So you've just made your final loan payment – congratulations! But here's the thing: your loan journey isn't quite over yet. You need to get your hands on something called a No Objection Certificate or NOC. Think of it as your official "debt-free" certificate from your lender.

This NOC document is basically your lender saying, "Yes, this person has paid us back completely, and we have no objections to them being debt-free." It's like getting a clean chit that protects you legally and helps boost your credit score for future loans.

What Is a No Objection Certificate (NOC) After a Loan?

A No Objection Certificate (NOC) is an official document from your lender confirming you've paid off your loan completely with no outstanding dues. It's your legal proof of being debt-free and protects you from future claims by the lending institution.

Now, let's break this down further. A NOC is essentially your lender's way of giving you a clean slate. When you finish paying your personal loan, home loan, or any other credit, this document officially closes that chapter. It's like getting a "mission accomplished" certificate that you can use whenever someone asks about your loan history.

What Does NOC Stand For in Banking?

NOC stands for "No Objection Certificate." In simple terms, it's your lender saying they have no objection to your loan being marked as fully paid and closed. Some people also call it a "No Dues Certificate" both mean the same thing.

Here's what makes this NOC document so important: it's the only official proof you have that your loan is completely finished. Without it, technically speaking, your loan might still show as active in various systems, even though you've paid everything off.

When Is a No Objection Certificate Issued by Lenders?

Your lender will issue a NOC for loan closure in these situations:

- Complete loan repayment: When you've paid off your personal loan, home loan, or car loan entirely

- Property sales: If you're selling property that was mortgaged to the bank

- Credit clearance: After settling credit card outstanding balances

- Collateral release: When you need your security deposits or assets back

Most banks process your NOC within 30-45 days after loan closure, though this can vary. Some modern banks like IDFC First Bank now offer instant digital NOC downloads through their online banking platforms.

Why Is an NOC Important After Loan Repayment?

An NOC is essential after loan repayment as it provides legal proof that you've cleared all dues and protects you from future claims by the lender. It ensures your credit report shows the loan as "closed" rather than "settled," which positively impacts your credit score and future loan eligibility.

For secured loans, the NOC releases the lien on your property or vehicle, allowing you to freely sell or transfer ownership. Without an NOC, you remain technically liable to the lender despite full repayment, which can create complications in future financial transactions and legal matters.

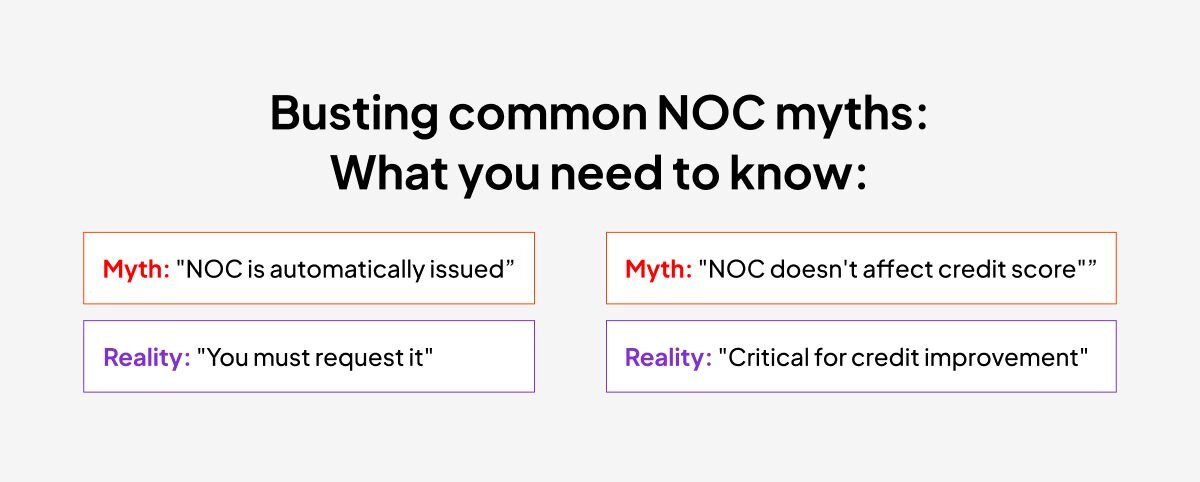

How Does an NOC Impact Your Credit Score?

