A safe place to park short-term funds - who wouldn’t want that?

Millions of Indians are discovering Treasury Bills (T-Bills) – one of the safest investment options backed by the Government of India itself.

Think of T-Bills as the government's way of borrowing money from you for a short period, promising to pay you back with interest. It's like lending money to the most reliable borrower in the country – the Indian government – knowing you'll get your money back guaranteed.

Whether you're a conservative investor looking for capital protection or someone wanting to diversify beyond traditional fixed deposits, this article has got you covered.

What Exactly Are Treasury Bills (T-Bills)?

Treasury Bills are short-term debt instruments issued by the Reserve Bank of India (RBI) on behalf of the central government to meet its immediate cash requirements.

Picture this scenario: The government needs money to fund its day-to-day operations – paying salaries, maintaining infrastructure, or managing unexpected expenses. Instead of printing more money (which would cause inflation), it borrows from citizens through Treasury Bills.

Here's what makes T-Bills unique – they're "zero-coupon" securities. This means they don't pay periodic interest like traditional bonds. Instead, you buy them at a discount to their face value and receive the full face value at maturity. The difference between what you pay and what you receive is your profit.

Let us explain with a simple example:

Imagine a 91-day Treasury Bill with a face value of ₹100. You might purchase it for ₹98.50 today. After 91 days, the government pays you the full ₹100. Your return? ₹1.50 for every ₹98.50 invested, which translates to an annualized return that's often better than savings accounts and sometimes even competitive with fixed deposits.

The beauty of this system lies in its simplicity and transparency. The discount rate is determined through competitive bidding in auctions conducted by the RBI, ensuring fair market pricing. Since these are government securities, they carry the sovereign guarantee of the Government of India, making them virtually risk-free investments.

What Are the Different Types of Treasury Bills Available in India?

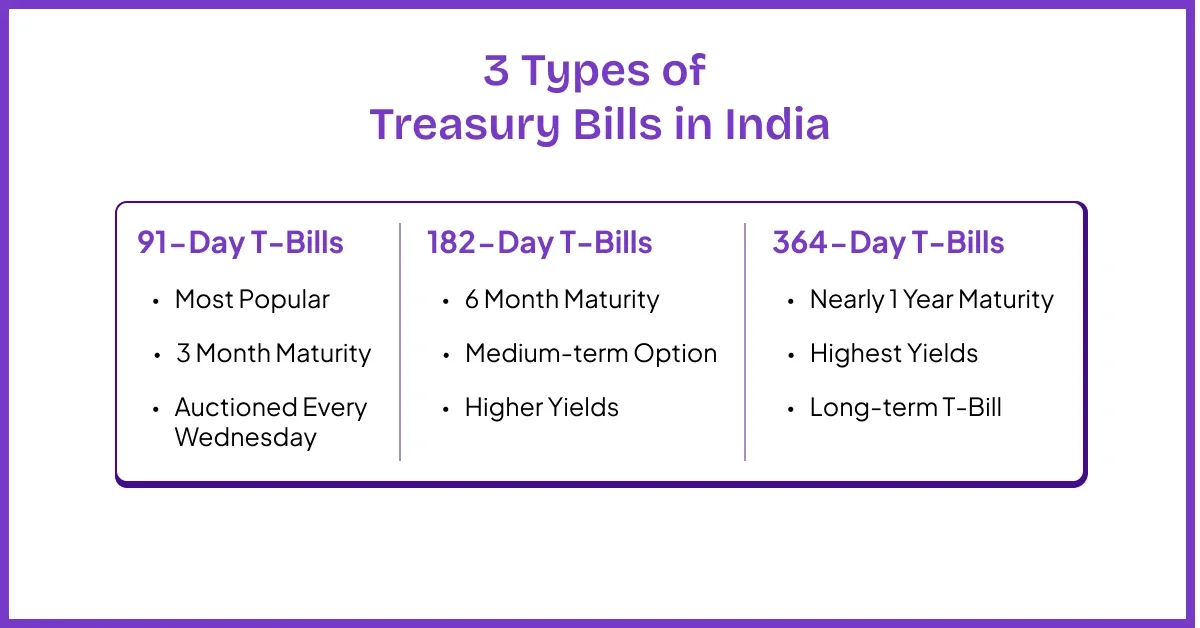

The RBI currently issues three types of Treasury Bills in India, differentiated by their maturity periods: 91-day, 182-day, and 364-day T-Bills.

1. 91-Day T-Bills

The 91-day Treasury Bill is the most popular and frequently traded T-Bill in India. With a maturity period of approximately three months, it's perfect for investors looking to park funds for a quarter. These bills are auctioned every Wednesday, providing regular investment opportunities.

