What’s the one cost that can make or break your property purchase in Telangana?

It’s not just the sale price. It’s the mandatory government levies: stamp duty and registration charges.

Ignoring these can leave your investment legally vulnerable.

The good news is that the process for 2025 has been streamlined.

This guide cuts through the jargon to give you clear, actionable steps. You'll learn the exact rates, how to pay online via the e-stamp paper Telangana system, and how to complete your registration confidently.

Let's ensure your property ownership is fully secured.

What Are the Latest Stamp Duty and Registration Charges in Telangana?

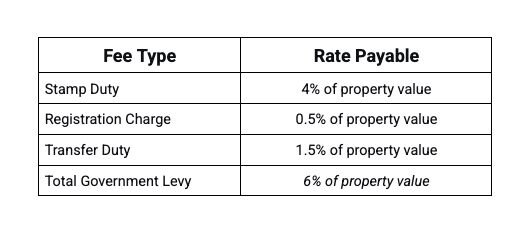

The latest stamp duty in Telangana is 4% of the property's market value, plus a 0.5% registration charge and a 1.5% transfer duty.

This makes the total government levy 6% for a standard property sale in urban areas. Skipping these payments means your property purchase will not be legally recognized.

Here’s a quick breakdown of the main charges for a standard sale deed:

These charges are calculated on the property's sale value or its government-guided market value, whichever is higher. This ensures the state receives the correct revenue.

Now, let's break down exactly how these costs are calculated.

How Are Stamp Duty and Charges Calculated in Telangana?

Stamp duty and registration charges are calculated as a percentage of your property's market value or sale consideration, whichever amount is higher.

You can calculate this yourself by following a simple three-step process before you opt for an e-stamp paper Telangana purchase.

- Determine the Property's Value: Identify the final sale price. Compare it to the government's circle rate, also called the guidance value. Your calculation must be based on the higher of the two figures.

- Apply the Percentage Rates: Multiply the higher value by the applicable rates. For a city apartment, this is 4% for stamp duty, 0.5% for registration, and 1.5% for transfer duty.

- Add Them Up: Sum the results of all three calculations to get your total payable amount.

Example: If you buy a flat in Hyderabad for ₹80,00,000:

Then,

- Stamp Duty = ₹80,00,000 x 4% = ₹3,20,000

- Registration Charge = ₹80,00,000 x 0.5% = ₹40,000

- Transfer Duty = ₹80,00,000 x 1.5% = ₹1,20,000

- Total Cost = ₹3,20,000 + ₹40,000 + ₹1,20,000 = ₹4,80,000

This total is what you need to pay for a valid legal transfer. But remember, these rates are not one-size-fits-all.

Are Charges Different by Property Type or Location in Telangana?

Yes, the final charges change significantly based on your property's type and its location within Telangana.

A commercial building in Hyderabad has different fees than agricultural land in a village. This is a key detail to verify when calculating your Stamp Duty in Telangana.

- Location Matters: Properties in Gram Panchayat areas often have lower registration charges. For example, a sale deed in a village might have a 2% registration charge instead of the standard 0.5%.

- Property Type Matters: The instrument you are registering, like a Gift, Mortgage, or Power of Attorney, has its own fee structure. Gifts to family members have lower maximum caps compared to gifts to non-relatives.

Always confirm the exact rates for your specific situation. This avoids last-minute surprises during the registration appointment.

What Is the Stepwise Property Registration Process in Telangana?

