If you’re looking to understand what is contract of indemnity, you’re at the right place.

A contract of indemnity serves as a legal safeguard against potential losses in business transactions. Whether you’re a business owner, legal professional, or contract manager, having a clear understanding of indemnity contracts can significantly impact your risk management strategy.

This comprehensive guide explores the concept, legal framework, and practical applications of indemnity contracts, while also highlighting modern solutions for efficient contract management.

What is Contract of Indemnity: Definition and Legal Framework

The Indian Contract Act of 1872 provides specific provisions governing contract of indemnity. According to Section 124 of the Act, a contract of indemnity is defined as “a contract by which one party promises to save the other from loss caused to him by the conduct of the promisor himself, or by the conduct of any other person.” This legal definition establishes the foundation for understanding indemnity agreements in the Indian legal context.

In simpler terms, what is contract of indemnity? It’s a legal agreement where one party (the indemnifier) promises to protect another party (the indemnity holder) from financial loss. This protection typically covers losses that may arise from specified events or circumstances. Many business professionals ask what is contract of indemnity and how it differs from other contractual protections, and the key distinction lies in its focus on compensation for actual losses rather than mere promises of performance.

To understand what is contract of indemnity, we must examine Section 124 of the Indian Contract Act, which outlines the basic structure and requirements for such agreements. The Act establishes that indemnity contracts are contingent in nature, meaning they depend on future uncertain events. This contingent nature distinguishes them from absolute promises and places them in a special category of contractual relationships.

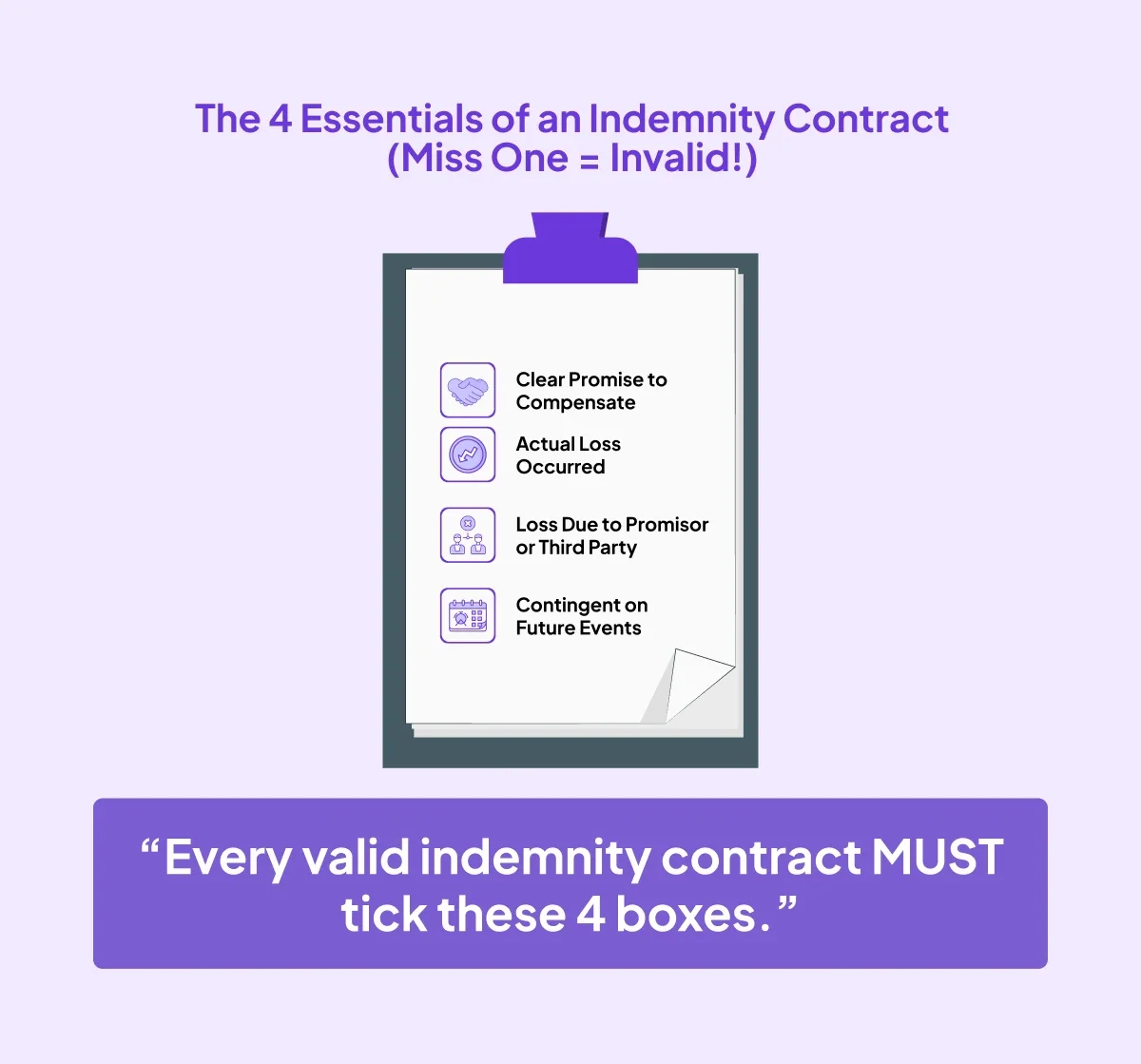

Essential Elements of Contract of Indemnity

The essentials of contract of indemnity include a clear promise to compensate and a defined scope of coverage. For an indemnity contract to be valid and enforceable, it must contain several key elements:

- Promise to Compensate: There must be an explicit commitment by the indemnifier to compensate the indemnity holder for losses.

- Loss Occurrence: The contract is triggered only when an actual loss is suffered by the indemnity holder.

- Causation: The loss must be due to the conduct of either the promisor or a third party.

- Contingent Nature: The contract depends on future uncertain events, making it a contingent contract.

Understanding the essentials of contract of indemnity is crucial for drafting enforceable agreements. Legal experts emphasize that the essentials of contract of indemnity must be explicitly stated in the agreement to avoid ambiguity and potential disputes. Without these essential elements, an agreement may not qualify as a valid indemnity contract under Indian law.

Types of Indemnity Contracts

Indemnity contracts can be classified into various categories based on their formation and scope of coverage. Understanding these classifications helps in selecting the appropriate type for specific business needs.

Based on Formation

- Express Indemnity: These are explicitly stated in written or oral agreements. Insurance policies, construction contracts, and service agreements often contain express indemnity clauses. The terms and conditions are clearly defined, leaving little room for interpretation.

- Implied Indemnity: These arise from the conduct of parties without a formal agreement. For example, in master-servant relationships, there’s an implied indemnity where the master may be responsible for losses caused by the servant’s actions in the course of employment.

Based on Liability Coverage

- Broad Indemnification: This comprehensive coverage protects against losses from all parties, including third parties. It offers the most extensive protection but may also come with higher costs or stricter requirements.

- Intermediate Indemnification: Limited to losses from actions of the promisor and promisee, this provides moderate coverage scope. It excludes third-party actions that are beyond the control of the contracting parties.

- Limited Indemnification: Restricted to losses from the indemnifier’s actions only, this is the narrowest form of coverage. While more limited in scope, it provides clear boundaries for liability.

A practical contract of indemnity example can be found in service agreements between businesses. For instance, when a software development company agrees to indemnify its client against any copyright infringement claims related to the developed software, it’s creating an express indemnity contract with specific coverage parameters.

Read: Contract vs Agreement: Everything you Need to Know!

Rights of Indemnity Holder Under Indian Contract Act

The Indian Contract Act provides specific rights to the indemnity holder, ensuring they receive adequate protection under the agreement. These rights form the foundation of the indemnity relationship and establish the legal recourse available to the protected party.

Key Rights Include:

- Right to Recover Damages: The indemnity holder has the right to recover all damages that they may be compelled to pay in any suit related to matters covered by the indemnity.

- Right to Recover Costs: They can recover all costs incurred in defending or settling any such suit, provided they acted prudently and under the authority of the indemnifier.

- Right to Recover Sums Paid: Any sums paid under compromise settlements can be recovered, provided the compromise was not contrary to the orders of the indemnifier and was prudent.

- Right to Sue for Specific Performance: If the indemnifier fails to indemnify as promised, the indemnity holder can sue for specific performance of the contract.

The concept of indemnity in contract law has evolved significantly through various legal precedents. Courts have established that the indemnity holder’s rights crystallize as soon as the liability becomes certain, even if actual payment hasn’t been made yet. This principle was established in landmark cases and represents a significant aspect of indemnity in contract law.

The Role of Indemnity in Contract Law: Legal Perspectives

Indemnity in contract law serves as a mechanism to allocate risk between contracting parties. It allows businesses to engage in potentially risky activities with the assurance that they won’t bear the full financial burden if things go wrong. This risk allocation function makes indemnity clauses a critical component of many commercial agreements.

Courts have established specific principles regarding indemnity in contract law through landmark judgments. These precedents help in interpreting indemnity clauses and determining their enforceability in various situations.

Some key legal perspectives include:

Landmark Judgments

- State Trading Corporation Case (1994): The Supreme Court of India addressed the enforceability of indemnity clauses in frustrated contracts. While the court left open the question of indemnity clause enforceability in frustrated contracts, it established the precedent for careful consideration of indemnity provisions in government contracts.

- Osman Jamal Case (1929): The Calcutta High Court established a fundamental timing principle for indemnity obligations. The court ruled that the payment obligation arises at the time of loss occurrence, not after the indemnity holder makes a payment. This principle clarifies when the indemnifier’s liability is triggered.