The 91-day Treasury Bill yield serves as a benchmark for short-term interest rates in the Indian financial system. Banks, mutual funds, and financial institutions closely watch these yields as they influence money market rates across the economy. For individual investors, the 91-day T-Bill offers the flexibility to reinvest every quarter, allowing you to take advantage of changing interest rate scenarios.

2. 182-Day T-Bills

The 182-day Treasury Bill, with a six-month maturity, bridges the gap between very short-term and medium-term investments. These are ideal for investors who want slightly higher returns than 91-day bills but don't want to lock their money for a full year.

Typically, longer-duration T-Bills offer marginally higher yields than shorter ones, following the general principle that longer commitments deserve better compensation. However, this isn't always guaranteed, as yields depend on market conditions and the government's funding requirements.

3. 364-Day T-Bills

The 364-day Treasury Bill is the longest-duration T-Bill available, with a maturity of nearly one year. These bills usually offer the highest yields among the three variants, making them attractive for investors comfortable with locking their funds for almost a year.

One important point to note: The RBI used to issue 14-day Treasury Bills for very short-term funding needs, but these have been discontinued. The three variants mentioned above are currently the only Treasury Bills issued by the government.

What Are the Main Benefits of Investing in Treasury Bills?

Treasury Bills offer unmatched safety, excellent liquidity, zero credit risk, and transparent pricing, making them ideal for conservative investors and those seeking capital preservation.

1. Unmatched Safety (Sovereign Guarantee)

When you invest in Treasury Bills, you're essentially lending money to the Government of India. This comes with what's called a "sovereign guarantee" – the full faith and credit of the Indian government backing your investment. In simple terms, the government would have to default on its obligations for you to lose money, which is extremely unlikely for a sovereign nation like India.

This level of safety is unmatched by any other investment instrument in India. Even the safest bank fixed deposits carry some risk of the bank failing, but Treasury Bills are backed by the government's ability to print money and collect taxes. For risk-averse investors, this peace of mind is invaluable.

2. High Liquidity

Unlike fixed deposits, where breaking early incurs penalties, Treasury Bills can be sold in the secondary market before maturity. Both the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) facilitate trading in Treasury Bills, providing you with an exit option if you need your money urgently.

This liquidity feature makes T-Bills particularly attractive for emergency funds or money you might need on short notice. While the price you get in the secondary market depends on prevailing interest rates, you're not locked in until maturity like with traditional fixed deposits.

3. Zero Credit Risk

Credit risk is the possibility that the borrower won't repay the loan. With Treasury Bills, this risk is virtually zero because the borrower is the Government of India. Unlike corporate bonds or bank deposits, where there's always some risk of default, T-Bills offer the ultimate in credit security.

This zero credit risk makes Treasury Bills an excellent foundation for any investment portfolio, providing stability and predictability that more volatile investments can't match.

4. Transparent Pricing

Treasury Bill prices are determined through transparent auctions conducted by the RBI. The yields are announced publicly, and historical data is readily available. This transparency ensures you always know the fair market value of your investment, unlike some other investment products where pricing might be opaque.

The auction mechanism also ensures competitive pricing, as institutional investors bid against each other, resulting in fair market rates for all investors.

