If you’re someone who’s ever bought a home or is in the process of buying one, this one’s for you.

When you’re at the stage of sealing the deal on a property, you often feel that it’s the last stage. But wait—there's one more crucial step that could save you from legal headaches and hefty penalties: TDS compliance.

If you're scratching your head wondering what TDS has to do with buying property, you're not alone. Most property buyers discover this requirement at the last minute, often scrambling to understand their obligations.

Don't worry, we've got you covered. This blog will walk you through everything you need to know about TDS on property purchases, from the basics to more detailed info that even seasoned investors sometimes miss.

What is TDS on Property Purchase?

TDS (Tax Deducted at Source) on property purchase is a tax collection mechanism where the buyer must deduct a specific percentage of the property's value and deposit it with the government before completing the transaction. Think of it as an advance tax payment on behalf of the seller.

When you buy property worth ₹50 lakh or more, you're required to deduct 1% TDS from the total consideration amount. This isn't an additional cost—it's simply a way for the government to collect tax at the point of transaction rather than waiting for the seller to file their annual returns.

Why Does TDS Apply to Property Transactions?

The government introduced TDS on property transactions to tackle tax evasion in real estate deals. Property transactions involve substantial amounts, and historically, many sellers would underreport their gains or avoid paying capital gains tax altogether.

By requiring buyers to deduct TDS upfront, the system ensures that:

- Tax is collected at the source of income

- Sellers can't completely avoid their tax obligations

- The government has a record of high-value property transactions

- There's better compliance with tax regulations

Key Laws: Section 194-IA Explained

Section 194-IA of the Income Tax Act, 1961, is the backbone of TDS on property purchases. Introduced in 2013, this section mandates that any person purchasing immovable property (other than agricultural land) must deduct TDS if the consideration amount exceeds ₹50 lakh.

The key provisions include:

- Applicable rate: 1% of the property value

- Threshold limit: ₹50 lakh

- Scope: All immovable property except agricultural land

- Responsibility: Lies with the buyer (purchaser)

