Mergers are big, transformational events in the corporate world, where two (or more) companies join forces to create a single, often more powerful entity.

Whether driven by the desire to dominate a market, secure supply chains, diversify offerings, or enter new geographic territories, each merger type brings its own strategic rationale, legal complexities, and operational challenges.

In this quick blog, we’ll break down the main types of mergers, explain what drives companies to pursue each, and sprinkle in insights on how ZoopSign’s contract management and Deal Room features can simplify every stage of your next big deal.

Read Blog: M&A Process: All About Mergers and Acquisitions

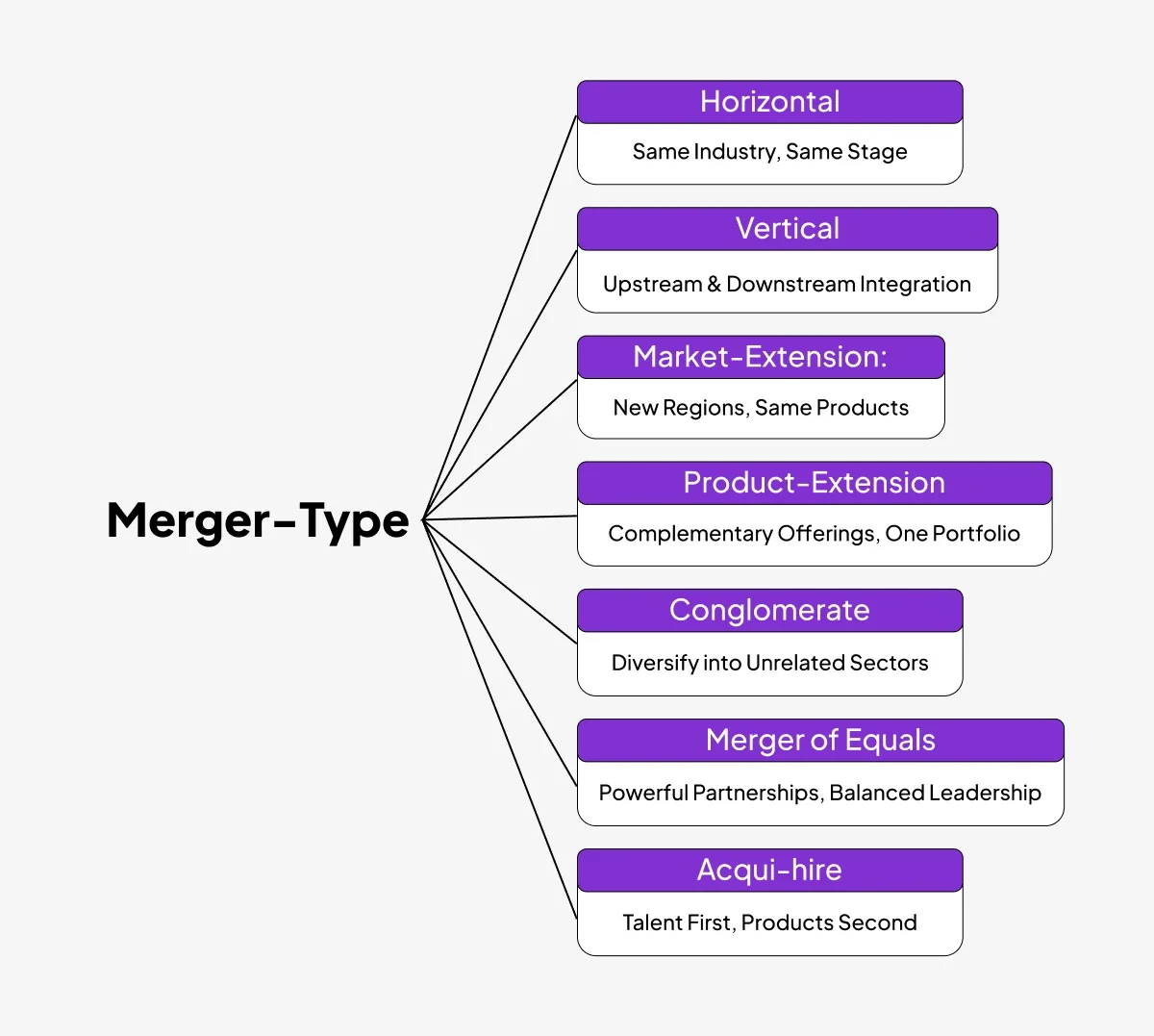

Types of Mergers and Acquisitions

1. Horizontal Mergers

A horizontal merger happens when two companies operating in the same industry and at the same stage of production join forces. Think a video game publisher acquiring another gaming studio or two regional banks uniting to increase market share.

Primary goal: Gain market share, achieve economies of scale, and reduce competition.

Benefits:

- Cost synergies through consolidated operations (e.g., shared R&D labs).

