If you’re opening a demat account in India or are considering doing so, this process has undergone a complete digital transformation over the last decade.

By 2025, investors no longer need to sign physical forms, courier documents, or wait for days to activate their trading accounts. Instead, the entire process is paperless, quick, and fully compliant with SEBI regulations - thanks to Aadhaar-based eSign.

In simple terms, a Demat account can now be opened online by submitting KYC details, uploading required documents, completing identity verification, and signing digitally using Aadhaar OTP. Once verified, account credentials are issued instantly, allowing investors to begin trading the same day.

What is a Demat Account and Why Do You Need One?

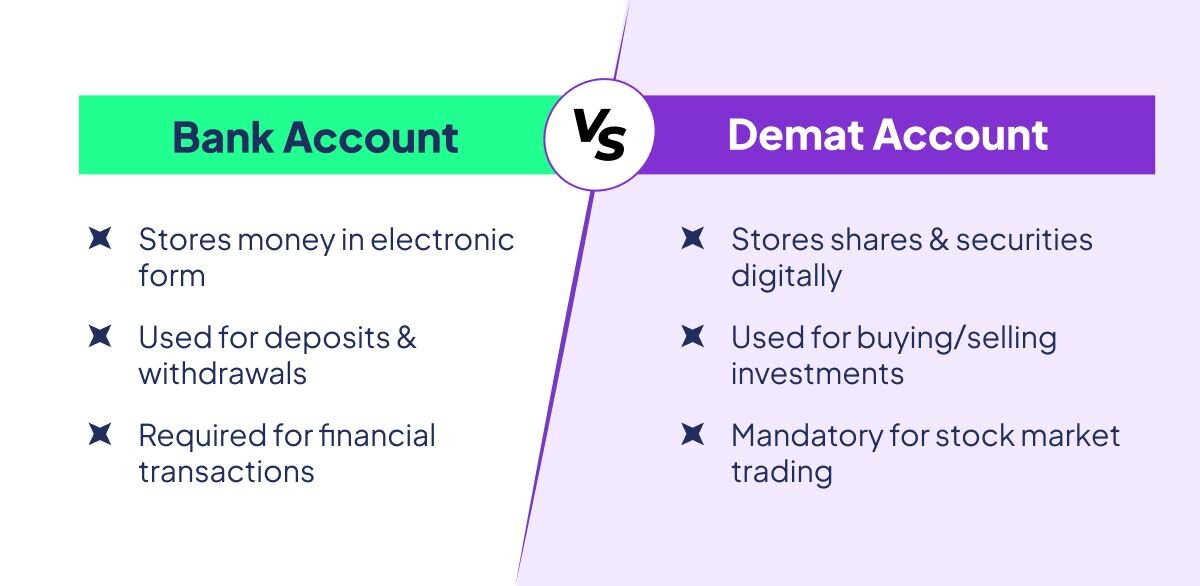

A Demat account, short for Dematerialised account, is where an investor’s shares and securities are stored in electronic form. Just like a bank account holds your money, a Demat account holds your investments, including equity shares, bonds, mutual funds, exchange-traded funds (ETFs), and government securities.

The purpose of a Demat account is to eliminate physical share certificates, which were once prone to damage, forgery, and lengthy transfer procedures. In the electronic format, securities are safe, easily transferable, and quickly accessible.

Reasons why a Demat account is essential:

- Mandatory for trading in Indian stock markets as per SEBI guidelines.

- Simplifies the buying and selling of shares without the hassles of paperwork.

- Acts as a single repository for multiple investments - stocks, bonds, and mutual funds.

- Provides security and transparency in holding and transferring assets.

Example: Suppose you buy 100 shares of Infosys through an online broker. Instead of receiving a paper certificate, these shares are credited directly to your Demat account. When you decide to sell them, the shares are debited from your account and the sale proceeds are credited to your linked bank account.

What is eSign, and How Does it work in Account Opening?

eSign is an electronic method of signing documents online using Aadhaar authentication. It eliminates the need for physical signatures, scanned copies, or couriering of forms. Instead, a user can sign in instantly by verifying identity through Aadhaar OTP.

In the context of Demat account opening, eSigning is the step where an investor digitally signs the account opening form, KYC document, and agreements with the broker or Depository Participant (DP).

Key features of eSign:

- Authentication is done using the Aadhaar number and OTP sent to the Aadhaar-linked mobile.

- Legally recognized under the Information Technology Act, 2000.

- No physical token, dongle, or hardware device is required.

- Works in real-time for instant approvals.

ZoopSign provides Electronic Signature and Aadhaar eSign solutions designed for businesses like stockbrokers and financial institutions. These integrations ensure compliance while offering a seamless onboarding experience to investors.

For more details on the Aadhaar-based method, see this blog on What is Aadhaar eSign.

How are Demat and eSign Related During Account Opening?

When an investor applies for a Demat account online, multiple documents need to be signed - including KYC forms, broker-client agreements, and consent declarations. Earlier, this required printing, signing with a pen, and sending via courier.

With eSign, the same process is reduced to a few clicks. The Aadhaar OTP-based authentication serves as a legally valid signature.

