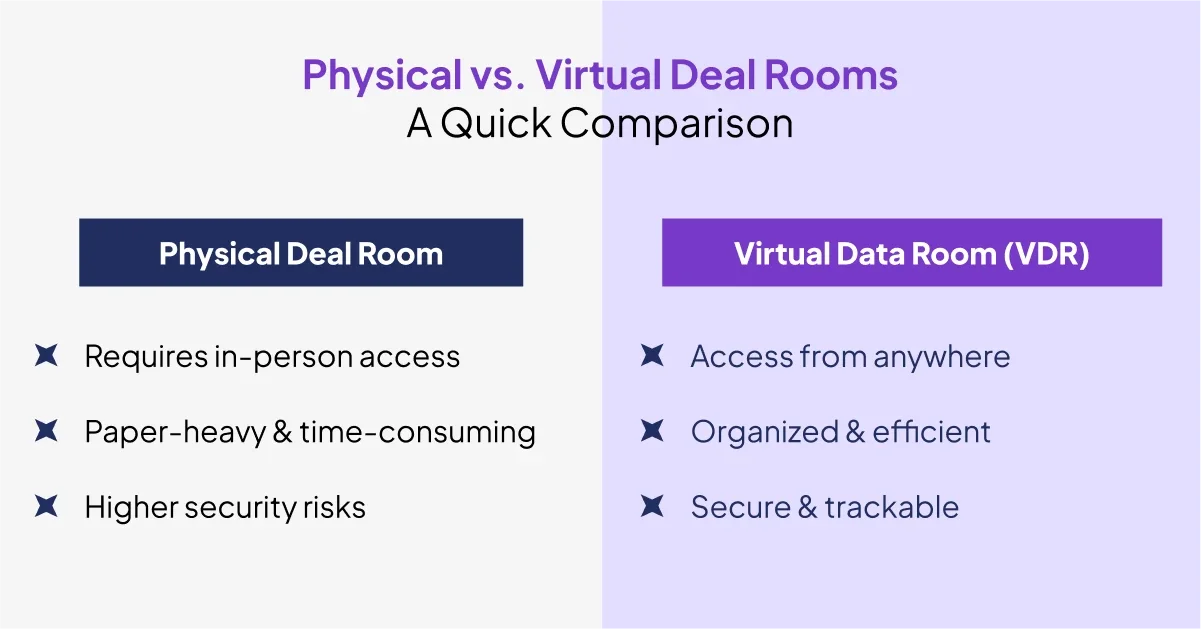

For decades, physical deal rooms were the gold standard for high-stakes transactions. Whether for mergers and acquisitions (M&A), IPOs, financing rounds, restructuring, or audits, businesses relied on secure, on-premise spaces to facilitate due diligence. However, as transactions became more global and digital-first, virtual data rooms (VDRs) emerged as the more efficient, secure, and scalable alternative.

Today, VDRs have become indispensable for industries dealing with sensitive information, providing a secure environment for document management and seamless collaboration. But how do virtual data rooms compare to traditional physical deal rooms? And what factors should businesses consider when selecting a virtual data room provider?

What Is a Virtual Data Room (VDR)?

A virtual data room (VDR) is an online platform designed for the secure document storage, management, and sharing of confidential documents. Businesses, legal teams, investment bankers, and private equity firms rely on VDRs to conduct due diligence, negotiate deals, and manage projects with multiple stakeholders while maintaining high levels of security.

Unlike traditional physical deal rooms, a VDR provides a digital-first, highly secure, and remotely accessible solution for businesses engaged in sensitive transactions.

Purpose of a Virtual Data Room

A virtual data room serves as a centralized hub for document exchange, providing granular control over user permissions, access levels, and document versioning to ensure that only the right individuals access specific documents.

IPOs (Initial Public Offerings)

When a company prepares to go public, it must provide regulators and potential investors with detailed financial disclosures, compliance records, and operational data. A VDR streamlines this process by allowing companies to organize, index, and securely share sensitive files with auditors, underwriters, and potential investors. Features like document tracking, controlled access, and watermarking ensure that sensitive data is protected from unauthorized sharing.

