Sole proprietorship is India's simplest business structure for freelancers, home sellers & side hustles—no incorporation needed. Use ZoopSign eSign for instant business agreements, vendor contracts & GST documents.

This guide keeps it simple and practical, providing exact steps, documents, tax information, compliance details, timelines, and FAQs, so you can get started without wading through legalese.

What is a Sole Proprietorship in India?

Sole proprietorship means the owner & business are legally the same - no separate entity, board or partners required.

A sole proprietorship is a business run and owned by a single individual, with no separate legal entity from its owner. In practice, that means the proprietor keeps full control and all profits but also bears unlimited personal liability for debts and obligations.

The business income is taxed as the owner’s income (there’s no separate corporate tax), and the setup is simple with minimal paperwork, making it popular with freelancers, consultants, shopkeepers, home-based sellers, and early-stage side hustles.

Because the business and the owner are legally the same, raising equity or transferring ownership is less straightforward than with an LLP or company, but it’s a fast, low-cost way to start and validate an idea.

What does it mean?

- Single owner, simple structure: You are the business. There’s no separate incorporation, board, or partners. Decisions are quick and personal.

- Complete profit/loss responsibility: All profits are yours and all losses and liabilities are yours too (more on “unlimited liability” in the limitations section).

- Perfect for small/local businesses: Ideal for early-stage ventures, freelancers, independent professionals, kirana/retail outlets, online sellers, tutors, and service providers who want to test, learn, and grow with minimal overhead.

What are the Advantages of a Sole Proprietorship in India?

Sole proprietorships are easy to start, require minimal compliance, and provide full control and profits to the owner. In practice, you can launch with basic KYC and a few local registrations - no incorporation formalities, partner agreements, or complex governance.

Ongoing compliance is lighter than LLPs/companies (fewer filings, no board meetings), letting you focus on customers. And because all decision-making rests with you, you can pivot fast, set pricing, and keep all profits personally (reported in your ITR), reinvesting as you choose.

The real-world upsides:

- Fast setup, low cost: No incorporation paperwork. You set up your identity and licenses, then open a current account.

- Complete autonomy in decisions: No partners to consult; you can test ideas faster.

- Lower formalities and compliance: Compared to companies/LLPs, proprietorships have fewer recurring filings.

- Direct tax reporting on individual returns: Your business income is reported in your personal ITR (ITR-3 or ITR-4 under presumptive taxation, explained later).

Source: India ServicesClearTax

What are the Limitations of a Sole Proprietorship?

Sole proprietorships are constrained by unlimited personal liability (your savings or property can be used to settle business debts), limited fund-raising options (you can’t issue equity and bank finance relies heavily on your personal credit and collateral), and no perpetual succession (the business typically ceases or is disrupted on the proprietor’s death, incapacity, or retirement).

They’re also harder to transfer or onboard partners into, and can face credibility hurdles with enterprise customers or investors limitations that become more visible as you try to scale.

What to weigh before you choose:

- Unlimited liability: Your assets are at risk for business debts and claims.

- Harder to raise external capital: Banks may lend (especially with Udyam + cash flows), but equity investors and VCs prefer LLPs/companies.

- No perpetual existence: The business ends with the proprietor and can’t outlive you or easily transfer like company shares.

- Scaling constraints: As headcount, risk, and compliance complexity grow, many proprietors convert to LLP or private limited later.

What are the Documents Required for Sole Proprietorship?

Aadhaar card, PAN card, address proof, and business proof are essential for registration.

Here’s a crisp checklist (organised by purpose):

1. Identity & tax:

- Aadhaar of the proprietor

- PAN of proprietor (your business uses your PAN since the entity isn’t separate)

2. Address proofs (any one, recent):

- Utility bill (electricity/water/gas) of residence or place of business

- Registered rent agreement or ownership document of premises

3. Photos:

- Recent passport-size photographs of the proprietor

4. Business address documents (if different from residence):

- Rent/lease/ownership papers + utility bill (optional but helps with bank KYC)

5. Optional but strongly recommended “proofs of business” to smooth banking & vendor onboarding:

- Shop & Establishment registration (state-wise)

- Udyam Registration (MSME certificate)

- GST registration (if you cross thresholds or want it voluntarily)

- Professional Tax registration (if applicable in your state)

- Trade/sectoral licences like FSSAI for food businesses, IEC for import/export, etc

Why these “optional” proofs matter: Banks follow RBI KYC and will ask for official identity plus proof of business when opening a current account for a sole proprietorship. Having the Shop Act/Udyam/GST handy makes this painless.

How to Register a Sole Proprietorship Online/Offline in India?

Registration involves securing a business name, obtaining tax and trade licenses, and opening a business bank account.

A practical flow that works in most states/cities:

- Choose a unique business name (and quickly check domain/social handles).

- Apply for PAN (if you don’t already have one).

