You got your home loan approved. That is good news. But before you can move in, there is one last and very important paper to sign. It is called the Mortgage Deed.

This is the legal paper that says your property is the guarantee for the loan. What is written in this deed decides your EMI, your rights, and what the bank can do if you stop paying.

This guide will explain the Mortgage Deed in simple words. What it is. Why you need it. The different types of it. And what everything written inside means for you.

Let us understand it properly, because your home is involved.

What Exactly Is a Mortgage and How Does It Work?

A mortgage is a loan you take from a bank or an NBFC to buy a house or property. The catch is, the property you buy itself becomes the security for the loan.

You agree to pay back the money in monthly instalments over many years, usually 15 to 30. Until you make that final payment, the bank holds a claim on your property. This is called keeping the property as collateral. If you fail to pay back the loan (this is called a default), the bank has the right to take your property, sell it, and recover their money. This action is known as foreclosure.

So, while you live in the house, the bank’s name is on the deal until you finish paying. It’s the standard way most people in India afford a home without having crores of rupees ready upfront.

Now that you know a mortgage is simply a loan with your house as security, the actual deal is written down in a special document.

Let's talk about that document: The Mortgage Deed.

What Is a Mortgage Deed and What Does It Contain?

A Mortgage Deed is the main legal paper that makes your home loan official. It's the written contract between you (the borrower, called the 'mortgagor') and the bank (the lender, called the 'mortgagee').

This document does one big thing: it clearly states that you are putting up your property as security for the loan. Because it's a legal contract, it lists out all the terms you agreed to. This includes the exact loan amount you took, the home loan interest rate, your repayment schedule, and any other charges or rules.

Most importantly, the Mortgage Deed is what gives the bank the legal right to take over your property if you stop paying the loan. Without this signed and registered deed, the bank's claim on your house isn't solid in the eyes of the law.

So, the deed is the rule book for your home loan. But when exactly do you need this rule book?

Let's talk about why and when a Mortgage Deed is required.

Why Is a Mortgage Deed Required for Home Loans and When?

A Mortgage Deed is required by law to officially create a mortgage on your property. It's the document you sign with the bank that gets registered with the government, making the whole deal legally solid and enforceable.

Here’s why and when it becomes a non-negotiable:

- This deed is the bank’s safety net. It gives them the clear right to take possession of your property and sell it if you stop paying your EMIs. Without this registered deed, they have very weak legal power to recover their money.

- For yourself or the borrower in general, it acts as your proof of the deal. It locks in all the terms you agreed to like the loan amount, the interest rate, the repayment schedule. This stops any future confusion or arguments with the bank about what was promised.

- Under the Transfer of Property Act, for a common Simple Mortgage, executing and registering this deed with the local authorities is what makes the mortgage official. The only common exception is an ‘equitable mortgage’ where you just deposit your property papers with the bank in certain big cities.

So the bottom line is that you need this deed whenever you are taking a home loan or a loan against property from a bank or an NBFC, and you are using that property as security.

It’s the final, binding step that turns a loan approval into a secured legal agreement.

Now, the law doesn't just have one type of mortgage. Depending on your deal, the deed can be of different types.

What Are the Different Types of Mortgage Deeds in India?

In India, the Transfer of Property Act, 1882 defines different types of mortgage deeds. The one you sign depends on the agreement with your bank. Here are the main types:

- Simple Mortgage: This is the most common registered mortgage. You promise to repay the loan. If you don't, the bank has the right to sell your property to get their money back. You keep living in the house. The deed must be officially recorded with the authorities.

- Equitable Mortgage or Mortgage by Deposit of Title Deeds: Here, you just hand over your original property papers to the bank in certain notified towns like Mumbai, Delhi, Kolkata. This acts as security. It's popular because it does not require registration, so it's faster and saves on stamp duty and registration fees.

- Usufructuary Mortgage: The bank gets the right to use the property or collect its rent until you repay the loan. You don't pay EMIs; the income from the property goes to the bank instead.

- English Mortgage: You promise to repay the loan by a fixed date. As security, the ownership of the property is temporarily transferred to the bank's name. Once you fully repay, they transfer it back to you.

- Anomalous Mortgage: This is a custom mix of any of the above types, based on a special agreement between you and the lender.

Besides these, deeds can also be Fixed rate (interest stays same) or Floating rate (interest changes with market), and can include Joint Ownership details if there are multiple owners.

Now you know the types, but what exactly goes inside this important document? Every mortgage deed must have some key parts to be valid.

Let's look at the essential elements of a Mortgage Deed.

What Are the Essential Elements of a Mortgage Deed?

A Mortgage Deed is a detailed legal contract. For it to be valid and hold up in court, it must include certain key elements. Miss one, and you could have problems later.