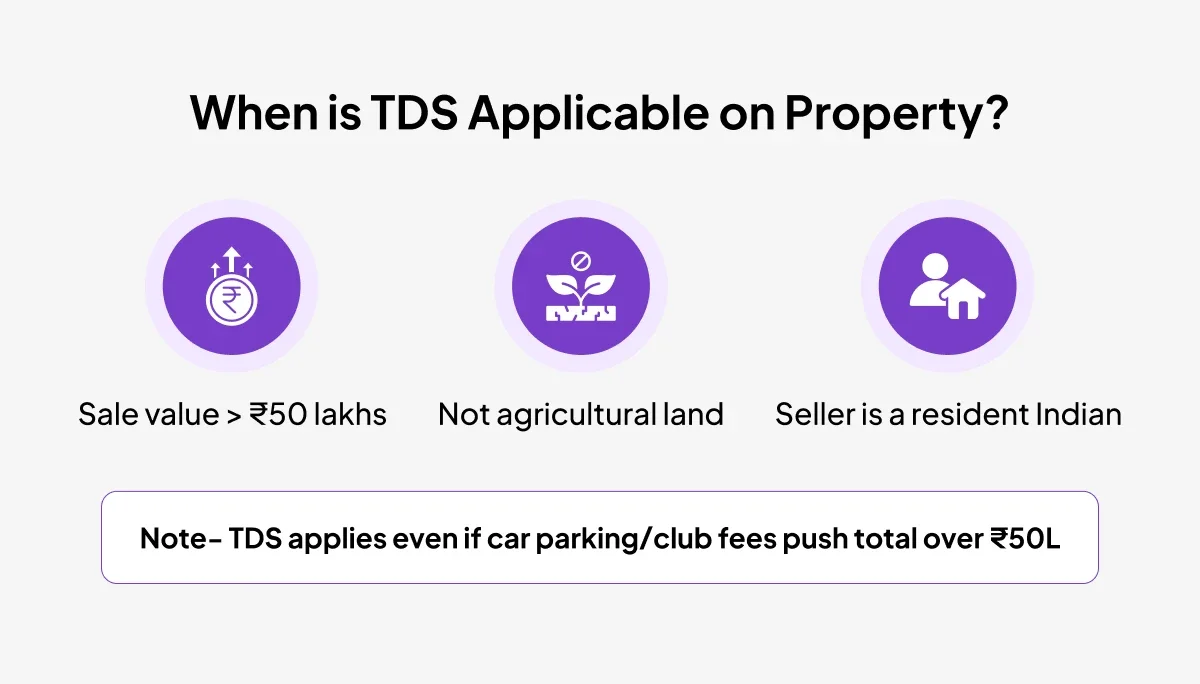

When is TDS Applicable on Property?

Understanding when TDS kicks in can save you from compliance nightmares. Let's break down the scenarios where TDS becomes mandatory.

Limit Amount & Types of Properties Covered

1. TDS applies when:

- The total consideration for immovable property exceeds ₹50 lakh

- The property is classified as immovable property (residential, commercial, industrial buildings, land, etc.)

- The transaction involves a sale/purchase (not gifts or inheritance)

2. What all Properties are covered:

- Residential apartments and houses

- Commercial buildings and office spaces

- Industrial properties

- Vacant land (except agricultural land)

- Parking spaces sold separately

- Club memberships linked to property

3. What all Properties are exempt:

- Agricultural land (with specific conditions)

- Property transactions below ₹50 lakh

- Compulsory acquisition by the government

- Transactions between specified persons in certain cases

What Counts Towards the ₹50 Lakh Limit? (Inclusive Payments: Parking, Club, etc.)

Here's where many buyers get confused. The ₹50 lakh limit isn't just the basic property price—it includes all payments made as part of the property transaction:

- Basic property price

- Parking space charges

- Club membership fees

- Preferential location charges (PLC)

- Floor rise charges

- Maintenance deposits

- Power backup charges

- Any other charges related to the property

Example: If you're buying a flat for ₹45 lakh but pay ₹3 lakh for parking and ₹4 lakh for club membership, your total consideration is ₹52 lakh, making TDS applicable.

Who is Responsible for Deducting and Paying TDS?

The responsibility for TDS compliance rests only on the buyer's shoulders. However, the specifics can vary based on the transaction structure.

Buyer's Duties (Including Joint Buyers)

As a buyer, you must:

- Calculate the correct TDS amount

- Deduct TDS before making the final payment

- Deposit the TDS with the government

- File Form 26QB

- Issue Form 16B to the seller

In case of joint buyers: The TDS obligation applies to all buyers collectively. If there are multiple buyers, they can nominate one person to handle TDS compliance on behalf of all, or they can file separate forms for their respective shares.

TDS in Home Loan Transactions

Many buyers assume that since banks are involved in home loan transactions, TDS compliance is automatically handled. This isn't true. Even when you're taking a home loan:

- You (the buyer) remain responsible for TDS deduction and deposit

- The bank disburses the loan amount, but TDS must be deducted from the total consideration

- You need to arrange for TDS deduction before the final payment/registration

Practical tip: Inform your bank about TDS requirements early in the process so they can coordinate the payment structure accordingly.

Installment Payments & TDS

For properties bought in installments (common in under-construction projects), TDS applies when the cumulative payments exceed ₹50 lakh. You don't need to deduct TDS on each installment—only when the total crosses the threshold.

However, once you cross ₹50 lakh, you must deduct TDS on the entire amount, not just the excess.

How Much TDS to Deduct and When?

The TDS calculation is straightforward: 1% of the total consideration amount. However, the timing and specific calculations can vary based on circumstances.

