If you’re someone who’s ever dealt with rent receipts, legal documents, or business transactions in India, this one’s for you.

There’s a high possibility that you’ve come in contact with a small but significant requirement of revenue stamps. Despite their modest ₹1 value, these tiny pieces of paper carry substantial legal weight and can save you from potential compliance issues.

Know more in detail about the important term called revenue stamps in India.

What is a Revenue Stamp?

A revenue stamp is a government-issued adhesive stamp that serves as proof of payment of a specific tax or fee to the government. In India, the most commonly used revenue stamp is ₹1 and is usually affixed to transactions above ₹5,000. Think of it as a small tax receipt that validates the authenticity and legality of certain financial transactions and documents.

Revenue stamps are governed by the Indian Stamp Act of 1899, a legislation that has stood the test of time and continues to regulate stamping requirements across the country. These stamps are not just ceremonial – they're a legal requirement that can make the difference between a valid and invalid document in the eyes of the law.

What are the Importance and Purpose of Revenue Stamps?

Revenue stamp India serve multiple critical purposes in India's legal and financial ecosystem:

- Legal Validation: They provide legal sanctity to documents and transactions, making them admissible in courts and legally enforceable.

- Government Revenue: They generate revenue for the government, contributing to public finances through a simple, widespread collection mechanism.

- Transaction Authentication: They serve as proof that the required stamp duty has been paid, preventing disputes about the document's validity.

- Fraud Prevention: The requirement helps maintain proper records and reduces the likelihood of fraudulent transactions.

For businesses and individuals, revenue stamps act as insurance against legal complications. A missing stamp on a crucial document could render it legally invalid, potentially costing far more than the nominal ₹1 stamp fee.

When & Where Are Revenue Stamps Required in 2025?