This ensures that:

- The process is paperless and much faster.

- Identity verification is completed securely.

- Brokers and DPs can comply with SEBI and the IT Act requirements.

Traditional signatures, such as scanned copies or USB-token-based digital certificates, involve cost, time, and security concerns. By contrast, Aadhaar eSign is instant and cost-effective. For a detailed comparison, read Advantages of Aadhaar eSign over Traditional Digital Signatures.

Step-by-Step Guide: Demat Account Opening with eSign in 2025

Opening a Demat account in 2025 involves the following steps:

1. Choose a SEBI-registered broker or Depository Participant (DP)

Select a trusted broker that provides both trading and Demat services. Popular choices include discount brokers, full-service brokers, and bank-affiliated DPs.

2. Fill out personal and KYC details online

Enter your name, date of birth, PAN number, Aadhaar number, and contact details in the digital application form.

3. Upload required documents

- PAN card copy.

- Aadhaar card for e-KYC.

- Bank proof, such as a cancelled cheque or bank statement.

- Passport-sized photograph.

4. Complete in-person video or selfie verification

SEBI mandates a “live verification” step to confirm the applicant’s identity. This may include recording a short video while showing Aadhaar/PAN or taking a live selfie.

5. Sign documents using Aadhaar eSign.

An OTP is sent to the Aadhaar-linked mobile. Entering this OTP digitally signs the KYC and agreements instantly.

6. Receive account credentials and start trading.

Once verified, your Demat account number and trading login are shared, often within a few hours.

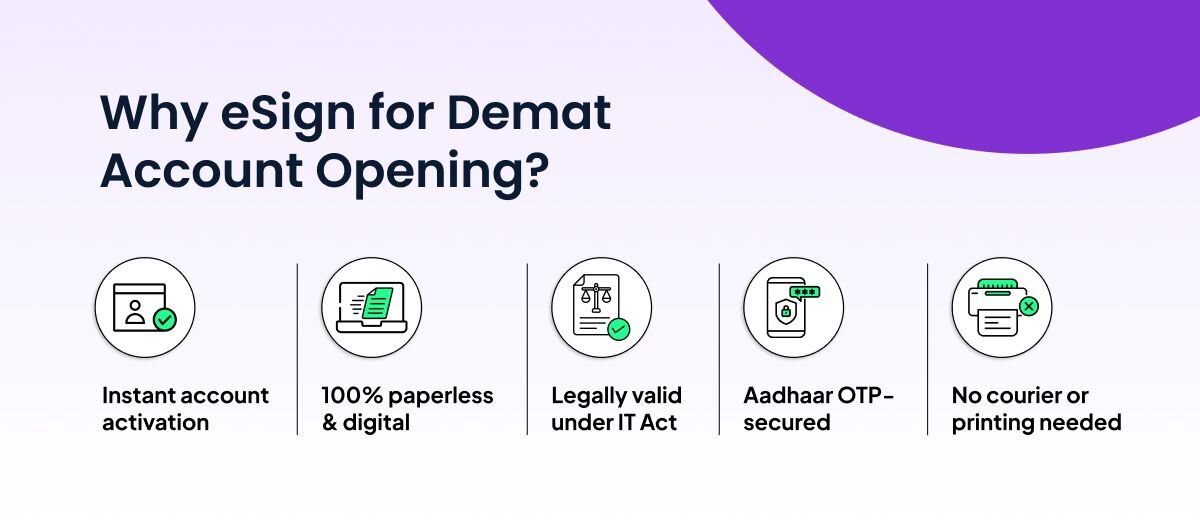

What Are the Benefits of eSign for Demat Account Opening?

Using eSign for Demat account opening provides significant advantages over traditional methods:

- Speed: The Entire process can be completed within hours instead of days.

- Legality: eSign is recognized by SEBI, NSDL, CDSL, and Indian law.

- Security: Aadhaar OTP ensures two-factor authentication and prevents misuse.

- Convenience: No need for printing, couriering, or visiting the broker’s office.

- Cost savings: Eliminates courier, printing, and physical storage expenses.

- Sustainability: 100% paperless, reducing environmental impact.

For brokers, it also means faster client onboarding and reduced drop-offs during the registration process.

Which Documents Are Needed for Opening a Demat Account Online?

The required documents for opening a Demat account digitally are:

- PAN Card.

- Aadhaar Card (mandatory for e-KYC and eSign).

- Passport-sized photograph.

- Bank proof, such as a cancelled cheque or a recent bank statement.

- Scanned signature on plain paper.

These documents ensure compliance with KYC norms and financial regulations.