Example 1: Simple Purchase

- Property value: ₹75 lakh

- TDS to deduct: ₹75,000 (1% of ₹75 lakh)

- Amount to pay seller: ₹74.25 lakh

- TDS to deposit: ₹75,000

Example 2: With Additional Charges

- Basic property price: ₹48 lakh

- Parking: ₹3 lakh

- Club membership: ₹2 lakh

- Total consideration: ₹53 lakh

- TDS to deduct: ₹53,000 (1% of ₹53 lakh)

Example 3: Installment Purchase

- Total property value: ₹60 lakh

- Paid so far: ₹45 lakh (no TDS required yet)

- Final payment: ₹15 lakh

- TDS to deduct: ₹60,000 (1% of total ₹60 lakh)

What if Seller Doesn't Provide PAN?

If the seller doesn't provide their PAN or provides an invalid PAN, you must deduct TDS at 20% instead of 1%. This significantly increases the deduction amount:

- With PAN: 1% of consideration

- Without PAN: 20% of consideration

For a ₹60 lakh property:

- With PAN: ₹60,000 TDS

- Without PAN: ₹12,00,000 TDS

Always insist on getting the seller's PAN to avoid this massive deduction.

What Documents do you need for TDS compliance?

Before you proceed with TDS deduction and filing, ensure you have these documents ready:

1. Documents from the Seller Side:

- PAN card copy

- Aadhaar card copy

- Bank account details

- Property documents

- NOC (if applicable)

2. Documents from Buyer Side:

- Buyer PAN card

- TAN (Tax Deduction Account Number)

- Bank account details for TDS payment

- Property purchase agreement

- Payment receipts

3. Additional Documents Required:

- Form 26QB (to be filled online)

- Challan for TDS payment

- Form 16B (TDS certificate)

How do I fill and file Form 26QB online?

Filing Form 26QB might seem daunting, but it's quite straightforward once you understand the process.

What is the the Process of Filing Form 26QB Online? Form 26QB is an online form that must be filed on the Income Tax e-filing portal. Here's how to do it:

- Log in to the IT e-filing portal using your credentials

- Navigate to 'e-File' → 'Prepare and Submit Online' → 'Form 26QB'

- Enter the deductor details (your information as the buyer)

- Add deductee details (seller's information)

- Enter transaction details (property details, consideration amount, TDS deducted)

- Validate all information carefully

- Submit the form

Here are the Important dates for form filing:

- Form 26QB must be filed by the 30th of the month following the month of deduction

- For example, if you deduct TDS in March, file by April 30th

What all Payment Options & Acknowledgement to consider while paying TDS?

You can pay TDS through various methods:

1. Online Payment method:

- Net banking

- Debit card

- RTGS/NEFT

- UPI (for smaller amounts)

2. Offline Payment method:

- Bank challan

- Cash (at authorized banks)

3. After payment, you'll receive:

- Challan counterfoil

- CIN (Challan Identification Number)

- BSR code

Save these documents—you'll need them for Form 26QB filing.

How do Joint Buyers or Multiple Sellers handle TDS?

When dealing with multiple buyers or sellers, you have options:

1. Multiple Buyers:

- File one consolidated Form 26QB with all buyers' details

- Or file separate forms for each buyer's share

2. Multiple Sellers:

- Must file separate Form 26QB for each seller

- Each seller gets their own Form 16B

Choose the approach that's most convenient for your situation.

How to Download and Issue Form 16B TDS Certificate?

Form 16B is the TDS certificate that you must provide to the seller. It's their proof of TDS deduction and crucial for their tax filing.

How to Download from TRACES

TRACES (TDS Reconciliation Analysis and Correction Enabling System) is the platform where you can download Form 16B:

- Log in to TRACES portal

- Navigate to 'Form 16B' section

- Select the relevant quarter and assessment year

- Choose the specific transaction

- Generate and download the certificate

Note: The system automatically generates Form 16B after successful filing of Form 26QB and TDS payment.

Why Form 16B is Important for Sellers

For sellers, Form 16B is essential because:

- It's proof of TDS deduction

- Required for claiming TDS credit in their tax returns

- Needed to avoid double taxation

- Helps in tax planning and compliance

Note: Always ensure you provide Form 16B to the seller promptly after generation.