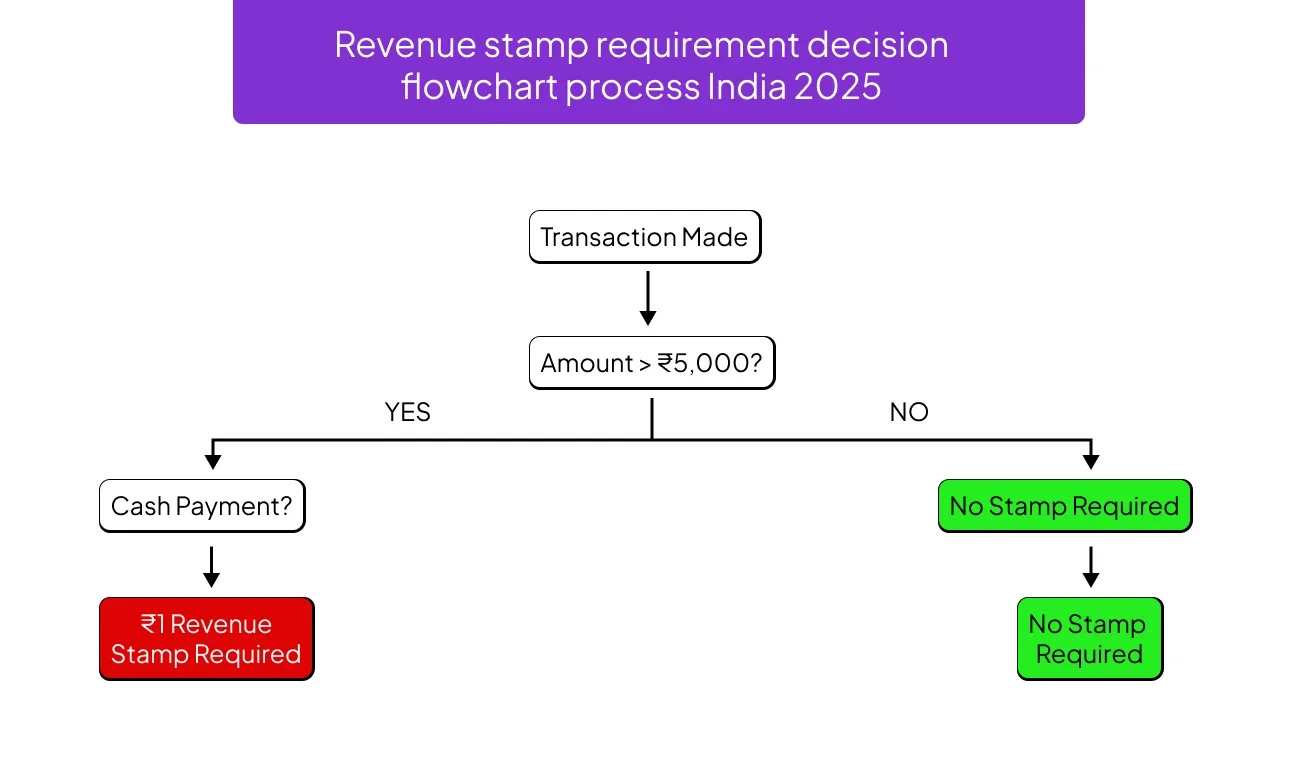

The requirement for a revenue stamp India on rent receipts depends on the payment mode: Cash Payments

For cash payments exceeding Rs.5,000, a revenue stamp is mandatory on rent receipts. However, the applications extend far beyond just rent receipts.

Revenue stamps are required in several scenarios:

- High-Value Cash Transactions: Any receipt for cash payments exceeding ₹5,000 must bear a revenue stamp.

- Rental Agreements and Receipts: Monthly rent receipts for cash payments above ₹5,000 require stamping.

- Loan Agreements: Personal loans and business lending documents often require revenue stamps.

- Employment Documents: Salary receipts, especially for high-value cash components, may need stamping.

- Business Receipts: Service providers and businesses issuing receipts for substantial cash payments.

- Legal Documents: Various legal instruments and commercial papers require stamping for validity.

The key trigger is typically the ₹5,000 threshold for cash transactions, though specific requirements can vary based on the document type and state regulations.

List of Documents That Need Revenue Stamps in India 2025

Understanding which documents require revenue stamp rules 2025 can save you from compliance headaches.

Here's a comprehensive list:

1. Rental Documents:

- Monthly rent receipts (cash payments > ₹5,000)

- House Rent Allowance (HRA) receipts for tax exemption claims

- Commercial lease receipts

2. Financial Documents:

- Personal loan receipts and acknowledgments

- Business loan documents

- Promissory notes above the specified values

- Bills of exchange

3. Employment-Related Documents:

- Salary receipts with significant cash components

- Bonus payment receipts

- Commission payment acknowledgments

4. Business Documents:

- Service receipts for professional services

- Consulting fee receipts

- Freelancer payment receipts

- Contractor payment acknowledgments

5. Legal and Commercial Papers:

- Partnership agreements (in some cases)

- Memoranda of understanding

- Various commercial contracts

The specific requirements can vary by state, as stamp duties fall under both central and state jurisdictions. It's always wise to consult current regulations or legal experts for complex transactions.

Read: How digitization & eStamping make documentation easy?

