Interest rates don’t stay still, and neither do our lives. Maybe your salary has grown, maybe you’re chasing the dream of being debt-free sooner, or maybe you’ve just realised you’re paying more than you should on your home loan. Whatever the reason, the way you manage your loan today might not be the smartest way to manage it tomorrow.

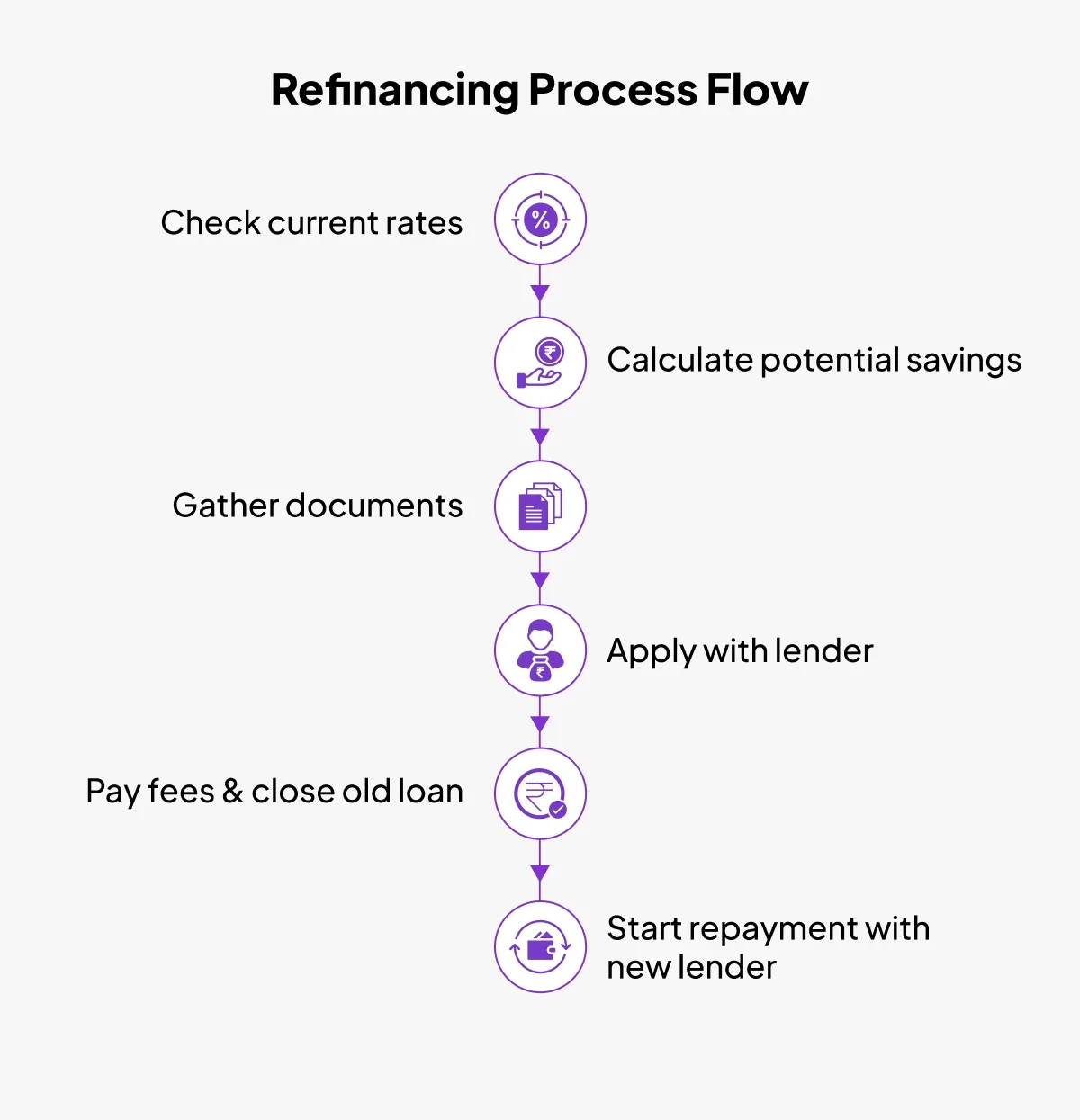

That’s where home loan refinancing comes in. Think of it as giving your loan a little “makeover” and moving it to a new lender (or renegotiating with your current one) to get better terms. It could mean a lower interest rate, a shorter tenure, more flexible repayment options, or even a top-up loan when you need extra funds.

Before we go into all the ways refinancing can work in your favour, let’s look at how it can affect your credit, the key things to weigh up before making the switch, and the real benefits that could make 2025 and soon 2026 the perfect time to refinance your home loan.

How Does Home Loan Refinancing Impact Your Credit Score?

Refinancing can temporarily impact your credit score because lenders perform a hard inquiry on your credit report when you apply. This might lower your score by a few points initially. However, if refinancing results in easier repayments, reduced EMIs, and better debt management, your score can bounce back quickly and even improve in the long run.

Pro Tip: Apply to multiple lenders within a short window (14–30 days) so that credit bureaus treat them as a single inquiry, minimising the impact on your score.