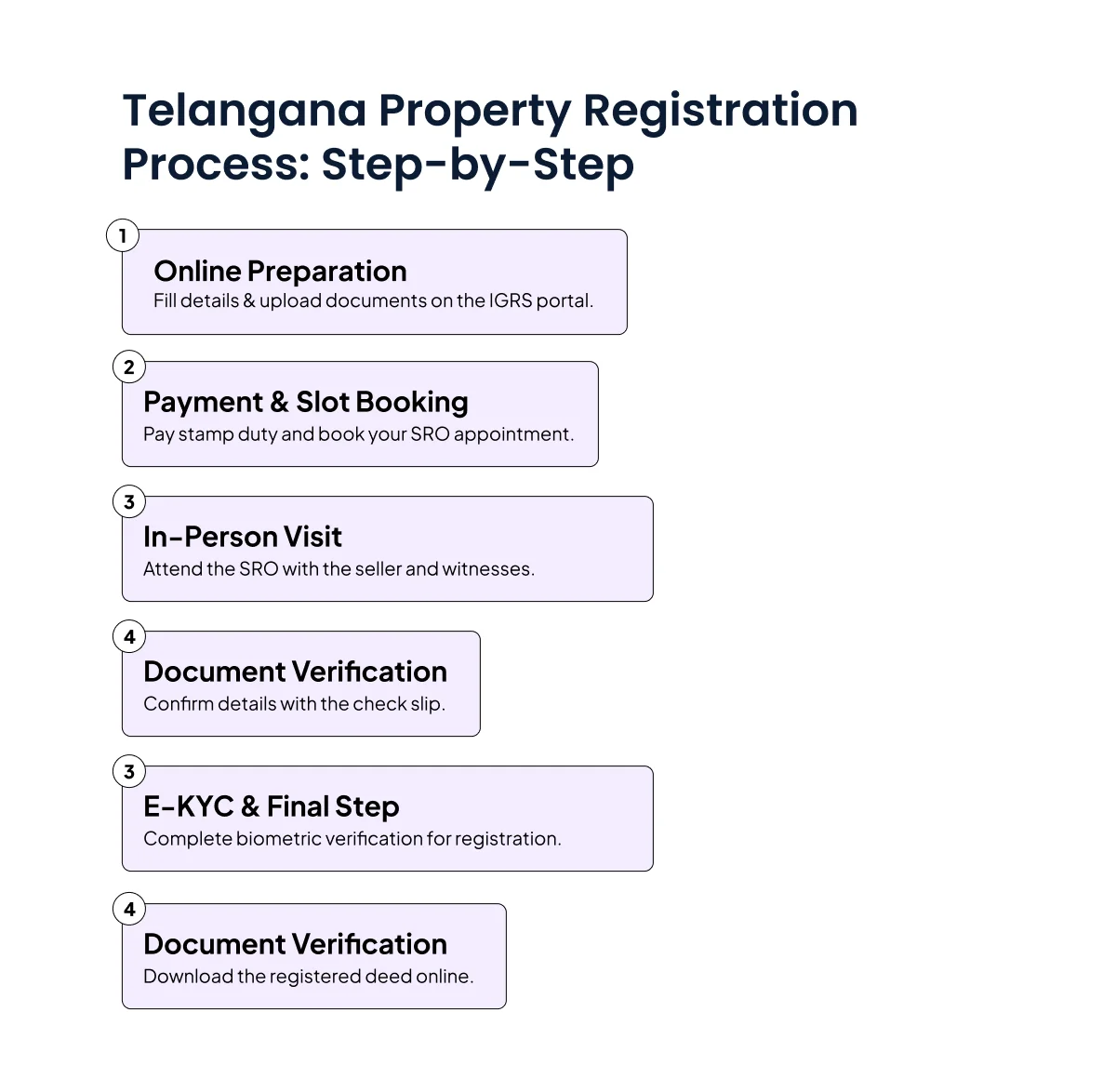

The property registration process in Telangana is a hybrid model that starts online and ends with a mandatory in-person visit to the Sub-Registrar Office.

The goal is to make the process smoother, but you must still be physically present with the seller and witnesses to complete the deal. Missing this final step means your property sale will not be legally valid.

Here is the step-by-step process you need to follow:

- Online Preparation: Visit the official Telangana Property Registration portal, like IGRS and create an account. Fill in the deed details and upload all required documents digitally.