Here are the main things that must be in the deed:

- The people/Parties involved (Mortgagor/Mortgagee): Full names, addresses, and details of the Borrower (this is the 'Mortgagor') and the Lender (this is the 'Mortgagee' or bank). Getting this wrong invalidates the whole deed.

- Property details: A complete description of the property being mortgaged - its full address, survey number, area, and any other identification so there's zero confusion.

- Loan amount & interest: The exact loan amount, the interest rate, the EMI amount, and the total loan tenure.

- The default clause: This is the "what if" section. It clearly says what happens if you stop paying your EMIs. It outlines the bank's right to take possession and sell the property.

- Borrower's covenants: Your promises, like keeping the property insured, paying all property taxes on time, and not damaging the property.

- Legal formality (Registration clause): A note that this deed must be registered with the local Sub-Registrar's office to be legally enforceable. An unregistered deed has very little power.

Before you sign, read each of these sections carefully. This document is the rulebook for perhaps what's going to be your biggest loan.

Okay, so you have a deed with all the right elements. But a deed is just a paper until the government recognises it.

The next critical step is registration. Let's see how a Mortgage Deed is registered.

How Do You Register a Mortgage Deed Step-by-Step Process?

Executing a mortgage means completing all the legal steps to make the home loan and the bank's claim on your property official. It's the final, binding process that involves careful drafting and government registration.

Here is the step-by-step process for a registered mortgage:

1. Draft and negotiate the terms

This is where the contract is made with the bank. Agree on all terms, not just the interest rate. Discuss other conditions like prepayment penalties.

2. Get a lawyer to review it

Always have a lawyer check the final draft before you sign. They make sure the clauses protect your rights and you understand everything.

3. Pay the stamp duty

This is a state government tax. You pay it by buying the correct value of non-judicial stamp paper and printing the deed on it. You can also use the e-stamp paper online system. The amount depends on your loan and state rules.

4. Register at the Sub-Registrar’s office

This is the mandatory final step. Visit the local Sub-Registrar of Assurances office with the bank representative, two witnesses, and all documents. Submit the deed, pay a registration fee, and sign in front of the officer.

5. Get your certified copy

After registration, the office keeps the original deed. You and the bank get a certified copy for your records. This copy is your legal proof.

For most mortgages, registration is compulsory by law to make the deed enforceable in court. The only common exception is an equitable mortgage, where you just deposit your property papers with the bank.

Not getting a lawyer to review or failing to register the deed are serious mistakes. They leave you without proper legal protection.

Now that you know the steps, let's see who can actually go through this process and what papers you need.

