If you’re a part of an NGO or planning to start one, chances are you've stumbled upon the term 12A Registration more than once. It’s not just a legal word, this registration can make a massive difference in how your organization operates and grows.

So, what exactly is 12A Registration, why does it matter, and how can you get it?

Let’s break it all down.

What Is 12A Registration and Why Does It Matter for NGOs and Non-Profits?

Simply put, 12A Registration is a provision under the Income Tax Act, 1961, that allows non-profit organizations, NGOs, and charitable trusts to claim exemption from paying income tax on the funds they receive.

Once your NGO gets registered under Section 12A, it’s recognized as a tax-exempt entity. This means the income you receive, be it from donations, grants, or other charitable activities, won’t be taxed. More resources in your pocket = more impact in the world.

Think of it as your golden ticket to running your non-profit efficiently and legally, without tax burdens draining your funds.

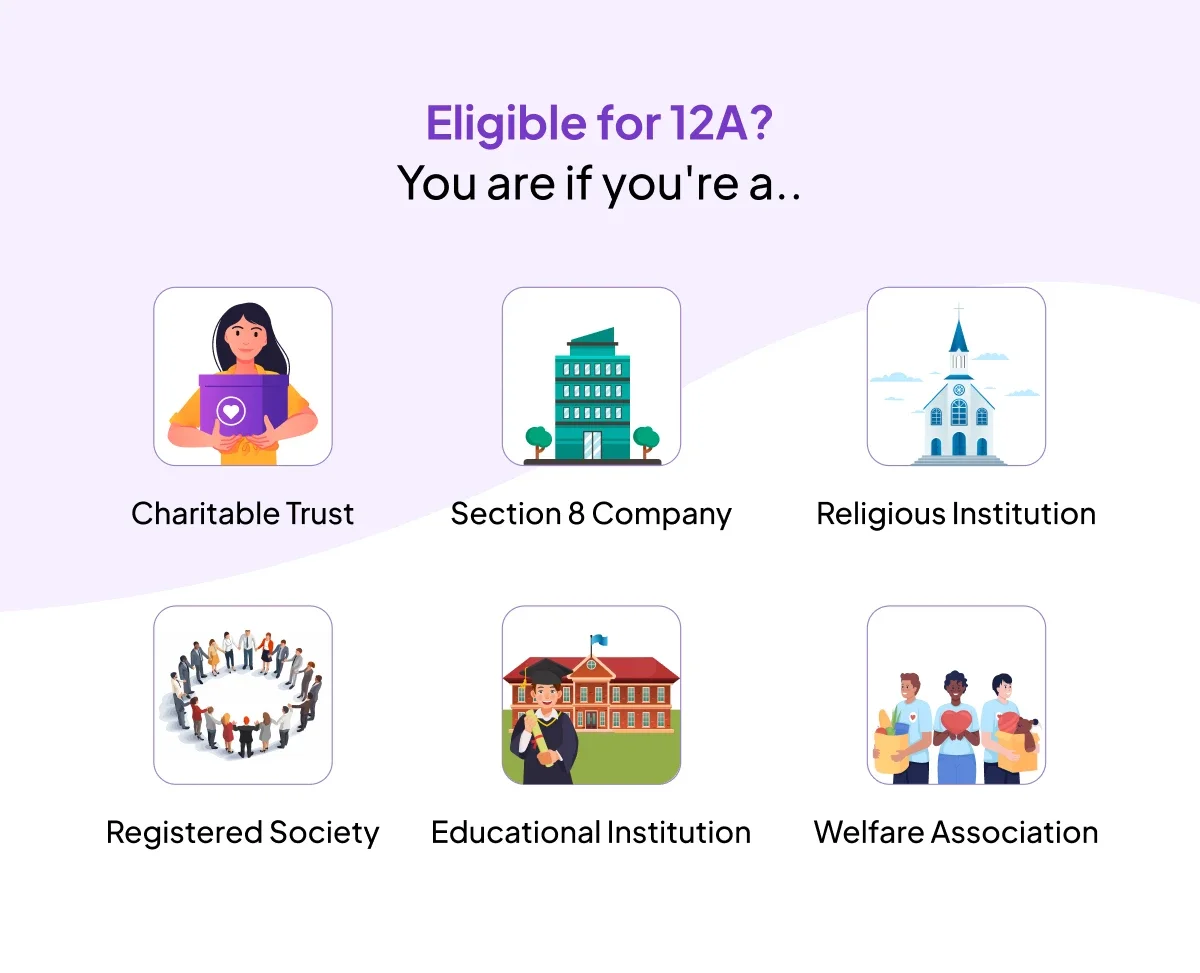

Who Can Apply for 12A Registration in India?

