A Letter of Sanction is your lender’s formal "yes" to your loan, but it’s not cash in your account yet. Think of it as a pre-approval slip with fine print that can make or break your loan terms.

Why it matters for your loan journey:

- Home loans, personal loans, business loans: This document is your golden ticket across credit types.

- Power to negotiate: Spot a better interest rate? Use this letter to bargain or switch lenders.

- Avoid nasty surprises: Skip reading the terms, and you might face hidden fees or revoked approval.

But here’s the catch - this ‘approval’ isn’t what you think. Let’s decode what a sanction letter really means (and why banks love calling it ‘conditional’)

What Is a Letter of Sanction?

A Letter of Sanction is a lender's official document confirming your loan eligibility, detailing the approved amount, interest rate, and terms - but it's not final approval. It's a ‘conditional’ green light, meaning the bank can still withdraw the offer if your documents fail final checks. While it sounds definitive, the meaning of ‘Sanction Letter’ shifts across contexts.

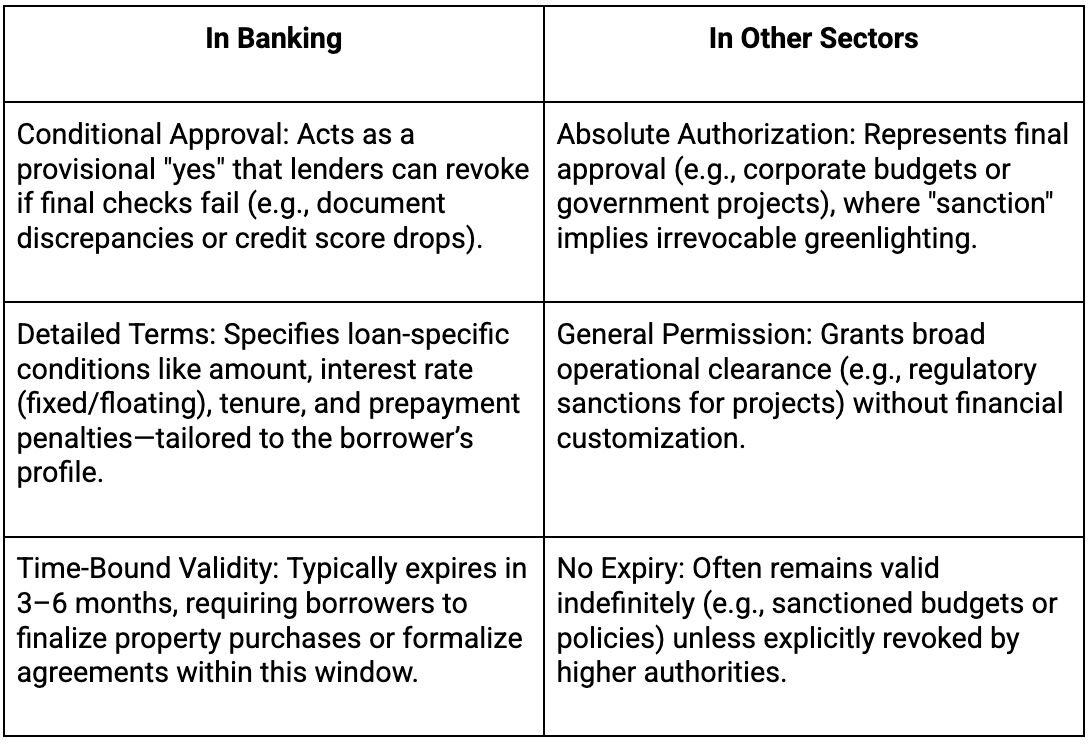

Here's how its usage differs in banking and other sectors:

Understanding these distinctions is just the first step. What truly matters are the specific terms contained in your loan sanction letter. Each element directly impacts your financial commitments and rights as a borrower.

What Does a Home Loan Sanction Letter Include?

Getting your loan approved is just half the battle - the real test comes when you open that sanction letter. This isn't just a formality. It's where lenders hide all the important (and sometimes painful) details about your loan.

Before you celebrate that approval, make sure you check these crucial details:

- Borrower & lender details: Full names, addresses, and contact information of both parties.

- Loan amount approved: The exact sum you’re eligible to borrow.

- Interest rate type & percentage: Fixed or floating rate, plus the exact percentage (e.g., 8.5% floating).