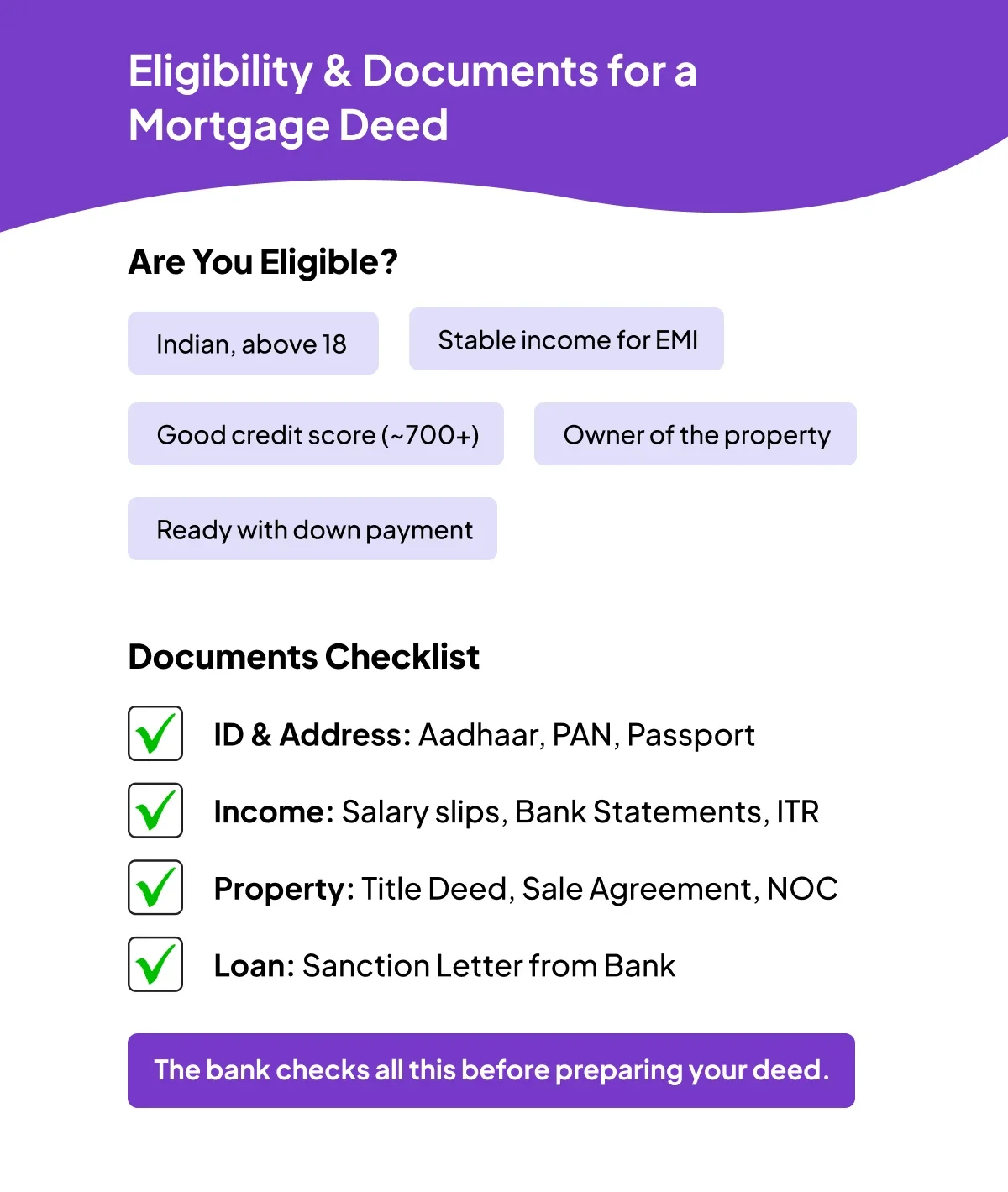

Who Is Eligible for a Mortgage Deed?

Before a bank even prepares the mortgage deed, they check if you qualify for the loan. This means meeting their eligibility rules and submitting the right documents. This is the first and biggest hurdle.

The bank will look at these main things:

- Must be an Indian resident, above 18 years old.

- A stable job or income source that comfortably covers the new EMI plus any other loans.

- A good credit score (usually 700 or above) from a clean repayment history.

- You must be the legal owner of the property being mortgaged.

- A sufficient down payment from your own savings and a suitable Loan-to-Value ratio.

What Documents Are Required for a Mortgage Deed?

Get these papers ready for your loan application:

1. Identity & Address Proof:

- Aadhaar Card

- PAN Card

- Passport

- Voter ID

- Utility bills (for address)

2. Income Proof:

- Salary slips (last 3-6 months)

- Bank statements (last 6 months)

- Income Tax Returns (ITR) for last 2-3 years

3. Property Documents:

- The original Title Deed (Sale Deed)

- Previous sale agreements

- No Objection Certificates (NOCs) from society

4. Loan Papers:

- The final loan agreement or sanction letter from the bank

The bank helps you verify all this. Once they are satisfied, they will prepare the Mortgage Deed for the next steps.

Getting the loan approved is one thing. But what happens if, after all this, you can't keep up with the payments?

Let's talk about the consequences of defaulting on a Mortgage Deed.

What is the stamp paper value for a mortgage deed?

The stamp duty is what you pay to make the deed legally valid. You pay it by buying non-judicial stamp paper of that value or through the e-stamp paper online system.

Here is a look at the stamp duty for a mortgage deed in some major states.

1. Andhra Pradesh: Stamp duty for a simple mortgage deed is 0.5% of the loan amount.

For more details, read our Andhra Pradesh e-stamp paper guide.

2. Assam: The stamp duty for a mortgage deed varies based on the loan amount.

For more details, read our Assam e-stamp paper guide.

3. Bihar: Stamp duty for a mortgage deed is generally 2% of the loan amount.

For more details, read our Bihar e-stamp paper guide.

4. Gujarat: For a mortgage deed where the bank does not take possession, stamp duty is 1.5% of the loan amount.

For more details, read our Gujarat e-stamp paper guide.

5. Haryana: Stamp duty for a mortgage deed without possession is 0.5% of the loan amount. If possession is given, higher charges may apply.

For more details, read our Haryana e-stamp paper guide.

6. Karnataka: If possession of the property is not given, stamp duty is 0.5% of the loan amount (maximum Rs. 10,000). If possession is given, it's 5%.

For more details, read our Karnataka e-stamp paper guide.

7. Kerala: Stamp duty is Rs. 8 for every Rs. 100 of the loan amount secured by the deed.

For more details, read our Kerala e-stamp paper guide.

8. Madhya Pradesh: Stamp duty for a mortgage deed is usually 2% of the loan amount secured by the property.

For more details, read our Madhya Pradesh e-stamp paper guide.