- Register under your State’s Shop & Establishment Act (online in many states; typically within 30 days of starting operations).

- Get GST if you cross thresholds (or opt in voluntarily for B2B credibility/input tax credit). See thresholds below.

- Open a business current account (submit KYC + “proof of business”).

Running a food business? Add FSSAI registration (₹100 for petty FBOs up to ₹12 lakh turnover; State/Central licence above that).

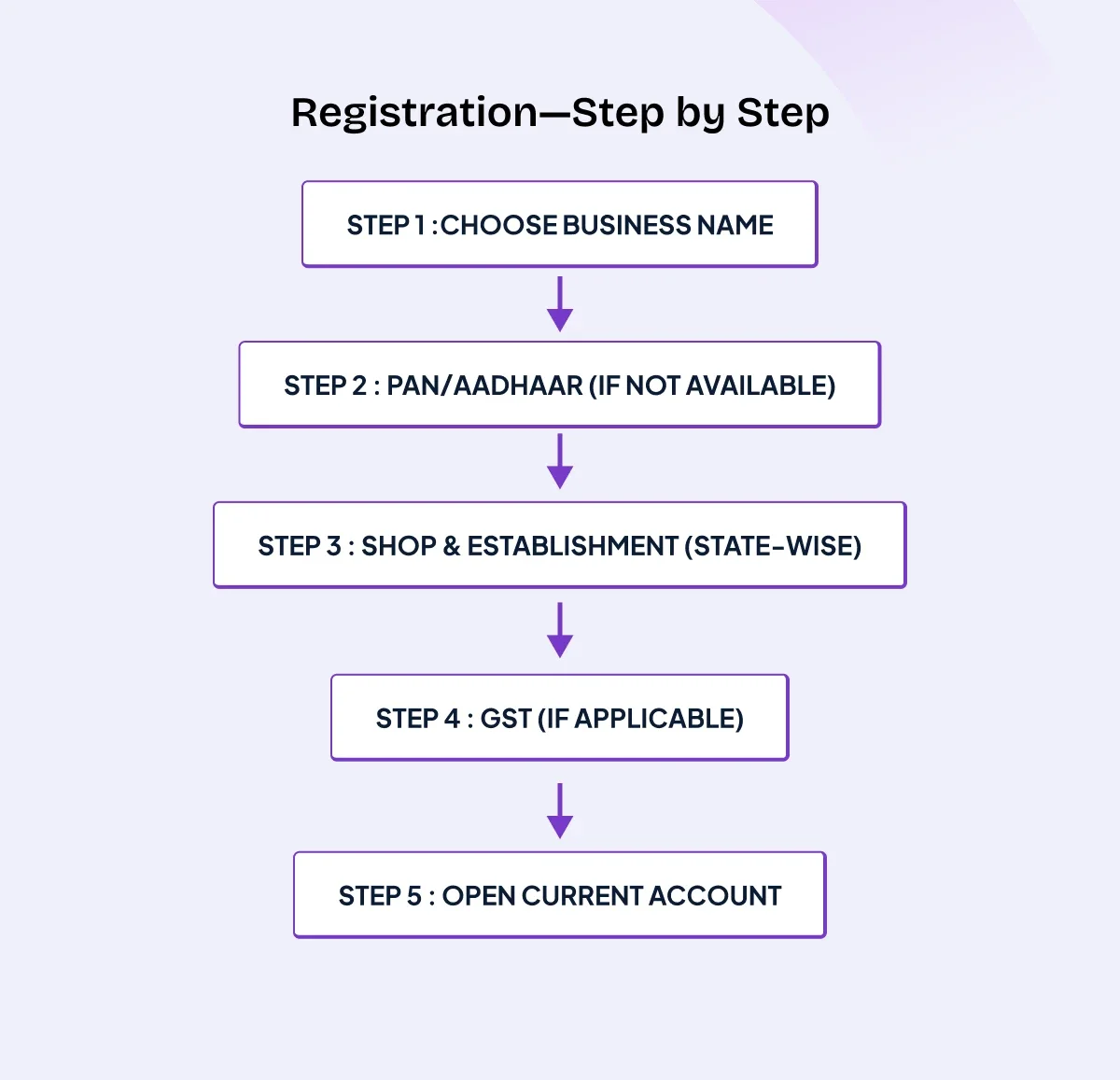

What is the Stepwise Procedure for Sole Proprietorship Registration?

Gathering documents, choosing a name, applying for necessary licenses, and opening a business account complete the process.

Follow this ordered checklist:

1. Collect documents: Aadhaar, PAN, photos, address proofs, and basic business address papers.

2. PAN/Aadhaar (if missing): Get PAN (NSDL/UTIITSL) and link Aadhaar-PAN (required for ITR filing).

3. Pick a business name: Keep it distinctive (run a quick trademark database query later if you’re brand is heavily).

4. Shop & Establishment registration (state-wise): Online in many metros, some states issue e-certificates instantly or within a few days. Apply within 30 days of starting.