An NOC directly improves your credit score by ensuring your loan appears as "closed" rather than "settled" on credit reports. This distinction helps you qualify for better interest rates and higher credit limits on future loans while demonstrating responsible financial behavior to lenders.

Here's why this matters for your NOC credit score impact:

- Credit Report Accuracy: Your NOC ensures that credit bureaus mark your loan as properly "closed." If you don't have this document, your loan might show as "settled" or even still active, which can hurt your credit score significantly.

- Future Credit Applications: When you apply for new loans, lenders check your credit history. An NOC serves as solid proof that you're a reliable borrower who pays back loans completely. This makes lenders more confident about approving your applications.

- Dispute Resolution: Got issues with your credit report? Your NOC is your best friend here. It's the official document you can use to fix any errors or discrepancies with credit bureaus.

- Better Financial Standing: For secured loans like home loans, your NOC releases the lien on your property, which improves your overall financial profile.

Why Do Banks and Lenders Require an NOC?

Banks and lenders require NOCs for several regulatory and operational reasons:

- Legal Compliance: Financial institutions must maintain proper documentation for loan closures to comply with banking regulations and audit requirements.

- Risk Management: NOCs help banks maintain accurate records of their loan portfolio and reduce operational risks associated with incomplete loan closures.

- Customer Protection: The NOC system protects borrowers from potential future claims or disputes regarding loan repayment status.

- Regulatory Reporting: Banks are required to report loan closure statistics to regulatory bodies, and NOCs serve as supporting documentation for these reports.

What Are the Key Benefits of Getting an NOC?

Getting an NOC offers multiple benefits, including improved credit score as it reflects proper loan closure on your credit report, making you eligible for better interest rates on future loans. It provides complete legal protection against any future claims from the lender and serves as definitive proof of debt clearance.

For secured loans, an NOC releases liens on your property or vehicle, enabling smooth sales or transfers without legal complications. Additionally, it's essential for various administrative processes like property registration, insurance claims, and background verifications for employment or visa applications.

How Can an NOC Help in Future Transactions or Property Sales?

The benefits of obtaining an NOC extend far beyond loan closure confirmation:

- Property Transactions: For secured loans like home loans, the NOC is essential for property sales. It proves that the property is free from any lien or encumbrance, enabling smooth property transfers. Without an NOC, you cannot legally sell or transfer property that was previously mortgaged.

- For digital NOCs, solutions like Aadhaar-based eSign for digital loan documents provide secure, legally compliant methods for document authentication. Additionally, electronic signatures in real estate transactions offer similar benefits for property-related NOCs.

- Credit Enhancement: Having NOCs for all closed loans significantly improves your credit profile, making you eligible for better interest rates and higher credit limits on future loans.

- Legal Protection: An NOC protects you from potential future claims by the lender regarding the loan. It serves as definitive proof that all obligations have been met and prevents any harassment or legal action.

- Insurance Benefits: For vehicle loans, an NOC allows you to transfer insurance policies and reduces premium costs as the vehicle is no longer considered encumbered.

What Legal Protections Does an NOC Offer?

NOCs provide several layers of legal protection:

- Dispute Prevention: The document serves as irrefutable evidence of loan closure, preventing any future disputes about payment status.

- Asset Protection: For secured loans, NOCs ensure that your assets (property, vehicles, etc.) are legally free from any claims by the lending institution.

- Inheritance Rights: NOCs are crucial for estate planning, as they confirm that inherited assets are free from any loan obligations.

- Business Transactions: For business loans, NOCs are essential for company acquisitions, mergers, or when seeking new investors, as they prove the company's debt-free status.