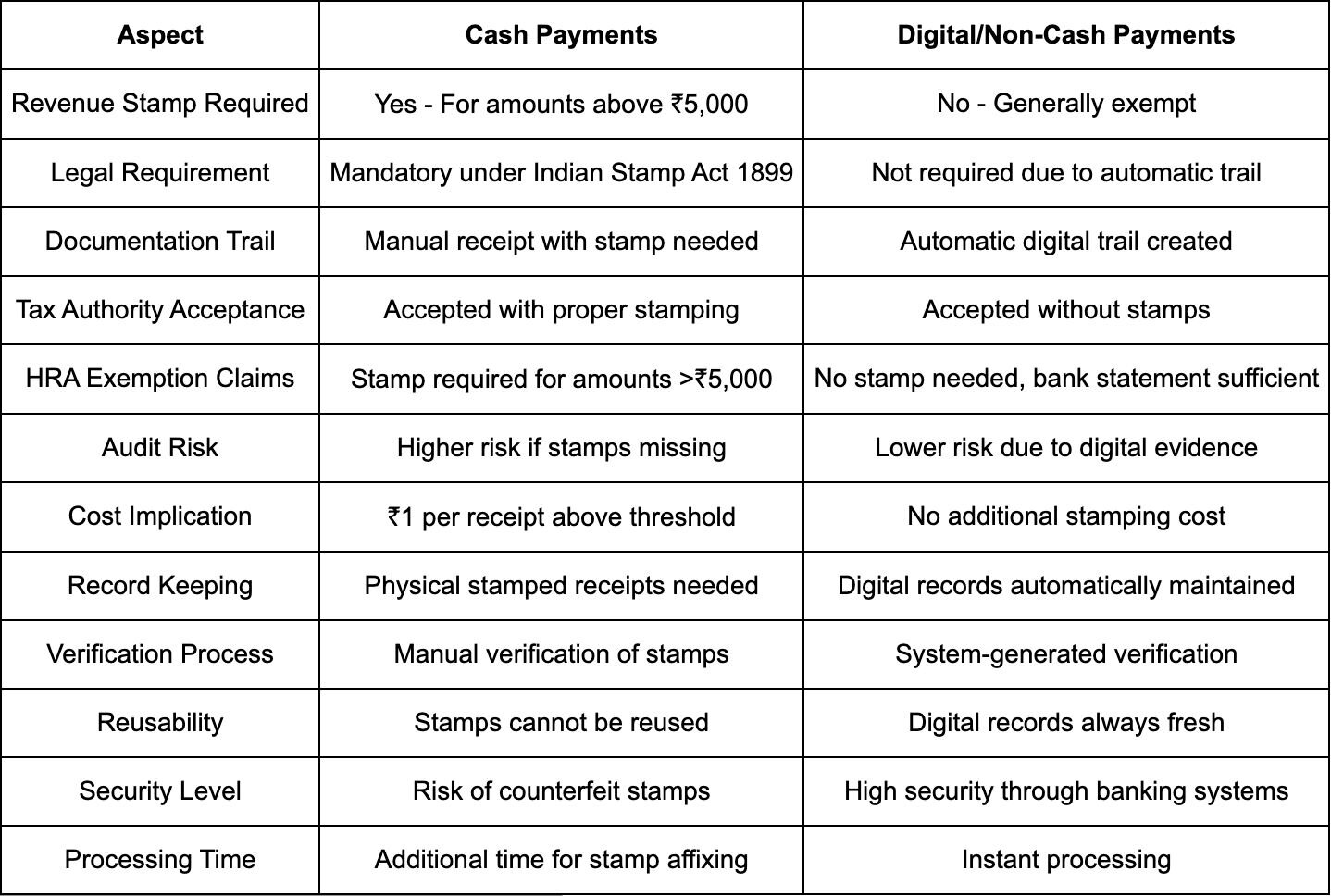

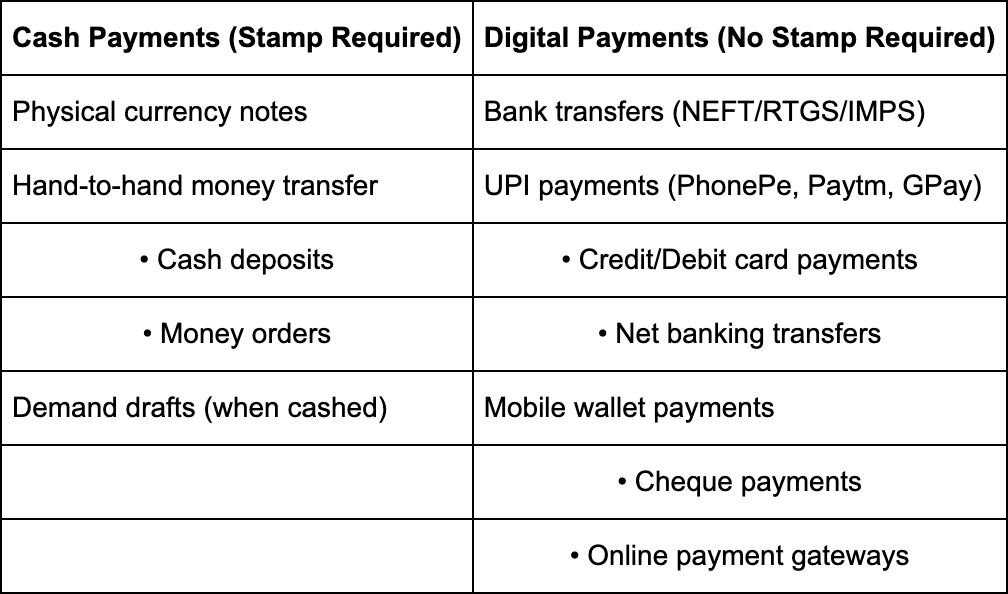

Cash Payments Vs. Digital Payments

One of the most important distinctions in revenue stamp requirements lies in the payment method. For payments made through cheque, bank transfer, or other non-cash means, revenue stamp are typically not required.