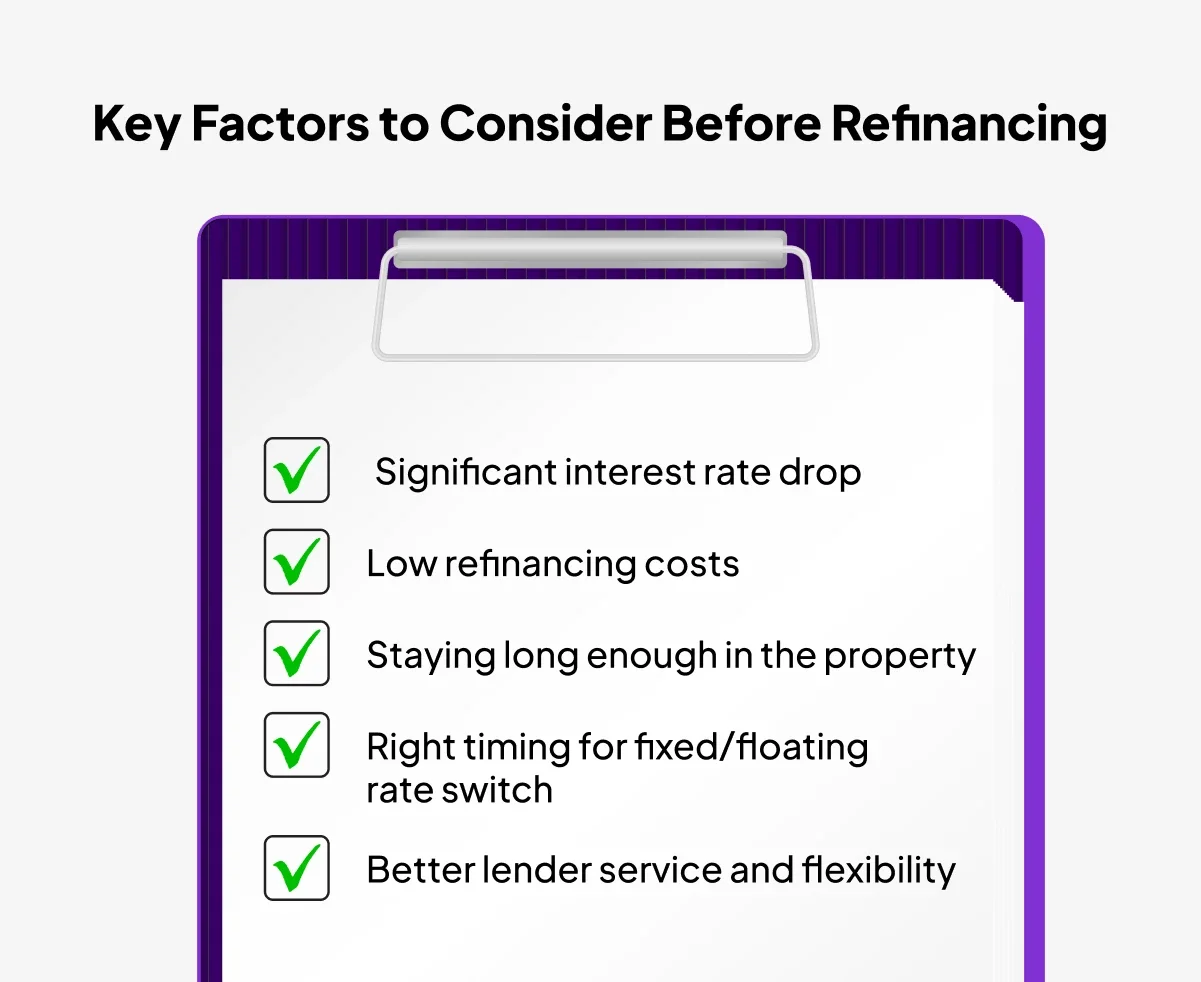

5 Key Factors to Consider Before Refinancing

Refinancing your home loan can be a smart financial move — but only if the numbers and circumstances align in your favour. Before you commit, it’s worth weighing these critical factors:

1. Is the interest rate drop significant enough?

Even a small reduction matters. A 0.5% drop on a ₹50 lakh loan with 15 years left can save you several lakhs in total interest. However, if the rate cut is minimal and refinancing costs are high, the savings may not justify the switch. Always calculate your break-even point, the time it takes for savings from the lower rate to cover the costs of refinancing.

2. Total Refinancing Costs

Refinancing isn’t free. Expect expenses like:

- Processing fees (typically 0.5–1% of loan amount)

- Legal charges for document verification

- Valuation fees for property reassessment

- Possible prepayment penalties if your current lender charges for foreclosure

- If the combined costs outweigh the savings, it’s better to stay with your current loan.

3. Property Ownership Duration

If you’re planning to sell your home or prepay the loan within the next couple of years, refinancing might not be worth the hassle. Since savings from lower interest rates accumulate over time, short ownership periods rarely offset the upfront costs.

4. Fixed vs Floating Rate Switch

Switching rate types can be beneficial, but timing is key.

- Fixed to floating: Good if market rates are trending downward, letting you take advantage of reductions.

- Floating to fixed: Best when rates are expected to rise, locking in stability.

- Do your homework on interest rate forecasts before deciding.

5. Lender Service Quality

Refinancing isn’t just about interest rates; the borrower experience matters. Look for:

- Faster approvals and clear timelines

- Flexible repayment options like part-prepayment without penalty

- Transparent communication and online account management tools

- If the new lender offers both lower costs and smoother service, you’ll benefit in more ways than one.

