Transferring shares may sound like a simple exchange between two people - a seller, a buyer, and a few signatures. But in reality, it’s a bit more nuanced.

Between paperwork, timelines, and compliance requirements to meet, even a small delay can result in penalties or render the transfer invalid altogether.

Keep reading this blog to break down the share transfer process in India, understand the timelines, and the penalties for delay or non-compliance - all in simple terms.

What Is a Share Transfer and Why Is It Important for Indian Companies?

A share transfer is the process of legally handing over ownership of shares from one person (the transferor) to another (the transferee).

This can happen for various reasons - sale, gift, inheritance, or restructuring of a company’s ownership.

In simple terms, it’s how the ownership of a company changes hands, either fully or partially.

In India, the process is governed mainly by:

- Companies Act, 2013

- Companies (Share Capital and Debentures) Rules, 2014

- Articles of Association (AoA) of the company

And yes, stamp duty - that tiny but mighty legal requirement - also plays a key role here.

What Are the Main Types of Share Transfers in India?

Not all share transfers are alike. The procedure and paperwork depend on where and how the shares are held.

Transfer of Physical Shares

- Applies to companies where shares are still issued in physical certificate form.

- Though most listed companies now operate in demat form, private limited companies often still use physical transfers.

Transfer of Dematerialized (Demat) Shares

- Here, everything happens electronically through a depository like NSDL or CDSL.

- The transfer takes place via your Depository Participant (DP) - no physical paperwork, no courier delays.

- Both have their own set of procedures - let’s break them down.

How Is the Procedure for Transferring Physical Shares Carried Out?

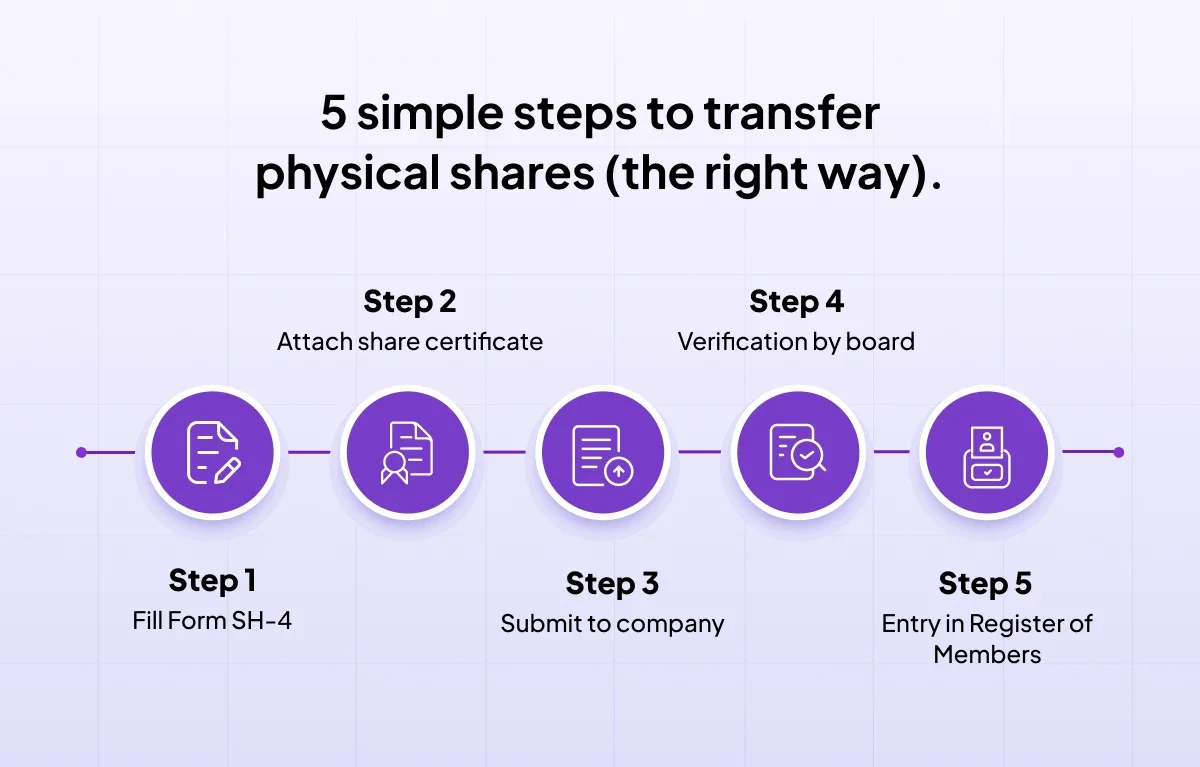

Physical transfers require an executed and stamped Form SH-4, submission with the original share certificate to the company, board approval, and updating the Register of Members.

Step 1: Obtain a Transfer Deed (Form SH-4)

This is the official instrument of transfer. Form SH-4 must be duly executed and dated by both the transferor and transferee.