5. Open a current account: The bank will ask for KYC + business proof (Shop Act/Udyam/GST, etc.).

6. Apply for GST (if applicable): Mandatory once you cross the thresholds; optional voluntary registration is allowed.

7. Sectoral licences (if needed)

8. Udyam Registration (MSME): Free, online, and helpful for loans, tenders, and scheme benefits. Apply only on the official site

9. Sign vendor agreements via ZoopSign Aadhaar eSign

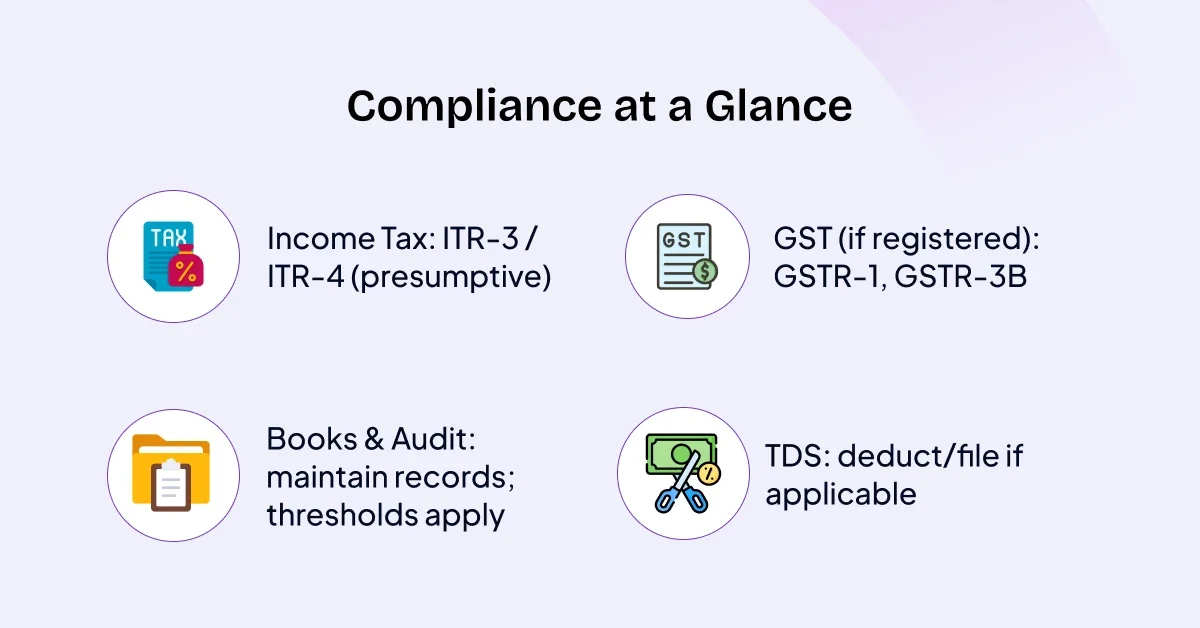

What are Compliance and Taxation Requirements 2025?

Sole proprietors file ITR-3/4 by July 31; GST if registered; audit if turnover >₹1 crore.

Submit annual income tax returns, file GST if registered, and maintain business records; minimal compliance compared to other entities.

What you must track (2025)

1. Income Tax Return (ITR):

- ITR-3 for proprietors maintaining regular books.

- ITR-4 (Sugam) if you opt for presumptive taxation (Section 44AD for businesses up to ₹3 crore, subject to ≤5% cash receipts; Section 44ADA for specified professionals up to ₹75 lakh subject to ≤5% cash receipts).

2. GST (if registered):

- Charge GST, file returns on time, and reconcile.

- Registration thresholds: ₹40 lakh (goods) via CGST Notification 10/2019; ₹20 lakh (services) continues to apply in most states (lower limits for certain special states)

- E-invoicing: mandatory if your aggregate turnover exceeds ₹5 crore in any FY since 2017-18 (B2B and exports).

3. Books & audit basics:

- Keep invoices, expense proofs, and bank trails.

- Tax audit (Sec 44AB): Required if turnover > ₹1 crore; relaxed up to ₹10 crore if cash receipts & payments each ≤5%.

4. TDS/TCS (if applicable):

- Deduct/file TDS where required (e.g., contractor payments, rent beyond thresholds) based on the Income-tax Act.

5. Other state/local compliance (if applicable):

- Professional Tax (in states like MH, KA, WB, etc..).

- Shops & Establishments renewals/changes, labour law displays, and record-keeping (varies by state).