- Make Payment & Book Slot: Pay the requisite Stamp Duty in Telangana and registration fees online through the portal. Once payment is successful, book an appointment slot for your visit to the SRO.

- Visit the SRO (In-Person): On your scheduled date, go to the SRO nearest to the property's location. You, the seller, and two witnesses must be present with all original documents.

- Check Slip & Verification: An officer will prepare a check slip based on your online submission. This is where the details are confirmed and any last-minute changes are made.

- E-KYC & Final Registration: Your biometrics (fingerprints) will be verified via Aadhaar. After successful verification and payment confirmation, the Sub-Registrar will assign a unique document number, take thumb impressions, and register the deed.

- Receive Your Document: The registered document is scanned and uploaded to the portal. You can download it once using the credentials sent to your mobile phone.

Now, let's understand the crucial E-KYC process that happens at the SRO.

What Is e-KYC for Property Registration in Telangana?

E-KYC for property registration in Telangana is the electronic Know Your Customer process where your identity is verified using your Aadhaar details and biometrics at the Sub-Registrar's Office.

It replaces physical identity checks with a secure, digital verification. This step is mandatory for all parties involved in the transaction.

Here’s how it works during your SRO visit:

- After the officer generates the check slip, you will be directed to provide your fingerprints on a biometric device.

- These fingerprints are instantly verified against the live database of the Unique Identification Authority of India (UIDAI).

- This process ensures that you are the legitimate person involved in the property transaction, preventing identity fraud.

Successful E-KYC is essential for the registration to proceed. If it fails, you will be asked to correct the issues with your Aadhaar details before trying again.

With this process now clear, the next crucial step is knowing exactly which documents to prepare for your online upload and SRO visit.

What Documents Are Required for Property Registration in Telangana?

You need a specific set of original documents, identity proofs, and witnesses to complete your property registration in Telangana.

Arriving at the Sub-Registrar's Office (SRO) without these can lead to immediate rejection and a wasted appointment. Proper preparation is non-negotiable for a smooth process.

Ensure you have the following documents ready for both the online upload and the in-person visit:

- The Original Document: The sale deed or agreement, signed by all parties.

- Proof of Stamp Duty Payment: The Telangana e-Stamp certificate or challan proving full payment.

- Identity Proof: Aadhaar card, PAN card, passport, voter ID, or driving license for the buyer, seller, and witnesses.

- Address Proof: Any of the above-mentioned ID cards that contain your address.

- Passport-sized Photographs: Of all parties involved.

- Property Photograph: A clear frontal view photo of the property.

- Witnesses: Two credible persons who can identify the parties, along with their own ID proofs.

- Additional Documents: Any link documents related to the property's history, and a Power of Attorney (if applicable) in original.

Having this checklist ready streamlines the entire process. And a major part of that process can now be handled from your home.

Read: Stamp Duty on Issuance of Share Certificates

Can You Pay Charges and Book Appointments Online?

Yes, you can pay the stamp duty, registration charges, and book your SRO appointment entirely online through the official Telangana registration portal.

This digital step saves significant time and avoids long queues at the office. The online payment for your e-stamp paper Telangana is a mandatory first step.

Here’s how the online part works:

- Visit the Portal: Go to the official IGRS Telangana Website.

- Upload and Pay: Upload the required documents and pay the required stamp duty and registration fees online.

- Book Your Slot: Once payment is confirmed, you can select and book an appointment slot for your physical visit to the SRO.

This online procedure ensures that your documents are pre-scrutinized and your payment is verified before you even step into the government office. It makes the final in-person verification much faster.

For a similar walkthrough, see our e-Stamp in Maharashtra: Complete Guide to Digital Stamp Duty blog.

How Do I Use the e-Stamping Facility in Telangana?

You use the e-stamping facility in Telangana through the fully online eSTAMPS system on the Telangana Registration & Stamps Department official website.