It should include:

- Name, address, and occupation of both parties

- Number, class, and distinctive numbers of shares being transferred

- Folio number (if applicable)

- Consideration paid (in case of sale)

The transfer deed must be duly stamped before or at the time of signing.

Pro Tip: The stamp duty is 0.25% of the consideration amount or the market value of shares (whichever is higher). Platforms like ZoopSign make this process easier through eStamping - no physical stamp papers or delays.

Step 2: Attach the Original Share Certificate

The transfer deed must be submitted to the company along with the original share certificate(s) related to those shares.

If the certificate is lost, a duplicate must be obtained following the due procedure.

Step 3: Submission to the Company

Once executed, the transferor or transferee must send the documents to the company’s registered office within 60 days of the date of execution.

Documents include:

- Duly stamped and signed Form SH-4

- Original share certificate(s)

- Proof of identity of transferee (if required by the company)

Step 4: Verification by the Company

The company’s Board of Directors reviews the transfer request.

They ensure:

- All documents are in order

- Proper stamp duty has been paid

- The transfer complies with the company’s Articles of Association

If satisfied, the board passes a Board Resolution approving the transfer.

Step 5: Entry in the Register of Members

Once approved, the company enters the transferee’s name in the Register of Members and issues a new share certificate in their name.

And that’s it - the ownership officially changes hands!

What Is the Process for Transferring Dematerialized (Demat) Shares?

For demat shares, transfers are initiated electronically via a Depository Participant, requiring digital authentication; no physical paperwork needed.

For companies whose shares are held electronically, the process is simpler and faster:

- The Transferor initiates the transfer through their Depository Participant (DP).

- The transferee’s DP account details (Client ID, DP ID) are entered.

- The off-market transfer is authenticated using a Digital Signature or eSign.

- The depository records the transfer electronically, and the shares are reflected in the transferee’s account.

No physical paperwork. No risk of misplaced certificates.

And with ZoopSign’s integrated eSign Solutions and eStamp solutions, even legal documentation can be executed digitally - safely and securely.

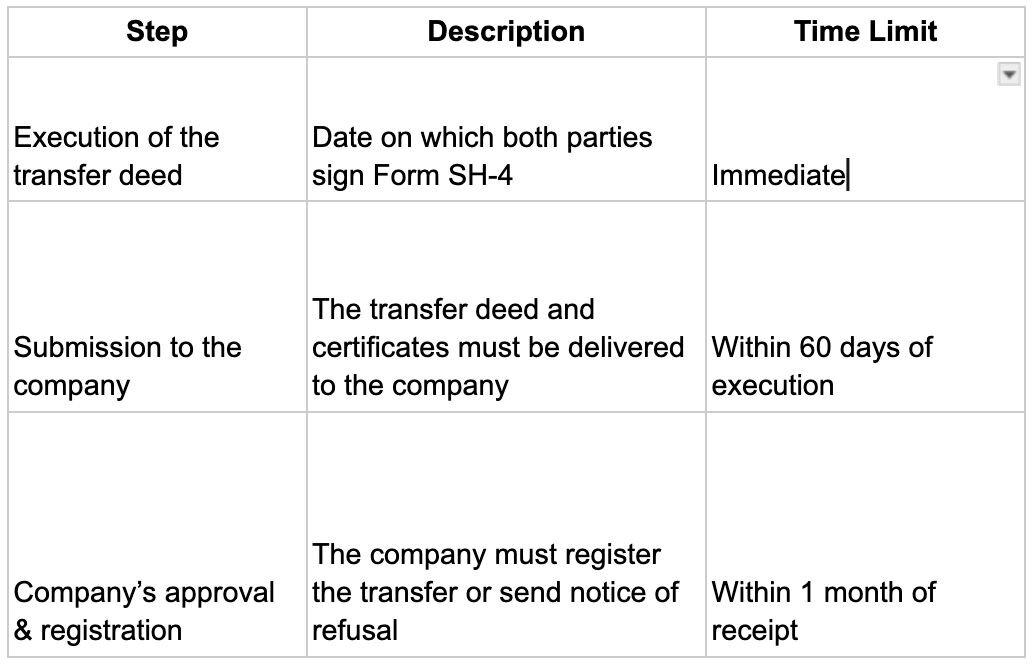

What Are the Statutory Time Limits for Share Transfer in India?

Form SH-4 must be submitted within 60 days of execution, and the company must register the transfer or refuse within 30 days of receipt, per Section 56 of the Companies Act.

Time is crucial in this process.

Here’s what the law says about timelines:

If the company fails to either register or refuse within 1 month, it’s considered a default under Section 56 of the Companies Act, 2013.

What Penalties Apply for Delay or Non-Compliance in Share Transfer?

Delays by the company or incorrect stamping can result in penalties up to ₹5,00,000 for the company and ₹1,00,000 for defaulting officers under Section 56(6).

