One thing common in business transactions, mergers, acquisitions, investments, and partnerships is that there exists a silent yet decisive component—due diligence.

Let’s put it simply: imagine you’re about to buy your dream house. You inspect every corner, checking the floors, walls, and ceilings. You test the plumbing, research the neighborhood, and even review the legal documents to ensure there are no hidden surprises. Why? Because no one wants to invest in a property with undisclosed issues that could cost a fortune to fix.

Now, imagine applying the same logic to a business deal, investment, or partnership. That’s the essence of due diligence—the careful, thorough investigation ensures you’re fully informed before you step into a potentially life-changing deal.

For businesses, investors, or banks, the stakes are even higher. A poor due diligence process could lead to financial losses, reputational damage, or even legal complications. It’s no small matter. So, let’s break things down to help you understand what due diligence is all about.

What is Due Diligence?

At its core, due diligence is about being thorough before making a major decision or entering into an agreement. It’s the process of gathering, reviewing, and evaluating all the relevant information to understand potential risks and opportunities. Think of it as running an in-depth background check, but on steroids—it’s more detailed, more specialized, and more focused on ensuring there are no hidden surprises.

Definition of Due Diligence

Due diligence is a systematic process of verifying and analyzing information related to a company, individual, transaction, or investment. This is done to assess potential risks, evaluate opportunities, and confirm compliance with laws and regulations—all before making any critical decisions.

History over Time

The concept of due diligence dates back to the U.S. Securities Act of 1933, which required brokers and dealers to investigate the securities they were offering. The idea was to ensure transparency and full disclosure of all relevant facts. Over time, due diligence has evolved into a global best practice, especially in industries like banking, mergers and acquisitions (M&A), real estate, and beyond.

In today’s world, due diligence isn’t just a nice to have—it’s a cornerstone of trust and integrity. Whether you’re a startup founder looking for investors, a business owner contemplating a merger, or a bank vetting a client, conducting due diligence ensures you’re entering into a deal with both eyes wide open, with risks managed and potential returns maximized.

Why is Due Diligence Important?