Not every entity qualifies, but if you’re any of the following, you’re good to go:

- Charitable Trusts – Organizations created to serve public welfare through charitable activities.

- Non-Profit Companies (Section 8 Companies) – Companies formed with a not-for-profit objective, often for social or cultural development.

- Religious Institutions – Entities focused on promoting religious teachings, rituals, or places of worship.

- Societies registered under the Societies Registration Act – Groups formed for promoting literature, science, fine arts, or social welfare.

- Educational Institutions – Schools, colleges, or training centers operating with a not-for-profit motive.

- Welfare Associations – Groups working towards the upliftment of specific communities, workers, or marginalized sections.

Basically, if your goal isn’t personal profit and you’re working for social, cultural, educational, or religious upliftment, 12A tax exemption is for you.

Key Benefits of 12A Registration for NGOs and Non-Profits

Why should your NGO apply for 12A? Let’s look at the key benefits:

1. Tax Exemption

This one’s obvious. All the income your NGO generates is exempt from income tax, which means you retain more funds for your projects.

2. Eligibility for Government Grants

Many government and international bodies require 12A registration to approve grants. Without it, your applications may hit a dead end.

3. Credibility Boost

Want to attract donors or CSR funds? A 12A certificate enhances your NGO’s credibility, showing you follow legal norms and operate transparently.

4. Smooth Audits and Reporting

Tax authorities are less likely to question your income or demand explanations when you’re 12A compliant. It simplifies your audits and annual filings.

What Is the Difference Between 12A and 80G Registration for NGOs?

People often confuse these two, so here’s a quick comparison:

Getting both 12A and 80G registration is the smartest move. While 12A saves your NGO from tax, 80G helps your donors save on theirs.

What Are the Eligibility Criteria for 12A Registration in India?

Before you jump into the process, make sure you meet the eligibility requirements:

- Your organization must be registered as a Trust, Society, or Section 8 Company

- The objectives should be charitable, like education, relief of the poor, medical aid, etc.

- No part of the income should go to any private individual or stakeholder.

- Proper books of accounts and records must be maintained.