- Srinivas Gupta Case: This case clarified the continuing nature of indemnity obligations. The court ruled that executing a mortgage doesn’t discharge indemnity obligations, which persist until full compensation is provided. This established the persistent nature of indemnity obligations.

These legal precedents demonstrate how indemnity in contract law has been shaped by judicial interpretation. They provide guidance for drafting enforceable indemnity clauses and understanding their implications in various contractual scenarios.

Contract of Indemnity Example: Real-World Applications

A common contract of indemnity example is an insurance policy where the insurer agrees to compensate for specific losses. Insurance represents perhaps the most widespread application of indemnity principles, with the insurer (indemnifier) promising to compensate the insured (indemnity holder) for covered losses.

In construction projects, a contract of indemnity example might include protection against third-party claims. Construction contracts often contain indemnity clauses where contractors indemnify property owners against claims arising from the contractor’s work. These clauses help allocate risk appropriately based on which party has control over the work being performed.

Other practical examples include:

- Corporate Acquisitions: When one company acquires another, the seller often indemnifies the buyer against undisclosed liabilities that may emerge after the transaction.

- Director and Officer Indemnification: Companies indemnify their directors and officers against liabilities arising from their official duties, protecting them from personal financial risk.

- Intellectual Property Agreements: Developers or creators often indemnify clients against claims of intellectual property infringement related to their work.

- Service Agreements: Service providers may indemnify clients against damages resulting from the provider’s negligence or misconduct.

These examples illustrate how indemnity contracts function in various business contexts, providing financial protection and facilitating risk management across industries.

Contract of Indemnity and Guarantee: Key Differences Explained

The distinction between contract of indemnity and guarantee lies in the primary liability of the parties involved. While studying contracts of indemnity and guarantee, it’s important to note their different legal implications. Both contracts of indemnity and guarantee serve as risk management tools but function differently in practice.

The fundamental difference between indemnity and guarantee relates to when the liability arises. Businesses should understand the difference between indemnity and guarantee when drafting risk management contracts. Legal practitioners often explain the difference between indemnity and guarantee in terms of primary and secondary liability.

Understanding these distinctions is crucial for selecting the appropriate legal instrument for specific business needs. While indemnity provides direct protection against losses, guarantees offer security for the performance of obligations by a third party.

Modern Approaches to Indemnity Contract Management

The digital transformation of business processes has significantly impacted how indemnity contracts are managed. Modern businesses are increasingly adopting digital contract management solutions for handling indemnity agreements. These technological advancements offer numerous benefits that address traditional challenges in contract management.

Benefits of Digital Contract Management for Indemnity Agreements

Digital contract management platforms offer enhanced security and compliance features for indemnity contracts. The efficiency of digital contract management software reduces errors in complex indemnity agreements. Some key benefits include:

- Centralized Repository: A single secure location for all contracts, making it easier to track and manage indemnity agreements.

- Automated Workflows: Streamlined creation, review, and approval processes that reduce the time and effort required to manage indemnity contracts.

- Proactive Management: Automated alerts for renewals and obligations, ensuring that indemnity requirements are met on time.

- Enhanced Security: Role-based access control and data protection features that safeguard sensitive contract information.

Advanced contract management solutions provide automated tracking of indemnity obligations and deadlines. Implementing robust contract management solutions helps businesses mitigate risks associated with indemnity clauses by ensuring compliance and timely fulfillment of obligations.

How ZoopSign Transforms Indemnity Contract Management

ZoopSign offers specialized contract management solutions designed for handling indemnity agreements efficiently. As India’s one of the first Aadhaar eSign platform, ZoopSign provides a comprehensive suite of tools that streamline the entire contract lifecycle, from creation to execution and management.

Smart Document Creation and Management

ZoopSign’s Smart Document Creator reduces document creation time by 50% and offers over 100 ready-to-use templates, including specific templates for indemnity agreements. The platform’s real-time editing capabilities and smart inputs have been shown to decrease manual errors by 90%, ensuring that indemnity contracts are accurate and compliant.

Enterprise-Grade Security and Compliance

For indemnity contracts, which often contain sensitive financial and legal information, security is paramount. ZoopSign implements advanced encryption protocols, permission-based access management, and complete audit trails to ensure that contracts remain secure and compliant with regulatory requirements.

Proven Results

The effectiveness of ZoopSign’s contract management solution is demonstrated by impressive metrics from client case studies. For example, the Mighty Warner case study showed a reduction in contract signing time from up to one week to just 15-20 minutes, along with an 80% cost reduction per signing.

Integration Capabilities

ZoopSign integration with popular platforms like Microsoft Office, Dropbox, Salesforce, and Google Drive, allowing businesses to incorporate indemnity contract management into their existing workflows. The platform’s API and SDK integration options provide flexibility for custom implementations. Check out -

By implementing ZoopSign’s contract management solution, businesses can transform how they handle indemnity agreements, reducing risks, improving compliance, and enhancing operational efficiency.