Buying a property in Bihar? Or maybe you're just finalizing a rent agreement?

Then you've definitely heard about stamp paper. But here's the thing…

… going to a stamp vendor, trying to find the right value, and worrying if the stamp is real or fake is a real headache.

What if you could skip all that? Well, you can in many other states along with Bihar.

E stamp Bihar has made paying stamp duty for property and agreements far simpler and safer than ever before. By shifting to Bihar e stamp and online systems, you can now handle everything from your phone instead of chasing physical stamp vendors.

This blog will show you exactly how to buy e-stamp paper online in Bihar, step-by-step. We’ll also break down the costs, tell you what papers you need, and show you how to check if your stamp is genuine.

Let's get started.

What Is e-Stamping in Bihar?

Bihar estamp is just the online way to buy a stamp paper for your legal agreements in Bihar, commonly called e stamp Bihar or Bihar e stamp paper. It’s a digital certificate from the government that makes your rent agreement, property sale paper, or affidavit legally okay, without you having to go find a stamp vendor.

Before, you had to buy a physical stamp paper from a shop. Now, with e stamp Bihar online systems, you do the same thing from your phone. You go to the government's website, fill in your details, pay the stamp duty online, and get your e stamp paper Bihar certificate in a few minutes. It does the same job as the old paper stamp, but it's all done on the internet.

This change by the Bihar government is to make things simpler and safer for you, so Bihar estamp helps you avoid fake stamps and running around the market.

Now, let’s see why this online stamp paper is much better than the old physical one.