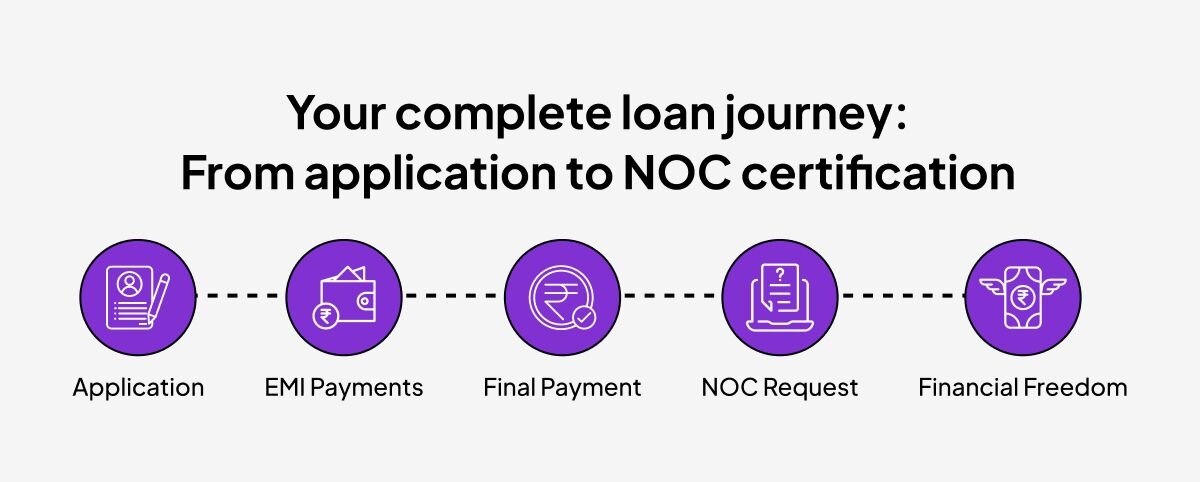

What is the Process to Obtain an NOC After Loan Closure?

To obtain an NOC after loan closure, first ensure all EMIs and charges are fully paid, then visit your bank branch or apply online with the required documents, including the loan closure receipt, identity proof, and the original loan agreement. Submit the completed NOC application form along with any applicable processing fees to the bank for verification. The bank will process your request within 15-30 days after verifying your loan account status and payment history. Once approved, you can collect the NOC from the branch or download it from the bank's online portal, ensuring all details are accurate before using it for future transactions.

What Documents Are Needed to Request an NOC?

To obtain an NOC, you'll typically need to provide:

1. Primary Documents:

- Loan closure receipt or final payment confirmation

- Original loan agreement

- Identity proof (Aadhaar card, PAN card, passport)

- Address proof (utility bills, rental agreement)

2. Supporting Documents:

- Bank statements showing the final payment

- Previous correspondence with the lender

- Property documents (for secured loans)

- Any collateral release documents

3. Additional Requirements:

- Duly filled NOC application form

- Processing fee payment receipt (if applicable)

- Authorized signatory details (for business loans)

What Is the Step-by-Step Process to Apply for a Loan NOC?

The NOC application process involves several steps:

Step 1: Final Payment Verification

- Ensure all EMIs and charges are paid

- Obtain payment confirmation from the bank

- Clear any pending fees or charges

Step 2: Application Submission

- Visit the bank branch or apply online

- Submit a completed application form with the required documents

- Pay the applicable processing fees

Step 3: Verification Process

- The bank verifies your loan account status

- Cross-checks payment history and outstanding dues

- Reviews collateral release requirements (if applicable)

Step 4: NOC Generation

- Bank processes your request (typically 15-30 days)

- NOC is generated and verified by authorized personnel

- The document is either sent by post or made available for collection

Step 5: Document Collection

- Collect NOC from the branch or download from the online portal

- Verify all details mentioned in the NOC

- Keep multiple copies for your records

Modern banks like IDFC First Bank now offer digital NOC services where you can navigate to the 'Statements' tab under 'Closed Loans' and locate and download the No Objection Certificate (NOC) directly from their online banking portal.