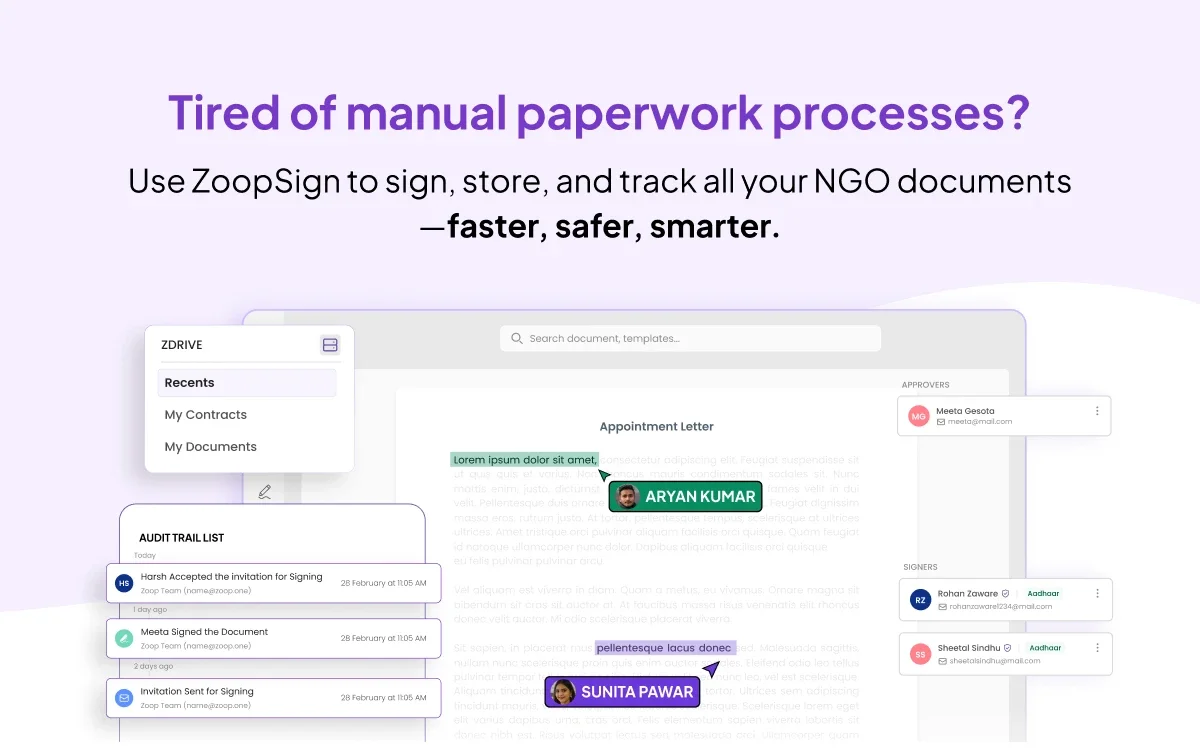

Need help keeping those records in order? That’s where solutions like ZoopSign’s digital document management system come in. Without hours wasted in paperwork, it helps you organize, store, and retrieve registration certificates, audit reports, and donation receipts.

What Documents Are Required for 12A Registration for NGOs?

Here’s are the Documents Required for 12A Registration checklist:

- Form 10A (Application form for 12A)

- Trust Deed / Memorandum of Association

- Registration Certificate of the NGO

- PAN Card of the NGO

- Bank account details

- Income and expenditure statements for the past 3 years (if applicable)

- List of trustees/board members with identity proof

- Utility bills of the office address (for address proof)

Keeping these documents digitally signed and stored can streamline this entire process. With ZoopSign’s eSign solutions, you can sign Form 10A and other paperwork quickly and securely, even from your phone.

Step-by-Step Process of 12A Registration for NGOs

The good news? The process is mostly online now. Here's how you do it:

Step 1: Register on the Income Tax Portal

Go to the Income Tax e-filing portal and register your NGO using your PAN.

Step 2: Fill Form 10A

This is the main form for Section 12A registration. You’ll need to upload all supporting documents here.

Step 3: Attach Required Documents

Submit the checklist we mentioned above. Make sure all scans are clear and documents are signed.

Step 4: Verification by CIT (Exemptions)

The Commissioner of Income Tax (Exemptions) may ask for further clarification or documents. Stay prepared.

Step 5: Get Your 12A Certificate!

Once approved, you’ll receive your Section 12A certificate digitally. You can now proudly call yourself a tax-exempt NGO.

Pro tip: Use a platform like ZoopSign to track submission timelines, set reminders, and securely store your certificate once received.

Read Blog: How to E-Verify Your Income Tax Return in Simple Steps

What Is the Validity Period of 12A Registration for NGOs in India?

Under the new income tax rules, all NGOs must revalidate their 12A registrations every five years since 2020. So yes, it’s not a “get it once and forget it” deal anymore.

What Are the Common Mistakes to Avoid During 12A Registration?

- Submitting incomplete or mismatched documents

- Using outdated formats for Form 10A

- Not maintaining proper books of accounts

- Missing out on revalidation deadlines

Avoid these, and you’re good to go. And remember, digitizing your document flow can significantly reduce these risks.

Why 12A Registration is Crucial for Your NGO’s Growth?

Getting 12A registration is more than a compliance task, it’s a foundation for your NGO’s financial health and reputation.

Let’s recap why:

- You save funds through tax exemption

- You unlock eligibility for major grants and donations

- You build legal and donor trust

- You streamline audits and compliance

In short, it’s not optional. It’s essential.

How ZoopSign Helps NGOs with 12A Compliance and Document Management?

At ZoopSign, we’ve seen how non-profits often struggle with managing documentation, compliance timelines, and signing workflows, especially when teams are working remotely or with volunteers.

Here’s how our solutions can help:

- Digital Document Management - Store trust deeds, certificates, donor agreements, and receipts in one secure place

- eSign and Aadhaar eSign - Sign and send forms like 10A or 80G applications without physical copies

- Audit Trail & Access Logs - Track who accessed or signed what, and when

- Reminders & Notifications - Never miss a revalidation or deadline again

When your backend is sorted, your front-end impact multiplies.

If you’re running a non-profit, getting 12A registration is a game-changer. It legitimizes your operations, keeps you compliant, and makes sure more of your hard-earned donations go where they’re needed most.

And with tools like ZoopSign, you don’t need to worry about paperwork slowing you down.

Start your 12A journey the smart way: digitally, securely, and stress-free.