9. Maharashtra: For a mortgage where you keep possession of the property, stamp duty is 0.3% of the loan amount. There is a minimum of Rs. 100 and a maximum of Rs. 10,00,000.

For more details, read our Maharashtra e-stamp paper guide.

10. Odisha: Stamp duty is generally 2% of the total loan amount for a mortgage.

For more details, read our Odisha e-stamp paper guide.

11. Punjab: Stamp duty for a mortgage deed is 4% of the loan amount, whether possession is given or not.

For more details, read our Punjab e-stamp paper guide.

12. Rajasthan: For a mortgage deed without possession, stamp duty is 2% of the loan amount.

For more details, read our Rajasthan e-stamp paper guide.

13. Tamil Nadu: For a simple mortgage deed, stamp duty is 1% of the loan amount, up to a maximum of Rs. 40,000.

For more details, read our Tamil Nadu e-stamp paper guide.

14: Telangana: For a mortgage without possession, the stamp duty charge is 0.5% of the loan amount.

For more details, read our Telangana e-stamp paper guide.

15. Uttar Pradesh: Stamp duty for a mortgage deed is 2% of the total loan amount.

For more details, read our Uttar Pradesh e-stamp paper guide.

Note: The stamp duty you pay on a mortgage deed is not the same everywhere in India. It varies state by state. Each state government sets its own rate, which is a percentage of your loan amount or a fixed fee.

The exact duty can depend on the type of mortgage and specific conditions. Always check the latest rules with your bank or a legal advisor in your state.

What Happens if You Default on a Mortgage Deed?

Defaulting on your mortgage means you have stopped paying your EMIs. Here's what the bank is legally allowed to do next, as per your Mortgage Deed:

- They can take possession of your property. This is the core of the mortgage deal. The house was the security.

- They can sell your property. The bank will auction or sell the property to get their loan money back.

- They will report you to credit bureaus. This will badly damage your credit score, making it very difficult to get any loan, credit card, or even a mobile connection on EMI in the future.

The exact steps and how fast they happen depend on the clauses written in your deed. But these three consequences are almost certain.

That covers the full journey of a Mortgage Deed, from what it is to what happens if things go wrong.

Frequently Asked Questions

1. Is stamp duty required on a mortgage deed?

Yes, absolutely. Before you can register the deed, you must pay stamp duty to the state government. This is like a tax on the document. You pay it by buying non-judicial stamp paper of the right value or through the e-stamp paper online system. The amount depends on your loan amount and state rules.

2. Who keeps the original mortgage deed?

The original registered mortgage deed is kept by the lender (the bank). They hold it as proof of their legal charge on your property. You, the borrower, get a certified copy of the deed for your records.

3. Can I apply online for a mortgage-linked home loan?

Yes, you can start the process online. Most banks let you apply for the home loan, upload documents, and even get pre-approved on their website or app. But the final step of signing and registering the physical mortgage deed still needs to be done in person at the bank and the registrar's office.

4. Is a mortgage deed the same as a loan agreement?

No, they are different. The loan agreement is from the bank saying they will give you money and on what terms. The mortgage deed is the legal document that specifically puts your property as security for that loan. The mortgage deed is what gets registered with the government.

5. What happens after the mortgage is paid off?

Once you pay the last EMI, the bank's claim on your property ends. The bank will give you two important papers: a No Objection Certificate (NOC) and a Release Deed (or Satisfaction Deed). You must get this Release Deed registered at the same Sub-Registrar office to officially remove the bank's charge from your property records.

6. Can a mortgage deed be modified?

Yes, but only if both you and the bank agree to the change. Any big modification, like changing the loan amount or interest rate, needs a fresh agreement or an addendum. This new document will also need to be stamped and registered properly to be legal.

7. Is it compulsory to register a mortgage deed?

For most types, like a Simple Mortgage, yes, registration is compulsory by law. An unregistered deed is not strong evidence in court. The only common exception is an Equitable Mortgage (created by depositing title deeds), which does not need registration in notified towns.

8. What is an anomalous mortgage?

An anomalous mortgage is not a standard type. It's a custom mix of two or more mortgage types (like simple and usufructuary) made from a special agreement between the borrower and the lender. The terms are decided case-by-case.

9. Can a mortgage deed be cancelled?

A mortgage deed is cancelled once the loan is fully repaid. The bank prepares a Release Deed to cancel their claim. You register this deed, and the mortgage is officially closed. It cannot be cancelled before that unless the bank agrees and the full loan is settled somehow.

10. What is a mortgage deed?

A mortgage deed is the main legal contract for your home loan. It is signed by you (the borrower) and the bank (the lender). This document states that you are putting your property as security for the loan. It lists all the terms like amount, interest, and what happens if you don't pay. It must be stamped and registered to be valid.