This system lets you pay your stamp duty from anywhere, 24/7, without needing physical non judicial stamp paper Telangana. It’s a secure and foolproof method accepted at all Sub-Registrar Offices (SROs) across the state, and tools like ZoopSign’s eStamp feature, make the process even more seamless.

The process is designed to be simple and can be completed in a few steps. You have the flexibility to pay online or at a bank branch.

Here is your step-by-step guide to using the Telangana e-Stamp facility:

1. Initiate the Process: Visit the Telangana Registration & Stamps Department website. Go to 'Online Services' and click on 'eSTAMPS', then select 'Generate eChallan'.

2. Fill the Proforma: Complete the required eSTAMPS proforma and register. You will receive an SMS with a 12-digit Challan code and a 5-digit passcode on your registered mobile number.

3. Choose Your Payment Method:

- Online Payment: You will be redirected to SBI ePay. Choose net banking, debit/credit card, or NEFT. Enter your payment details. Upon successful payment, print the duplicate challan with the SBI reference number.

- Offline Payment: Select the 'SBI Branch Payment' option. Print the generated challan and take it to any of the 900+ State Bank of India branches in Telangana. Pay the amount, and the bank will stamp and sign the challan.

4. Submit to SRO: After payment, download the challan from the portal. Submit the SRO copy of this challan along with your document at the Sub-Registrar's Office for registration.

This digital system eliminates the risk of fake stamps and makes the entire payment process transparent and efficient.

Who Is Eligible for Stamp Duty Concessions or Exemptions in Telangana?

Certain property buyers in Telangana, such as women, agricultural landowners, and those involved in family gift transfers, may be eligible for significant concessions or exemptions on stamp duty.

Overlooking these potential savings can cost you lakhs of rupees. It's crucial to check your eligibility before making any payment.

The Telangana government offers relaxations under specific scenarios to support various demographic groups.

Here are the key categories:

- Women Property Owners: Women buyers may be eligible for a lower stamp duty rate, often 1-2% less than the standard rate, particularly in rural areas. (Note: The exact concession should be verified with the local Sub-Registrar Office as it can vary.)

- Agricultural Land: If you are purchasing land specifically for cultivation (and not for conversion to residential/commercial use), components like transfer duty may be fully waived.

- Family Transfer (Gift Deed): Transfers among immediate family members like parents to children or between spouses attract a heavily reduced stamp duty of just 1%, along with nominal registration charges.

- Government Subsidy Homes: Buyers under government housing schemes often benefit from lower registration charges or complete waivers.

Always confirm your specific eligibility with the authorities to ensure you don't pay more than necessary. Failing to pay the correct amount, however, leads to serious consequences.

To explore these concessions in greater detail, you can read this guide on Stamp Duty Tax Exemption

What Happens for Non-Payment or Late Payment of Stamp Duty?

Non-payment or underpayment of stamp duty in Telangana renders your property document legally invalid and inadmissible as evidence in court.

This means your transaction has no legal standing, and you cannot use the document to prove ownership or defend your rights.

Skipping or incorrectly paying the Stamp Duty in Telangana leads to severe consequences:

- Invalid Transaction: The property deal is not legally recognized. You effectively do not have legal ownership.

- Useless in Court: The document cannot be used as evidence in any legal proceeding. You cannot use it to fight a property dispute.

- Document Impounded: If presented to a public officer like a Registrar, the document will be impounded or seized.

- Heavy Penalties: You will be required to pay the original stamp duty amount plus a significant penalty, which can be multiple times the duty owed.

Ignoring this crucial step puts your entire investment at risk.

It's always better to pay the correct duty on time. If you have already paid but made an error, there might be a way to rectify it.

What Is the Refund Process for Unused e-Stamp in Telangana?

The process for an unused e-stamp refund in Telangana is strict and has major limitations. Generally, refunds are only possible for low-value stamps (up to ₹100) and must be applied for quickly after cancellation.

The official channel is through a challan system as per the Indian Stamp Act of 1899.