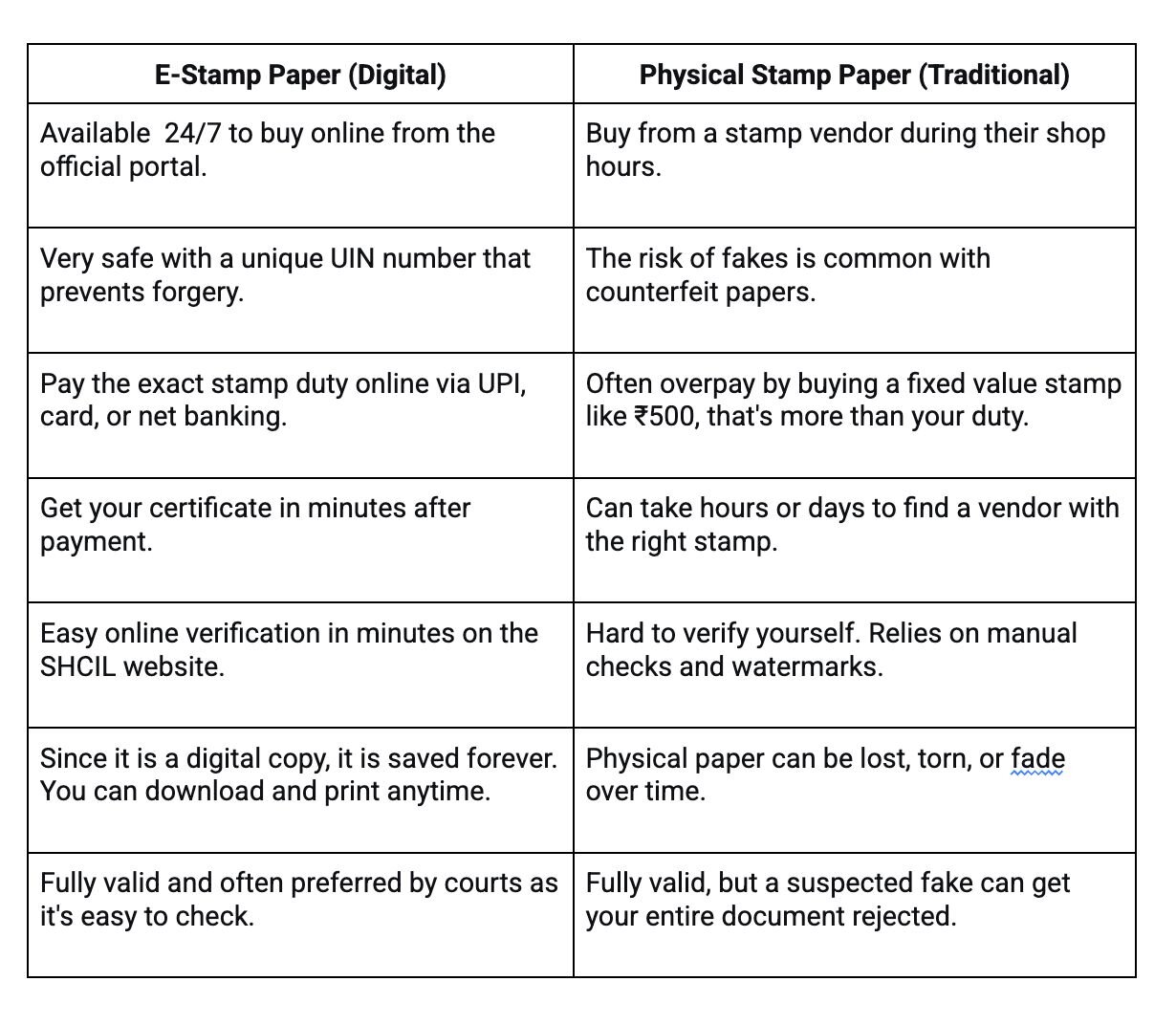

What Is e-Stamp Paper vs Physical Stamp Paper in Bihar?

E-stamp paper is the digital, online version of the traditional physical stamp paper you buy from a vendor, and both Bihar e stamp and physical paper are legally valid for your agreements. E stamp paper Bihar is safer and faster for your stamp duty payment for property, especially when using e stamp Bihar online payment options.

Here's a simple table for you to see the difference between the two:

It’s clear from this comparison that Bihar e stamp are better choices in most cases. The only time it makes sense to go for the physical version is if you are in a rural area with no internet, or if a specific government office in Bihar still asks for it in writing. But for most people, especially for property deals, e stamp Bihar online purchase is the clear winner.

What Are Stamp Duty & Registration Charges in Bihar 2025?

In Bihar, you pay two main government fees when you buy property: Stamp Duty, which is a tax on the document, and Registration Charges, which is a fee to record the document. Together, they are a big part of your total cost, so knowing the rates before generating Bihar e stamp paper is important.

Stamp duty and registration charges in Bihar are a percentage of your property's value, and the rates are mostly the same for men and women with one key exception.

Here are the standard rates for 2025-26:

- For a house or plot (Residential): You pay 6% as stamp duty and 2% as registration charges.

- For agricultural land: Same as residential - 6% stamp duty and 2% registration.

- For shop or office space (Commercial): 8% stamp duty and 2% registration.

A good thing to know: A big benefit to know about before buying Bihar e stamp is that the government gives a full 100% exemption on both stamp duty and registration charges for land used for industrial purposes.