M&A Transactions (Mergers and Acquisitions)

Mergers and acquisitions involve extensive due diligence, requiring multiple parties to review confidential financial and operational data. A VDR facilitates:

- Easy document categorization and indexing, helping buyers and sellers quickly find relevant information.

- Role-based access control, ensuring that only authorized stakeholders can view specific documents.

- Redaction tools allow businesses to hide sensitive details before granting access to third parties.

- Real-time tracking, providing insights into which documents have been viewed and by whom, helping businesses gauge buyer interest.

Read: M&A Process: Everything You Need to Know About Mergers and Acquisitions

Restructuring & Financing

Companies undergoing financial restructuring or seeking new funding need to share sensitive financial data with lenders, investors, or restructuring advisors. A VDR provides:

- Confidential data management, reducing the risk of leaks during negotiations.

- Collaborative tools, enable multiple parties to work on restructuring plans without compromising security.

- Custom permission settings, so different stakeholders see only the documents relevant to them.

Audits & Compliance

Businesses must undergo audits for regulatory compliance, tax filings, and financial reporting. Instead of physically transferring documents or emailing files, a VDR allows companies to:

- Grant controlled access to auditors, ensuring that only necessary documents are shared.

- Maintain version control, preventing unauthorized modifications or outdated files from being accessed.

- Set up automated reports and alerts, keeping track of document activity and access history for compliance purposes.

Key Benefits of Virtual Data Rooms

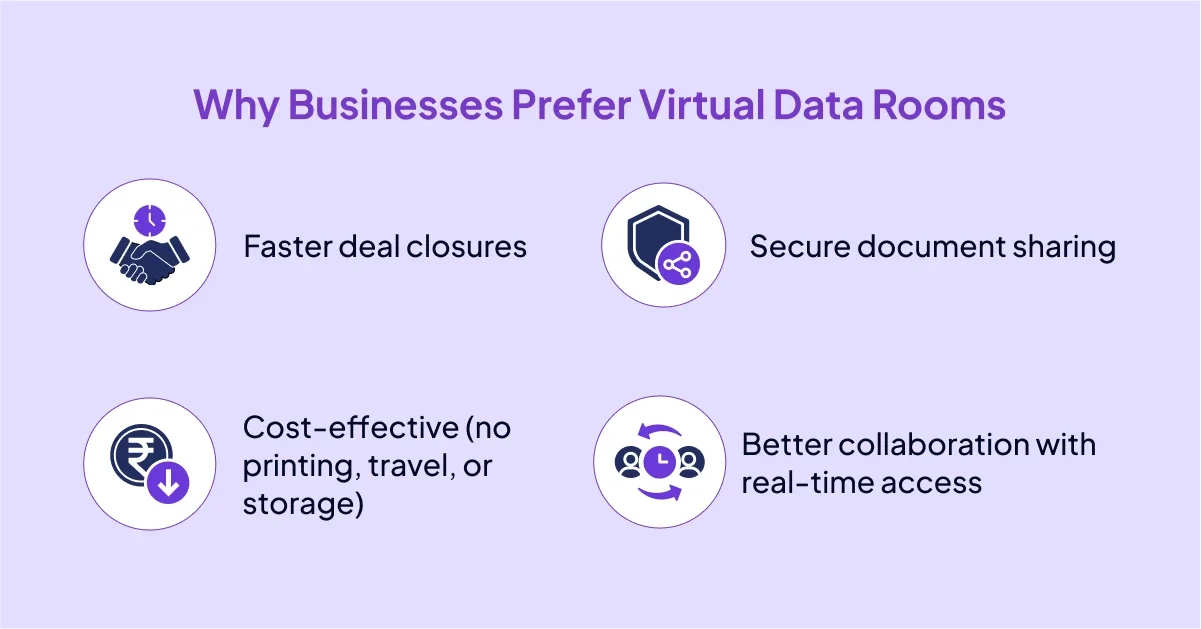

Unlike traditional physical deal rooms, VDRs offer several key advantages:

Enhanced Security & Control

Security is the biggest concern in high-value transactions. With ZoopSign’s Deal Room solutions, businesses can enforce folder security, set up customized permissions, and enable watermarking, tracking, and access logs. Multi-factor authentication and end-to-end encryption ensure that only authorized users access sensitive documents.