How Can I Buy Treasury Bills in India? Methods

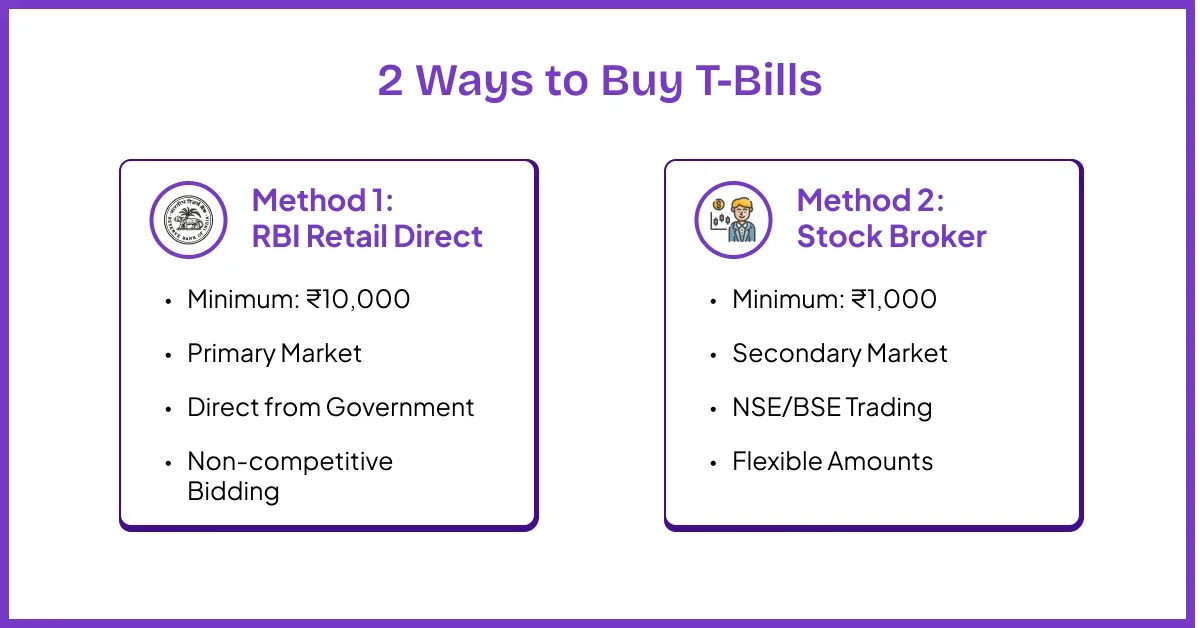

You can purchase Treasury Bills either directly through the RBI's Retail Direct Scheme by participating in primary auctions or through stockbrokers in the secondary market on exchanges like NSE and BSE.

Method 1: Through the RBI Retail Direct Scheme

Opening an RBI Retail Direct account requires a mandatory online Know Your Customer (KYC) process. This requires you to upload documents and digitally verify your identity, often using Aadhaar. Ensuring these financial application documents are handled with secure, legally binding electronic signatures is critical for protecting your information.

Platforms like ZooSign offer secure eSignature solutions that meet the high standards of security and compliance required for financial paperwork.

Method 2: Through a Stockbroker (Secondary Market)

If you prefer more flexibility or want to invest amounts smaller than ₹25,000, you can buy Treasury Bills through your stockbroker in the secondary market. Most major stockbrokers in India, including Zerodha, HDFC Securities, and ICICI Direct, facilitate T-Bill trading.

In the secondary market, you're buying T-Bills that other investors are selling before maturity. The prices fluctuate based on changes in interest rates and time to maturity. If interest rates have fallen since the T-Bill was issued, you might pay a premium (more than face value). If rates have risen, you might get a discount.

The advantage of this method is flexibility – you can invest smaller amounts, choose from T-Bills with different remaining maturities, and exit anytime during market hours. However, you'll pay brokerage charges, and the yields might be slightly different from primary market rates.

Who is Eligible to Invest in T-Bills?

Any resident of India, including individuals, Hindu Undivided Families (HUFs), partnership firms, companies, banks, financial institutions, and trusts, can invest in Treasury Bills.

The eligibility criteria for Treasury Bills are quite broad, making them accessible to almost every type of domestic investor.

- Individual investors – whether salaried employees, business owners, or retirees – can invest in T-Bills. This includes minors, with investments made through their guardians.

- Corporate entities, including private limited companies, public limited companies, and partnership firms, are also eligible. This makes T-Bills an excellent option for businesses looking to park surplus cash for short periods while earning better returns than savings accounts.

- However, there are some restrictions. Non-Resident Indians (NRIs) face certain limitations and should check the current RBI guidelines, as these rules can change.

- Foreign institutional investors and foreign portfolio investors may have specific routes and limits for investing in government securities.

- Banks and financial institutions are major investors in Treasury Bills, often using them for liquidity management and meeting regulatory requirements like the Statutory Liquidity Ratio (SLR).

Are Treasury Bills Really Risk-Free?

While Treasury Bills are considered among the safest investments globally due to government backing, they're not entirely without risk, though the risks are minimal and different from credit risk.

Let's be clear about what "risk-free" means in the context of Treasury Bills. When financial experts call T-Bills risk-free, they're primarily referring to credit risk – the risk that the borrower won't pay back the money. In this regard, Treasury Bills are indeed virtually risk-free because the Government of India has never defaulted on its debt obligations.

However, there are other types of risks to consider, albeit minimal ones. Interest rate risk is the main concern. If you need to sell your T-Bills before maturity and interest rates have risen since you bought them, you might receive less than what you paid. This is because newer T-Bills would offer higher yields, making your older, lower-yielding T-Bills less attractive.

Inflation risk is another consideration. If inflation rises significantly during your investment period, the purchasing power of your returns might be eroded. However, since T-Bills are short-term instruments, this risk is limited compared to longer-term investments.

Liquidity risk is minimal but exists. While there's a secondary market for T-Bills, during extreme market stress, liquidity might temporarily be reduced. However, given the short-term nature of these instruments, you can always hold until maturity.

The key takeaway? Treasury Bills are as close to risk-free as you can get in the investment world, especially if you hold them until maturity.