- Revenue synergies by cross-selling products to each other’s customer base.

- Stronger negotiating power with suppliers and distributors.

Example: When Disney acquired Pixar in 2006, it combined two animation powerhouses, leveraging Pixar’s cutting-edge CGI capabilities with Disney’s global distribution network.

Why it matters for your contracts: In horizontal deals, you’ll often merge nearly identical contracts—think licensing agreements or supplier contracts. ZoopSign’s bulk eSign and template library let you standardize and rapidly execute hundreds of similar documents, so you spend less time hunting down signatures and more time integrating operations.

2. Vertical Mergers

A vertical merger unites companies at different points along the same supply chain—such as a manufacturer buying its supplier (backward integration) or a distributor acquiring a retailer (forward integration).

Primary goal: Secure supply, reduce costs, and improve coordination across the value chain.

Benefits:

- Cost control by internalizing key suppliers.

- Improved reliability of inputs or enhanced market access for outputs.

- Better data sharing for forecasting and inventory management.

Example: Amazon’s acquisition of Whole Foods allowed it not only to enter grocery retail but also to optimize its distribution network for perishable goods.

Streamlining supplier agreements: Vertical integrations often involve drafting new long-term supply contracts or renegotiating existing ones. ZoopSign’s collaborative tools and real-time audit trail make it simple to collaborate, review, and finalize complex agreements without multiple email threads or version control nightmares.

3. Conglomerate Mergers

When two companies in unrelated businesses merge, that’s a pure conglomerate merger. The idea is diversification—spreading risk across different industries so that a downturn in one won’t tank the entire group.

Primary goal: Diversify revenue streams and stabilize earnings.

Benefits:

- Risk mitigation by operating in multiple sectors.

- Capital allocation flexibility—profits from one unit can fund growth in another.

Example: The merger of GE (industrial manufacturing) with NBC (media) in 1986 created a conglomerate that spanned heavy industry to television broadcasting.

Managing a diverse contract portfolio: Conglomerates juggle everything from manufacturing agreements to advertising contracts. ZoopSign’s centralized dashboard lets you organize your folders in the deal room, set automated reminders for renewal dates and signatures, and ensure compliance across geographies—all without losing sight of the big picture.

4. Market-Extension Mergers

A market-extension merger brings together two companies that sell the same products but in different markets. The goal? Rapidly expand your customer base without developing new products.

Primary goal: Enter new geographic or demographic markets with an established product line.

Key trait: Same industry and offerings, but complementary market footprints.

Example: When Exxon merged with Mobil in 1999, it combined two oil giants whose U.S. operations were strong in different regions, creating a truly nationwide—and eventually global—entity.

Accelerating market roll-outs: For this kind of deal, you’ll need to align sales agreements, distributor contracts, and local compliance documents. ZoopSign’s role-based access control (RBAC) ensures that your regional teams can only see and sign the contracts relevant to their territories, so you maintain governance while scaling fast.

5. Product-Extension and Other Strategic Mergers

Beyond the “big three,” companies sometimes merge to expand or complement their product lines.

- Product-extension merger: Two firms in the same market offering different but related products join forces (e.g., a smartphone maker merging with a wearable-tech startup).

- Congeneric merger (a subtype of conglomerate): Companies in related industries but with different products combine to cross-sell complementary offerings.

- Merger of equals: Two similarly sized firms merge, often to pool resources without a clear acquirer/target hierarchy.

- Acqui-hire: The deal is primarily about acquiring talent rather than products or services—common in tech and startup ecosystems.

Each of these structures demands specialized legal agreements—ranging from IP licenses in product-extension deals to detailed earn-out provisions in mergers of equals. ZoopSign’s advanced workflow automation ensures that each stakeholder reviews only their relevant section, shortening turnaround times and reducing bottlenecks.

Read Blog: Merger and acquisition: Types, Forms of Integration, Valuation

Specialized Merger Forms

M&A lawyers also classify deals by the legal form they take:

- Statutory merger: Acquirer survives, target dissolves.

- Subsidiary merger: Target becomes a subsidiary of the acquirer

- Consolidation: Both original entities dissolve, forming a new company.

- Forward triangular merger vs. reverse triangular merger: Involve shell subsidiaries to optimize tax treatment and shareholder approvals.

These legal nuances mean dozens of bespoke contracts—asset purchase agreements, shareholder consent forms, tax-structured merger agreements, and more. ZoopSign’s sequential signing feature guides signers through the correct signing order (for instance, board approvals before shareholder consents), reducing errors and compliance risks.

Why Is Contract Management Crucial in M&A Transactions?

