For the financial lending sector, transparency and clarity aren’t just good practices, they’re essential for building trust and more.

Recognizing this need, the Reserve Bank of India (RBI) has mandated the Key Facts Statement (KFS) for all lending institutions operating in India.

But what exactly is a KFS, and why does it matter to lenders and borrowers? In this guide, we’ll break down everything you need to know about the RBI KFS Guidelines, how they impact your lending operations, and practical approaches to implementation that benefit everyone involved.

What is a Key Facts Statement (KFS)?

A Key Facts Statement (KFS) is a standardized document that provides essential details of a loan agreement in a clear, concise, and easy-to-understand format. Think of it as the “CliffsNotes” version of a loan agreement – highlighting the most important information that borrowers need to know before signing on the dotted line.

The RBI has mandated that all regulated entities engaged in lending must provide a KFS to borrowers and obtain an acknowledgment confirming that they have understood all the details in the loan agreement. This requirement applies to banks, non-banking financial companies (NBFCs), and other financial institutions that offer loans to individual borrowers.

Why Did RBI Introduce KFS Guidelines?

The introduction of KFS guidelines stems from a simple yet profound observation: loan agreements are often complex documents filled with legal jargon that can be difficult for the average borrower to understand.

This complexity can lead to:

- Misunderstandings about loan terms and conditions

- Hidden charges that surprise borrowers later

- Disputes and legal complications

- Erosion of trust in financial institutions

By standardizing the presentation of key loan information, the RBI aims to:

- Enhance transparency in lending practices

- Empower borrowers with clear information to make informed decisions

- Reduce disputes arising from misunderstandings

- Promote fair lending practices

- Create a level playing field among different lenders

Make every signature count: integrate ZoopSign’s eSign solutions to capture borrower consent on your KFS digitally, securely, and in under a minute.

What are the Key Components of a KFS Document?

According to RBI guidelines, a KFS must include the following essential information:

1. Loan Amount and Term

- The principal amount being borrowed

- The total duration of the loan

2. Interest Rate Information

- Whether the interest rate is fixed, floating, or hybrid

- The actual interest rate applicable

- For floating rates: the reference benchmark and the benchmark rate

- The Annual Percentage Rate (APR) shows all costs associated with the loan

3. Fee Structure

All fees associated with the loan, including:

- Processing fees

- Administrative fees

- Documentation charges

- Any other fees related to the loan

4. Repayment Schedule

- Detailed breakdown of the repayment process

- Installment frequency and amount

- An amortization schedule showing how each payment is divided between interest and principal

5. Prepayment Terms

- Rules regarding early repayment of the loan

- Any prepayment penalties or foreclosure charges

- Conditions under which prepayment is allowed

6. Security/Collateral Details

- Information about any security or collateral required

- Valuation of the collateral

- Conditions related to the security

7. Grievance Redressal Mechanism

- Process for addressing complaints or issues

- Contact information for raising concerns

- Expected timeline for resolution

You can skip manual data entry with ZoopSign’s document template features to auto-populate your KFS templates with loan details, fees, APRs, and schedules in one click.

Format and Presentation Requirements

The RBI is specific about how the KFS should be presented:

- Language Requirement: The KFS must be provided in the vernacular language understood by the borrower, in addition to English.

- Font Size: The font size should be minimum Arial-12 to ensure readability.

- One-Page Format: Ideally, the KFS should be a concise, one-page document that summarizes all the key information.

- Timing: The KFS must be provided at every stage of the loan processing and whenever there is a change in terms and conditions.

- Clear Structure: Information should be presented in a structured format that is easy to navigate and understand.

What are the Benefits of KFS for Borrowers and Lenders?

1. Benefits for Borrowers:

The KFS provides several significant benefits to borrowers:

- Increased Transparency: By outlining all important details of the loan agreement – interest rates, fees, and repayment details – the KFS ensures that there are no hidden charges or surprises for the borrower later.

- Informed Decision-Making: With clear information about loan terms, borrowers can make more informed decisions about whether a particular loan product is right for their needs and financial situation.

- Protection Against Hidden Costs: The requirement to disclose all fees in the KFS protects borrowers from predatory lending practices and unexpected financial burdens.