Details You Shouldn’t Miss

1. Choosing a Business Name

Pick something distinct, easy to spell, and searchable. If you plan to scale the brand, consider running a trademark search (public search on IP India) before printing packaging/signage. You can also use a doing-business-as (DBA) style name with your bank once your Shop Act/GST shows that trade name.

2. Where & How to Register (State specifics)

Shop & Establishment (S&E): Every state/UT has its own rules, forms, and timelines. Many cities (like Mumbai) provide online S&E services and separate flows based on employee count. Most states expect you to apply within 30 days of starting. Keep your certificate safe, it’s frequently askedfor by banks, marketplaces, and landlords.

3. Udyam Registration (MSME)

Apply only on the official portal the Ministry of MSME highlights: udyamregistration.gov.in (beware of look-alike sites). It’s free, paperless, and opens access to MSME schemes, collateral-free loans, and tender participation.

4. GST - Do You Need It Right Away?

- Goods: Exempt up to ₹40 lakh turnover in most states (with specific exceptions/conditions).

- Services: Exempt up to ₹20 lakh in most states (lower for certain special states).

- Voluntary GST can make sense if you sell B2B (your clients may need input tax credit) or if marketplaces demand GSTIN for onboarding.

- e-Invoicing: If your AATO exceeds ₹5 crore in any year since 2017-18, start e-invoicing for B2B/exports

Sector-Specific Licences You Might Need

- FSSAI (food businesses): Registration up to ₹12 lakh turnover; above that, State/Central licence based on turnover/scale.

- IEC (import/export): Mandatory for cross-border trade apply at DGFT.

How ZoopSign Simplifies Sole Proprietorship Setup

Sign business agreements, vendor contracts, GST docs & employee NDAs instantly:

- Aadhaar eSign for legal validity

- zDrive storage for all docs

- Contract workflows for vendors/clients

CTA: Start your sole proprietorship with ZoopSign's free trial.

Frequently Asked Questions About Sole Proprietorship

Q: What documents are needed for sole proprietorship registration in India?

A: You’ll need:

- Identity proof: Aadhaar card, PAN card of the proprietor.

- Address proof: Utility bill, rent agreement, or property ownership document.

- Photographs: Recent passport-size photos of the proprietor.

- Business proof: Shop & Establishment licence, Udyam registration, or GST certificate (for bank account opening).

- Sectoral licences if applicable (e.g., FSSAI for food, IEC for import/export).

Q: Is registration compulsory for a sole proprietorship?

A: There’s no single central registration. But in most states, Shop & Establishment Act registration is mandatory within 30 days of starting your business. You must also get any sector-specific licences and GST registration if you cross the prescribed turnover limits.

Q: How long does it take to register a sole proprietorship?

A: To register a sole proprietorship:

- Shop & Establishment: 1–7 working days (state dependent, often online).

- Udyam (MSME): Instant online.

- GST: 3–10 working days if documentation is correct.

- Current account: 1–5 working days after submitting KYC and business proof.

Q: What are the tax rules for sole proprietorship in India? / What tax returns does a sole proprietor need to file?

A: The business income is taxed as your personal income:

- ITR-3 if you maintain books and report actual profits.

- ITR-4 if you opt for presumptive taxation under 44AD (business) or 44ADA (professionals).

- If GST-registered, you must also file periodic GST returns.

Q: Can a sole proprietorship be converted to an LLP or company later?

A: Yes. You can convert to an LLP or private limited company when you need investor funding, shared ownership, or better liability protection. Assets, licences, and GST can be migrated with proper documentation.

Q: Who can register a sole proprietorship in India?

A: Any resident Indian above 18 years with valid Aadhaar and PAN can start. Non-residents and foreign nationals have additional legal conditions and often choose LLP/company structures.

Q: Is there a government-mandated registration for sole proprietorships?

A: No single central registration exists. Your “registration” is essentially a combination of state licences (Shop Act), Udyam, and tax registrations like GST, plus sectoral approvals.

Q: Do I need a business address to register a sole proprietorship?

A: Yes. It can be your residential address or a commercial property, as long as you can provide documentary proof (utility bill + rent/ownership papers).

Q: Is GST registration mandatory for all sole proprietorships?

A: No. It’s only mandatory if:

- Annual turnover exceeds ₹40 lakh (goods) or ₹20 lakh (services) in most states.

- You sell through e-commerce platforms or operate in inter-state trade for certain goods/services.

- You may also register voluntarily for input tax credit or business credibility.

Q: What are the typical costs involved in starting a sole proprietorship?

A: The typical costs involved in starting a sole proprietorship are:

1. Government fees:

2. Shop & Establishment: ₹300–₹5,000 depending on state.

- Udyam: Free.

- GST: Free to apply.

- FSSAI (if required): ₹100 for registration; higher for licences.

3. Professional fees (optional): ₹1,000–₹5,000 for consultants to handle applications.

4. Bank charges: No registration fee, but current accounts may have monthly average balance requirements.