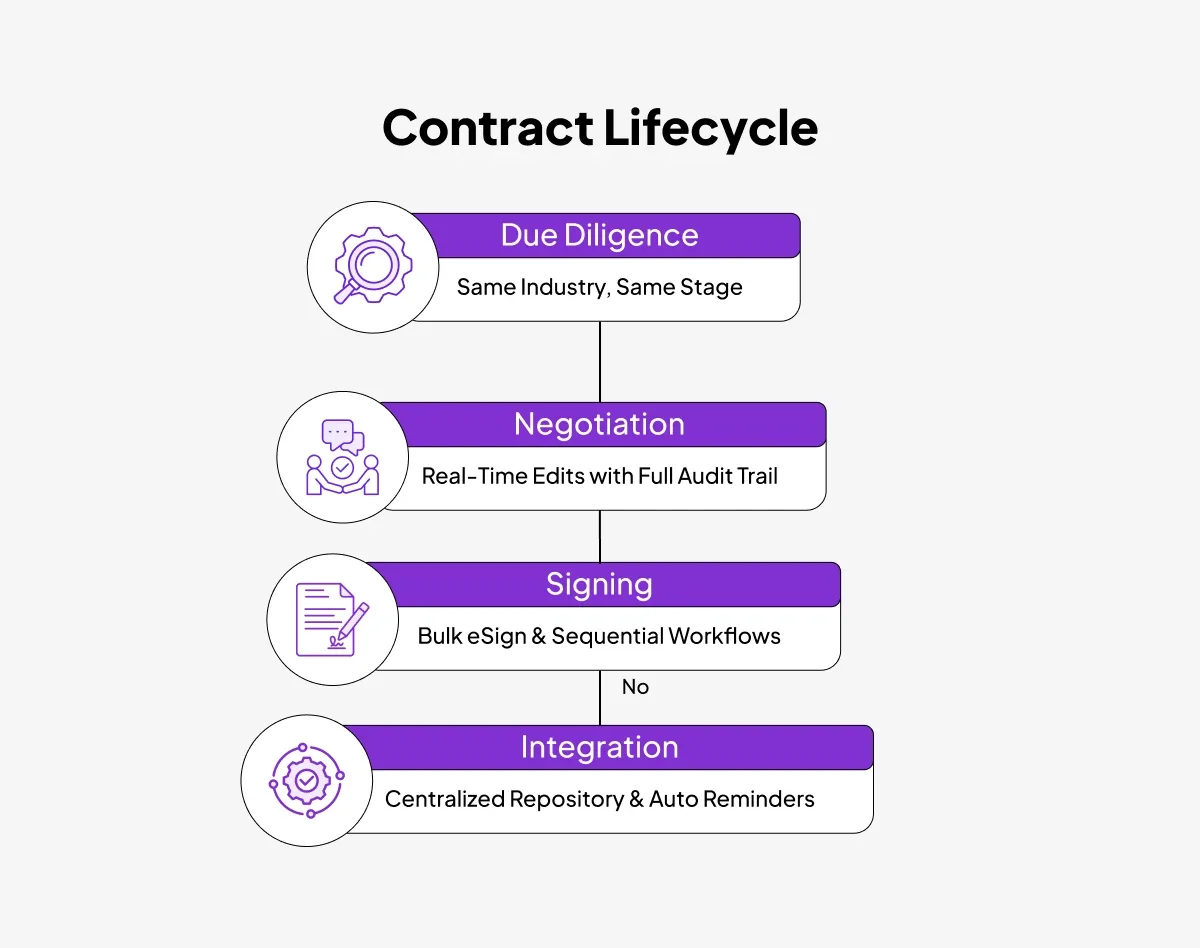

Across every merger type, contracts are the lifeblood of the transaction:

- Due Diligence requires reviewing thousands of existing agreements.

- Negotiation produces multiple drafts as teams collaborate.

- Signing often involves executives in different time zones.

- Post-merger integration demands tracking renewal dates and compliance obligations.

How Can ZoopSign's Deal Room Facilitate Seamless M&A Processes?

Beyond individual contracts, M&A teams need a secure, collaborative space to negotiate deal terms, exchange sensitive data, and track progress. That’s where ZoopSign’s Deal Room shines:

- Granular permissions let you control exactly who sees financial models, legal memos, or customer data.

- Real-time notifications alert you the moment a draft is updated or a document is accessed.

- Integrated Q&A threads keep discussions in context—no more long email chains.

Imagine a merger where your legal, finance, and integration teams all work side-by-side in a single portal: drafting asset purchase agreements, sharing diligence checklists, and setting milestone reminders—all under one roof. That’s modern M&A.

Conclusion

Mergers come in many shapes and sizes—from horizontal alliances aiming for scale to specialized product-extension deals seeking complementary portfolios. Each type carries its own legal complexities and contract-management challenges.

By embracing tools like ZoopSign’s Contract Management and Deal Room, you can transform tedious, risk-filled processes into streamlined, transparent workflows—so you can close your next merger not just on time, but with confidence.

Curious to know how? Book a Demo with us today!