This distinction encourages digital payments and aligns with India's push toward a digital economy. For businesses and individuals, understanding this difference can help in planning payment methods strategically.

Payment Method Examples

The digital payment exemption makes sense from an administrative perspective – electronic transactions automatically create verifiable trails that serve the same purpose as revenue stamps for cash transactions.

Types of Revenue Stamps in India

Only a ₹1 revenue stamp is legally available and used in India currently. This uniformity simplifies the system significantly compared to some other countries that have multiple stamp denominations.

The simplicity of having just one type of revenue stamp makes compliance easier for businesses and individuals. You don't need to worry about calculating different stamp values – if a revenue stamp rules 2025 is required, it's always ₹1.

However, it's important to note that this refers specifically to revenue stamps. India also has various other types of stamps for different purposes, including judicial stamps and non-judicial stamps with different denominations for various legal documents.

Read: Types of Stamps: Your Guide to Digital and Physical Options

How to Buy Revenue Stamps & E-Stamps (Online & Offline)

People can buy stamps at post offices, courts, or licensed stamp vendors. As everything is digital, people can also buy them online.

1. Offline and Online Options

- Traditional Offline Sources:

- Post offices across India

- District courts and subordinate courts

- Licensed stamp vendors

- Some government offices

- Authorized stamp dealers

- Digital Alternatives:

- Online stamp purchasing platforms

- Government e-stamping portals

- Digital payment systems

- Mobile applications for stamp procurement

2. Price and Authenticity

The price of revenue stamps is standardized at ₹1, but ensuring authenticity is crucial:

- Genuine Stamps Features:

- Official government watermarks

- Specific paper quality and texture

- Proper printing and color consistency

- Serial numbers where applicable

- Avoiding Counterfeits:

- Purchase only from authorized vendors

- Verify physical characteristics

- Check for proper adhesive quality

- Ensure stamps are not pre-cancelled

Read: Judicial vs Non Judicial Stamp Papers Guide

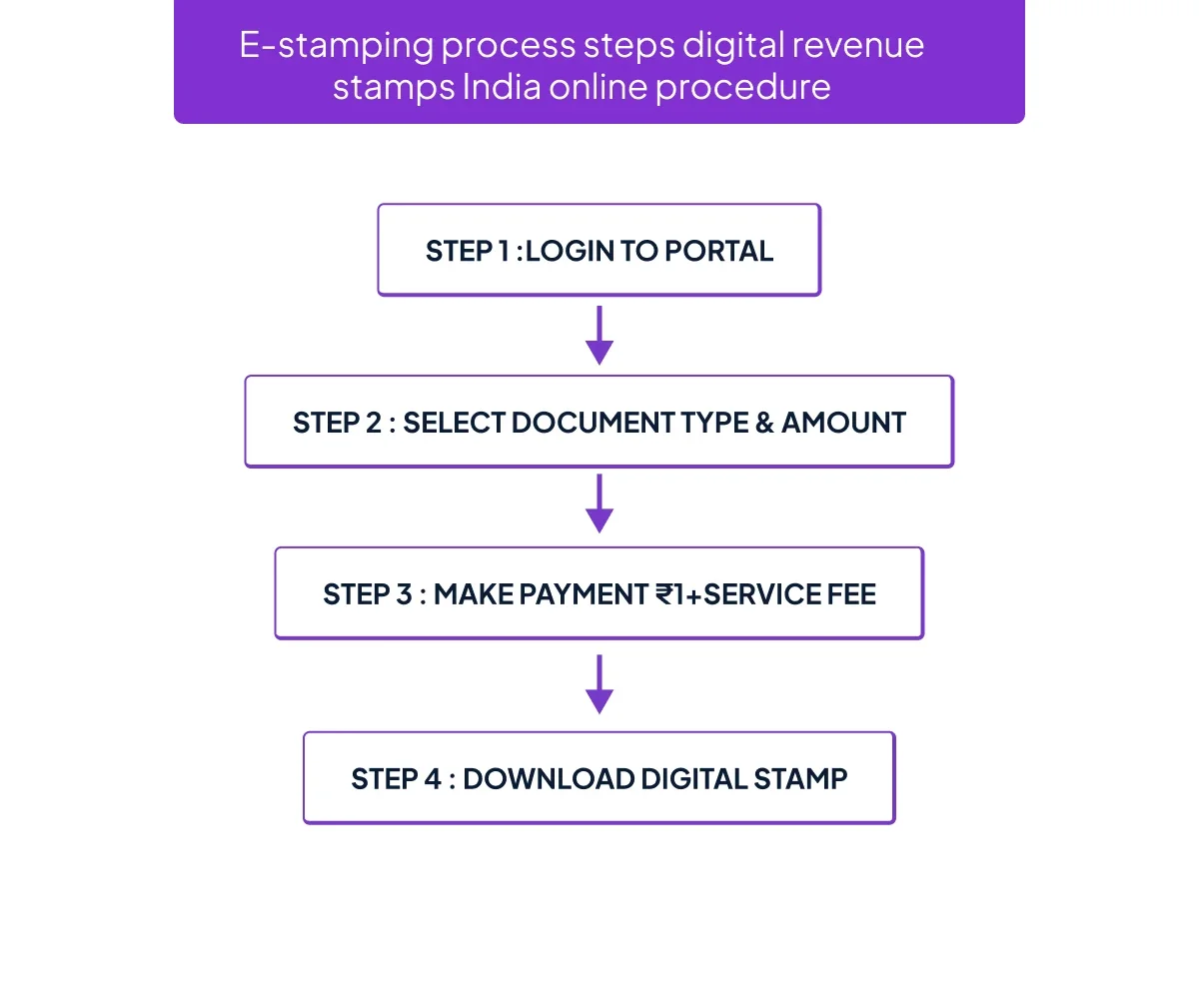

E-Stamping in India: The Digital Alternative

E-Stamping, short for electronic stamping, is a digital method of paying stamp duty for various legal documents and transactions. This modern approach is revolutionizing how India handles stamp duty requirements.

e-Stamping India is currently operational in the states of Haryana, Odisha, Gujarat, Karnataka, NCR Delhi, Maharashtra, Assam, Tamil Nadu, Rajasthan, Himachal Pradesh, Andhra Pradesh, Uttarakhand, and the union territories of Dadra & Nagar Haveli, Daman & Diu, Puducherry, Jharkhand, and Uttar Pradesh.

What are the Benefits of E-Stamping?

1. Convenience and Accessibility:

- 24/7 availability for stamp purchases

- No need to visit physical locations

- Instant generation and application

- Integration with digital document workflows

2. Security and Authentication:

- Unique transaction reference numbers (TRNs)

- Instant verification capabilities

- Reduced risk of counterfeiting

- Digital audit trails

3. Cost and Time Efficiency:

- Eliminates physical stamp wastage

- Reduces procurement time

- Lower administrative overhead

- Streamlined compliance processes

Legal Acceptance of E-Stamps

The SHCIL eStamping system is authorised by the Ministry of Finance to issue digital stamp certificates that are legally equivalent to traditional non-judicial stamp papers.

E-stamps carry the same legal weight as physical stamps, making them a viable alternative for modern businesses. They're particularly beneficial for organizations managing high volumes of stamped documents or operating in multiple states.

For companies using digital document management systems, e-stamping India integrates seamlessly with electronic workflows, eliminating the need to handle physical stamps while maintaining full legal compliance.

How Do Revenue Stamps Help in Claiming Tax Exemptions?

Revenue stamps play a crucial role in tax exemption claims, particularly for House Rent Allowance revenue stamp (HRA) exemptions. When claiming HRA benefits, the Income Tax Department requires proper documentation of rent payments.

HRA Exemption Requirements:

- Rent receipts for amounts exceeding ₹1,00,000 annually

- Revenue stamps on receipts for cash payments above ₹5,000

- Proper documentation of payment methods

- Landlord's PAN details for higher amounts

Tax Compliance Benefits:

- Validates rent payment documentation

- Provides legal backing for exemption claims

- Reduces audit risks and queries

- Demonstrates proper financial record-keeping

Record Keeping Best Practices:

- Maintain chronological receipt files

- Ensure stamps are properly affixed and not reused

- Keep digital copies of stamped receipts

- Document payment methods clearly

For salaried employees, maintaining properly stamped rent receipts can result in significant tax savings through HRA exemptions. The small investment in revenue stamps often pays for itself many times over through reduced tax liability.