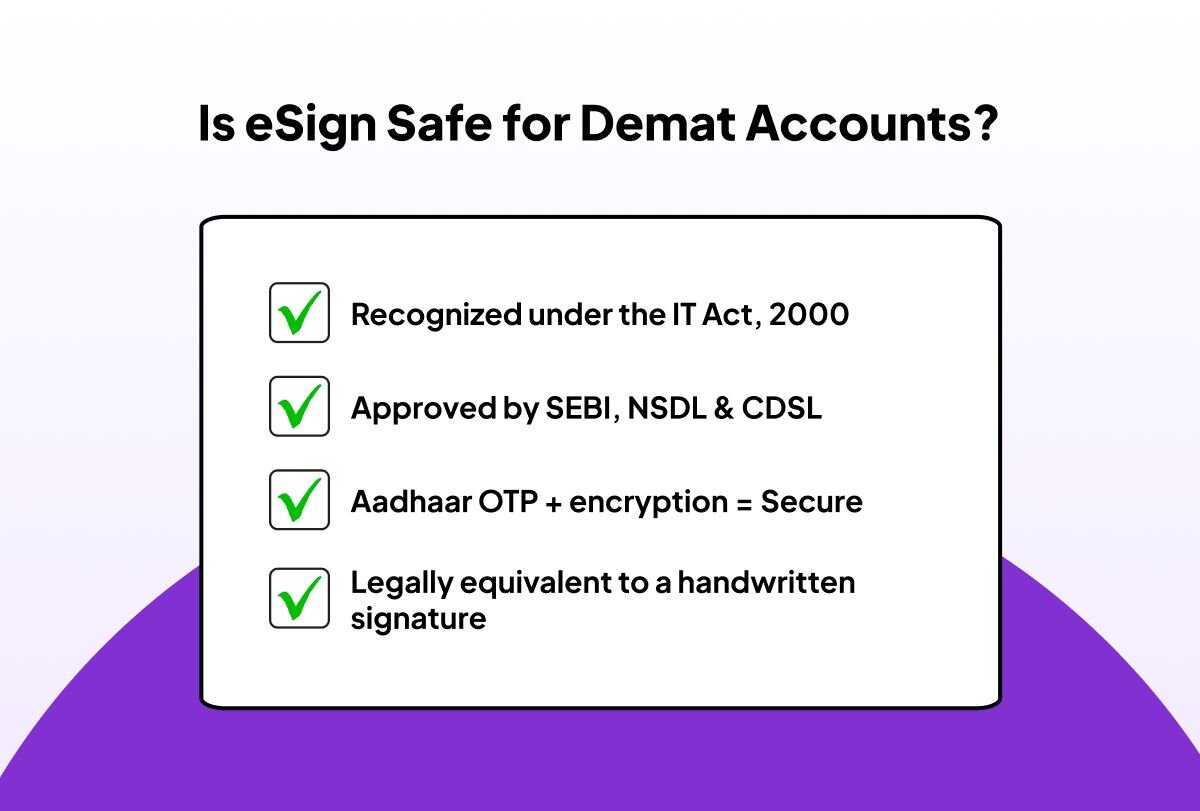

How Safe and Legal is eSign for Demat Accounts?

Aadhaar eSign is fully secure and legally valid in India.

- It is authorized under the Information Technology Act, 2000.

- Accepted by SEBI, NSDL, and CDSL for account openings.

- Uses encrypted data transfer and Aadhaar OTP verification.

- Legally equivalent to a handwritten signature.

This ensures that documents signed using eSign are admissible in courts and binding under Indian law.

Common Issues and Solutions During eSign Demat Account Opening

While the process is smooth, some applicants face issues such as:

- Aadhaar-mobile link not active: Without linking Aadhaar to your mobile, OTP cannot be received. The solution is to update details on the UIDAI portal before retrying.

- PAN verification pending: Sometimes, PAN and Aadhaar details do not match due to name spelling errors. Updating KYC records resolves this.

- Bank proof rejected: The uploaded cheque or statement may be blurry, outdated, or password-protected. A clear, recent image without restrictions is required.

Brokers usually provide real-time notifications to help applicants correct such issues quickly.

By 2025, opening a Demat account will have become one of the easiest steps for any aspiring investor. With Aadhaar eSign, the process is paperless, quick, and fully secure. Instead of days of paperwork, approvals now take only a few hours.

For investors, this means faster access to markets and fewer hassles. For brokers and financial institutions, it reduces costs and ensures compliance.

Businesses that want to integrate seamless onboarding can explore Aadhaar eSign and Electronic Signature solutions, which are trusted by enterprises for their security, compliance, and ease of use.

Opening a Demat account is no longer about paperwork; it is about digital convenience. With eSign, the future of investing is here - faster, safer, and smarter.

Frequently Asked Questions about Demat Account

Q: Can I open a Demat account fully online with just eSign?

Yes. Most brokers in India now support fully digital account opening through Aadhaar eSign without the need for any physical paperwork.

Q: Is it necessary for my Aadhaar and mobile to be linked for eSign?

Yes. Aadhaar OTP authentication works only if your Aadhaar is linked with your mobile number. Without this, eSign cannot be completed.

Q: Are all brokers in India offering Aadhaar eSign for Demat account opening?

Most leading brokers and banks have adopted Aadhaar eSign, but availability may vary. It is best to check with your chosen broker before applying.

Q: What if my documents do not match during online verification?

You will need to update your PAN or Aadhaar records to ensure consistency or provide additional supporting documents as requested by the broker.

Q: How long does it take to open a Demat account with eSign?

If all documents are in order, the process can be completed within a few hours, and in many cases, the account is activated instantly.