Non-compliance with the prescribed timelines can attract penalties for both the company and the officers in default.

1. Delay in Delivering Transfer Deed: If the transfer deed isn’t delivered to the company within 60 days, the company may refuse to register the transfer.

2. Delay in Registering Transfer: If the company fails to register the transfer within 30 days of receipt (without reasonable cause), penalties apply:

- Company: ₹25,000 to ₹5,00,000

- Every officer in default: ₹10,000 to ₹1,00,000

These penalties are under Section 56(6) of the Companies Act, 2013.

3. Improper Stamping or Execution: A transfer deed that isn’t properly stamped or executed is invalid in law. The transfer can be rejected outright, or worse, challenged later in disputes.

That’s why digital stamping through verified platforms matters - it ensures every instrument is legally compliant, timestamped, and tamper-proof.

What Common Mistakes Lead to Rejection of Share Transfer Requests?

Frequent issues include missing or incorrect stamp duty, mismatched signatures, late submission, and non-compliance with AoA restrictions. Even a small oversight can lead to rejection. Some frequent causes include:

- Transfer deed not duly stamped or signed

- Mismatch in signatures or share certificate details

- Expired or undated transfer deed

- Documents submitted after 60 days

- Non-compliance with the company’s AoA restrictions

- Transfer of partly paid-up shares without Board consent

A careful review before submission saves a lot of time and back-and-forth.

How Is Digital Transformation Streamlining Share Transfers in India?

Modern platforms enable instant eStamping, eSignatures, and automated compliance trails, reducing turnaround time and making share transfers secure and audit-ready.

Until a few years ago, transferring shares meant couriering papers, physical stamps, and long approval cycles.

Today, much of that is changing.

With the rise of digital stamping (eStamp), eSign, and online share registries, the process has become more seamless.

Especially for private companies, using platforms like ZoopSign means:

- Legally valid eStamping in seconds

- Instant eSignatures by both parties

- Automated document trail for compliance

- Reduced turnaround time for execution and filing

It’s not just convenient - it’s compliant, secure, and audit-ready.

What Practical Tips Helps in Smooth and Compliant Share Transfer?

Check AoA restrictions, pay correct stamp duty, properly date documents, keep digital records, and use verified digital platforms to avoid friction or fraud.

- Always check AoA restrictions - Some private companies restrict share transfers without board approval.

- Ensure correct stamp duty - Even a minor shortfall can invalidate the deed.

- Date everything properly - Undated or post-dated transfer deeds are not accepted.

- Keep digital backups - Scanned or digitally signed copies simplify future verification.

- Use verified eStamp/eSign platforms - Prevents fraud, ensures traceability, and aligns with MCA norms.

How a Delayed Transfer Can Turn Costly

Imagine a shareholder executing a transfer deed on March 1, but submitting it to the company only on June 15.

That’s 106 days later - well beyond the 60-day limit. The company can legally refuse registration.

Even if accepted, the transfer may later be challenged, and both the transferor and company officers may face penalties.

A simple delay can derail the entire transaction - which is why digital processes (with date-stamped execution via ZoopSign) are a lifesaver.

Why Does Share Transfer Compliance Matter for Corporate Governance?

Compliant share transfers safeguard transparency, legal validity, investor protection, and corporate integrity - vital for startups and growing companies.

At its core, share transfer compliance ensures:

- Transparency in ownership

- Fair valuation and legal validity

- Investor protection

- Corporate governance integrity

In a startup ecosystem where equity changes hands frequently - founders, investors, ESOP holders - every transfer is a legal event.

Getting it right builds trust and credibility, both internally and with regulators.

Transferring shares isn’t just an exchange of paper - it’s a legal shift in ownership that must align with timelines, documentation, and statutory duties.

Missing a stamp, a date, or a submission deadline can make all the difference between a valid and void transfer.

With tools like ZoopSign, companies can now handle the entire process - from digital stamping to eSignatures - without the friction of manual paperwork. It’s compliant, secure, and future-ready.

FREQUENTLY ASKED QUESTIONS:

1. What documents are required for physical share transfer in India?

A: Form SH-4, original share certificate, proof of identity, and proper stamp duty payment are mandatory for physical transfers.

2. What is the time limit for registering share transfers under the Companies Act?

A: Share transfer documents must be submitted within 60 days, and the company must decide on registration within 30 days.

3. What happens if stamp duty is not paid on share transfer?

A: Transfers without correct stamp duty are invalid and subject to rejection or legal challenges.

4. What penalties apply for delayed or non-compliant share registration?

A: Companies may face fines from ₹25,000 to ₹5,00,000 and officers from ₹10,000 to ₹1,00,000 under Section 56(6).

5. How can digital platforms help in share transfer compliance?

A: Digital solutions enable instant eStamping, secure eSignatures, and automated document trails for compliance and audits.