Is TDS Mandatory for Under-construction or NRI-owned properties? Special Cases

Real estate transactions aren't always straightforward. Here are some special scenarios you might encounter for under-construction and NRI-owned Properties:

1. For Under-Construction Properties:

TDS applies to under-construction properties too, but the timing is crucial:

- Possession-based: TDS is deducted when possession is handed over

- Payment-based: If total payments exceed ₹50 lakh before possession, TDS applies immediately

- Installment consideration: Monitor cumulative payments to determine when TDS kicks in

2. If the Seller is an NRI (Section 195)

When the seller is a Non-Resident Indian (NRI), different rules apply:

- Section 195 governs TDS for NRI sellers

- TDS rate: 20% (higher than the domestic rate)

- Advance ruling: NRIs can seek an advance ruling for TDS rate determination

- Double Taxation Avoidance Agreement (DTAA): May provide relief

Note: For NRI transactions, consult a tax expert to ensure compliance.

3. Agricultural Land: Urban vs Rural

Agricultural land has specific exemptions:

Generally exempt:

- Rural agricultural land

- Land used for agricultural purposes

May be covered:

- Agricultural land in urban areas (depends on local definitions)

- Land converted from agricultural to non-agricultural use

The definition of "agricultural land" can be complex and varies by state. When in doubt, consult local authorities.

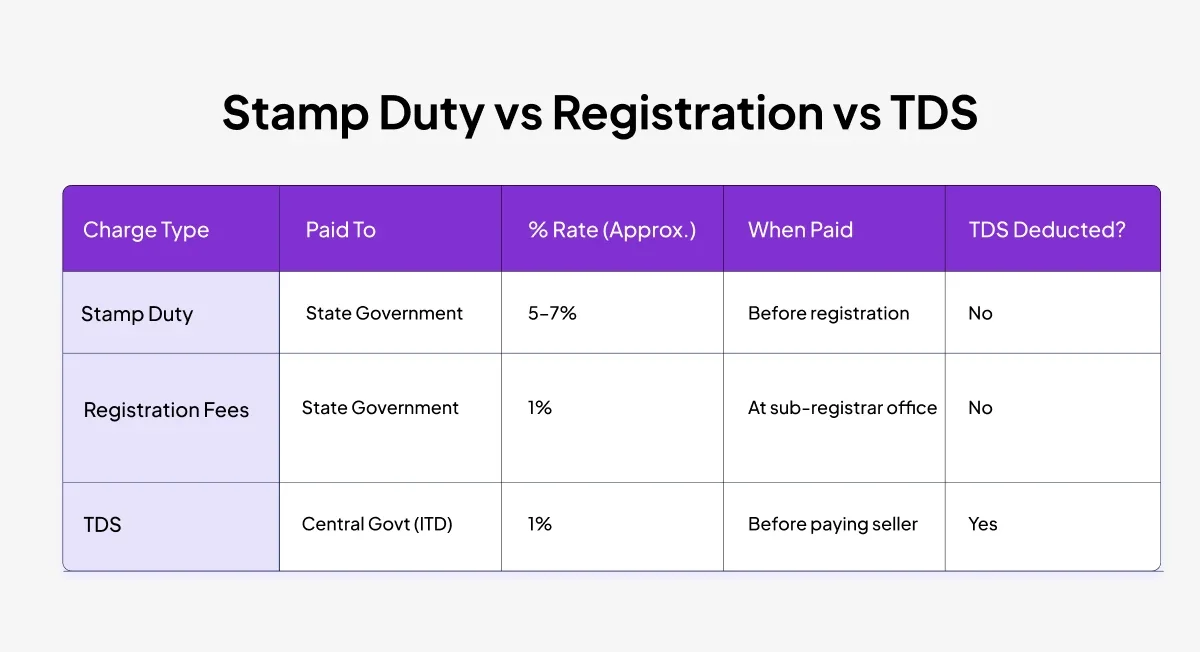

How is TDS on property different from stamp duty or registration?

