Look, we get it. You're probably here because someone mentioned "conveyance deed" and you nodded along, pretending to know what they meant. Or maybe your builder is asking for one, or your society is considering obtaining one from the builder. Either way, you're not alone in being confused – this stuff trips up even experienced property buyers.

Let's walk you through everything you need to know.

Keep reading!

What is a Conveyance Deed?

A conveyance deed is the official document that says "this property now belongs to you instead of the previous owner" – it's the paperwork that makes a property transfer legally binding and complete.

Think of buying property like buying a car. You can shake hands, pay money, even get the keys. However, until the registration is transferred to your name, you don't legally own that car. The conveyance deed is like that registration transfer, but for property.

Now here's where people get confused (and honestly, it's not their fault).

"Conveyance deed" is a category. It's like saying "vehicle" – there are cars, trucks, and motorcycles, all under that umbrella. Similarly, there are different types of conveyance deeds depending on how you're getting the property.

The most common one you'll encounter is a sale deed – that's when you're buying property with money. But if your grandparents are gifting you their house, that's a gift deed. Same category, different type.

Why is a Conveyance Deed Important?

Okay, real talk – we've seen people spend months house-hunting, negotiate prices down to the last rupee, and then get sloppy with the paperwork. Don't be that person.

Legal Validity & Property Rights

Without a proper conveyance deed, you basically have an expensive piece of paper that says you paid someone money. You need this document to prove you actually own the property, especially if someone challenges your ownership later.

We know a guy who bought a flat in Pune five years ago. Beautiful place, great location, but the builder never properly executed the conveyance deed. Fast forward to last year – he couldn't sell the property because potential buyers' lawyers flagged the ownership issue. He's still fighting it in court.

The conveyance deed:

- Makes you the legal owner (not just someone who paid money)

- Protects you if anyone disputes your ownership

- It is required for any future sale or transfer

- Gives you standing in court if needed

Impact on Home Loan & Society Ownership

Banks aren't stupid. They won't lend you money against a property if you can't prove you own it. No conveyance deed = no home loan. It's that simple.

For housing societies, this gets even messier. Your society might be running smoothly, collecting maintenance, making decisions, but if the builder hasn't executed a conveyance deed, legally speaking, the builder still owns the land your building sits on. That's a recipe for trouble.

What are the Types of Conveyance Deeds in India?

Alright, let's break down the different types. Most people only deal with one or two of these in their lifetime, but it's good to know what's what.

- Sale Deed: You pay money, you get property. This is what 90% of property buyers deal with.

- Gift Deed: Someone gives you property for free (usually family). Lucky you, but you'll still pay stamp duty.

- Exchange Deed: "I'll trade you my flat in Mumbai for your house in Goa." Both properties should be roughly equal in value.

- Lease Deed: You get to use the property for a specific time period. Think 99-year leases that some builders offer.

- Mortgage Deed: You're putting up your property as security for a loan. The bank gets certain rights until you repay.

- Relinquishment Deed: Usually happens in families. Like when one sibling gives up their share of inherited property to another.

- Settlement Deed: Family fighting over property? This document settles who gets what.

- Partition Deed: Joint property gets divided. "You take the ground floor, I'll take the first floor."

- Will Deed: Property transfer according to someone's will after they pass away.

Most people only encounter sale deeds and maybe gift deeds, so don't worry about memorizing all of these.

Sale Deed vs Conveyance Deed

This confusion drives us crazy because even some property agents get it wrong.

A sale deed is a specific type of conveyance deed used when property is transferred in exchange for money – it's the most common form of property transfer in purchase transactions.

| Aspect | Conveyance Deed | Sale Deed |

|---|---|---|

| Definition | Umbrella term for all property transfer documents | Specific type of conveyance deed for monetary transactions |

| Scope | Covers all types of property transfers (sale, gift, exchange, etc.) | Only covers property transfers involving money |

| Usage | General category used in legal contexts | Most common document for property purchases |

| Money Involved | May or may not involve monetary consideration | Always involves monetary payment |

| Examples | Sale deed, gift deed, exchange deed, lease deed, etc. | Only when buying property with money |

| Registration | All types must be registered | Must be registered (mandatory) |

| Stamp Duty | Varies based on type and consideration | Based on property value and state rates |

| Common Confusion | People use this term when they mean sale deed | Often mistakenly called just "conveyance deed" |

Here's the simple way to think about it:

- Conveyance deed = The big umbrella category

- Sale deed = One specific type under that umbrella (the one you'll probably use)

When people say "I need a conveyance deed for my property purchase," they usually mean they need a sale deed. It's like saying "I need a vehicle" when you specifically want a car.

What is the Procedure for Obtaining a Conveyance Deed?