If your property deal falls through, you may apply for a refund by submitting the original unused e-stamp paper Telangana challan to the Stamp Office or Sub-Registrar.

However, this usually needs to be done within a short window, like 30 days from the deed cancellation. Approval is not automatic and is decided case-by-case, often involving a small deduction.

It's important to note that the rules are specific. Always verify the exact procedure and your eligibility directly with the local Sub-Registrar's Office (SRO) before proceeding.

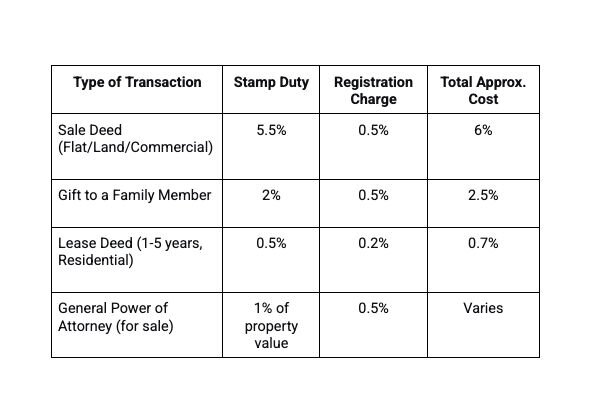

How Much to Register a Flat, Land, or Commercial Unit?

For a standard sale deed of a flat, land, or commercial unit in Telangana, the total government charge is 6% of the property's market value.

This is split into a 5.5% stamp duty and a 0.5% registration charge in most urban areas. The cost is calculated on the sale value or the government's guidance value, whichever is higher.

While the 6% rate is common, the exact cost depends heavily on the specific type of property transaction you are executing. A simple sale deed has different fees than a gift, lease, or partition deed.

Here is a quick cost breakdown for the most common property transactions:

Example: If you buy an apartment in Hyderabad for ₹1 Crore:

- Stamp Duty = ₹1,00,00,000 x 5.5% = ₹5,50,000

- Registration Charge = ₹1,00,00,000 x 0.5% = ₹50,000

- Total Registration Cost = ₹6,00,000

Always confirm the exact rates for your specific deed type and location.

Once you pay for your Telangana e-Stamp, the final step is to verify its authenticity.

How Do I Verify e-Stamp Certificate Authenticity in Telangana?

You can verify the authenticity of an e-stamp certificate online in minutes using the Unique Identification Number (UIN) and other details on the certificate.

This is a critical step to protect yourself from fraud, as a fake e-stamp can render your property document legally invalid. Always verify your Telangana e-Stamp before finalizing any transaction.

The official and free method is through the SHCIL (StockHolding Corporation of India Ltd.) portal, which is the authorized government agency. Here’s how to do it:

1. Go to the Official Portal: Visit the SHCIL eStamp website or use their official mobile app.

2. Navigate to Verification: Click on the ‘Verify eStamp’ option.

3. Enter Certificate Details: You will need to enter specific details from your e-stamp certificate:

- State (Select Telangana)

- Certificate Number (The UIN)

- Stamp Duty Type

- Certificate Issue Date

- Session ID (A 6-character alphanumeric code)

4. Get Instant Results: After submitting the details, the portal will instantly display the certificate's status, including its generation time and whether it is authentic and valid.

*Many certificates also feature a QR code. You can simply scan this code with the SHCIL app to verify the e-stamp instantly, without manually typing any numbers.

This simple check ensures your document is legally enforceable and protects your investment from costly scams.

Conclusion

Successfully registering your property in Telangana hinges on understanding and correctly completing the stamp duty process.

This guide has walked you through every critical step, from calculating the correct charges to navigating the online systems and finalizing your registration at the SRO.

By demystifying the requirements, the path to securing your legal ownership is clear. With this knowledge, you can approach your property transaction with confidence, ensuring it is not only completed efficiently but is also fully protected under the law.

Your investment is now secure.

Related Blogs: