vendors or franking agents were necessary intermediaries. With e-stamping, individuals and businesses can directly pay their stamp duty online, eliminating middlemen and reducing delays.

5. Increased Efficiency and Convenience

Digital methods allow for instant processing, 24/7 availability, and access from any location. This is especially beneficial for businesses handling multiple legal documents or individuals in remote areas.

When to Choose Franking vs Stamping

The choice between franking and stamping depends on several factors:

Choose Franking When:

- Maximum legal security is required

- Documents will be used in official proceedings

- Long-term document preservation is important

- Fraud prevention is a priority

- Dealing with high-value transactions

Choose Stamping When:

- Quick processing is essential

- Cost efficiency is a priority

- Dealing with routine documents

- Flexibility in processing methods is needed

- Working with standard commercial agreements

The Future of Document Authentication Methods

Both franking and stamping are evolving with technology. Digital solutions are making these processes more accessible and efficient while maintaining their legal validity.

Electronic franking and digital stamping are becoming increasingly common, offering the benefits of traditional methods with improved convenience and speed.

As businesses and individuals increasingly rely on digital document processing, understanding these authentication methods becomes even more important. The choice between franking and stamping will continue to depend on specific requirements, but both methods will remain essential tools for document validation.

Frequently Asked Questions (FAQs)

1. What is the main difference between franking and stamping?

The main difference lies in the method and authority. Franking involves creating official impressions directly on documents by authorized government agencies, while stamping can include various methods (adhesive, impressed, or electronic) performed by different authorized entities.

2. Is franking more expensive than stamping?

Franking costs are typically standardized by government regulations, while stamping costs vary by provider and method. The overall cost depends on document type, value, and specific requirements.

3. Can I use stamping instead of franking for all documents?

Not necessarily. Some documents specifically require franking for legal validity, while others may accept various forms of stamping. It's important to check specific requirements for each document type.

4. How long does the franking process take?

Franking processing time varies by jurisdiction and document complexity. It can range from same-day processing to several business days, depending on the specific requirements and office workload.

5. Are digitally franked documents legally valid?

Yes, digital franking is increasingly recognized as legally valid, provided it's performed by authorized agencies using approved systems. However, acceptance may vary by jurisdiction and specific use case.