Buckle up, because this process has several steps. Miss one, and you might have to start over (or worse, end up in legal trouble).

1. Title Verification & Due Diligence

Before you do anything, make sure the person selling actually owns the property and has the right to sell it. I can't stress this enough – verify everything. Check previous ownership documents, look for any pending court cases, unpaid society dues, or property tax issues.

Pro tip: Get a property lawyer to do this verification. Yes, it costs money upfront, but it's way cheaper than fixing problems later.

2. Sale Agreement or Agreement for Sale

This is like your roadmap. It outlines who's selling what to whom, for how much, and when. Think of it as the plan before the actual execution. Many people use digital platforms like ZoopSign to create and manage these agreements efficiently, especially when multiple parties need to review and approve terms quickly.

3. Stamp Duty Payment

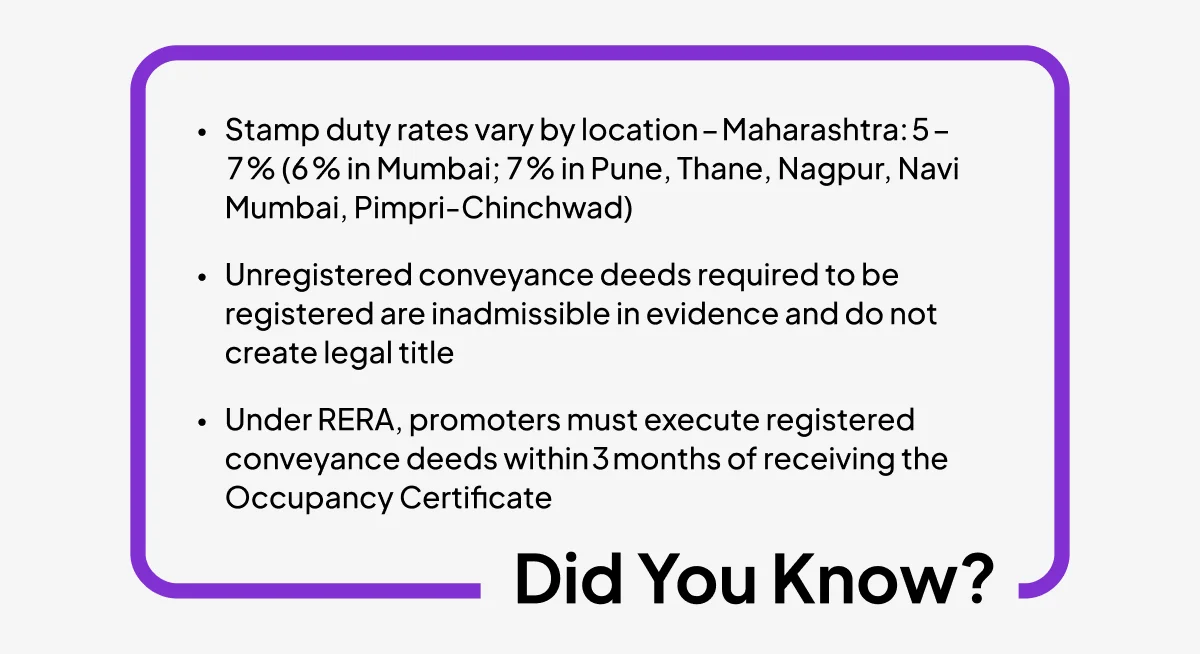

Every state has different stamp duty rates, and they change periodically. In Maharashtra, it might be 5% for women and 6% for men (as of when I'm writing this), but check current rates. Don't try to save money by undervaluing the property – it can backfire badly.

4. Drafting the Conveyance Deed

This is where you create the actual transfer document. It needs to include every detail – property boundaries, what's included (parking space? that extra storage room?), payment terms, everything. One small error can cause big problems later.

5. Execution of the Conveyance Deed

This is the big moment – both parties sign the deed in front of witnesses. For remote transactions or when parties are in different cities, digital signing solutions like ZoopSign can streamline this process while ensuring legal compliance. The property officially changes hands at this point.

6. Conveyance Deed Registration

Take the signed deed to your local sub-registrar's office and get it registered. This step is mandatory – an unregistered conveyance deed is almost worthless legally. The registration process validates the transfer and creates an official record.

7. Mutation of Property Records

Update the property records with your local municipal corporation or village office. This ensures the property tax and other records reflect your ownership.

8. Deemed Conveyance (For Societies)

Here's something that affects a lot of housing societies: builders are supposed to transfer land ownership to the society within four months of its formation, but many don't bother doing it.

If your builder is being difficult, your society can apply for a deemed conveyance. You're asking the authorities to force the transfer through legal means. It's a bit of a process, but it's better than staying in legal limbo forever.