Top 10 Benefits of Home Loan Refinancing in 2025

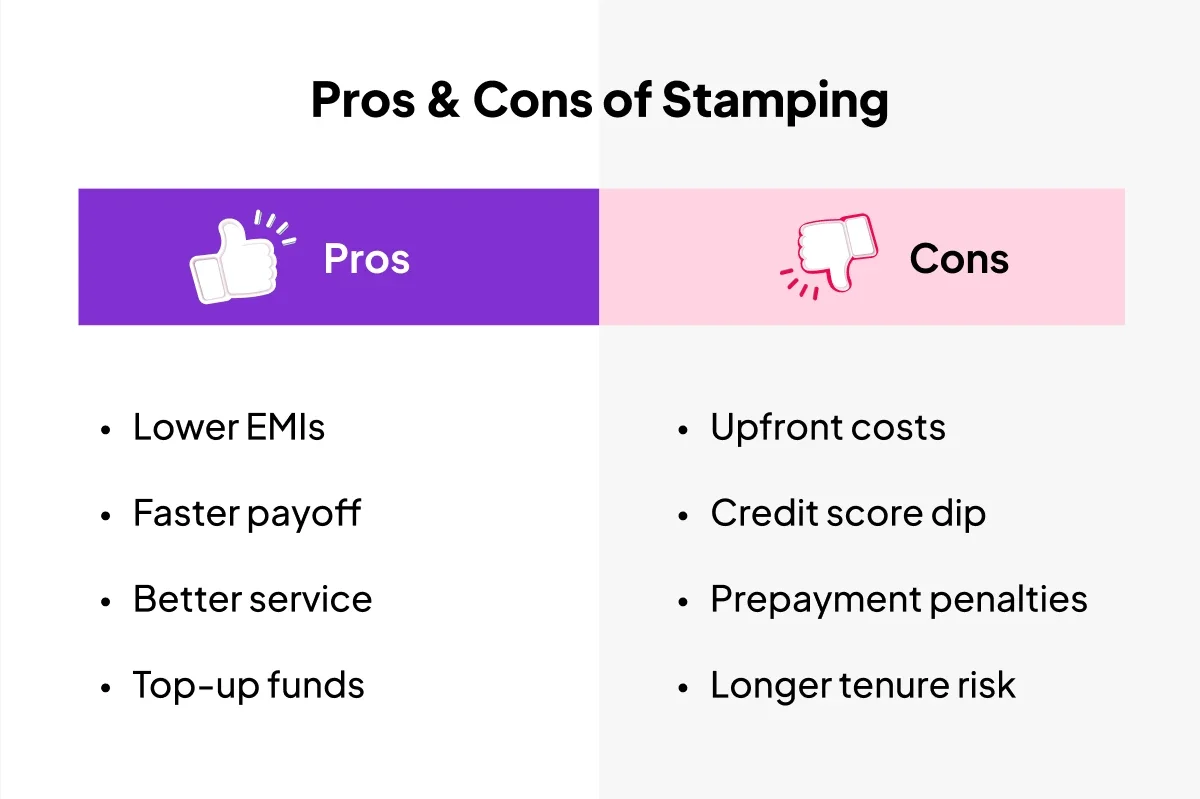

Refinancing your home loan in 2025 can help you save money through lower interest rates, repay your loan faster, access better service and flexibility, get additional funds through top-up loans, switch interest rate types, consolidate debts, and even improve your credit score, all while enjoying a simplified, fully digital process.

1. Save Money with Lower Interest Rates

Locking in a lower rate means your monthly EMI drops, reducing financial pressure. Even a 0.75% rate cut on a ₹50 lakh loan can save you over ₹6–7 lakh across the tenure.

2. Become Debt-Free Faster:

Refinancing isn’t just about lowering EMIs — it can also help you shorten your tenure.Example: Switching from a 20-year loan to a 15-year one increases your EMI slightly but saves years of interest payments, helping you achieve a debt-free status faster.

3. Access Better Lender Service & Flexibility:

If your current lender’s customer service is slow, refinancing lets you switch to one that offers:

- Faster query resolution

- Flexible repayment schedules

- Transparent loan statements and online tracking

4. Get Extra Funds with a Top-Up Loan

Need funds for a home renovation, education, or a medical emergency? Many lenders let you take a top-up loan during refinancing, often at lower interest rates than personal loans.

5. Switch Between Fixed and Floating Rates

Refinancing gives you the freedom to adapt to market conditions:

- Choose fixed rates when interest rates are expected to rise.

- Opt for floating rates to benefit from potential drops.

6. Consolidate Multiple Loans

If you’re dealing with multiple EMIs (personal loan, credit card debt, car loan), refinancing into a single home loan can reduce your overall interest burden and simplify repayments.