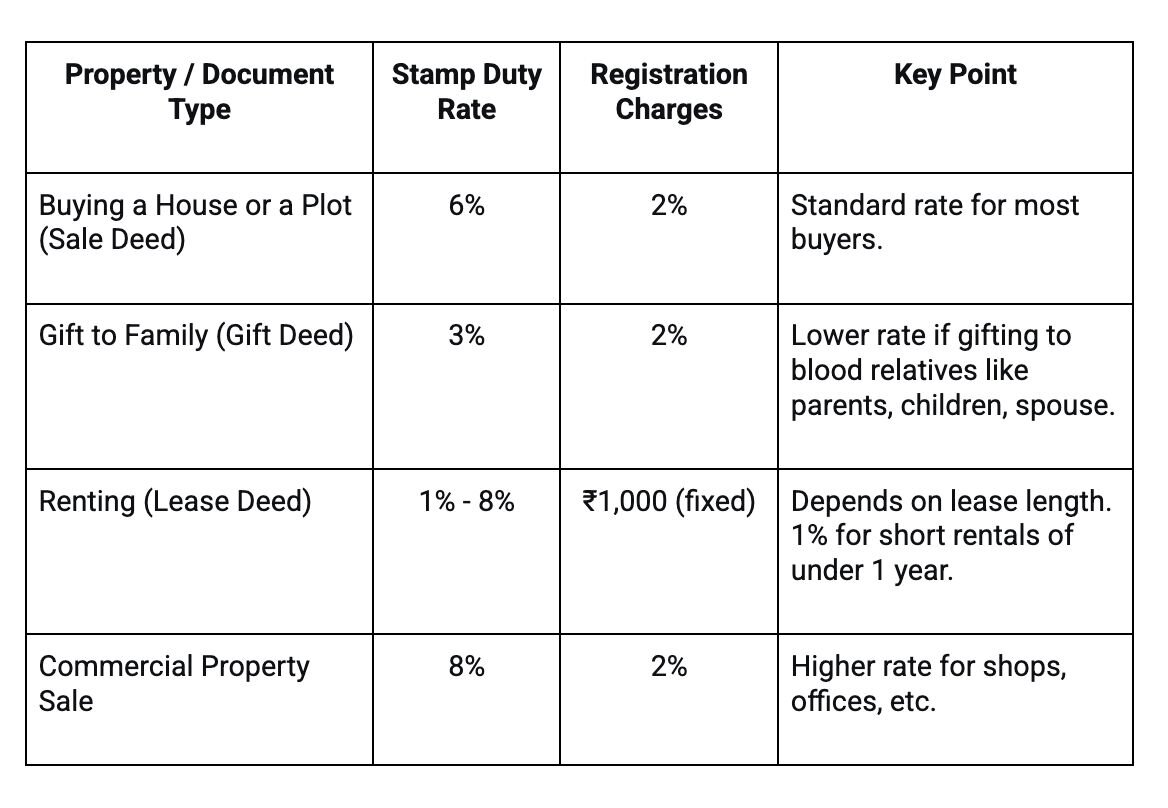

How Do Stamp Duty Rates Vary by Property Type in Bihar?

The rate changes based on what type of document you are signing and what you are using Bihar e stamp paper for. A sale deed for a house has one rate, a gift deed to family has another.

Here is a simple table for common property types:

Special Case - Property Transfer to a Woman:

If a man sells property to a woman, she gets a benefit. The rate is lower, at 5.7% stamp duty and 1.9% registration charges instead of 6% and 2%. This is important when you generate Bihar estamp for such transfers.

How Do You Calculate Stamp Duty and Registration Charges in Bihar?

You calculate the fee on the property's value, but the government uses whichever value is higher - your sale price or the official “circle rate” for that area. This same principle applies whether you pay via physical stamp or Bihar e stamp.

Let's take an example: You buy a house in Patna for ₹50 lakhs.

- Stamp Duty (6%): 6% of ₹50,00,000 = ₹3,00,000

- Registration Charges (2%): 2% of ₹50,00,000 = ₹1,00,000

- Total Government Fee: ₹3,00,000 + ₹1,00,000 = ₹4,00,000

The easiest way to calculate your stamp duty and registration charges in the state of Bihar before buying e stamp Bihar online is to use the official Bihar Stamp Duty Calculator on the Bhumijankari or IGRS Bihar portal. You just put in the property details, and it gives you the exact amount.

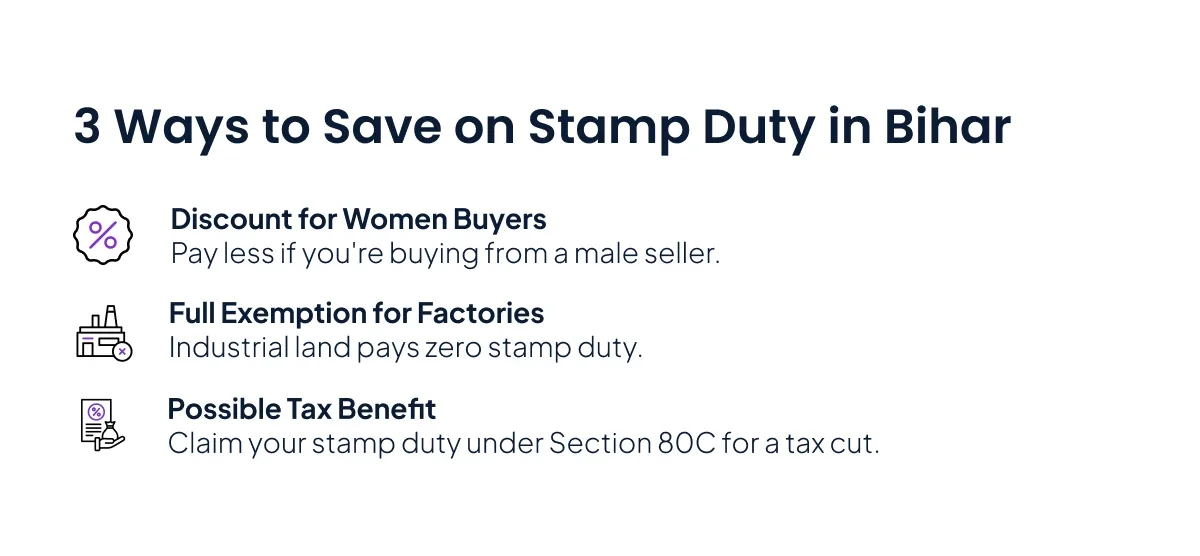

Who Gets Stamp Duty Exemptions or Rebates in Bihar?