What Are Best Practices for Managing and Storing NOCs Digitally?

- Digital Documentation: Leverage digitization and eStamping for easy documentation to ensure secure, tamper-proof NOCs that are easily accessible and verifiable.

- Systematic Storage: Implement proper contract lifecycle management essentials to organize and maintain all NOCs systematically.

- Regular Verification: Periodically verify the authenticity of your NOCs and ensure they remain valid for legal and financial purposes.

- Modern Solutions: Consider using modern eStamp solutions for enhanced security and legal compliance.

In Which Other Situations Apart from Loans Is an NOC Required?

Beyond loans, NOCs are required for property transfers when selling mortgaged assets, employment changes where current employers issue NOCs for joining competitors, and educational transfers between institutions or for studying abroad. They're essential for visa applications, government travel approvals, and vehicle transfers to remove hypothecation from documents.

NOCs are also needed for construction permits, building approvals, environmental clearances, and utility connections for new projects. Additionally, they're required for business ventures, freelance work permissions, scholarship applications, and various administrative processes that require proof of no outstanding obligations with previous institutions or authorities.

1. Property Transfers

NOCs are essential for various property-related transactions:

- Sale of Property: Required when selling property that was previously mortgaged

- Property Registration: Needed for registering property transfers with local authorities

- Construction Approvals: Required for obtaining building permits on mortgaged property

- Rental Agreements: Some landlords require NOCs for high-value rental properties

2. Employment

Professional NOCs serve important workplace functions:

- Job Changes: Current employers may issue NOCs for employees joining competitors

- Freelance Work: NOCs allow employees to take up additional consulting work

- Higher Education: Employers may issue NOCs for employees pursuing further studies

- Business Ventures: NOCs permit employees to start their businesses (subject to company policy)

3. Education

Educational institutions often require NOCs for:

- College Transfers: Students transferring between institutions

- Scholarship Applications: Proof of no outstanding dues to the current institution

- Course Changes: Switching between different courses or departments

- International Education: Required for students applying to foreign universities

4. Travel/Visas

NOCs facilitate various travel-related processes:

- Visa Applications: Some countries require NOCs from employers or educational institutions

- Government Travel: Required for government employees traveling abroad

- Student Visas: Educational institutions issue NOCs for students studying abroad

- Business Travel: Companies issue NOCs for employees on extended business trips

5. Vehicle Transfer

Automotive NOCs are crucial for:

- Vehicle Sales: Essential when selling vehicles with outstanding loans

- Insurance Claims: Required for processing vehicle insurance claims

- Registration Transfer: Needed for transferring vehicle ownership

- Hypothecation Removal: Required to remove bank hypothecation from vehicle documents

6. Constructions and Renovations

Construction-related NOCs include:

- Building Permits: Required from local authorities for construction approvals

- Environmental Clearance: Needed for projects with environmental impact

- Neighbor Consent: NOCs from adjacent property owners for certain constructions

- Utility Connections: Required for new electricity, water, or gas connections

What Makes an NOC Legally Binding?

The legal validity of an NOC depends on several critical factors:

- Proper Authorization: The NOC must be issued by an authorized representative of the lending institution, typically signed by branch managers or designated officials with proper authority.

- Complete Information: A legally binding NOC should contain comprehensive details, including borrower information, loan account details, repayment confirmation, anda clear statement of no outstanding dues.

- Official Documentation: The document must be printed on official letterhead, contain proper stamps/seals, and follow the institution's standard format for legal documents.

- Digital Signatures: Digital and other electronic signatures are legally binding. The ESIGN Act gives these forms of signatures the same weight as handwritten signatures, meaning documents signed with these signatures are legally binding. Modern NOCs can be digitally signed and remain legally valid.

- Audit Trail: An e-signature is only legally binding if it includes an audit trail, noting details like when the signing event took place and who initiated it. This ensures the document's authenticity and prevents tampering.