What are the Key Clauses and Contents of a Conveyance Deed?

A proper conveyance deed isn't just "A sells property to B for X amount." There are specific things that must be included, and missing any of them can create problems.

- Parties Involved: Full names, addresses, ages, and occupations of both buyer and seller. Be precise – "Rajesh Kumar" isn't enough if there are multiple Rajesh Kumars in the area.

- Recitals: This explains how the seller got the property in the first place and why they have the right to sell it.

- Property Description: Detailed description including survey numbers, boundaries ("bounded on the north by..."), built-up area, carpet area, and what's included in the sale.

- Consideration: How much money changed hands and how it was paid (cash, cheque, bank transfer).

- Transfer Clause: The magic words that transfer ownership. Usually something like "hereby grants, sells, and transfers..."

- Covenants and Warranties: The seller's promises about the property – that it's free from legal issues, properly approved, etc.

- Habendum Clause: Defines exactly what rights you're getting. Full ownership? Leasehold? Any restrictions?

- Delivery and Acceptance: Confirmation that keys, documents, possession – everything has been handed over and accepted.

- Signatures and Execution: Proper signatures of buyer, seller, and witnesses. For complex transactions involving multiple stakeholders, platforms like ZoopSign can ensure all parties sign correctly and in the right sequence.

- Schedule of Property: A detailed list or map of exactly what property is being transferred.

- Stamp Duty and Registration: Proof that all required fees have been paid.

What are the Common Mistakes to Avoid During a Conveyance Deed Transaction?

I've seen people make expensive mistakes with conveyance deeds. Here are the ones that'll hurt:

1. Not Verifying the Seller's Title

This is the big one. Always check that the seller owns the property and has a clear title. We know someone who bought a flat only to discover later that the seller had forged documents. Two years of court battles later, he got his money back, but imagine the stress.

2. Incomplete or Incorrect Information in the Deed

Double-check everything – names (including spellings), addresses, property details, and survey numbers. A friend of ours had his name misspelled in the deed. Seems minor, right? It took six months to fix because the property records didn't match his ID documents.

3. Failure to Pay Stamp Duty and Registration Fees

Some people try to save money by showing a lower property value to reduce stamp duty. Don't do this. If authorities discover the real value later, you could face penalties, and the deed might be invalid.

4. Not Registering the Conveyance Deed

An unregistered conveyance deed is like having a marriage certificate that's not legally registered – it might mean something to you, but legally it doesn't count for much.

5. Neglecting to Obtain Necessary Certificates and Approvals

Make sure the property has all required approvals – completion certificate, occupancy certificate, environmental clearances if needed. Don't assume the seller has handled this.

6. Ignoring or Overlooking Encumbrances

Check if there are any mortgages, liens, court cases, or other legal issues attached to the property. These problems become yours after the transfer.

7. Lack of Legal Advice

Property law is complicated, and it varies by state. Getting a lawyer might seem expensive, but it's nothing compared to the cost of fixing legal problems later.

8. Not Updating Property Records After Registration

After registering the deed, make sure to update property records with local authorities. This prevents confusion and complications during future transactions.

9. Not Preserving Original Documents

Keep original documents in a safe place and make multiple copies. These papers are crucial for any future property transactions. Consider storing digital copies securely as well – some people use digital document management platforms to keep everything organized and easily accessible.

How Does RERA Impact Conveyance Deeds and Society Ownership?

RERA has been a game-changer for property buyers, especially when it comes to conveyance deeds and housing societies.

1. Statutory Obligation for Conveyance:

Before RERA, builders could drag their feet on transferring ownership to societies. Now it's legally mandated – they have to execute conveyance deeds within three months of meeting certain conditions. This has put real teeth into the requirement.

2. Importance of Housing Societies

RERA has made it much easier for housing societies to get conveyance from reluctant builders. The law is now clearly on the side of society, and there are specific procedures to follow.

3. Impact on Deemed Conveyance

The deemed conveyance process has become more streamlined under RERA. Societies have clearer guidelines on how to proceed when builders don't cooperate.

4. Penalties for Non-Compliance

Builders who don't execute conveyance deeds as required can face serious penalties under RERA. This has encouraged better compliance, though some builders still try to avoid their obligations.

Conclusion

Here's what we want you to remember: a conveyance deed isn't just another piece of paperwork in your property transaction. It's the document that makes you the legal owner. Everything else – the negotiations, the site visits, even the money transfer – is just leading up to this moment.

Don't rush through this part. Don't try to save money by skipping legal advice. Don't assume the other party (whether it's a builder, seller, or anyone else) will handle everything correctly.

Property transactions involve a lot of money and even more emotions. Take the time to get the conveyance deed right. In the future you will thank you for it.

Good luck with your property transaction!