Apart from the industrial land exemption, there are a couple of other benefits matter when planning Bihar e stamp paper:

- Rebate for Women Buyers: As mentioned, a woman buying from a man pays less, that is 5.7% stamp duty instead of 6%, and 1.9% registration instead of 2%.

- Industrial Units: Full 100% exemption on both stamp duty and registration for land for factories and industries, which can be availed via Bihar e stamp.

- Possible Income Tax Benefit: Stamp duty and registration charges paid for a new residential property can be claimed as a tax deduction under Section 80C (up to ₹1.5 lakhs per year, in the old tax regime only). If you sell within 5 years, this benefit is reversed.

Note: It's important to note that this benefit is only applicable if you use the old tax regime. It is not available under the new tax regime. Also, if you sell the property within 5 years, this deduction is taken back and you will have to pay tax on that amount.

Now that you know how much you need to pay, let's get your papers ready.

Here’s what documents you'll need for the stamp duty payment and registration process.

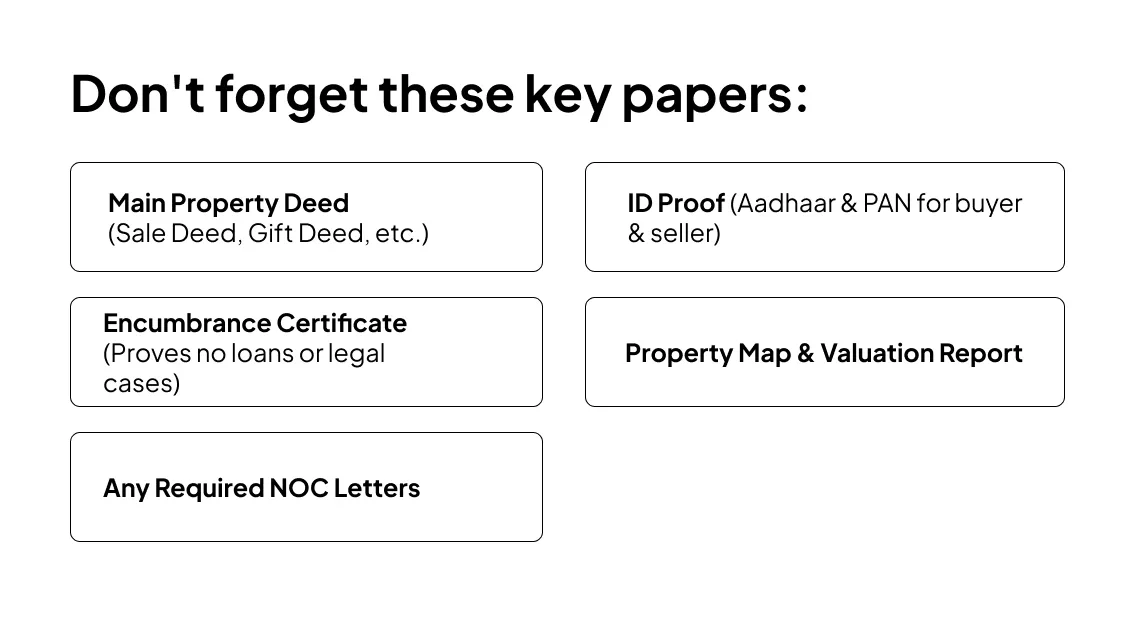

What Documents Are Required for Bihar e-Stamp & Registration?

To avoid delays when buying e stamp paper Bihar or paying at the registry office, keep these documents ready:

Here is the main list of documents you should keep ready:

- The Main Agreement: This is your Sale Deed (for buying), Gift Deed (for gifting), or any other main property paper. This is the document you will actually stamp and register.

- ID Proof for Everyone: Aadhaar Card and PAN Card for both the buyer and the seller. They need to know who is involved.

- Proof that the Property is Clear: An Encumbrance Certificate (EC). It proves there is no bank loan or legal case pending on your property.

- Property Maps & Papers: The official plot map and any property valuation report. This helps them check the location, size, and correct value of the property.

- No-Objection Certificates (NOCs): If your property is in a society, or if it's a special type of land, you might need a "No Objection" letter from the relevant authority.

Why these documents matter: The registration office uses these documents to do two big things. First, to make sure you are paying the correct stamp duty based on the property's real value. Second, to check that the person selling the property actually has the right to sell it and that there are no hidden problems.

Having all this ready makes the whole process smooth and keeps you safe from future legal trouble.

With that, your papers are in order.

Now, let's see how to actually buy your e-stamp paper online in Bihar, step-by-step.

What Is the Stepwise Process to Buy e-Stamp Online in Bihar?