- Easier Comparison of Loan Products: The standardized format makes it easier for borrowers to compare different loan offers and choose the one that best suits their needs.

- Legal Clarity: The KFS helps borrowers understand both their obligations and their rights under the loan agreement, reducing the potential for disputes.

2. Benefits for Lenders:

While designed primarily to protect borrowers, the KFS mandate also offers several advantages to lenders:

- Enhanced Customer Trust: By providing clear and transparent information, lenders can build stronger relationships with their customers based on trust and mutual understanding.

- Reduced Disputes and Delinquencies: When borrowers fully understand their obligations, they are less likely to default on their loans or raise disputes about terms they didn’t understand.

- Streamlined Loan Process: The standardized KFS format helps streamline the loan origination process, potentially reducing the time and resources needed to process applications.

- Competitive Advantage: Lenders who embrace transparency and provide clear, comprehensive KFS documents can differentiate themselves in the market and attract more customers.

- Regulatory Compliance: By implementing KFS requirements properly, lenders can ensure compliance with RBI regulations and avoid potential penalties or regulatory actions.

Stay audit-ready with real-time insights—tap into ZoopSign’s dashboard to track KFS issuance, acknowledgments, and any outstanding tasks across your portfolio.

How to Implement KFS Compliance Process Efficiently?

For lenders looking to implement or improve their KFS compliance processes, here are some practical steps to consider:

1. Build a Centralized KFS Repository

Create a centralized repository of KFS templates for each loan product offered by your institution. This repository should include:

- Standardized templates in all relevant languages

- Updated versions reflecting any changes in loan products

- Easy access for all relevant staff members

2. Staff Training

Ensure that all customer-facing staff understand:

- The KFS mandates and guidelines

- How to explain KFS documents to borrowers

- The process for obtaining borrower acknowledgments

3. Technology Integration

Consider integrating KFS generation into your loan origination system to:

- Automatically generate customized KFS documents

- Ensure accuracy and consistency

- Track acknowledgments and compliance

4. Documentation and Record-Keeping

Maintain comprehensive records of:

- KFS documents are provided to each borrower

- Signed acknowledgments from borrowers

- Changes to KFS documents due to modifications in loan terms

5. Regular Audits and Reviews

Conduct regular audits to ensure:

- All KFS documents comply with current regulations

- Staff are following proper procedures

- Any issues are identified and addressed promptly

Connect your LOS to Zoop’s API integration and workflow automation to simplify your workflows. This will enable seamless KFS generation, instant updates, and centralized tracking.

The Common Challenges and Solutions

Implementing KFS requirements can present certain challenges. Here are some common issues and potential solutions:

1.Language Requirements

Challenge: Providing KFS in multiple vernacular languages can be resource-intensive.

Solution: Invest in translation services or technology solutions that can automatically generate KFS documents in multiple languages.

2.Timing of KFS Provision

Challenge: Ensuring the KFS is provided before loan documents are signed.

Solution: Implement a sequential process where borrowers must acknowledge the KFS before they can proceed to sign loan documents.

3.Handling Changes to Loan Terms

Challenge: Updating the KFS when loan terms change during the application process.

Solution: Use digital KFS solutions that can be quickly updated and re-sent to borrowers for acknowledgment.

4.Collecting and Storing Acknowledgments

Challenge: Efficiently collecting and storing borrower acknowledgments.

Solution: Use digital signature solutions that allow borrowers to acknowledge the KFS electronically, with automatic storage of the acknowledgment.

If you’re already looking for one, connect your loan origination system to ZoopSign’s API integration and workflow automation to auto-generate, update, and distribute KFS documents in real time.

The Future of KFS in Digital Lending in India

As digital lending continues to grow in India, we can expect the KFS requirements to evolve as well. Some potential future developments include:

- More standardized digital formats for KFS that can be easily shared and acknowledged online.

- Enhanced Disclosure Requirements: Additional information that lenders may be required to include in the KFS.

- Integration with Digital Lending Platforms: Seamless integration of KFS generation and acknowledgment into digital lending workflows.

- Data Analytics: Using KFS data to analyze trends and improve lending practices.

ZoopSign’s Solutions for RBI KFS Compliance

At ZoopSign, we understand the challenges that lenders face in implementing and maintaining compliance with RBI KFS guidelines. Our comprehensive digital solutions are designed specifically to address these challenges and streamline the KFS process from generation to acknowledgment.