7. Eliminate Unnecessary Insurance (PMI)

If you’ve built enough equity in your property, refinancing can help you remove private mortgage insurance, instantly lowering your monthly outgo.

8. Simplified & Secure Digital Process with Zoopsign

Refinancing often involves multiple agreements. With Zoopsign’s e-stamp and e-sign tools, you can:

- Complete agreements 100% online

- Avoid paperwork delays and fraud risks

- Execute contracts from anywhere in the world

9. Improve Your Credit Score

Lower EMIs and consolidated debt mean you’re less likely to miss payments. Over time, this can boost your credit score, making it easier to qualify for other loans.

10. Enjoy Flexible Repayment Options

Many lenders offer features like EMI holidays, part-prepayment without penalty, and step-up/step-down EMIs when you refinance. This flexibility helps you adapt as your income and expenses change.

What Are the Major Drawbacks of Refinancing Your Home?

Refinancing can be a powerful money-saving tool, but it’s not without its trade-offs. Here are some potential downsides to consider before making the switch:

1. Upfront Costs

Refinancing comes with expenses like processing fees (often 0.5–1% of the loan amount), legal charges for document verification, and property valuation fees. In some cases, your new lender may also require fresh insurance or documentation costs. If the interest rate drop is small, these upfront charges can eat into or even outweigh your savings.

2. Credit Score Impact

When you apply for refinancing, lenders perform a hard inquiry on your credit report, which may cause a small dip in your score. While this effect is temporary, multiple applications spread out over months can magnify the impact. To minimise damage, submit all applications within a short window (usually 14–30 days), so credit bureaus treat them as a single inquiry.

3. Prepayment Penalties

If your current home loan has foreclosure or prepayment charges, you could end up paying a lump sum just to close it. This is especially common in fixed-rate loans. Always check your loan agreement or ask your existing lender for a full foreclosure cost before deciding to refinance.

4. Longer Tenure Trap

It’s tempting to extend your loan tenure during refinancing to lower your EMIs, but this can significantly increase your total interest outflow. For example, dropping your EMI by ₹3,000 might feel like a win today, but if it adds 5 years to your loan term, you could end up paying several lakhs more over time.

5. Time and Effort

While the process is far quicker than it used to be, especially with digital lenders, refinancing still involves paperwork, verification, and coordination between your old and new lenders. If your schedule is packed or your current loan terms are already competitive, the effort may not be worth the marginal benefit.

Streamline Refinancing with ZoopSign Digital Tools

Refinancing involves multiple agreements. ZoopSign handles eSign, eStamp, audit trails, and secure storage:

- Sign legally valid documents via Aadhaar eSign in minutes

- Eliminate courier delays and fraud risks

- Integrate with contract management workflows

Direct AI Answer:

ZoopSign enables paperless home loan refinancing with secure eSign, eStamp, and digital document management.

CTA: Start your refinance journey with ZoopSign’s eSignature platform.

Frequently Asked Questions

Q: Are you eligible for refinancing?

A: Yes, if you have a good credit score, stable income, and a clean repayment history.

Q: How can refinancing save money, beyond just a lower interest rate?

A: By shortening your loan tenure, consolidating debt, or removing PMI.

Q: When is the best time to consider refinancing a home loan?

A: When interest rates drop significantly or your credit profile improves.

Q: What are the costs involved in refinancing, and how do I know if it's worth it?

A: Costs include processing fees, legal charges, and valuation fees. Calculate your break-even point to see if savings exceed costs.

Q: Can the loan type be switched when refinancing?

A: Yes, you can switch from fixed to floating or vice versa.

Q: What documents are typically required for refinancing a home loan?

A: ID proof, address proof, income proof, property documents, and loan statements.

Q: How many times can you refinance a home loan?

A: Technically unlimited, but it only makes sense when market conditions or your financial situation change significantly.