You can buy your Bihar e stamp or e stamp Bihar online in a few minutes from the official government portal.

Here is the simple step-by-step process for your e stamp Bihar online purchase:

Step 1: Go to the Official Website: Open your device and visit the Bhumijankari portal (bhumijankari.bihar.gov.in). This is the main government site for property and Bihar e stamp paper.

Step 2: Log In or Register: Log in with your mobile number and password, or sign up if you are new by entering basic details.

Step 3: Fill in Your Property & Document Details: Enter property address, area, sale or agreement value, buyer and seller information, and document type (Sale Deed, Gift Deed, Lease, etc.) before generating e stamp Bihar.

Step 4: Check the Calculated Stamp Duty: Once you enter the value, the website will auto-calculate the stamp duty and registration charges for you. It will show you the total amount you need to pay. This matches the rates we talked about earlier (like 6% + 2%).

Step 5: Pay the Amount Online: Pay securely using UPI, Net Banking, Debit Card, or Credit Card to complete Bihar estamp payment.

Step 6: Download Your e-Stamp Certificate: After successful payment, your Bihar e stamp certificate with Unique Identification Number (UIN) is generated; download and print it for use with your agreement.

And that’s it! You have now finished your stamp duty payment for property online. The whole process can be done in under 30 minutes from your home.

You’ve got your e-stamp certificate. But how can you be sure it’s real? And what if someone wants to check it later?

Let’s see how to verify your e-stamp in Bihar, which is even easier than buying it.

How Do You Verify e-Stamp Certificate in Bihar?

You can check if your e-stamp certificate is real in less than a minute on the official SHCIL website. This is the most important step after buying your stamp online, because it proves your document is legally valid.

Here’s the simple online process to verify any e-stamp:

Step 1: Go to the Official Verification Website

Open your internet browser and go to the SHCIL e-stamping website. This is the main government platform for checking stamps all over India, including Bihar.

Step 2: Find the 'Verify e-Stamp' Option

On the website's homepage, look for a button or link that says “Verify e-Stamp Certificate” or something similar. Click on it.

Step 3: Enter Your e-Stamp Details

Select State (Bihar), enter the certificate number (UIN), stamp duty type, issue date, and Session ID from your Bihar e stamp paper.

- State: Select Bihar.

- Certificate Number: This is the Unique Identification Number (UIN) on your certificate.

- Stamp Duty Type: Choose the type of document (like 'Sale Deed' or 'Agreement').

- Certificate Issue Date: The date when you bought the stamp.

- Session ID: A 6 character code from your certificate.

Step 4: Click 'Verify' and See the Result

If valid, the system shows confirmation details; if not, it shows not found or invalid. This protects you from fake Bihar estamp and confirms that your stamp duty was correctly paid.

Related Blogs:

- eStamp Maharashtra

- eStamp Uttar Pradesh

- eStamp Karnataka

- eStamp in Tamil Nadu

- Assam eStamp

- E-Stamp in Rajasthan

- e stamp Haryana

- e stamp punjab

- eStamp in Andra Pradesh

- Kerala e-Stamp Paper

Frequently Asked Questions

1. Is e-Stamp legally valid in Bihar?

Yes, it is fully legal. The e-stamp paper Bihar has the same legal power as physical stamp paper under the Indian Stamp Act, 1899. All courts, banks, and government offices in Bihar accept it.

2. What is the Bihar house stamp duty in 2025/2026?

For most residential properties, the stamp duty is 6% of the property value plus 2% registration, so total is usually 8%, whether you use physical stamp paper or e stamp Bihar.

3. Are there reduced stamp duty rates for women?

Yes, if a man sells property to a woman, she pays 5.7% stamp duty and 1.9% registration instead of 6% and 2%, and this applies equally when using Bihar e stamp paper.

4. What if wrong details in Bihar e-stamp?

Once you submit and pay for Bihar estamp, it is very difficult to change or cancel, so always double-check all names, amounts, and details before final payment.

5. How do I calculate my total stamp duty and registration charges?

Use the higher of sale price or circle rate and apply the correct percentages, or use the free Bihar Stamp Duty Calculator on the Bhumijankari portal before generating e stamp Bihar online.

6. How to check Bihar e-stamp authenticity?

Verify your Bihar e stamp certificate on the SHCIL e-stamping website using the UIN, issue date, and related details for instant authenticity status.

7. What happens if I don’t pay the correct stamp duty?

If you underpay, your document can be treated as invalid, rejected by the registry office or court, and you may face heavy penalties later, regardless of whether it is physical or e stamp bihar.