1. Digital KFS Generation and Management

ZoopSign’s platform enables you to:

- Generate customized KFS documents for different loan products

- Automatically populate KFS templates with loan-specific information

- Manage versions and updates to KFS templates centrally

2. Digital Signature and Acknowledgment

ZoopSign’s electronic signature solution allows you to:

- Send KFS documents to borrowers electronically

- Collect legally valid acknowledgments digitally

- Maintain an audit trail of when and how the KFS was acknowledged

3. Seamless Integration

Our API-based approach enables:

- Integration with your existing loan origination systems

- Automated KFS generation as part of the loan application workflow

- Reduced manual intervention and error potential

4. Compliance Tracking and Reporting

Our platform provides:

- Dashboards to track KFS compliance across your loan portfolio

- Alerts for pending acknowledgments or compliance issues

- Comprehensive reporting for regulatory audits

Ready to simplify KFS end-to-end? Book a ZoopSign demo and see how our platform handles creation, eSign, compliance tracking, and more!

Conclusion

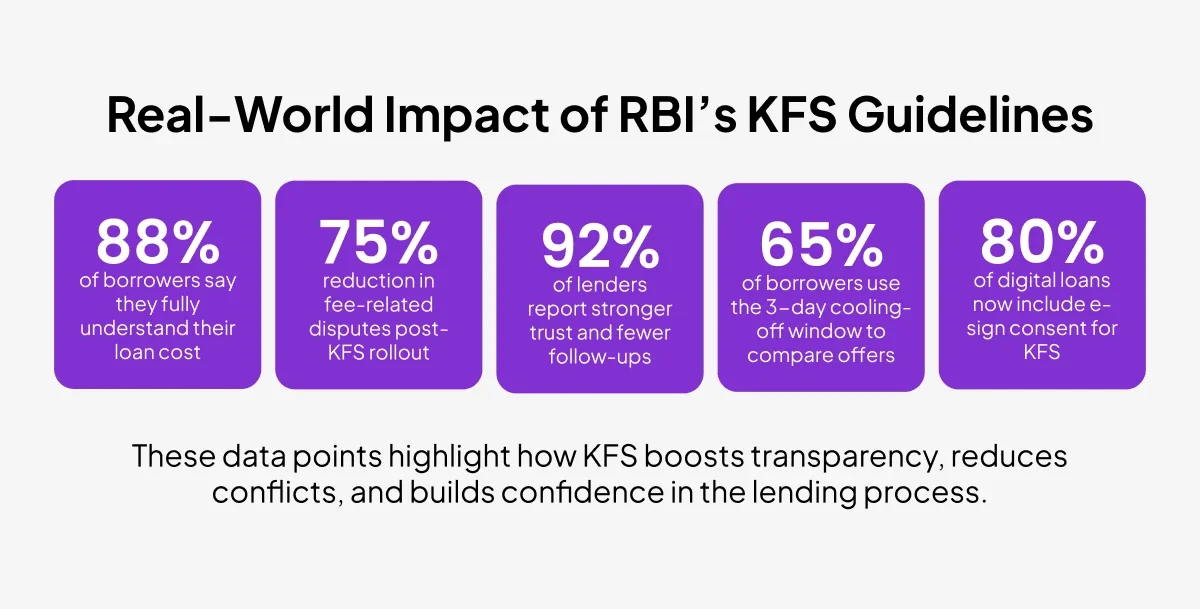

The RBI’s KFS guidelines represent an important step toward greater transparency and fairness in India’s lending ecosystem. By embracing these guidelines and implementing effective processes for KFS generation, distribution, and acknowledgment, lenders can not only ensure regulatory compliance but also build stronger, more trusting relationships with their customers.

As the lending landscape continues to evolve, staying ahead of KFS requirements will be crucial for lenders operating in India. By partnering with innovative solution providers like ZoopSign, lenders can turn compliance challenges into opportunities to differentiate themselves in the market and deliver a superior customer experience.

Remember, the KFS is more than just a regulatory requirement – it’s a tool for building trust, reducing disputes, and creating a more transparent lending environment that benefits everyone involved.