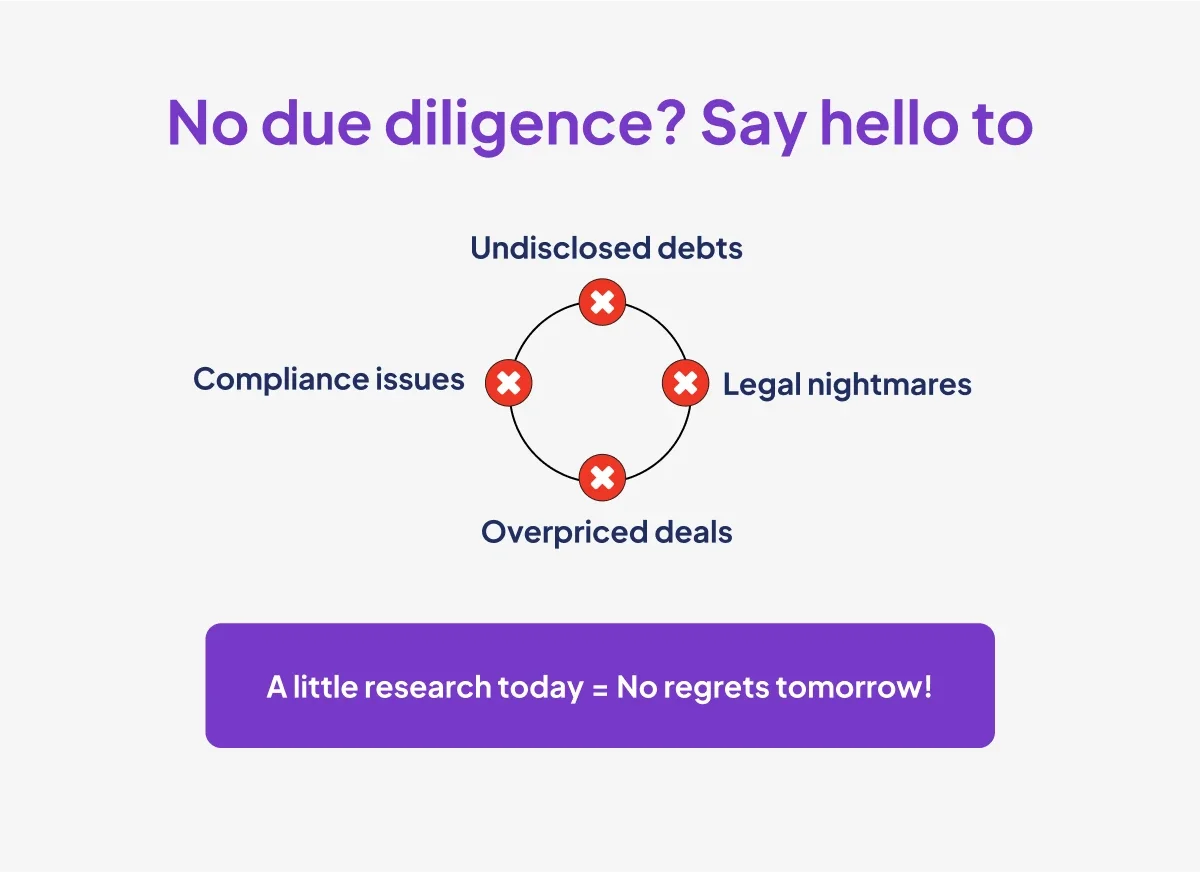

Neglecting due diligence is a bit like diving into a pool without checking how deep it is. You might be fine, but then again, you might break your ankle. Conducting due diligence helps avoid that very scenario, giving businesses and individuals the confidence to move forward without the fear of unpleasant surprises.

Key Benefits of Due Diligence

1. Protects Against Risks

Due diligence helps uncover hidden risks, from undisclosed liabilities to potential compliance issues, ensuring that you know exactly what you’re getting into.

2. Enables Informed Decisions

Instead of relying on guesswork, due diligence arms you with verified data. This empowers stakeholders to make decisions based on facts, not assumptions.

3. Ensures Regulatory Compliance

For businesses navigating complex laws and policies, due diligence helps ensure compliance with regulations, thus avoiding hefty fines or even lawsuits.

4. Builds Trust with Stakeholders

When you prove that you’ve done your homework, whether it’s with partners, investors, or customers, you’re instilling confidence. It shows that you’re serious, trustworthy, and responsible.

5. Prepares for the Future

By identifying potential issues in advance, businesses can take proactive steps to address them before they turn into costly problems down the line.

In short, due diligence helps provide clarity—financially, legally, and operationally—about what you’re stepping into.

The Different Types of Due Diligence

Due diligence isn’t a one-size-fits-all process. It varies depending on the type of deal or transaction. Let’s break down some of the most common types:

1. Financial Due Diligence

This is probably the most well-known type of due diligence. It involves digging deep into a company’s financial health—reviewing income statements, balance sheets, cash flow, and tax records.

Why It’s Done: To ensure that the financial information is accurate and that there are no hidden monetary risks lurking beneath the surface.

2. Legal Due Diligence

Legal due diligence involves examining contracts, licenses, intellectual property, ongoing litigations, labor laws, and compliance documents. This process is typically handled by legal experts who can spot potential legal risks or irregularities.

Example: It could involve checking if the company being acquired owns its intellectual property outright or whether it’s involved in any ongoing lawsuits that could affect the deal.

3. Operational Due Diligence

This type of due diligence focuses on the day-to-day operations of a business—its supply chain, workforce, processes, and overall operational efficiency.

Why It Matters: Buyers or investors need to assess whether the business will be able to sustain its operations after the deal is signed. Operational due diligence ensures the company can function smoothly post-acquisition or investment.

4. Commercial Due Diligence

This type evaluates the market dynamics, competitive landscape, and growth potential of the business or investment in question. It helps assess the viability of the business within its market, customer demand, and potential for future growth.

Why It’s Important: Understanding the commercial environment allows you to gauge whether the business can continue to grow and succeed in its industry, minimizing the risk of investing in a failing market.