Improved Collaboration & Accessibility

A secure virtual data room allows stakeholders from different geographical locations to access and work on documents in real time. With ZoopSign, teams can assign specific roles and permissions, ensuring that only relevant parties have access to critical data.

Faster Due Diligence & Deal Closure

Physical deal rooms require extensive coordination, travel, and manual oversight. VDR solutions accelerate due diligence by providing indexed, searchable documents, automated workflows, and AI-powered analytics that highlight potential risks.

Cost & Time Savings

Maintaining a physical deal room involves expenses like rent, security personnel, and administrative costs. A cloud-based data room eliminates these costs while reducing paperwork and improving efficiency.

Customization & Scalability

With ZoopSign, businesses can tailor data room security settings, define user roles, and integrate workflows to meet specific transaction needs. Whether handling a small business acquisition or a large-scale corporate merger, VDRs offer seamless scalability.

How Virtual Data Rooms Work

A well-structured VDR platform follows these steps:

- Find a reliable provider: Choose a trusted virtual data room provider like ZoopSign, ensuring industry-grade security and compliance.

- Upload and categorize documents: Index files efficiently for easy retrieval.

- Redact confidential information: Protect sensitive data before sharing it with external stakeholders.

- Assign roles and permissions: Define user access levels to maintain control over document security.

- Set up a checklist and workflow: Organize deal-related tasks and ensure smooth project management.

- Monitor activity logs: Track who accessed, modified, or downloaded files for accountability and compliance.

Security Features to Look For in a Virtual Data Room

Choosing a secure VDR requires evaluating key security measures:

- End-to-end encryption to protect data in transit and at rest.

- Role-based access control (RBAC) for managing user permissions.

- Multi-factor authentication (MFA) to prevent unauthorized access.

- Dynamic watermarking to track document usage and prevent leaks.

- Audit logs and tracking for full visibility into user activity.

Who Uses Virtual Data Rooms?

- Corporate Development Teams: Businesses expanding through acquisitions or partnerships rely on VDRs to conduct due diligence efficiently.

- Investment Bankers: VDRs help investment banks facilitate deals, manage client documents, and coordinate financial transactions.

- Private Equity & Venture Capital Firms: PE and VC firms use secure virtual data rooms to evaluate potential investments and manage portfolio companies.

- Lawyers & Legal Teams: Attorneys use VDR solutions for managing legal documents, contracts, and compliance records securely.

How to Choose the Right Virtual Data Room Provider

Selecting the best VDR provider depends on several factors:

1. Nature of the Transaction: Different transactions require varying levels of security and functionality. For example:

- M&A transactions demand high-level security, due diligence tracking, and AI-powered insights.

- Government contracts require strict compliance with regulatory standards.

2. Budget Constraints: A VDR should fit your budget while offering essential security and collaboration features. ZoopSign provides flexible pricing models tailored for businesses of all sizes.

3. Scalability & Remote Access: A good VDR solution should grow with your business needs. ZoopSign’s cloud-based platform ensures remote accessibility and seamless scalability.

The Future of Secure Transactions: Why VDRs Are Here to Stay

The digital transformation of deal-making is undeniable. As businesses increasingly prioritize data security, compliance, and efficiency, virtual data rooms have become the go-to solution for handling confidential transactions.

With ZoopSign’s latest deal room solutions, organizations can streamline workflows, enhance security, and close deals faster—without the hassle of physical paperwork. Whether you’re preparing for an IPO, managing a private equity deal, or navigating complex regulatory audits, a secure virtual data room is the future of transactions.

Physical deal rooms had their time, but the shift to cloud-based deal rooms is the natural progression for businesses seeking agility, security, and cost efficiency. Choosing the best virtual data room provider is crucial for ensuring a seamless experience, and with ZoopSign, you can trust that your data remains protected, accessible, and efficiently managed.

Looking for a reliable virtual data room? Contact us and try ZoopSign’s deal room today to take your secure transactions to the next level!