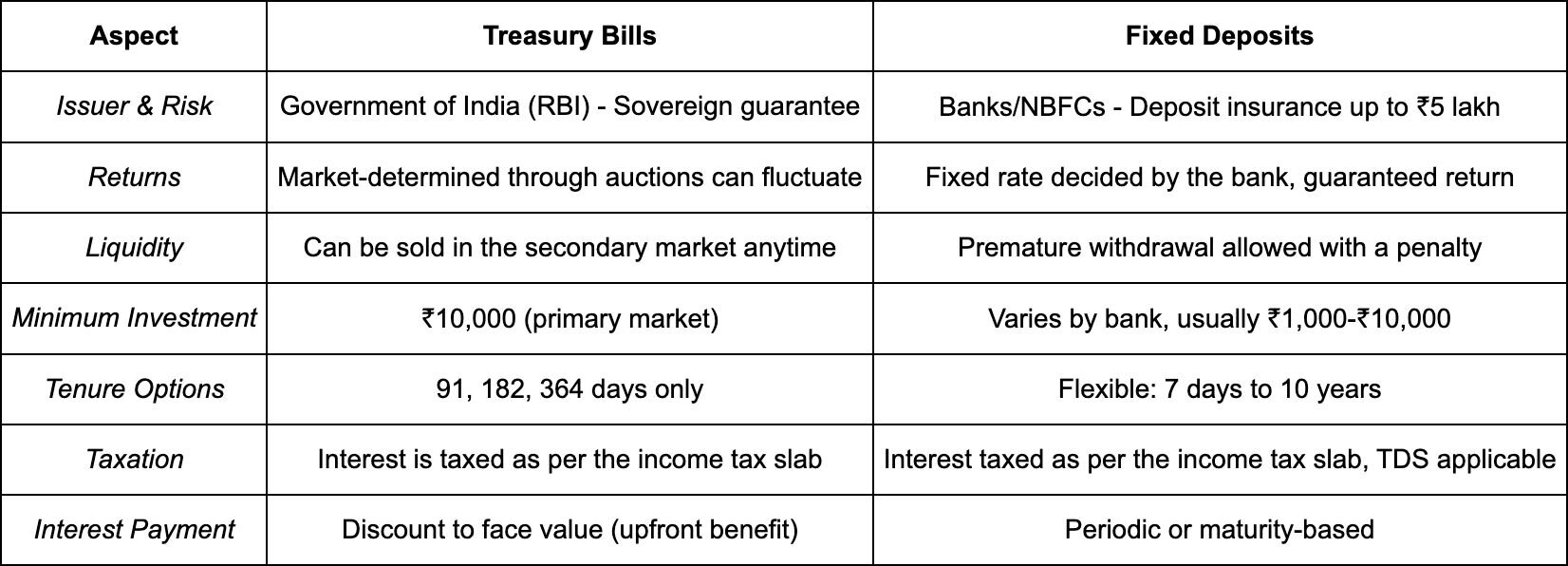

How Do Treasury Bills Compare to Fixed Deposits (FD's)?

Treasury Bills are government-issued securities with market-determined returns and high liquidity, while Fixed Deposits are bank products offering fixed returns with limited liquidity and early withdrawal penalties.

Understanding the differences between T-Bills and Fixed Deposits is crucial for making informed investment decisions. Both are considered safe investments, prolonged many investors find themselves choosing between these options.

Frequently Asked Questions (FAQs) about T-Bills

Q: What is the minimum investment for T-Bills?

A: The minimum investment in Treasury Bills through the RBI Retail Direct Scheme is ₹25,000, and subsequent investments must be in multiples of ₹25,000. However, if you're buying T-Bills through a stockbroker in the secondary market, the minimum investment can be lower, typically starting from ₹10,000 or even less, depending on your broker's policies.

Q: How are returns on Treasury Bills taxed?

A: Returns from Treasury Bills are treated as interest income and taxed according to your income tax slab. This means if you're in the 20% tax bracket, your T-Bill gains will be taxed at 20%. The gains are calculated as the difference between the purchase price and maturity value (or sale price if sold before maturity).

Unlike equity investments, there's no distinction between short-term and long-term capital gains for T-Bills. All gains are considered interest income and added to your total income for tax purposes. TDS (Tax Deducted at Source) may be applicable in certain cases, particularly for non-individual investors.

Q: Can NRIs invest in Treasury Bills?

A: NRI investment in Treasury Bills is subject to specific RBI guidelines that can change over time. Generally, NRIs can invest in government securities, including T-Bills, but there may be limits on the amount and specific procedural requirements. NRIS should check the latest RBI circular on NRI investments in government securities or consult with their bank or financial advisor.

Q: When are Treasury Bill auctions held?

A: Treasury Bill auctions are held regularly by the RBI according to a pre-announced calendar. Typically, 91-day T-Bills are auctioned every Wednesday, while 182-day and 364-day T-Bills have their own schedules, usually bi-weekly or monthly. The RBI publishes an auction calendar at the beginning of each quarter, so investors can plan their investments accordingly.