- Loan tenure: Repayment period (e.g., 15 years).

- EMI schedule: Monthly payment amount and due dates.

- Validity period: Typically 3–6 months to accept terms before expiry.

- Terms & conditions: Processing fees, prepayment penalties, late charges, and insurance requirements.

- Special requirements: Property documents or collateral needed before disbursement.

Now that you know what’s inside this letter, here’s the real question: why should you care? Because that piece of paper is your golden ticket to better deals, faster approvals, and financial peace of mind.

Why Is a Sanction Letter Important?

In the world of home loans and property deals, a sanction letter quietly holds more power than most borrowers realize. While it might arrive as just another document in your approval process, its true value reveals itself in subtle but crucial ways throughout your financial journey.

This document becomes your:

- Financial passport that validates your credibility to sellers and developers.

- Bargaining chip when negotiating property prices or loan terms elsewhere.

- Mandatory checkpoint without which most real estate transactions can't advance.

- Budget blueprint that helps you simulate future finances with real numbers.

- Bridge to disbursement that moves you closer to actual funds in hand.

Obtaining your home loan sanction letter acts as the bridge between loan approval and fund disbursement. This journey involves several milestones - from initial documentation to final acceptance.

Let's walk you through the steps.

How to Get a Loan Sanction Letter?

Securing your sanction letter for a home loan is a systematic process, and lenders follow these steps to verify your eligibility and finalize terms.

- Submit loan application with required documents: Provide completed application forms, KYC (ID, address proof), income statements (salary slips/tax returns), and property details (if applicable).

- The lender processes and verifies KYC, income proof, and credit history: The bank checks your credit score, verifies document authenticity, and assesses repayment capacity (income stability, existing debts).

- Lender issues sanction letter upon eligibility confirmation: If approved, you’ll receive a letter of sanction detailing the loan amount, interest rate (fixed/floating), tenure, and validity period (typically 3–6 months).

- Review terms and sign: Carefully validate all conditions (prepayment penalties, processing fees) before you go ahead and sign.