Many buyers confuse these three obligations. Here's how they differ:

1. Stamp Duty:

- State government levy

- Based on property value or circle rate

- Paid at the time of registration

- Ranges from 3% to 10% (varies by state)

2. Registration Fees:

- Fees for registering the property

- Usually 1% of property value

- Paid to the registrar's office

3. TDS:

- Central government obligation

- 1% of consideration amount

- Advance tax on seller's behalf

- Paid before property registration

All three are separate obligations and must be fulfilled for a complete, legal property transaction.

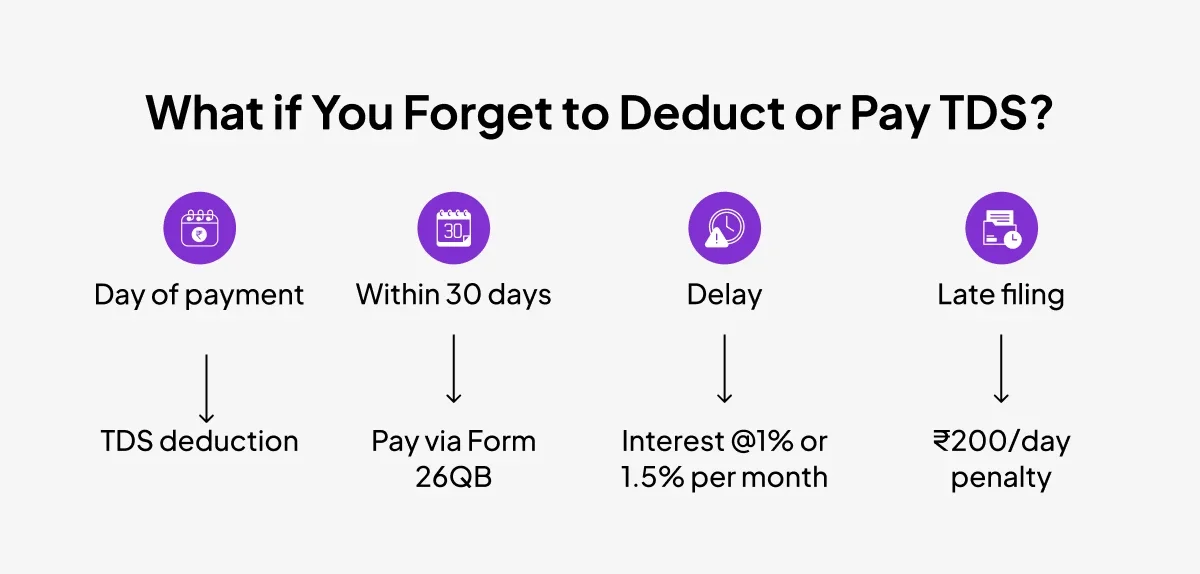

What are the penalties for late or Missed TDS payments?

TDS non-compliance can be expensive. Understanding the penalties can help you avoid costly mistakes.

Late Deduction, Late Deposit, and Filing Penalties

1. Late Deduction:

- 1% per month on TDS amount

- Minimum penalty: ₹10,000

2. Late Deposit:

- 1.5% per month on TDS amount

- Calculated from due date to actual deposit date

3. Late Filing:

- ₹200 per day for delayed filing

- Maximum penalty: TDS amount

4. Non-compliance:

- Penalty equal to TDS amount

- Prosecution under Section 276B (imprisonment up to 7 years)

How to fix mistakes in the TDS process? (Revising Form 26QB)

If you make mistakes in Form 26QB, you can file a revised form:

- Identify the error in the original form

- File a revised Form 26QB with correct information

- Pay any additional TDS if required

- Generate fresh Form 16B

- Provide updated certificate to seller

The revised form should be filed as soon as you discover the error.

Digital Tools to Simplify Property TDS & Documentation

Managing TDS compliance manually can be overwhelming. Fortunately, several digital tools can streamline the process:

1. Government Portals:

- Income Tax e-filing portal

- TRACES

- TIN-NSDL

2. Professional Tools:

- TDS calculation software

- Compliance management systems

- Document management platforms

ZoopSign Solutions: For property transactions requiring multiple document signatures and approvals, ZoopSign offers secure digital signature solutions that can streamline your property documentation process. From purchase agreements to TDS compliance documents, digital signatures can significantly reduce processing time while maintaining legal validity.