- Compliance with Regulations: The NOC must comply with banking regulations, consumer protection laws, and local legal requirements to maintain its legal standing.

What Are Common NOC Issues and How Can You Resolve Them?

Common NOC issues include delayed processing, incorrect information, and lost documents, which can be addressed through regular follow-ups, immediate error reporting, and requesting duplicates from the bank. Digital signature problems require using verified electronic platforms and staying updated with legal compliance requirements.

For serious disputes where lenders refuse to issue NOCs despite full payment, escalate to senior bank officials or file complaints with the banking ombudsman while maintaining all payment records as evidence.

Common NOC Issues and Solutions

1. Delayed Processing

- Problem: Banks are taking longer than promised to issue NOCs

- Solution: Follow up regularly with relationship managers, escalate to higher authorities if necessary, and maintain proper documentation of all communications

2. Incorrect Information

- Problem: NOCs containing wrong loan details, names, or amounts

- Solution: Immediately notify the bank, provide correct information with supporting documents, and request reissuance of the corrected NOC

3. Lost or Damaged NOCs

- Problem: Physical NOCs getting lost or damaged over time

- Solution: Request duplicate NOCs from the bank, maintain digital copies, and consider storing documents in secure cloud storage

4. Digital Signature Issues

- Problem: Technical problems with electronically signed NOCs

- Solution: Utilize modern electronic signature verification guide resources and ensure proper PKI and secure digital signatures implementation

5. Compliance Concerns

- Problem: Questions about NOC validity under changing regulations

- Solution: Stay updated with the IT Act Amendment and digital signatures changes, and ensure compliance with current legal requirements

FREQUENTLY ASKED QUESTIONS:

Q: What is the full form of NOC in banking?

A: NOC stands for "No Objection Certificate" in banking. It's a legal document that confirms loan closure and is also known as "No Dues Certificate" in some contexts.

Q: Why is collecting an NOC after loan settlement essential?

A: Collecting an NOC after loan settlement is essential because it provides legal proof of loan closure, protects against future claims by lenders, and is crucial for credit score improvement and future loan applications.

Q: How does an NOC impact my credit score?

A: An NOC positively impacts your credit score by ensuring your loan shows as "closed" rather than "settled" on credit reports, improving your creditworthiness for future loan applications, and helping resolve any credit report discrepancies.

Q: What information does a typical NOC for a loan contain?

A: Typical NOC for a loan contain following:

- Borrower's personal and contact information

- Loan account number and original loan amount

- Confirmation of full payment and no outstanding dues

- Date of loan closure and NOC issuance

Q: What should I do if I lose my NOC?

A: If you lose your NOC, immediately contact your lender to request a duplicate, provide necessary identification and loan details, pay applicable duplicate issuance fees, and consider maintaining digital copies for future reference.

Q: Why might an NOC not be issued automatically after loan closure?

A: An NOC might not be issued automatically because some banks require an explicit request from borrowers, there may be pending documentation or verification processes, outstanding charges or fees not yet cleared, or administrative delays in the bank's internal processes.

Q: What should be done if the lender refuses to issue an NOC despite fulfilling all obligations?

A: If the lender refuses to issue an NOC despite fulfilling all obligations, escalate the matter to senior bank officials, file a complaint with the banking ombudsman, seek legal advice if necessary, and maintain all payment records and correspondence as evidence.

Q: What happens if an NOC is lost?

A: If an NOC is lost, you need to request a duplicate NOC from the original lender, provide proof of identity and loan account details, pay duplicate issuance fees typically ranging from ₹100-500, and keep multiple copies, both physical and digital, once received.

Q: Can an NOC be obtained online or digitally?

A: Yes, an NOC can be obtained online or digitally. Many banks now offer digital NOC services available through online banking portals and mobile apps, and digitally signed NOCs are legally valid and secure.

Consider using how to electronically sign and send Word documents for additional document management needs