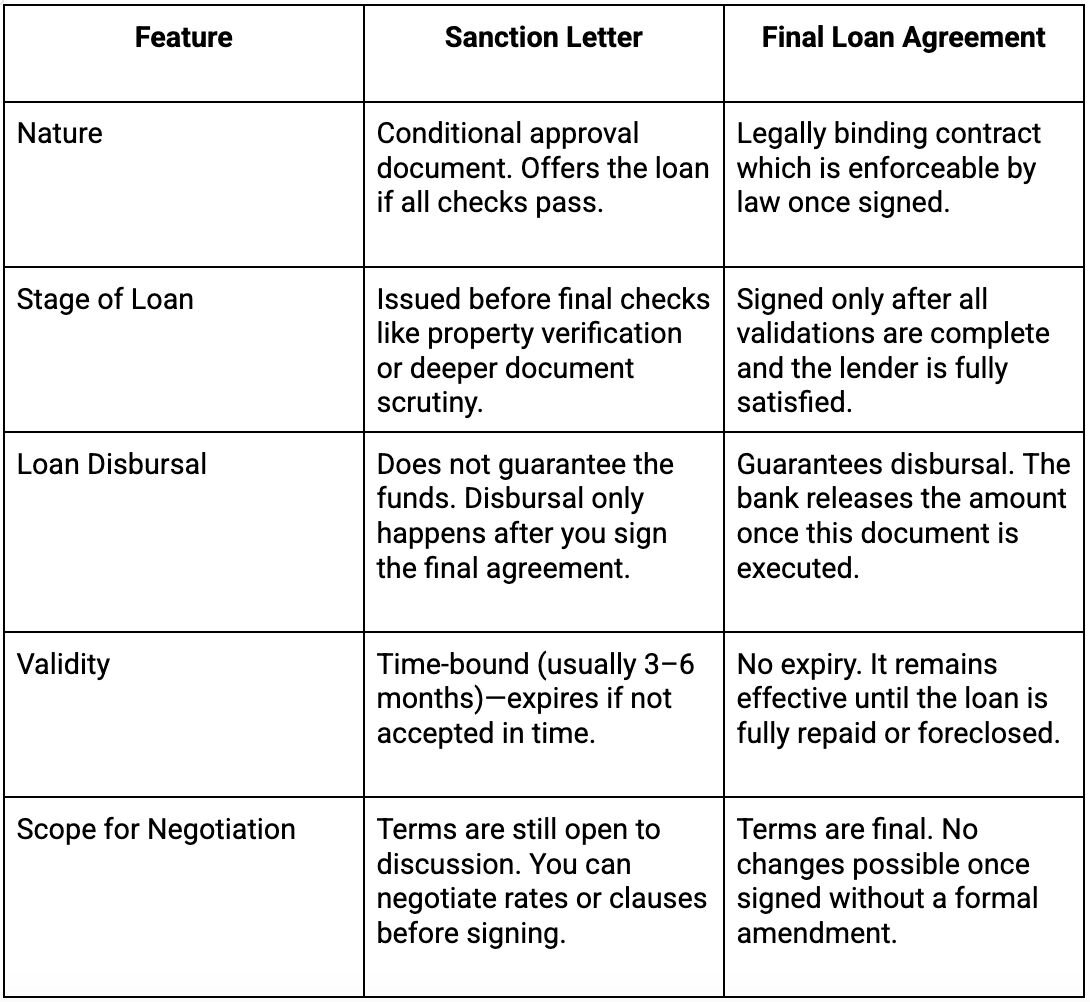

Your sanction letter is just the beginning. What comes next (the final loan agreement) changes everything. One’s a promise, the other’s a contract. Know the difference before you sign.

How is a Sanction Letter Different from the Final Loan Agreement?

Many borrowers breathe a sigh of relief when they receive their sanction letter for that home loan they had applied for, only to face confusion when the final agreement arrives. These are fundamentally different documents with separate legal weight and practical implications.

Understanding these differences is helpful, but not as helpful as seeing the document itself. Here’s a breakdown of a typical sanction letter’s format to help you spot these details in your own letter.

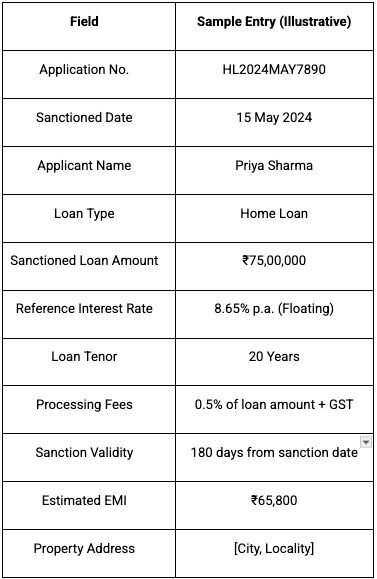

Sample Sanction Letter Format

A sanction letter’s format can be overwhelming if you’re seeing it for the first time. Below is a simplified, illustrative example based on typical industry templates, highlighting the key fields you must review:

Your home loan sanction letter is the foundation of your financial commitment. Understanding its terms, validity, and conditions empowers your borrowing journey from negotiation to disbursement. With this clarity, you now hold the key to better informed financial decisions.

Frequently Asked Questions (FAQs)

Q: What is the validity period of a home loan sanction letter?

A: A home loan sanction letter is typically valid for 3 to 6 months. This window allows you to complete property checks, submit additional documents, and accept the terms before the offer expires. Always confirm the exact validity period directly in your letter of sanction, as timelines can vary by lender.

Q: Can I negotiate loan terms after receiving the sanction letter?

A: Yes, you can. The sanction letter is a conditional offer, and its terms are negotiable before you sign the acceptance. This is your window to discuss better interest rates or remove unfavorable clauses. However, once you sign the final loan agreement, these terms become legally binding and very difficult to change.

Q: Is a sanction letter the same as loan approval?

A: No. A sanction letter is a conditional approval, meaning the lender’s offer can still be withdrawn if your documents fail final checks. Full loan approval only happens after you sign the legally binding final agreement, which guarantees disbursal.

Q: What happens if I do not accept the sanction letter within its validity?

A: If you don’t accept the sanction letter within its validity period (usually 3-6 months), the offer expires. The loan sanction is withdrawn, and you must restart the application process if you still wish to secure the home loan.

Q: Do all lenders offer digital sanction letters?

A: No, not all lenders offer digital sanction letters, but most banks and major housing finance companies now provide home loan sanction letters electronically for faster processing. Always check your lender’s specific process when applying.