Recent Updates and Policy Changes (2024-2025)

The revenue stamp landscape has seen several significant updates in recent years that businesses need to be aware of:

Latest Amendments and Changes

- Maharashtra Stamp Act Amendments 2024-2025: The Maharashtra government issued amendments in October 2024 and further changes in 2025, including increases in application fees for stamp duty adjudication from ₹100 to ₹1,000. The Maharashtra government has also extended the Stamp Duty Amnesty Scheme until June 30, 2024, providing relief for properties with incomplete stamp duty payments dating back to 1980.

- Gujarat Stamp Act Changes: Gujarat released new Jantri rates in November 2024 that were proposed 5 to 2000 times higher than the 2023 rates, causing significant reactions from citizens and real-estate stakeholders.

- Supreme Court Clarifications: Recent Supreme Court judgments in 2024 have clarified stamp duty and registration requirements, particularly for compromise decrees and revenue record mutations.

COVID-19 Impact on Revenue Stamp Requirements

The pandemic didn't significantly alter revenue stamp requirements, but it did impact compliance timelines and procedures. Most states provided extensions for document filings and allowed digital submissions where previously only physical documents were accepted. The push toward digitalization accelerated, making e-stamping more widely adopted across states.

Frequently Asked Questions

Q: Is a revenue stamp required for rent receipts over ₹5,000 in cash?

A: Yes, revenue stamps are mandatory on rent receipts for cash payments exceeding ₹5,000. This requirement helps validate the transaction for tax purposes and legal compliance. The stamp must be affixed by the recipient of the payment and cannot be reused.

Q: What is the penalty for not using a revenue stamp when required?

A: The penalty for not using required revenue stamp uses can include fines up to 10 times the stamp duty amount, though enforcement varies by jurisdiction. More importantly, unstamped documents may be deemed inadmissible in legal proceedings, potentially causing greater financial losses than the penalty itself.

Q: Can I use e-stamps instead of physical revenue stamps in 2025?

A: Yes, e-stamps are legally equivalent to physical revenue stamp uses and are accepted in most states across India. E-stamping offers greater convenience, security, and integration with digital workflows. However, availability varies by state, so check local regulations.

Q: Who is responsible for buying and affixing the revenue stamp?

A: Generally, the person receiving the payment (the payee) is responsible for purchasing and affixing the revenue stamp. For revenue stamp rent receipts, this would be the landlord. For service receipts, it would be the service provider. The stamp validates their acknowledgment of payment received.

Q: Are revenue stamps necessary for payments made by cheque or online transfer?

A: No, revenue stamps are typically not required for payments made through cheques, bank transfers, or other non-cash methods. These payment modes create automatic paper trails that serve the same documentary purpose as revenue stamps for cash transactions.

Q: Which transactions require a revenue stamp in India?

A: Revenue stamps are required for various transactions, including rent receipts above ₹5,000 in cash, certain loan acknowledgments, high-value service receipts, and specific legal documents. The requirement generally applies to cash transactions and documents that need legal validation.

Q: How do you use and affix a revenue stamp on receipts?

A: Affix the revenue stamp on the receipt document, ensuring it's properly stuck without damage. The stamp should not cover important text and must not be reused. Some practitioners recommend signing across the stamp to prevent removal and reuse, though this isn't always legally required.

Q: Are revenue stamps needed for digital rent payments?

A: No, revenue stamps are not required for digital rent payments made through bank transfers, UPI, or other electronic methods. Digital payments create inherent documentation that eliminates the need for additional validation through revenue stamps.

Q: Where to buy revenue stamps or e-stamps?

A: Genuine revenue stamps can be purchased from post offices, courts, licensed vendors, and authorized dealers. E-stamps can be obtained through government-approved online platforms like SHCIL and state-specific e-stamping portals. Always verify vendor authorization to avoid counterfeit stamps.

Q: What happens if revenue stamps are missing from receipts?

A: Missing revenue stamps can render documents legally invalid, make them inadmissible in court proceedings, and potentially result in penalties. For tax purposes, unstamped receipts might not be accepted for exemption claims, leading to higher tax liability.

Q: How do revenue stamps help in claiming tax exemptions?

A: Revenue stamps validate rent receipts and other documents used for tax exemption claims, particularly HRA exemptions. They provide legal authenticity to cash transaction documentation, reducing the risk of tax authority queries and ensuring smooth exemption processing.