What all features help with property transactions?

Features that help with property transactions are:

- Multi-party document signing

- Audit trails for compliance

- Secure document storage

- Integration with compliance workflows

TDS on Property: TDS Rule Changes and Budget Highlights (2025)

Staying updated with the latest changes is crucial for compliance. Here are the recent developments:

1. Current Status (2025):

- TDS rate remains at 1%

- Threshold limit continues to be ₹50 lakh

- No major structural changes announced

2. Trends to Watch:

- Potential digitization of compliance processes

- Integration with property registration systems

- Simplified filing procedures

3. Best Practices:

- Stay updated with annual budget announcements

- Subscribe to tax authority notifications

- Consult professionals for complex transactions

Conclusion

The key to stress-free TDS compliance? Start early. Don't wait until the last minute to understand your obligations. Get your TAN, gather the necessary documents, and build TDS into your transaction timeline. Remember, this isn't an additional cost—it's simply ensuring the seller's tax obligations are met upfront.

Most importantly, TDS compliance isn't just about following rules; it's about completing your property purchase with complete legal backing. When you're investing lakhs in your dream property, that extra layer of protection is absolutely worth the effort.

Ready to make your property transaction seamless? With the right preparation and understanding, TDS compliance becomes just another checkbox on your path to homeownership.

Frequently Asked Questions (FAQs)

1. Is TDS applicable an under-construction property?

Yes, TDS applies to under-construction properties when the total consideration exceeds ₹50 lakh. The TDS is typically deducted when possession is handed over or when cumulative payments cross the threshold, whichever is earlier.

2. Do I need a TAN to deduct TDS on property purchase?

Yes, you need a Tax Deduction Account Number (TAN) to deduct TDS. You can apply for TAN online through the NSDL or UTITSL websites. The process is straightforward and usually takes 15-20 days.

3. How is TDS handled with multiple buyers or sellers?

For multiple buyers, TDS responsibility is collective, but you can nominate one person to handle compliance. For multiple sellers, separate Form 26QB must be filed for each seller, and each gets their own Form 16B certificate.

4. What if the seller is an NRI?

NRI sellers are subject to higher TDS rates (usually 20%) under Section 195. The process is more complex and may require advance approvals. It's advisable to consult a tax expert for NRI transactions.

5. Can I revise Form 26QB after submission?

Yes, you can file a revised Form 26QB if you discover errors in the original submission. File the revised form as soon as possible and provide an updated Form 16B to the seller.

6. Is TDS applicable on property bought in installments or with a home loan?

Yes, TDS applies regardless of the payment method. For installment purchases, TDS is required when cumulative payments exceed ₹50 lakh. Home loan transactions also require TDS compliance—the buyer remains responsible even when banks are involved.

7. What happens if I forget to deduct or deposit TDS on a property purchase?

Non-compliance results in penalties including 1% per month on the TDS amount, minimum ₹10,000 penalty, and potential prosecution. You should immediately rectify the situation by deducting and depositing the TDS amount along with applicable penalties.

8. Can TDS be paid online, and how do I get the TDS certificate?

Yes, TDS can be paid online through the Income Tax e-filing portal using net banking, debit cards, or other digital payment methods. Form 16B (TDS certificate) is automatically generated on TRACES after successful filing of Form 26QB and TDS payment.

9. Is TDS required if the property is jointly owned or has multiple sellers?

TDS requirements don't change based on ownership structure. If the total consideration exceeds ₹50 lakh, TDS must be deducted regardless of whether there are joint owners or multiple sellers. Each seller must receive their portion of the TDS certificate.

10. Is agricultural land exempt from TDS on property purchase?

Generally, rural agricultural land is exempt from TDS. However, agricultural land in urban areas or land converted from agricultural to non-agricultural use may be subject to TDS. The definition varies by state, so consult local authorities for clarity.