The Step-by-Step Process of Due Diligence

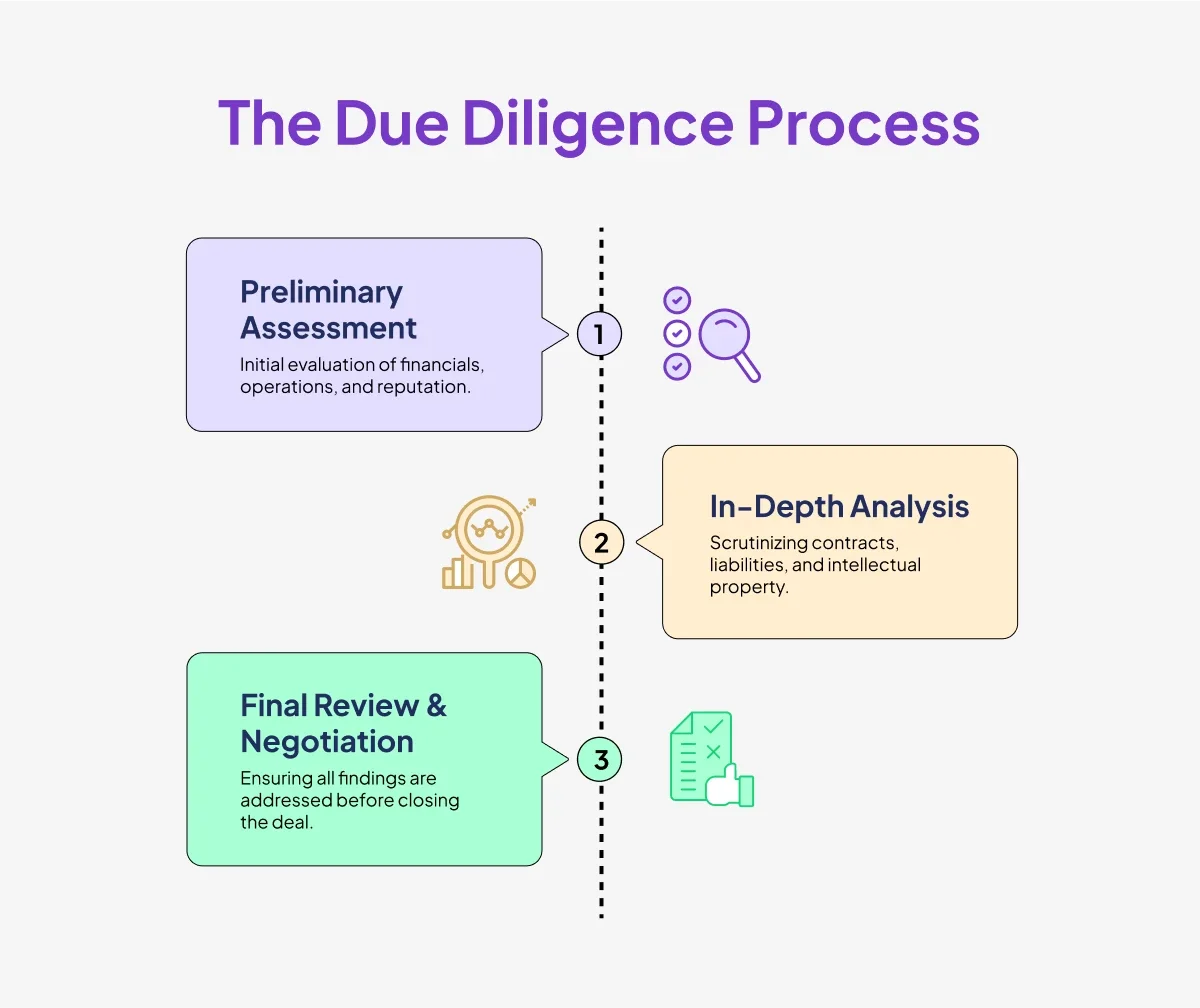

A due diligence audit is not a one-size-fits-all activity, but most processes follow these key steps:

1. Planning and Preparation

- Define the goals and scope: What are you trying to uncover?

- Identify the key stakeholders and assign roles (e.g., legal auditors, finance professionals).

2. Data Collection

- Request key documents such as financial statements, contracts, licenses, and legal filings.

- Conduct interviews with management or employees.

3. Analysis and Review

- Verify the accuracy of the information provided and analyze it for risks or opportunities.

- Flag inconsistencies, liabilities, or potential deal-breakers.

4. Reporting

- Compile findings into a clear, actionable report that outlines risks, opportunities, and recommendations for the next steps.

Due Diligence in Action: M&A and Banking

Due Diligence in Mergers & Acquisitions (M&A)

In M&A deals, M&A due diligence is at its most intricate. The buyer conducts investigations to avoid overpaying or inheriting liabilities.

Core areas include:

- Financial stability

- Operational capabilities

- Compatibility of cultures

What is Due Diligence in Banking?

Banks use due diligence for two primary purposes:

- Client Onboarding: Ensuring compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

- Credit Assessment: Evaluating the creditworthiness of borrowers, including financial health and repayment history.

Challenges of Conducting Due Diligence and Overcoming Them

Despite its importance, conducting due diligence isn’t always smooth sailing.

Common challenges include:

- Fragmented Data: Information is often spread across multiple departments or formats.

- Time Constraints: Tight deadlines can lead to oversight.

- Complex Regulations: Cross-border deals bring varying legal frameworks.

How ZoopSign Helps

ZoopSign’s Deal Room feature addresses these challenges effectively:

- Centralized document storage with advanced encryption for security.

- Easy sharing and collaboration tools for seamless teamwork across departments or organizations.

- Automatic audit trails to ensure compliance and transparency.

Best Practices for Due Diligence

1. Use Comprehensive Checklists

Having a checklist ensures no aspect of due diligence is overlooked. Tailor it based on transaction type.

2. Leverage Technology

Digital tools, like ZoopSign’s Deal Room, reduce time, cut costs, and offer unparalleled security for managing due diligence tasks.

3. Work with Experts

Hiring.specialists for legal, financial, or environmental reviews adds depth and accuracy to the process.

Conclusion

Due diligence is more than just a checklist—it’s a safety net that prevents organizations from entering into unfavorable deals. Whether you're buying a competitor’s company, acquiring real estate, or approving a business loan application, getting a complete picture before you commit is a must.

With tools like ZoopSign’s Deal Room, businesses can revolutionize their due diligence process—making it faster, more accurate, and more secure. In today’s unpredictable world, a smart due diligence process is not a choice but a necessity to stay ahead in the game.

Have questions? Get in touch with our sales experts who can help you!